Halal Investing Guide

Are you looking to invest in halal stocks and ETFs but don’t know where to start? Look no further than Interactive Brokers. This comprehensive review will show you all the great features this trading platform has to offer. From commission rates to customer care, you’ll be able to find everything you need to make an informed decision.

🔵Join the Islamic Finance Singapore community here!🔵

Trading stocks and ETFs can be a highly effective means of generating additional income or even a full-time livelihood for those who commit to it. In fact, over 48% of Singaporeans have already invested their money in stocks, emphasizing its popularity. If you’re considering entering the world of ETFs and stock trading, one of the primary decisions you’ll face is choosing a reliable stockbroker. Among the top-rated trading platforms for stocks and ETFs, Interactive Brokers stands out, catering to several countries, including Singapore.

The good news is that Interactive Brokers has a dedicated platform specifically designed for Singaporean investors, allowing them to trade using the local currency. If you’re eager to learn more about Interactive Brokers, this article is for you. In this review, we’ll explore everything you need to know about Interactive Brokers, from its standout features and user-friendly interface to the types of market data it offers and much more. So, without further ado, let’s dive right in!

What is Interactive Brokers?

With over 2.1 million client accounts, Interactive Brokers is currently one of the leading trading platforms in the trading industry. Interactive Brokers provides a comprehensive platform for trading various financial instruments, including stocks/ETFs, options, futures, currencies, bonds, and more. This trading platform has become popular over the years thanks to its low trading commissions, extensive range of tradable assets, and robust technology that allows for quick and efficient execution of trades.

Interactive Brokers was established in 1978 with headquarters in the USA. However, it has clients in over 200 countries and supports up to 26 currencies. It offers advanced trading tools, research resources, and market data to empower both individual investors and institutional clients to make informed trading decisions. Fortunately, this platform is designed to cater for traders with different levels of experience, including beginners and seasoned professionals.

What are the best features of Interactive Brokers?

Some of the notable features that make this platform stand out include the following;

Low Commissions

If you’re searching for a trading platform with low commissions, Interactive Brokers is one of the best options out there. This platform is known for its competitive and low-cost fee structure, making it an attractive choice for cost-conscious traders. For instance, their commissions for ETFs and stocks in the US markets are USD 0.0005 to 0.0035 per share and USD 0 on fee transactions fee ETFs.

Diverse Tradable Assets

The platform offers a vast selection of tradable assets, including Stocks/ETFs, Metals, sukuks, and Mutual Funds. This extensive range gives investors and traders a wide range of options to choose from, allowing them to diversify their portfolios.

Advanced Trading Tools

Among the factors you must consider when choosing a trading platform are the trading tools they offer. Fortunately, Interactive Brokers provides sophisticated trading tools and features that cater to both beginner and experienced traders. From customizable trading screens and advanced charting to risk management tools, the platform empowers users with essential resources for making informed decisions.

Research and Market Data

Trading and investing in financial assets like stocks requires having real-time updates about what is happening in the various markets. With Interactive Brokers, traders can access a wealth of research and market data, including real-time quotes, news updates, and comprehensive market analysis. This information lets traders stay up-to-date with market trends, which is crucial for making informed investment decisions.

Global Market Access

Interactive Brokers allows clients to access markets and trade in multiple countries, making it an excellent option for international investors looking to expand their investment opportunities. At the time of writing this article, investors and traders using this platform could access up to 150 markets in the US, EU, UK, and several other regions.

Mobile App

Interactive Brokers provides a feature-rich and user-friendly mobile app, enabling traders to manage their investments on the go. The app allows for real-time trading, account monitoring, and access to research and market data from the convenience of a smartphone or tablet. The IBKR app is available for both iOS and Android, and it is one of the top-rated trading apps on the Google Play Store and Apple App Store.

Algorithmic Trading

For advanced traders, Interactive Brokers provides access to API (Application Programming Interface), allowing developers to create and implement custom algorithmic trading strategies. These algorithms generate trade signals, allowing investors and traders to decide when to sell or buy a given financial asset.

Fractional Shares

At Interactive Brokers, you don’t have to own a whole share, thanks to fractional shares. With fractional shares, you can buy a portion of a company’s stock, making it easier for new investors to get started. This option applies to almost all US and EU stocks.

How to start investing in Halal stocks and ETFs through Interactive Brokers (IBKR)?

Interactive Brokers offers a broader range of exchanges for retail investors to invest in compared to the new brokerages advertised in public areas, such as Tiger Brokers, Webull, and Moomoo. This allows investors to diversify further instead of investing in stocks or ETFs in the US, Singapore, and Hong Kong. It also offers pretty low commission fees, a respectable currency conversion rate, and robust research tools for investors to make an informed decision. This is important before you even start investing, whether in a Shariah-compliant manner or not, as you are putting your hopes of growing that money to meet future needs.

So if you are ready to invest in the broader selection of halal stocks and ETFs, this guide will teach you the way.

Registering for an IBKR Account

First and foremost, you’ll have to register for an account with IBKR. You will need to be above 18 years old to open an account though! If you are not, then consider opening for your parents or a sibling who has yet to start investing. If you do meet the above age and are ready to start your halal investing journey then do use our referral link below to support IFSG efforts!

First and foremost, you’ll have to register for an account with IBKR. You will need to be above 18 years old to open an account though! If you are not, then consider opening for your parents or a sibling who has yet to start investing. If you do meet the above age and are ready to start your halal investing journey then do use our referral link below to support IFSG efforts!

Once you use our referral code, fill in your email address and username (only lowercase, at least 9 characters and must have 3 letters. Then, set your password and the country where you were born. For this guide, we will be using Singapore as an example. But if you are not a Singaporean, you can still use the brokerage account and invest in multiple halal stocks and ETFs.

Tip #1: Type your username and password in a note-taking app that can be password protected e.g., Colornote.

Once you have filled in the earlier step of email to nationality, you will need to open your email and verify that the email you used is true. Do check your spam/junk folder if you can’t find it after a while (somewhere between 5-10 minutes).

Once you have received the email, click “Verify Account”. Remember to also put IBKR emails as one of your safe senders!

Once you click the “Verify Account” button, you’ll be redirected to the IBKR page again. This time, fill in the username you typed in step 1 and your password.

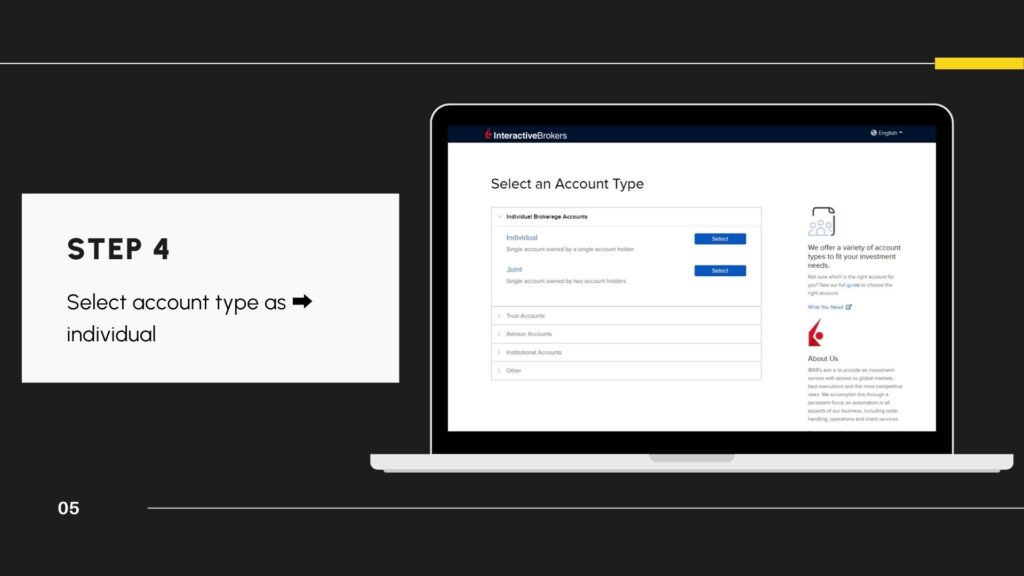

Once successfully logged in, you’ll be asked to choose which account type to open. Select the “Individual” account if you are opening it for yourself. You can also open a joint account, a trust account, an advisor account, institutional accounts and other types of accounts. For this guide, we are assuming you are an individual.

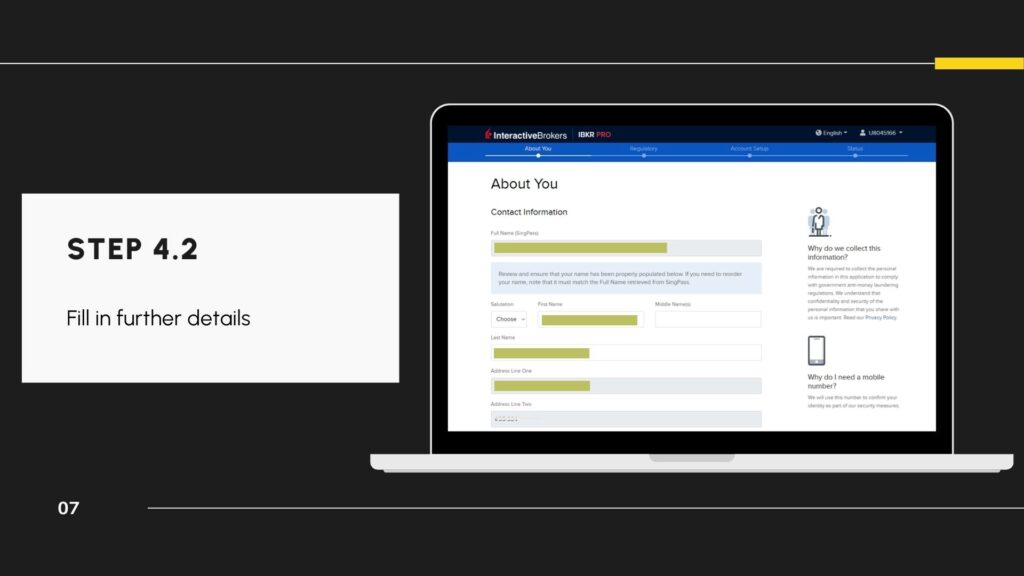

If you are a Singaporean, then use your SingPass to retrieve the information IBKR needs to process your application faster. This also goes for other brokerages such as Webull, Tiger Brokers, Syfe and Moomoo, among others. Once you allow IBKR to retrieve your information, then the following fields such as full name and so on will be automatically populated.

Although you might be using Singpass, you could still change some of the fields e.g., Phone number. But assuming you don’t, you’ll have to type in manually your particulars.

