Muamalat Essentials

Bridging the Past with the Present in Islamic Finance through the Guidance of a Practising Shariah and Finance-trained Instructor.

What would the Prophet (PBUH) and our esteemed scholars do if they were navigating today’s complex financial world? That’s the question at the heart of this course.

This isn’t just about building a solid foundation in Islamic finance—it’s about going deeper. Guided by a practicing professional trained in both Shariah and modern finance, this course takes you back to the classical texts of financial transactions and muamalat, bridging timeless principles with the realities of contemporary finance.

Join us on this transformative journey to connect the wisdom of the past with the needs of the present.

Who is this class for?

This Weekly Class Will Get You Where You Need To Be

"When Riba' Is Widespread, It Becomes Obligatory To Learn How To Protect Yourself From It" - Ihya' Ulumuddin of Imam Al-Ghazali

What's so different about this course?

Most courses on Islamic finance either focus heavily on the technicalities of finance or delve deeply into the Shariah, often neglecting the practical intersection of the two. Rarely do you find a course that combines mastery in both areas with real-world experience. Turaths & Todays: Muamalat Essentials offers you exactly that—a unique opportunity to learn from our instructor and guest experts who have both an in-depth understanding of Islamic jurisprudence and extensive experience in modern financial systems.

Here’s what sets this course apart:

Bridging Quran, Sunnah, and Contemporary Finance

Witness how timeless principles from the Quran and Sunnah are seamlessly applied to today’s complex financial landscape. This course goes beyond theoretical knowledge to show you real-world applications.Comprehensive Insight into Madhahibs

Explore how various Schools of Thought (Madhahibs) approach rulings in financial transactions. Gain a holistic understanding of how these perspectives converge and diverge, enriching your ability to analyze and apply Islamic rulings.Regional Relevance with Practical Tools

Learn about the financial instruments and halal alternatives available in Singapore and the broader region. Discover actionable solutions that align with Islamic principles and are directly applicable to your personal or professional life.

This course doesn’t just teach—it equips you with the tools to confidently navigate modern financial challenges while staying rooted in Islamic values.

Weeks of classes

A Dynamic & Emerging Shariah Scholar

Ustaz Aminuddin Abu Bakar

Ustaz Aminuddin Abu Bakar is a distinguished expert in Islamic finance industry, currently serving as the Principal Consultant at S Tradition, a boutique consultancy specializing in the sector.

With more than two decades of working experience, he has held significant roles in Islamic financial institutions, including serving as Vice President and Head of the Shariah Division at Kuwait Finance House Malaysia (KFHMB), where he was instrumental in shaping the institution's Shariah governance framework.

His expertise is further recognized through his appointments as a Shariah Committee Member for HSBC Amanah (Malaysia) and Financial Shariah Advisory & Consultancy (FSAC) under Pergas Investment Holdings (Singapore), providing critical advisory and oversight for Shariah-compliant financial products and practices.

Ustaz Aminuddin holds a Bachelor's Degree in Shariah and Islamic Studies from Al-Azhar University and an International Executive MBA in Business Administration and Management from Strathclyde Business School.

He is a Certified Shariah Advisor and Auditor (CSAA), accredited by the Auditing and Accounting Organization for Islamic Financial Institutions (AAOIFI). Additionally, he is a member of the Association of Shariah Advisors in Islamic Finance (ASAS) and has been accredited its Certified Shariah Advisor certification.

Throughout his career, Ustaz Aminuddin has demonstrated a unique ability to bridge classical Shariah principles with modern financial systems, contributing significantly to the advancement of Shariah-compliant finance and halal industry standards both regionally and internationally.

