Wahed Invest: A Guide

Much like all successful entrepreneurs are known for their inspiring stories, Junaid Wahedna, founder of Wahed Invest started his entrepreneur with a simple casual talk with a Muslim driver in the taxi. The Muslim cabbie was telling his story of seeking the advice of a local Imam for which stocks to purchase. The Imam responded by suggesting that the cabbie to purchase Apple shares since they had low debt and were hence shariah compliant.

While the Imam’s opinion may be true and made the cabbie wealthier, investing in a single stock is very risky, and this motivated Mr Wahedna to establish Wahed Invest as a platform to help Muslims make better financial decisions guided by professionals in the capital market industry.

Despite all this effort, some Muslims still doubt financial products endorsed by shariah scholars. In this session, we spoke to representatives of Wahed Invest in Malaysia, Mr Syakir Hashim, SVP of Business Operations and Mr Izzat Fadhli, Country Manager.

Addressing the scepticism

A survey by Gatehouse bank in the UK, where Wahed has a local presence, revealed that more than 60% of Muslim respondents doubted how “Islamic” their bank products really were, despite the respondents themselves lacking shariah knowledge[1]. Nevertheless, the take-up rate for Wahed’s services has been good in the UK and the rest of the countries it has operations in, as suggested by Mr Syakir. This is especially so in Malaysia, where Wahed has the license to operate, and its government is pushing for Islamic Finance growth.

Mr Izzat then discussed how there is still a need to address the misconceptions related to Islamic finance. Some people are staying away from it because it is labelled as a religious product and either think it is only for Muslims or believe it is just a replication of conventional financial products. He further shared how we should increase the level of Islamic finance and investment awareness and make things simpler for a layman who may be new to Islamic investing.

An example of this is Exchange-Traded Funds (ETF). The word itself may seem complex, but in truth, it is a simple product.

What is an ETF?

Simply, ETFs are a basket of securities that track a particular index and is traded on an exchange platform. If a fund states that it is an equity ETF, it means that it will only have holdings in stocks, and the same is applicable for Sukuk ETFs.

While there are many ETFs in the market, only a handful are deemed Islamic. Below is the list we have compiled:

While most of these ETFs can be bought on your own by just searching their tickers in the brackets on your broker apps, Wahed’s app allows you more. It enables you to construct a portfolio based on your profile that best suits your risk appetite. It also allows you to purchase multiple ETFs without breaking the bank since some ETFs cost more than $3000 for just one unit.

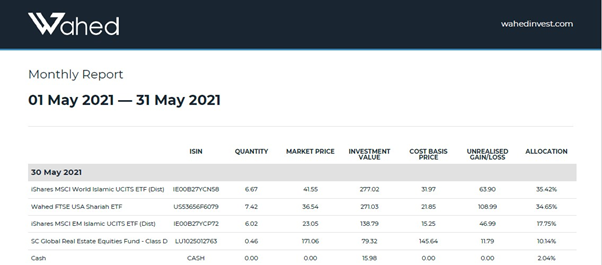

If you were an early user of Wahed’s app and invested in it, you will realise that some of your holdings are already invested in the Wahed FTSE USA Shariah ETF or, as some people call it, Wahed Nasdaq ETF. You may also be exposed to some of the iShares ETF, depending on your risk profile.

So why did Wahed created the Nasdaq ETF? This will be the focus of this article.

Intro to Wahed Nasdaq ETF

The good people in Wahed saw a gap of Islamic ETFs in the US, and they decided to address it. Coincidentally, they were also able to serve Muslims all over the globe by providing another avenue of investment.

But what exactly is this ETF? As all ETFs are, HLAL tracks the performance of a particular index. In this case, the FTSE USA Shariah Index is derived from the FTSE USA Index.

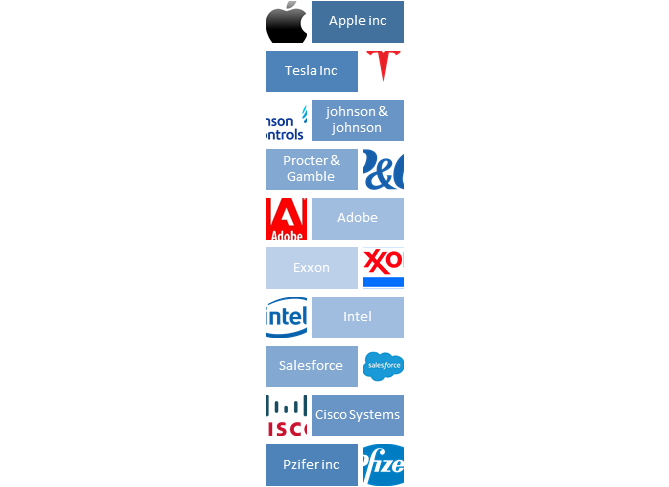

So basically, by investing in the HLAL ETF, which has an asset under management of $23.4 million and has more than 220 securities, you will be exposed to the performance of the FTSE USA Shariah Index. This includes stocks such as Apple, Tesla, Adobe, Intel and more. Furthermore, it charges only 0.5% in annual fees and has a 36.7% allocation in technology companies, the biggest of which is Apple.

But how and why is it shariah-compliant, and who does the compliant checks for these over 200 securities?

The shariah advisor

Derivatives, cryptocurrency, options, and many other complex financial products hold many shariah-compliant issues. However, the Shariah Review Bureau (SRB) has published comprehensive guides for Muslims seeking authoritative Islamic opinions on capital market products. While Wahed engages SRB for much simpler products, such as their HLAL ETF, SRB also ensures that the funds they offer, such as iShares are also compliant since different funds have different shariah consultants. Besides that, SRB advises on Wahed’s operation such as zakat and purification needed for the funds since some aspect of impermissible income is present in the securities.

As mentioned, different funds engage different shariah consultants, and the same goes for the FTSE Shariah Index, which engaged Yassar Limited to be their shariah consultant. Yassar is a globally recognised shariah advisor and is known to be school neutral. Thus, they can tap on the advantages of the different schools of thoughts in Islam.

Low annual expense fee

The HLAL ETF charges only 0.5% per annum. This is a stark difference from the fee charged by unit trust, which can be between 2% to 5%.

So, should you move your holdings to ETFs instead? Well, ETFs are generally cheaper because they are a passive form of investing and usually for the long term. It is historically proven to perform as you are riding the growth of the markets. Conversely, when you opt for unit trusts, you are also paying for the expertise and research done by these mutual fund institutions since many people do not have time to monitor the market.

Another reason why Wahed can charge lower fees is that they are a digital platform, thus incur lesser expenses and focus on improving their technology.

Why Wahed chose FTSE?

The Financial Times Stock Exchange (FTSE) shariah index has its own set of benchmarks consisting of thresholds that securities need to pass after going through a qualitative screening of its business operations, they are:

i) Debt is less than 33% of total assets

ii) Cash and interest-bearing items are less than 33% of total assets

iii) Accounts receivable and cash are less than 50% of total assets

iv) Total interest and non-compliant activities income should not exceed 5% of total revenue

In total, there are other six benchmarks for screening securities besides FTSE, as illustrated below :

While these benchmarks have different thresholds, you are free to choose whichever benchmark you feel is appropriate – provided you know the scholars’ rationale in coming out with these benchmarks (future article). Certain benchmarks may also include constituents that other benchmarks do not.

Now that we have understood the formulation let us go back to why Wahed chose FTSE. Firstly, as Mr Izzat mentioned, FTSE already had an index called the FTSE Shariah Index. Still, there were no ETFs yet. So for practical reasons, it made sense to attach HLAL to the index. The other aspect is the neutral position of Yasaar Limited, which advises FTSE on its index, allowing Wahed to tap on the advantages of each fiqh mazhab as mentioned.

You would also realise that FTSE uses Total Assets as its denominator. This gives its screening criteria much more certainty and stability than some benchmarks that use market capitalisation as its denominator, thus influencing market price movements. That is not to say that the FTSE is a better index, but scholars have their reasons for formulating such denominators.

Applying the screening criteria

So, if I am new to stock investing and realised that Apple is listed in one of HLAL holdings, can I just invest in Apple knowing it is halal? Well, technically, yes, since Apple passed the stringent screening criteria of FTSE. But this is not always the case. Sometimes a stock may be present in a particular benchmark but not on others since it did not pass the screening criteria.

Mr Syakir mentioned that Wahed’s fund managers generally tend to stay with the list of securities provided by the index since they have done all the heavy lifting research and screening. However, they (fund managers of Wahed) could put in a word on whether to include a particular stock or not. This is usually called off-benchmark screening and will be done first by the fund manager based on the benchmark threshold followed by a second confirmation screening by their shariah advisor, in this case, SRB.

You can also be sure that the dividends you received from Wahed Nasdaq ETF are compliant, as Wahed goes the extra mile to purify up to 5% of the dividends received since not all businesses engage in shariah-compliant activities fully

What about SRI/ESG investing?

With the current demand in funds that incline towards protecting the earth, the Environmental, Social and Governance (ESG) screening criteria and Socially Responsible Investments have witnessed huge developments and uptake. Islamic investments, while closely inclining towards these investment methodologies, do have several differences. The apparent difference is that SRI and ESGs are positive screenings, meaning they rank stocks based on how well they comply to the SRI or ESG standards.

In contrast, Islamic screening is a form of negative filter which screens out stocks that do not meet the thresholds. It is observed that a future ESG Islamic fund or SRI Islamic fund could be developed to meet investor demand. However, the demand is yet to be huge enough for now.

The performance of Wahed FTSE Shariah ETF

Despite launching only in July 2019, the Wahed FTSE Shariah ETF has performed remarkably well. Posing a year-to-date return of 10.58% (30 June 2021) and dipping to its lowest in March 2020 before going strong to this date. To what can this performance be attributed to?

Mr Izzat mentioned that the US market has generally reached multiple all-time highs this year since we are coming out of the pandemic. Tech companies have also been reporting high earnings, contributing to the ETF’s performance. On the economic side, markets are still supported by the easing of monetary policies, and this is set to be supplemented by the infrastructure bill introduced by the US, which would help the US economy. Despite this, HLAL does not contain financial institutions due to shariah not permitting interest. This is a double-edged sword since financial institutions would be riding the economy’s growth and be one of the first to enjoy their stock price rising due to monetary policies. This would then make shariah-compliant ETFs lose out on returns. Conversely, shariah-compliant ETFs will not be severely affected when the situation is overturned when financial institutions suffer a drastic drop in share prices.

So, while the US economy has hit all-time highs, there is still a possibility that a sell-down could occur. However, investing in an ETF would minimize the risk of losing the principal investment as adequate diversification across sectors can be achieved by avoiding unnecessary concentration in any industry.

Tips before you start investing in ETFs

If you are new to the investing world, ETFs are a great option since it offers diversification thus if a security is facing a sell-down, other securities will help to cushion the impact. It also allows you to be exposed to securities that would be expensive to purchase individually, such as Apple, Microsoft etc.

Multiple personal finance books recommend ETFs as the next best thing to index funds – they include Tony Robbins, Robert Kiyosaki and Dave Ramsay. On the other hand, if you are thinking of starting, you should seek professional advice to construct your portfolio.

Once that is done, and you know what allocation of your assets needs to be in ETFs, you explore the shariah-compliant ETFs available in the market and try to dig more information about these funds as recommended by Mr Syakir. This could be:

- Finding the size of the ETF

- How long has it been present?

- Performance of the ETF to its benchmark by looking at the difference between the ETF price and the fund’s net asset value (NAV). The closer the price is to the NAV, the more successful it is in tracking the benchmark.

- Looking at the constituents to ensure that you are adequately diversified.

Wahed’s Plans for Singapore

The good news is early adopters of Wahed’s app will continue to be serviced, whereas the bad news is that there are no concrete plans for Singapore as of now, and they are not onboarding new users. That is because their focus for Southeast Asia is Malaysia and Indonesia.

The former because of the strong awareness of Islamic finance and the latter because of its reputation as the biggest Muslim country. Besides that, they continue to focus on the US, UK, Saudi and some African countries.

Currently, the strategy for them is to focus on key markets since they are a tech company looking for the fastest way to scale. Nevertheless, they are still figuring out how to serve the pockets of Muslims in other countries through a central location, so hopefully, this will help serve Singaporean users.

In summary

While the focus was on Wahed Nasdaq ETF, we managed to squeeze a lot from both Syakir and Izzat from a shariah compliance perspective to the performance of the ETF and their operations. The investment opportunities in Singapore are limited, but that does not mean it is insufficient. You can simply DIY your investments or consult professional advice. We say why not do both since information is awash on the internet, and you can simply buy an ETF from brokerage apps like Tiger Brokers, DBS Vickers etc. Once again, it is recommended that you do not just jump into investments. Instead, do a bit of research to at least know what you are getting yourself into.

Writer: Muhammad Ridhwaan Radzi (Linkedin)

Ridhwaan found his passion for Islamic finance at the school where he graduated from – Madrasah Aljunied Al-Islamiah – after taking an Islamic Finance Qualification offered by Chartered Institute of Securities and Investments (CISI), UK. He is currently a business undergraduate in NTU and the Pro Tem Committee Chair at Islamic Finance @ Singapore.

Edited by: Zul Hakim Jumat (Linkedin)

Zul Hakim is a researcher for the Center of Islamic Economics and Finance (CIEF), and a PhD candidate in Islamic Finance and Economy at the College of Islamic Studies, Hamad Bin Khalifa University. Before joining CIEF, he was a research editor with the Dow Jones Risk & Compliance team that focuses on Sanction Ownership Research.

[1] https://www.ft.com/content/67c5702c-8def-11e9-b8cb-26a9caa9d67b

[2] AAOIFI Shariah Standards page 563

[3] Dow Jones Islamic Market Indices Methodogy page 30

[4] S&P Shariah indices methodology

[5] MSCI Islamic Index Series Methodology May 2019

[6] FTSE Global Equity Shariah Index Series v3.8, March 2021 page 9