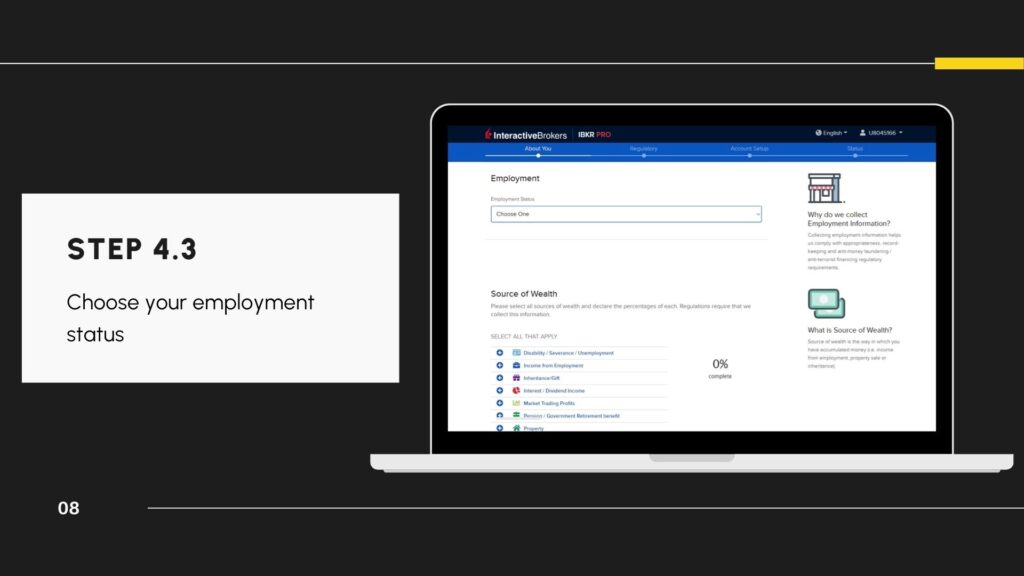

Once your personal particulars have been completed, you’ll have to fill in your employment status. It’s basically for their record-keeping and Anti-Money Laundering purposes. You’ll also have to complete your source of wealth, i.e.: where you get your money from when investing. Usually, investors will place “income from employment” as their source of wealth but if your situation differs, then sure you can declare (you might have to fill in further questions).

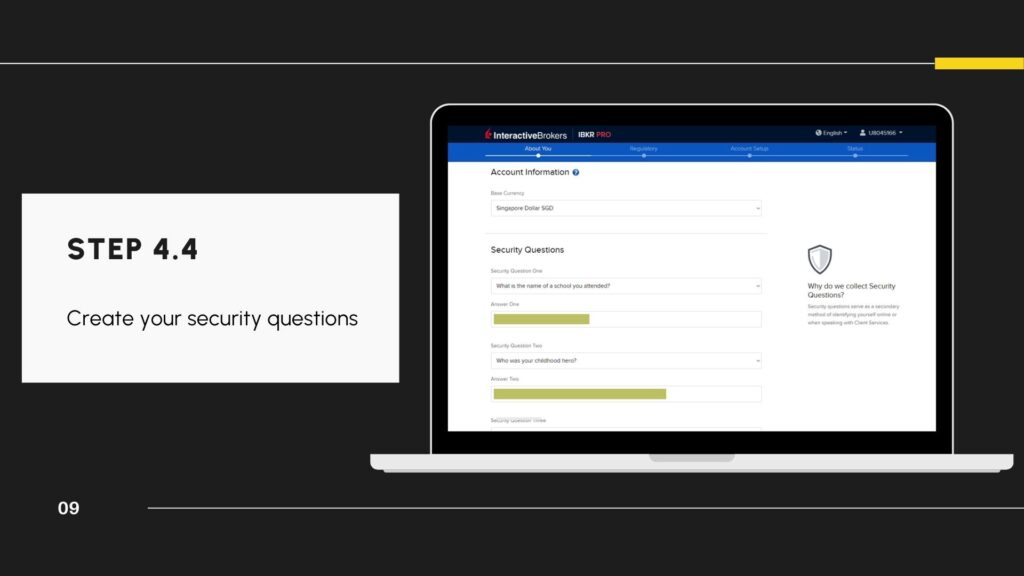

Once you have filled in your source of wealth, you’ll be brought to the next page, where you’ll have to select your base currency and three security questions. For base currency (assuming you are a Singaporean), select “Singapore Dollar SGD”. Thus, this will allow you to deposit and monitor your current portfolio in Singapore dollars (SGD). If you decide to use a different currency, share with us through our email (contact@islamicfinancesg.com) if there is any impact on your application.

Fill in your three Security questions to recover your account in any unforeseen circumstances.

Tip #2: Add the security questions (#1, #2 and #3) and their answers to your password-protected note-taking app.

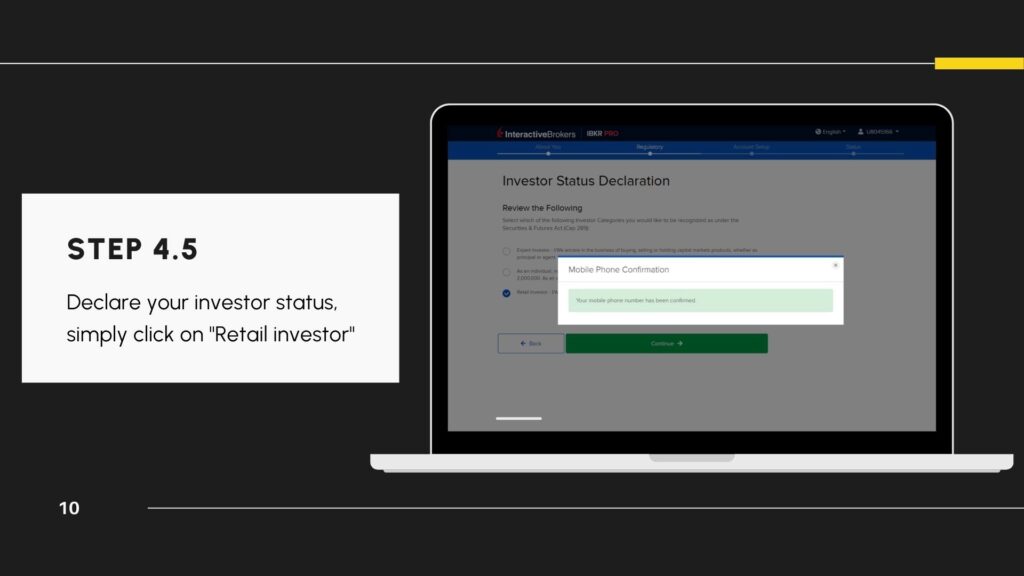

Once you have filled in your security questions, declare your current investor status. For this guide, we assume that you are a retail investor, which sufficiently allows you to buy stocks and ETFs. You’ll also be asked to confirm your mobile phone, so do keep it with you while in this registration process.

Retail investors are normal investors or the majority of investors with assets below 2 million and/or cash at hand amounting to S$200,000. Accredited investors on the other hand have assets of more than S$200,000 and/or cash at hand amounting to S$200,000. Being an AI allows you to invest in certain asset classes that retail investors can’t but that’s for another article.

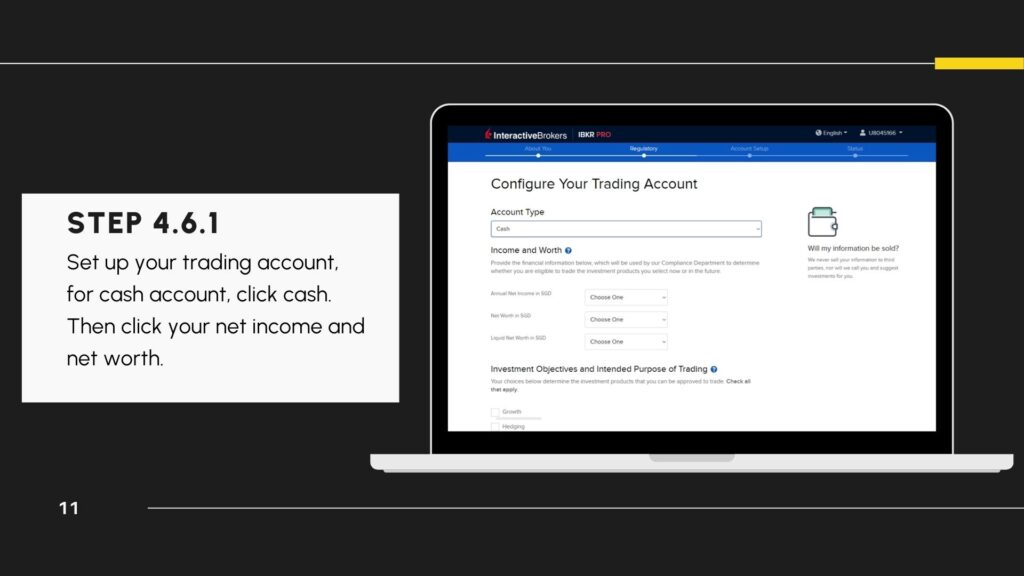

After setting up your investor declaration, you must set up your trading account. Select cash, as it means you will trade using the cash you deposit. Margin trading, on the other hand, involves the use of leverage thus you will be charged interest, which is impermissible in Islam.

Then select your annual net income in SGD, your net worth and liquid net worth. Annual net income is your annual take-home pay, your net worth is your assets minus your liabilities, whereas your liquid net worth is the amount of cash, fixed deposits, gold or any other assets that can be converted into cash minus your current debts e.g., credit card loans.