Guest speakers delving on the following:

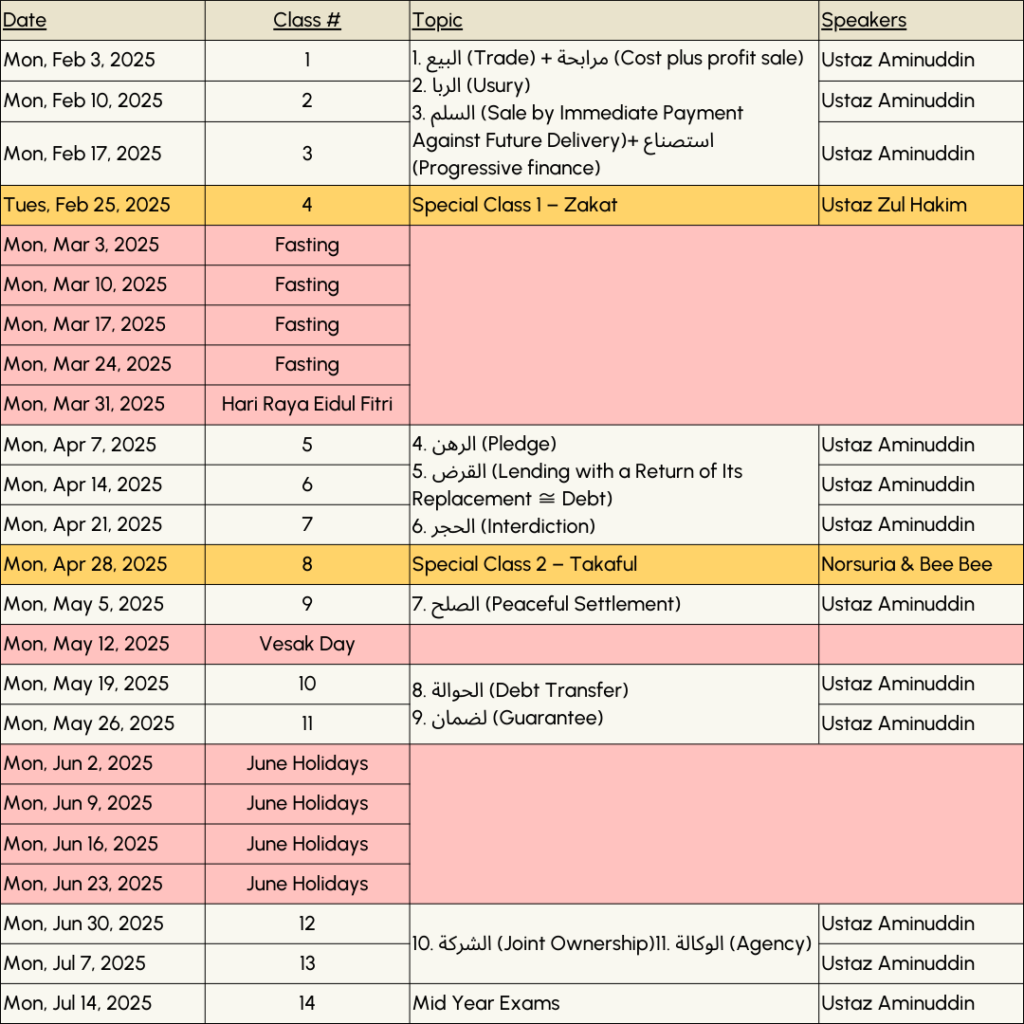

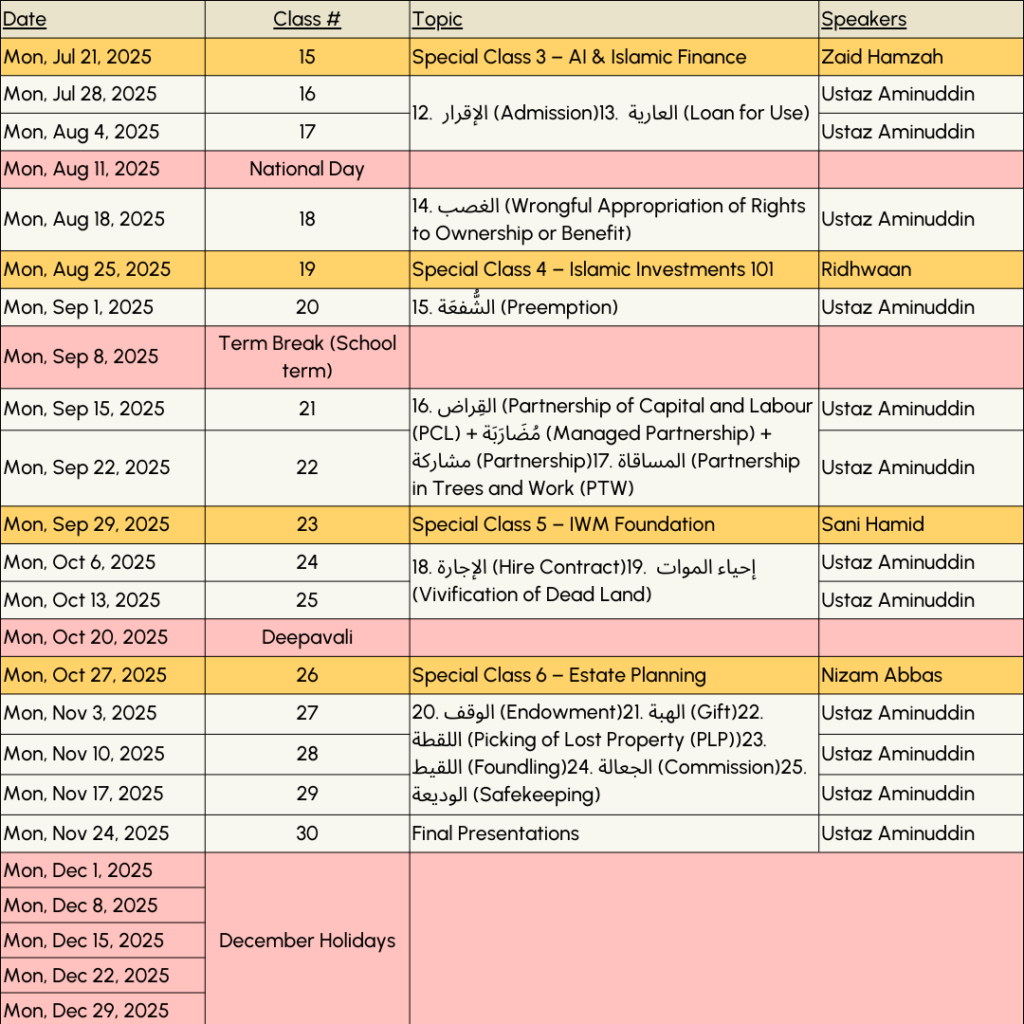

Tentative Course Schedule for 30 Weeks in 2025

Details:

Hayba Office, 63 Ubi Road 1

#02-49, Oxley Bizhub. Singapore 408728

Every Monday, for 30 Weeks

8.00 pm to 9.30 pm

Hybrid Classes

Monthly Payment

By card service providers-

Learning Management Portal

-

Recordings of classes

-

All Six Guest Classes

-

Physical class seat

-

All class materials

Annual Payment

By card service providers-

Learning Management Portal

-

Recordings of classes

-

All Six Guest Classes

-

Physical class seat

-

All class materials

The "Why" & "Who" behind this initiative

Why Are We Doing This?

The idea for this initiative began two years ago, following the success of the inaugural Rizq Symposium in 2023. During the symposium, one of the speakers, Ustaz Anwar Hussain, emphasized the pressing need to educate our community on financial matters, including equipping our masajids with this knowledge.

Since then, we’ve been striving to make this vision a reality: bringing together someone well-versed in Shariah principles and proficient in conventional finance to teach and bridge the gap between classical Islamic knowledge and modern financial applications. However, finding the right individual who truly excels in both fields has been a significant challenge.

While several notable classes have been conducted overseas, particularly in the UK, it became clear that waiting for the perfect solution wasn’t the answer. We realized the time to act is now. This is our effort to build something meaningful for Singapore and Southeast Asia—tailored to our unique context and needs.

Why Not Simply Follow the UK Approach?

There are several reasons why following UK-based classes is not practical for us:

- Cost Barrier: The currency exchange makes it significantly more expensive for participants here.

- Inconvenient Timing: Classes are held in the early hours of the morning (2:00 am), making attendance challenging.

- Contextual Differences: The application of Shariah to financial practices varies greatly between the UK and Singapore/SEA, making it crucial to develop localized solutions that reflect our realities.

This course isn’t just about teaching—it’s about starting a movement to empower our community with knowledge that’s relevant, accessible, and impactful. Now is the time to begin.

A Collaboration between: