Shariah-Compliant ETF Guide

Exchange Traded Funds (ETFs) are basically a basket of stocks that are passively managed to track an index and listed on the exchange (such as the Singapore stock Exchange). Some of the advantages include low management fee (0.5% and above) and broad diversification, allowing you to invest in many stocks without burning a hole in your wallet.

Having said that, there are a couple of ETFs that are shariah compliant for Muslims to invest in for as low as S$50 per unit and that is what this guides hope to help you get.

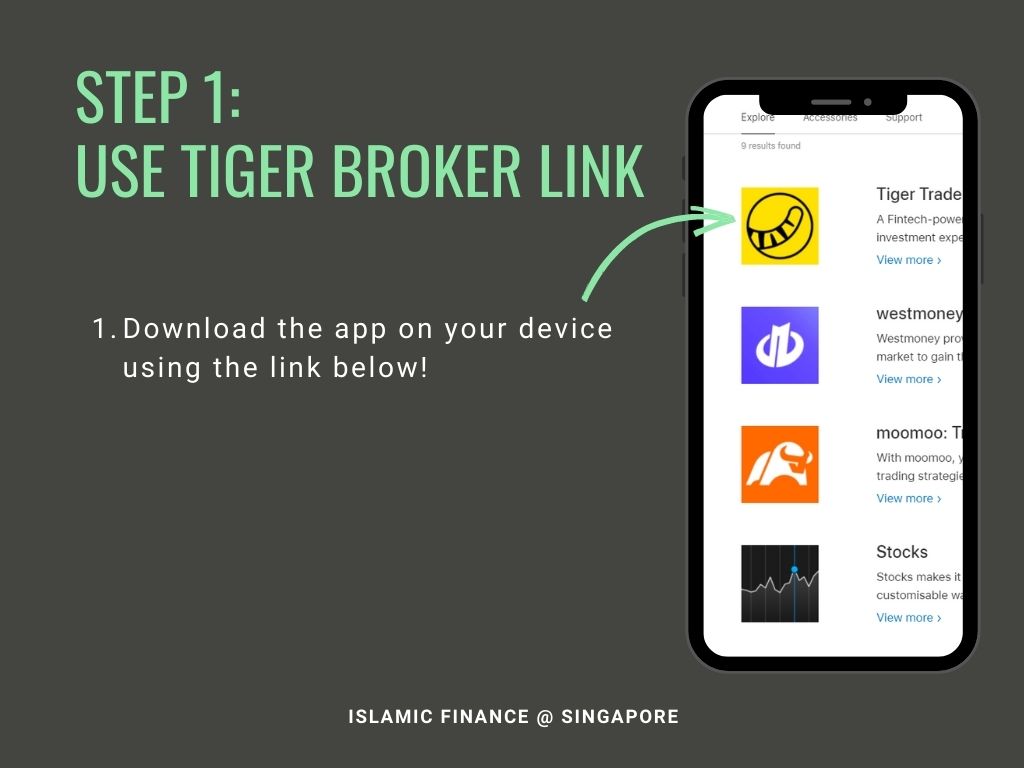

First and foremost, we will be using the Tiger Broker App due to the quickness and simplicity. If you are ready to invest, then let’s start:

1. Download the app on your device with the link in the button:

2.1 In here, you will need to key in your key details:

-

Nationality,

-

Country of birth,

-

Country of residence,

-

tax residency and whether you have a tax ID.

For Singaporeans and Permanent residents, the tax ID is your IC (S*******F).

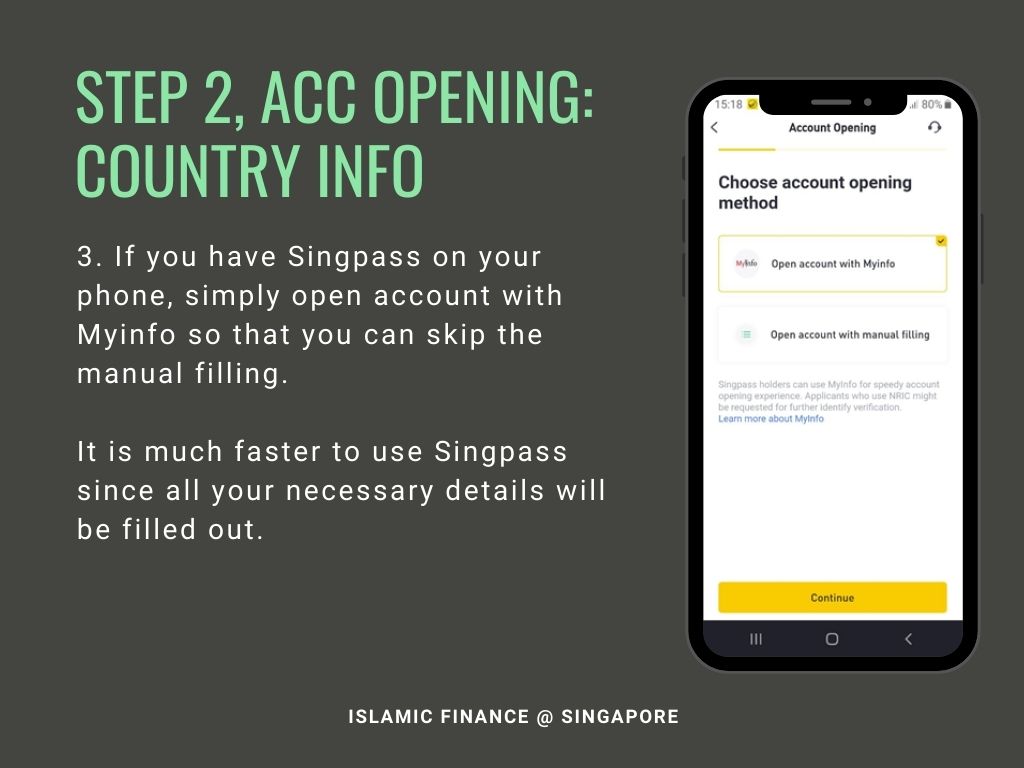

2.2 If you have Singpass on your phone, simply open account with Myinfo so that you can skip the manual filling. It is much faster to use Singpass since all your necessary details will be filled out.