Once done with the earlier step of declaring your assets, you’ll have to share why you intend to trade. Select Growth which means you want your money to grow through the purchase of halal stocks or ETFs, e.g., you are buying at S$1, and you sell for S$1.10, thus giving you a 10% return. Hedging is more of protecting your overall portfolio against unforeseen circumstances which might bring the value down, e.g., you have other assets like gold, which you bought at S$80, but the current market price of gold stands at S$75, or -6.7%, whereas your stocks went up by 10%, giving you a positive net portfolio.

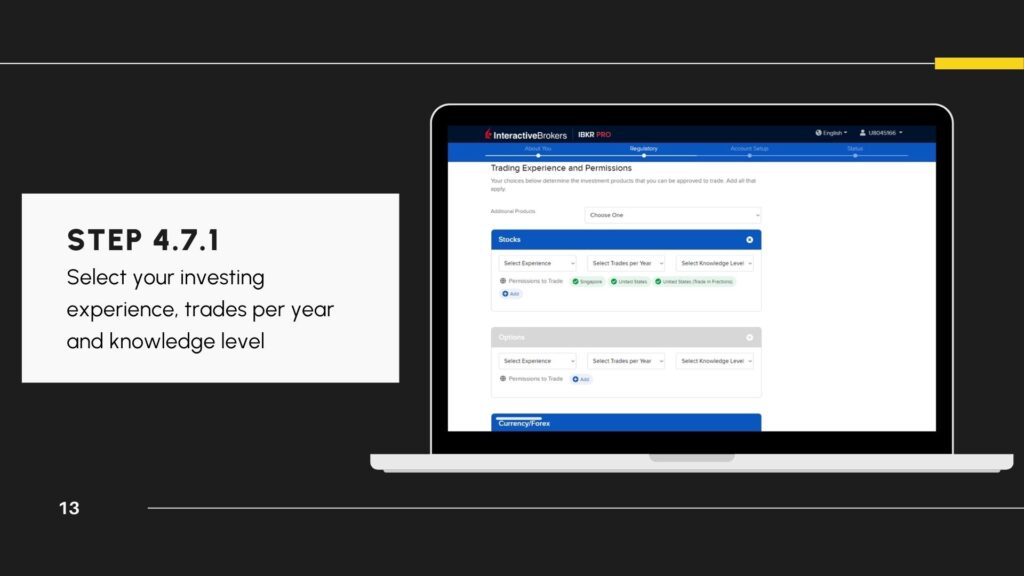

Once done with your investment objective, you’ll have to declare your trading experience and permissions. It’s okay to declare that you are new with minimal trading and basic knowledge. You should also expand on the “permissions to trade” by including other exchanges in different countries. We recommend Singapore, US, and US in fractions*. UK, Canada, and Australia, for a start. You can also choose other exchanges should you like to.

*Fractions mean you are investing in a fraction of the unit share price, e.g., the current unit price of Apple is S$1; you do not need to buy it at S$1; rather, you can buy it at S$0.80. This is a useful feature for new investors who might not have the money to buy a particular stock at the current market price but want a fixed amount to purchase the share.

Ignore Options and currency/forex as they are considered impermissible.