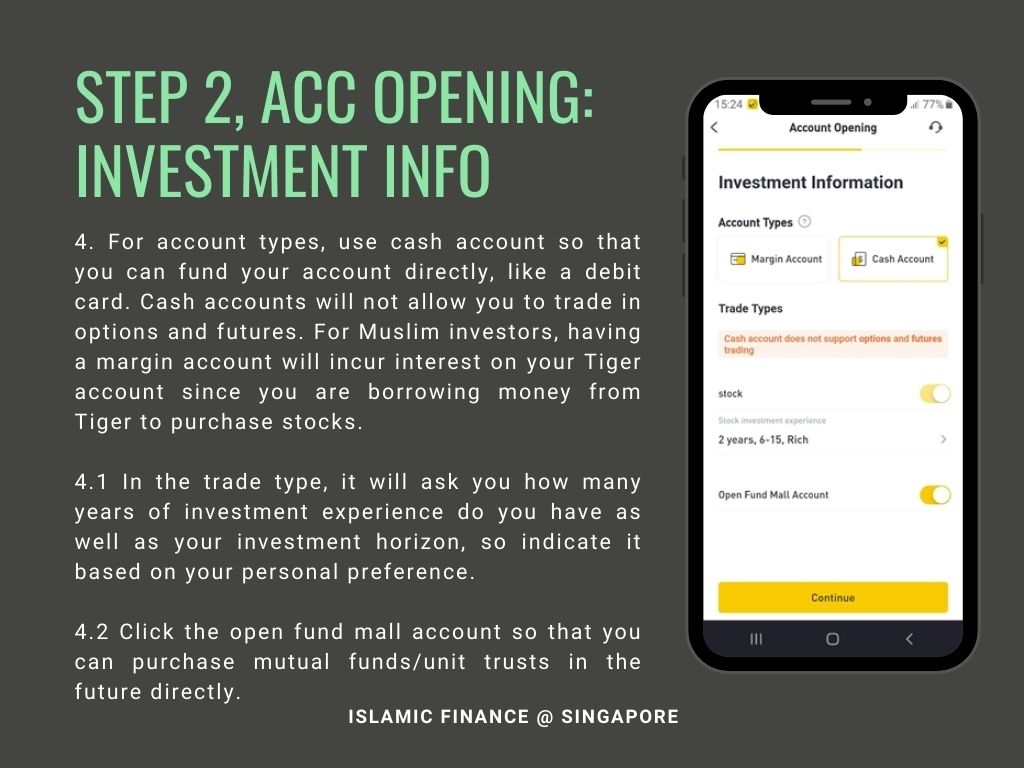

2.3 For account types, use cash account so that you can fund your account directly, like a debit card. Cash accounts will not allow you to trade in options and futures. For Muslim investors, having a margin account will incur interest on your Tiger account since you are borrowing money from Tiger to purchase stocks.

In the trade type, it will ask you how many years of investment experience do you have as well as your investment horizon, so indicate it based on your personal preference.

Click the open fund mall account so that you can purchase mutual funds/unit trusts in the future directly.

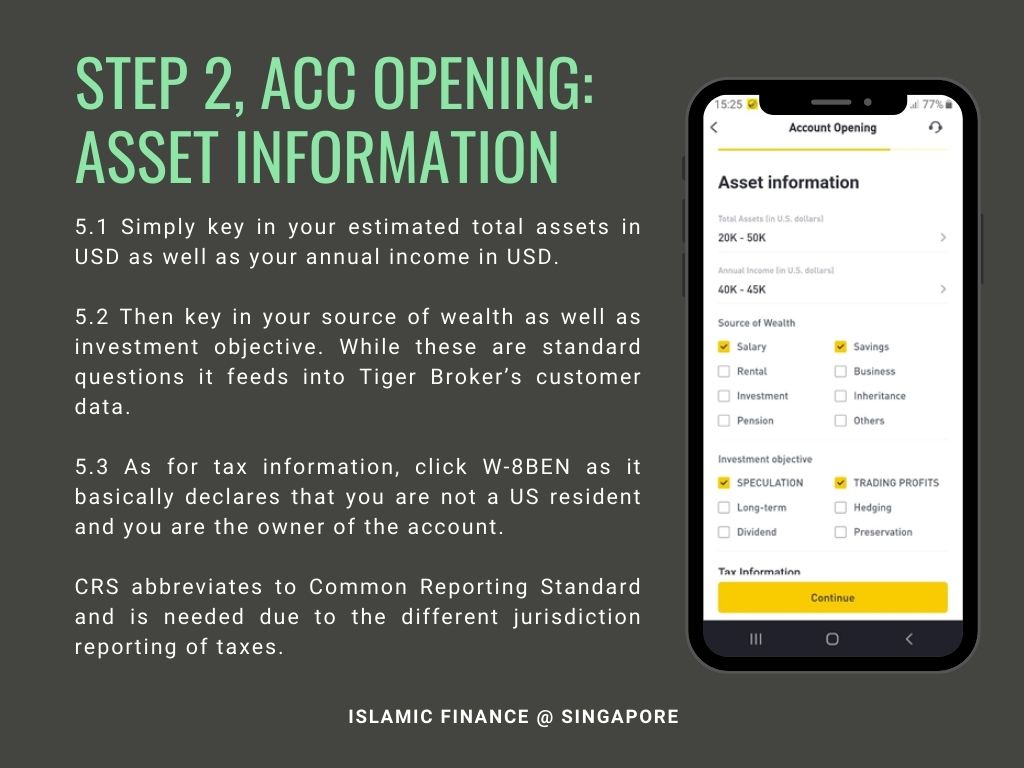

2.4 Simply key in your estimated total assets in USD as well as your annual income in USD.

Then key in your source of wealth as well as investment objective. While these are standard questions it feeds into Tiger Broker’s customer data.

As for tax information, click W-8BEN as it basically declares that you are not a US resident and you are the owner of the account.

CRS abbreviates to Common Reporting Standard and is needed due to the different jurisdiction reporting of taxes

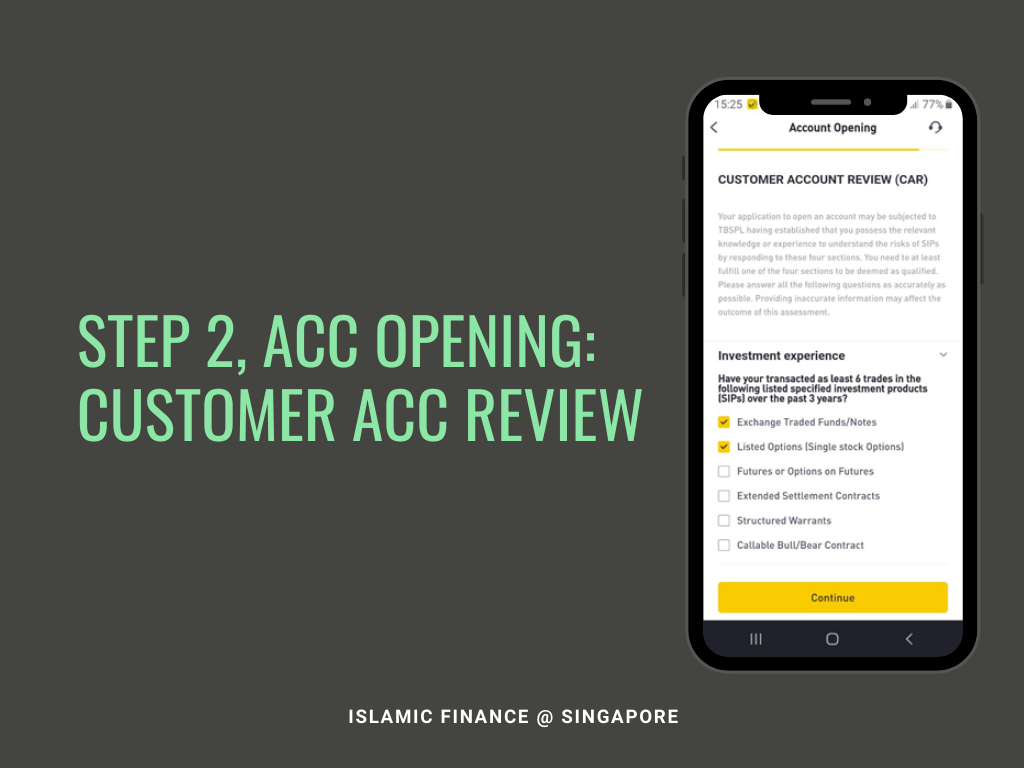

2.5. Indicate your investment experience as well as whether you have ever traded any of these securities. Again this is standard information for Tiger Broker to comply with regulation.

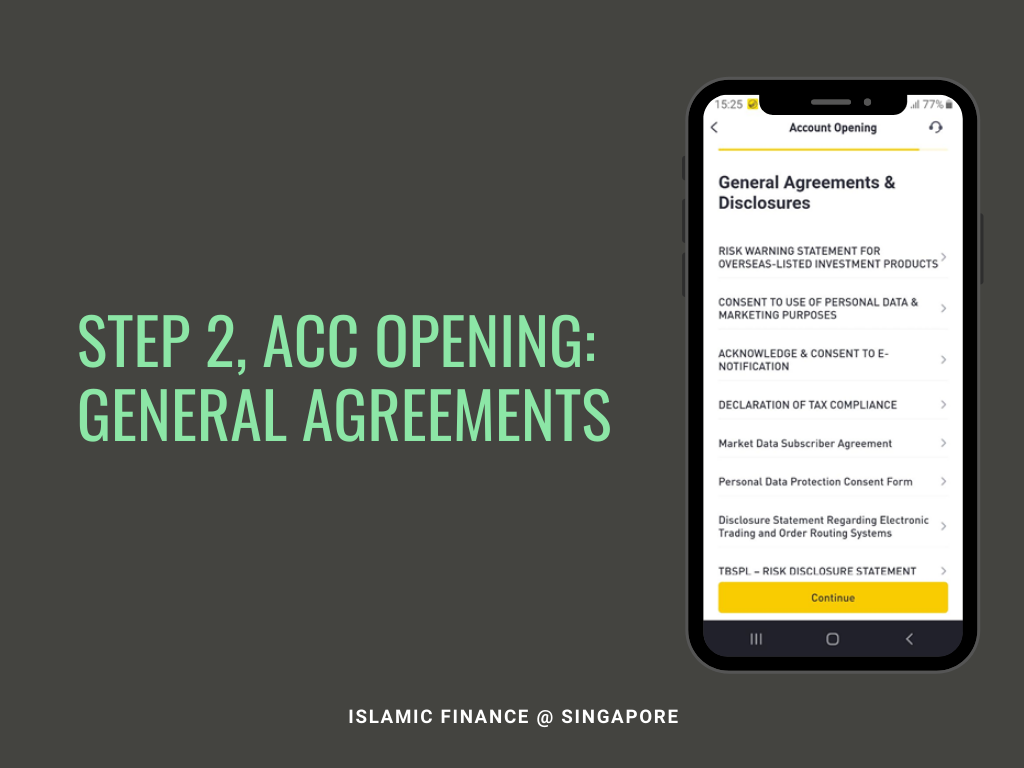

2.6 As usual, do read the terms & conditions before you click check the box on “I have read and understand and agree to accept the terms of all the above documents”. Then click continue.

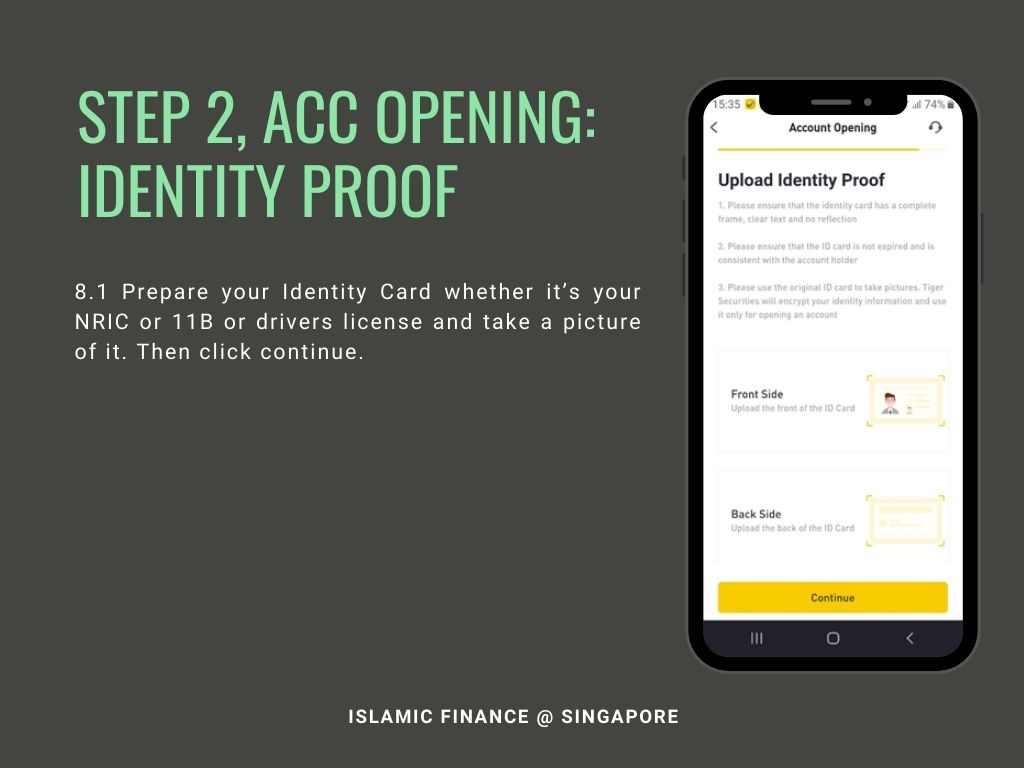

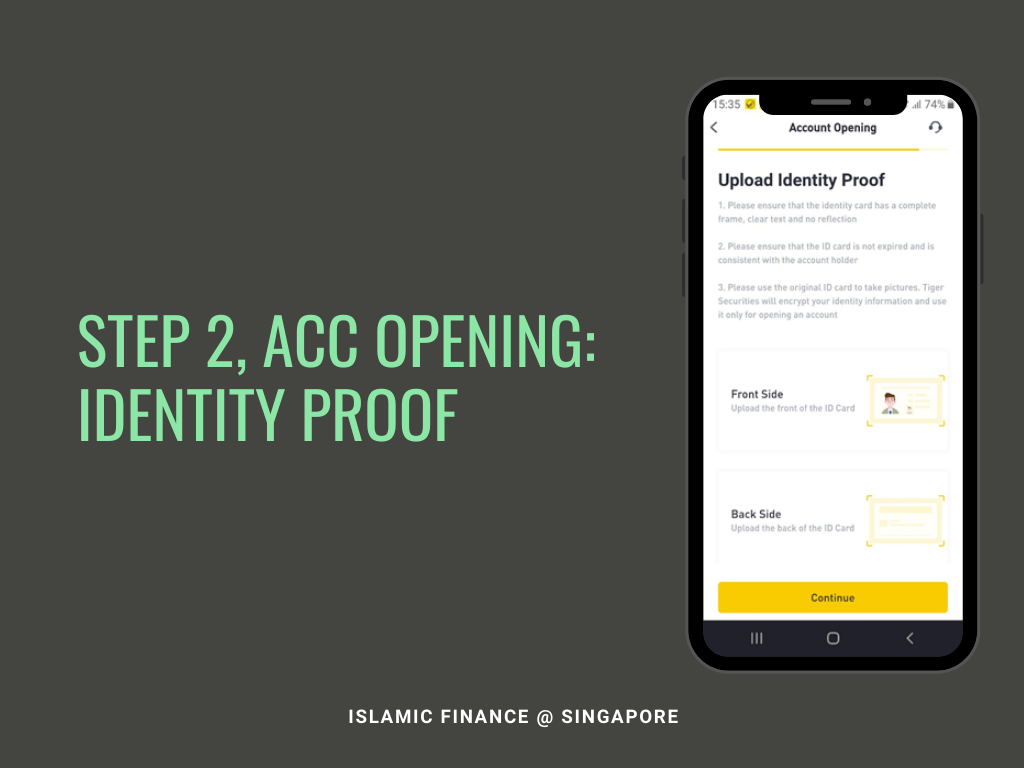

2.7 Prepare your Identity Card whether it’s your NRIC or 11B or drivers licence and take a picture of it. Then click continue.

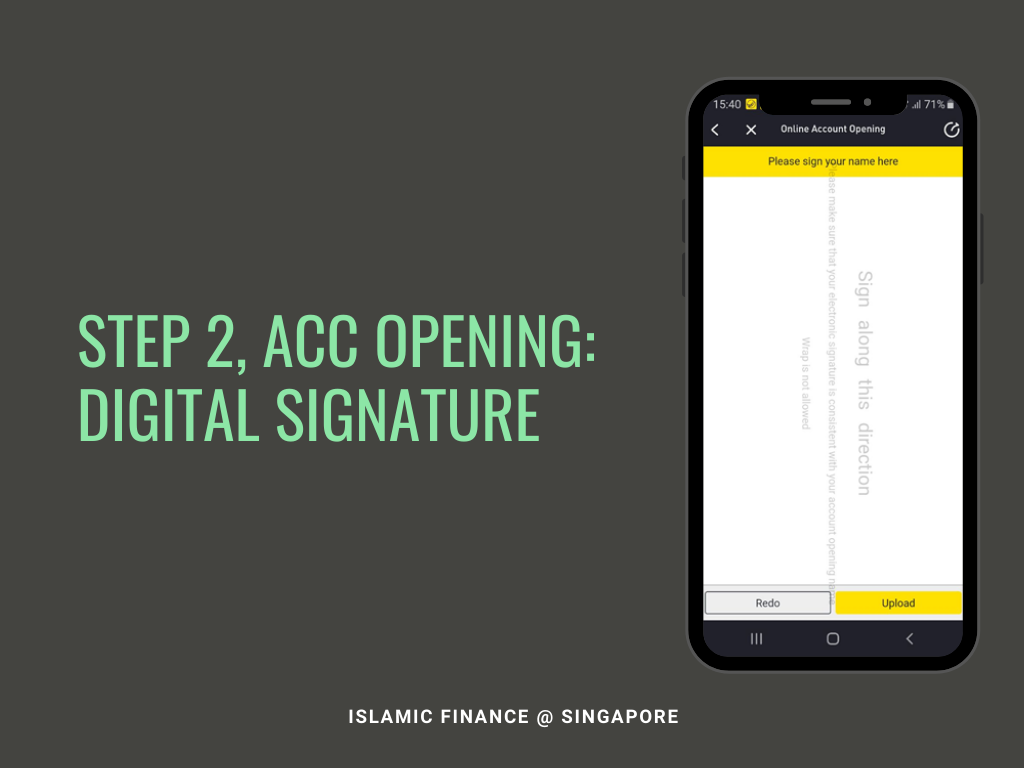

2.8 Simply sign using your finger, as you would with a pen and click upload.

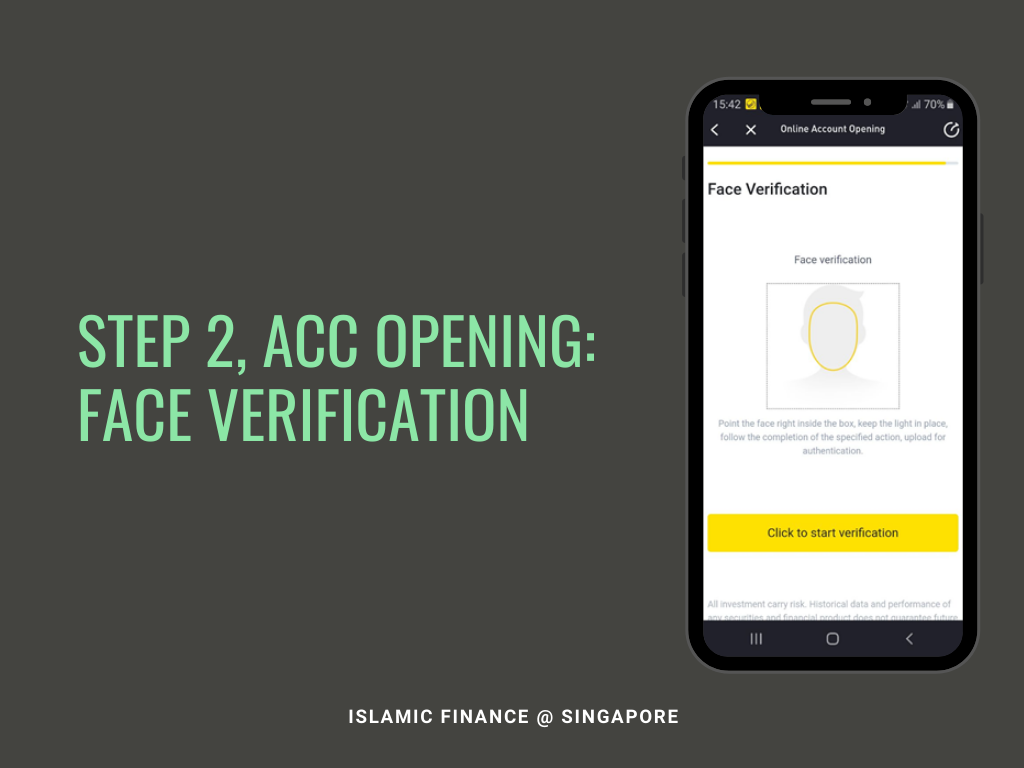

2.9 Get yourself in a lighted area and take a selfie for verification. This allows Tiger Broker to know that the one opening the account is you.