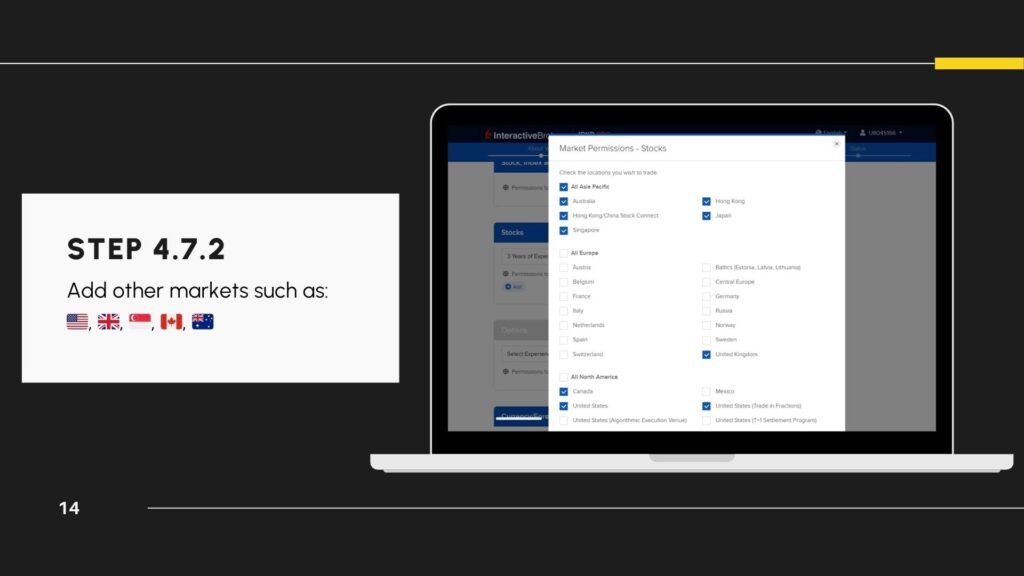

When selecting market permissions- Stocks, you’ll find the breadth of exchanges IBKR allows you to invest in. From Asia Pacific to Europe to even North America. If this is too much, follow our earlier recommendation of Singapore, the US, US in fractions, the UK, Canada and Australia. These countries contain ETFs that are Shariah-compliant (except for Singapore). The US, in particular, has some popular ETFs such as the SPUS and HLAL, but the UK has ETFs that can cover the whole world.

You may also select other countries should you wish to, find a screener that can screen for that particular stock in that particular country.

Once you have selected the countries you want to trade in, you’ll be directed to declare your regulatory information. Unless you are a director/employee/policy-making authority/10% shareholder of any publicly traded company, indicate No for the first question. This also goes for the second question, where you have an immediate family member employed by or registered with a financial firm. The two questions basically prevent someone from using insider information to its advantage.

Once you have made a regulatory declaration, you’ll be directed to a page where you can enrol in a stock yield enhancement program. Do not enrol in it, as it allows IBKR to loan your shares for interest. Simply put, you are involved in loaning out a stock for margin trading for interest.

On the “How did you hear about us” section, indicate that you heard about IBKR through IFSG to support IFSG efforts.

Once done, you’ll be brought to a page to confirm your tax residence. Fill in your name, country of citizenship, permanent address, Date of birth and country of birth. You do not need to input anything on the US tax identification number if you are a Singaporean who has been working and living in Singapore since birth.

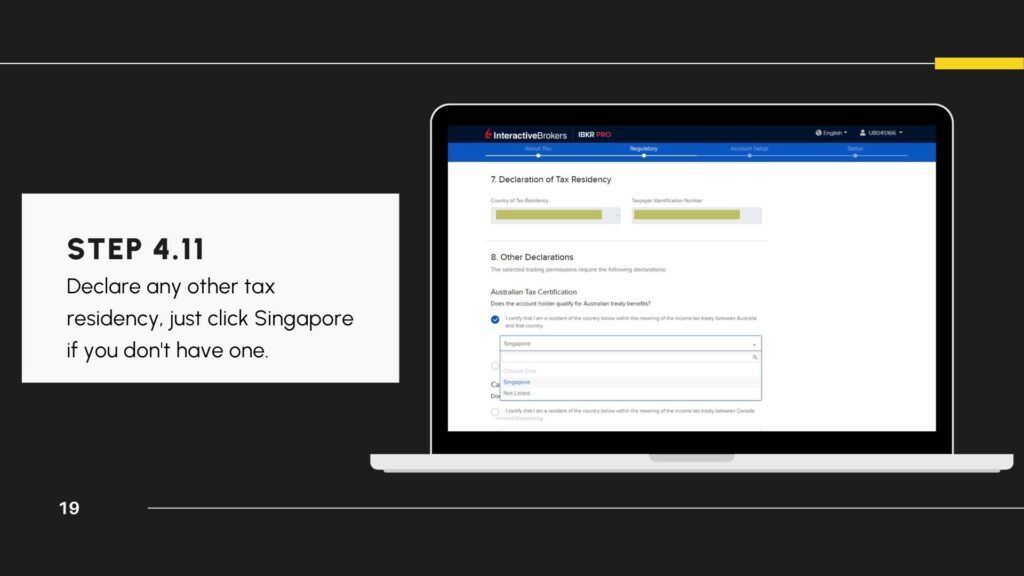

After filling out your tax residence declaration, you’ll have to further declare your tax residency based on the countries you wish to trade in e.g., Australia.