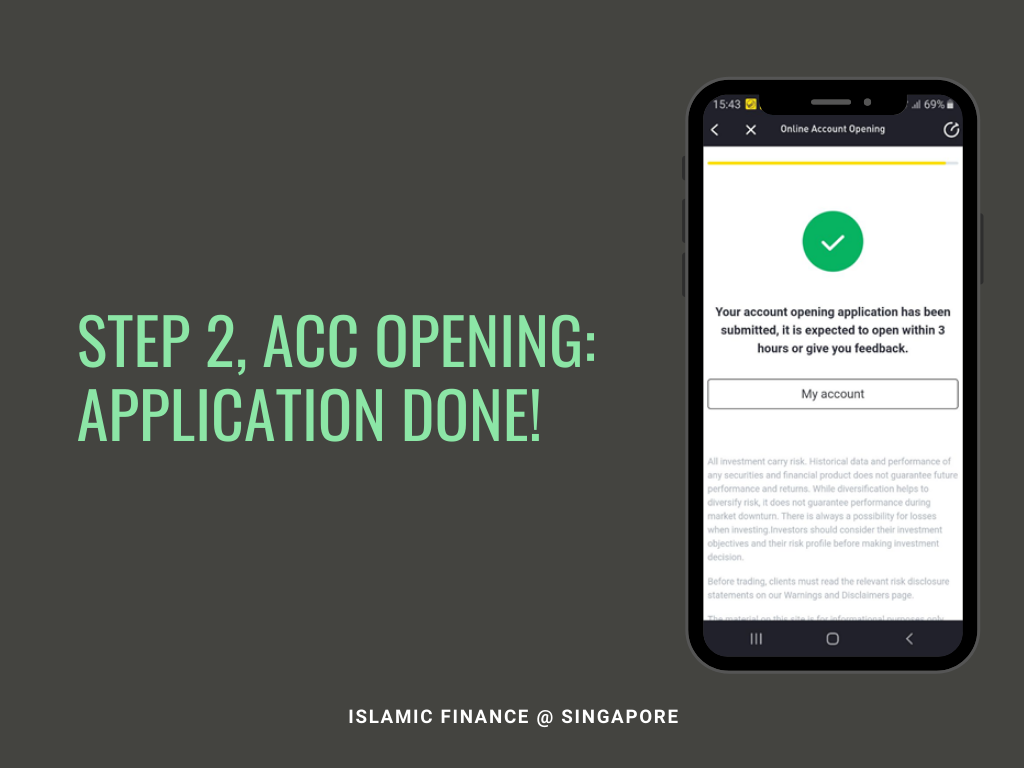

2.10 Now you just need to wait for three hours or less for the account to be processed. Also, Tiger Broker will only process your application on weekdays.

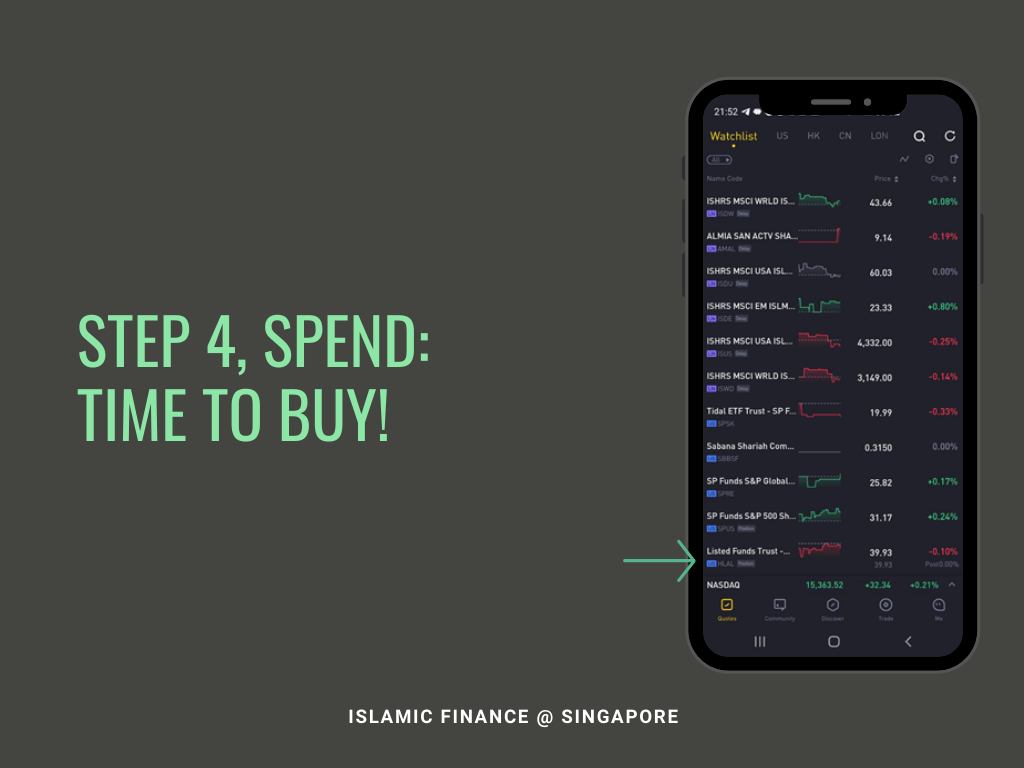

3.1 Once your application has been processed, you can now start to look for ETFs that are shariah compliant like the one in the picture. The long name in white is still an acronym, example:

ISHRS MSCI WRLD ISLMIC ETF USD stands for Ishares Morgan Stanley Capital International World Islamic Exchange Traded Funds US Dollars. You can look for the full name in the profile when you click the name.

The “ISDW” is the short form or ticker you can use to quickly identify the ETF or any security. Here is the cheatsheet for you:

For this example we will be looking at how to purchase the Wahed Nasdaq ETF (HLAL) from Tiger Broker. *For any other funds, simply search for it in the search box e.g.: HSBC Islamic Global Equity index.

3.2 Your investing journey now begins by parting ways with a portion of your savings you have set aside for investing.

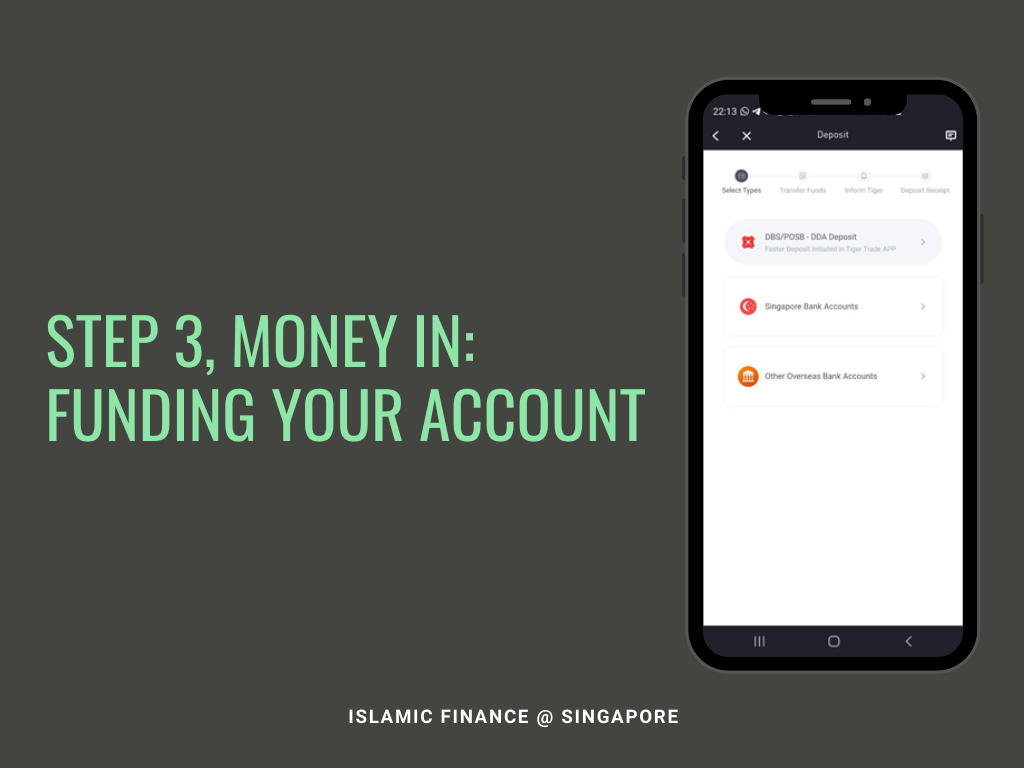

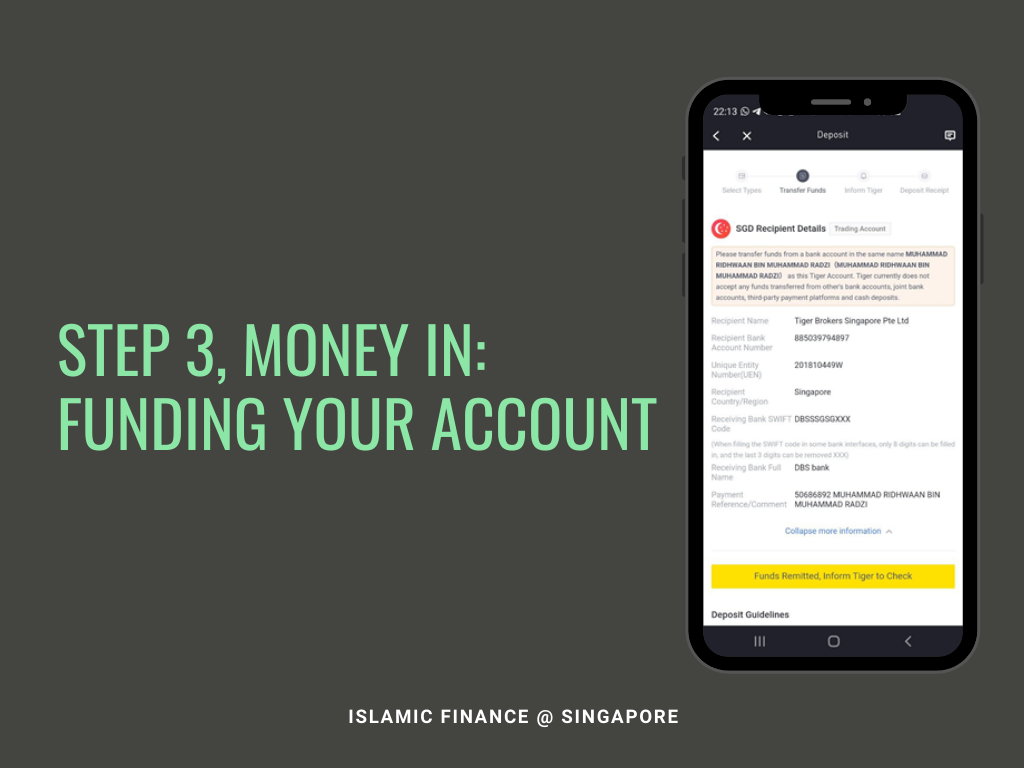

3.3 Go to the “me” option (1), and click the deposit button (2) which will bring you to a new window where you can choose which currency to deposit in. Simply choose SGD first (3).

3.4 Click “Singapore Bank Accounts” and then make a FAST transfer to the account stated by Tiger. You can also link your Tiger app to your DBS/POSB account, the deposit will take less than a minute to be verified as DBS is the custodian of Tiger Brokers.

3.5 You can transfer any amount but for a start, we recommend SGD$100 to 200 since this amount will then be converted to USD later.

Do make sure that all the fields you entered in your banking app match those stated by Tiger broker!

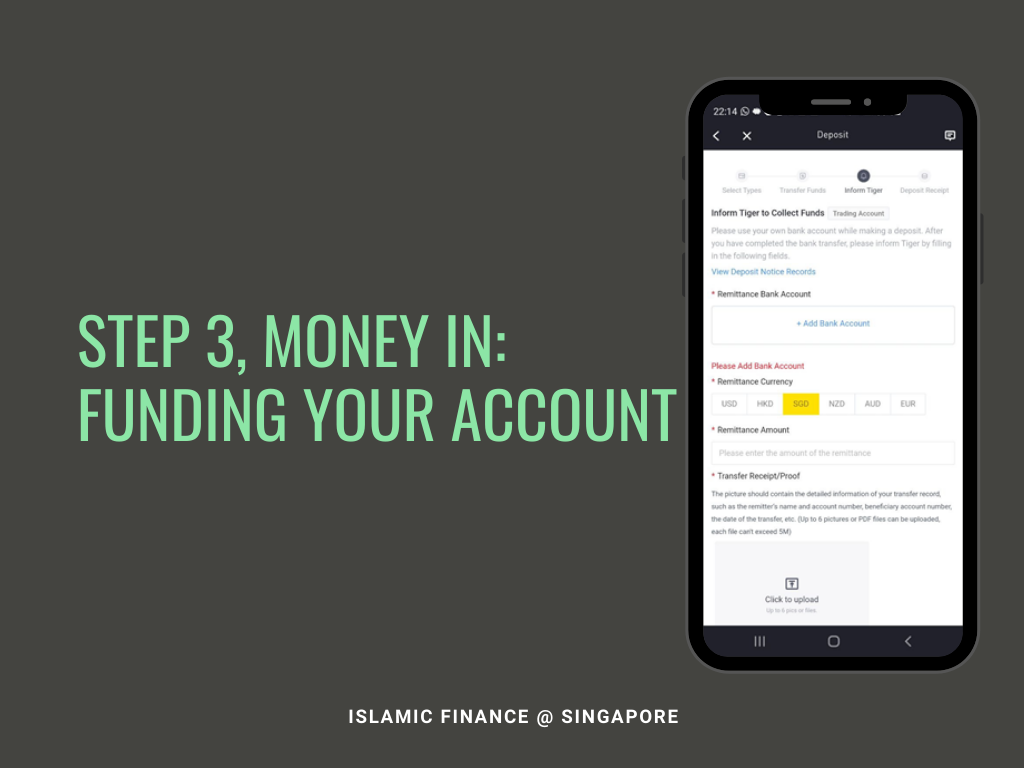

3.6 Then make a screenshot so that you can upload to Tiger broker for faster processing!

3.7 Now if you wanted to purchase Singapore shares then once your funds have been reflected in your SGD cash account you can start purchasing the Singapore stocks. But since we are talking about US, we will need to convert your SGD funds into USD, otherwise you will automatically create a margin account which means you are borrowing money from Tiger Broker to purchase the US securities.

Go to Trade button on the fourth widget (1) if your SGD funds have been received, and click exchange (2).

3.8 Then convert your SGD into USD and press Start exchange. Once you receive the notification that your SGD has been converted you can purchase an ETF.

4.1 Click the quote button on your bottom right and click on Wahed Nasdaq or search for HLAL.

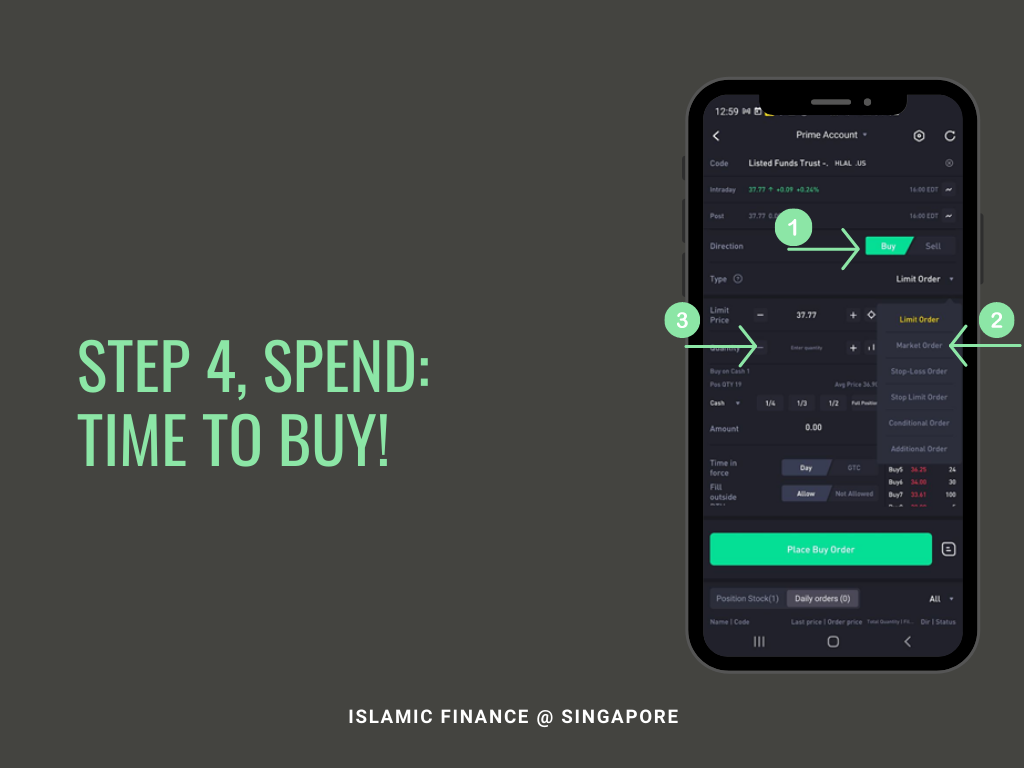

4.2 Then click the yellow “Trade” button in the bottom part of your screen. You will then be bought to the trading screen where you can choose how you wish to purchase the security.

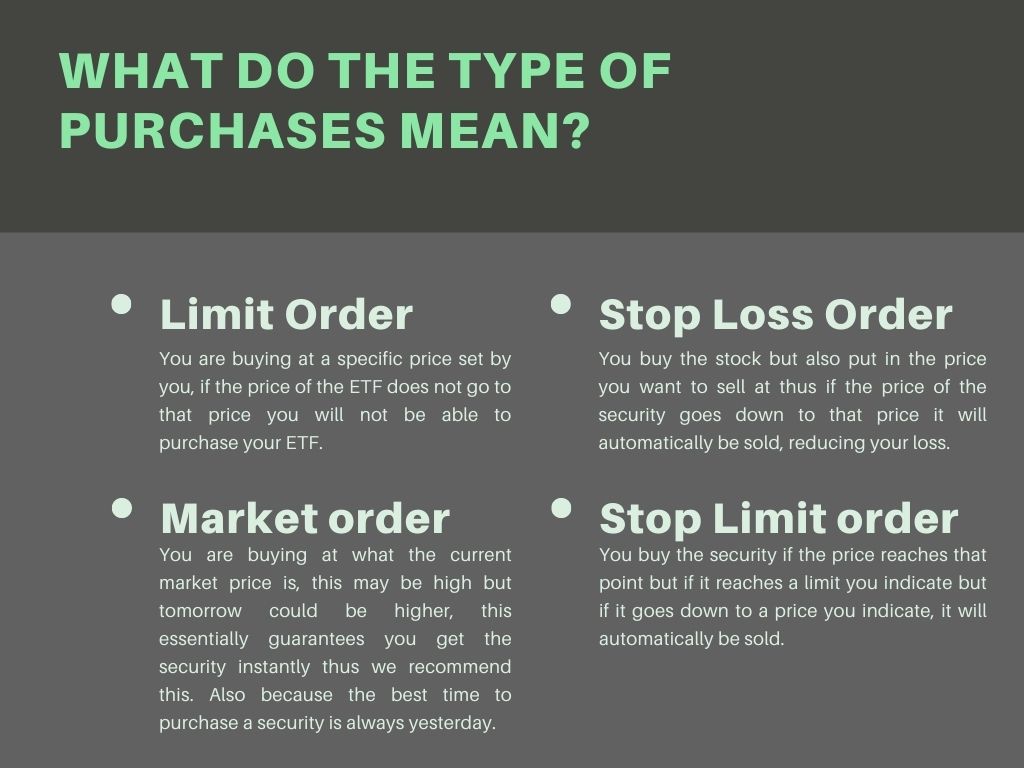

Limit order: You are buying at a specific price set by you, if the price of the ETF does not go to that price you will not be able to purchase your ETF.

Market order: You are buying at what the current market price is, this may be high but tomorrow could be higher, this essentially guarantees you get the security instantly thus we recommend this. Also because the best time to purchase a security is always yesterday.

Stop loss order: You buy the stock but also put in the price you want to sell at thus if the price of the security goes down to that price it will automatically be sold, reducing your loss.

Stop Limit order: You buy the security if the price reaches that point but if it reaches a limit you indicate but if it goes down to a price you indicate, it will automatically be sold.

4.3 At the point of writing, HLAL was priced at US$39.51 per unit so you’ll need to have that amount to purchase just unit. Usually we purchase more than one.

Remember that you can only start to trade when the US market is open, at 9.30pm Singapore time.

Once you have clicked Market Order as the order type (2), change the quantity but make sure the amount (3) section is lesser than the amount you currently have in your cash account, otherwise it will be treated as a margin account.

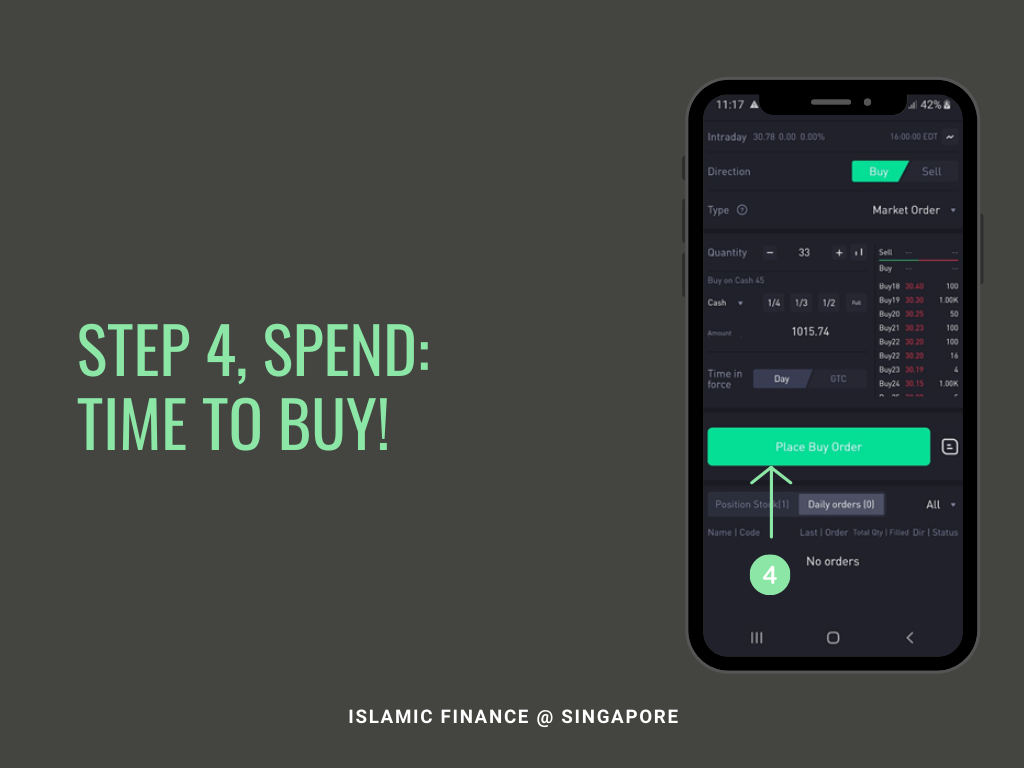

This account converted SGD2000 thus it had enough cash to purchase 33 units of HLAL. Time in force, simply choose Day, meaning your offer to purchase at the market price is valid for the day. While GTC is an acronym for Good till cancelled, which basically means the order is valid until it is completed or cancelled.

4.4 Confirm your investment by clicking the place buy order! Do not buy if it states you are buying on margin as it means you are borrowing to purchase and will incur interest charges.

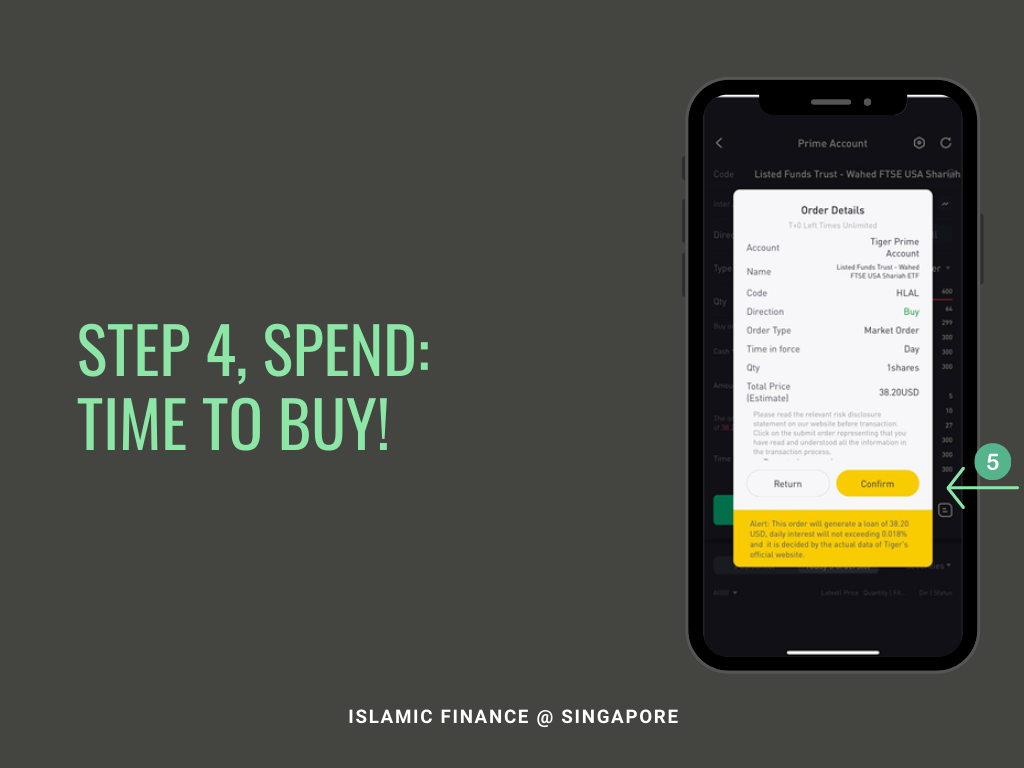

4.5 Check the details of the investment before clicking the “confirm” button (5). Once you are satisfied, click the place buy order and confirm (The picture is different amount but the same pop up will appear).

4.6 You will receive another notification that your order has been filled! To confirm, scroll lower where you will see a position which basically indicates how many shares you have, how much you have gained/are losing and the percentage gain or loss.

In the picture, it indicates that the account holder has 10 units of HLAL which was bought at USD 39.67, since the current market price was USD 39.51, the account owner is losing an accumulated USD1.63, equivalent to a drop of -0.41%.

It’s normal for your security to lose money since you bought it on the market order, this is also due to the taxes involved but with the economy rising, you can then purchase other ETFs besides HLAL while monitoring it.

Look for other ETFs that cover other regions such as Emerging Markets or Global but do note that US dividends will cost you 40%, meaning if you received $1 in dividends, it will be taxed 40% giving you a net dividend of $0.60.

We hope this is just the start of your investment journey to more investments in ETFs!

Ridhwaan found his passion for Islamic finance at the school where he graduated from – Madrasah Aljunied Al-Islamiah – after taking an Islamic Finance Qualification offered by Chartered Institute of Securities and Investments (CISI), UK. He is currently a business undergraduate in NTU and the Pro Tem Committee Chair at Islamic Finance @ Singapore.

Screenshots by:

Siti Nurul Fatinah Bte Khairy

Hanisah Subhi