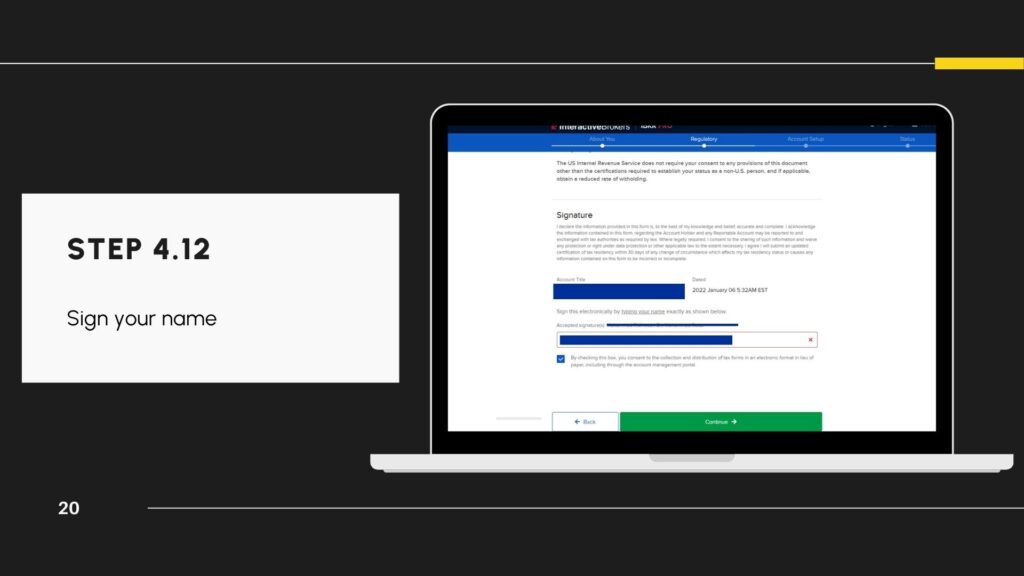

Once you have completed all the necessary declarations, you must sign your name by typing it out in the field provided.

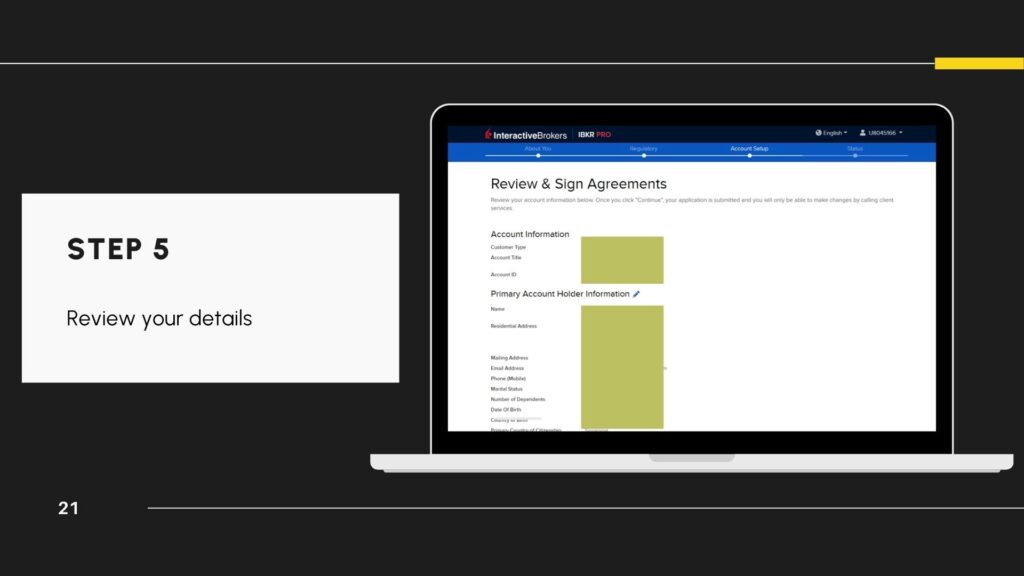

After signing your name, you’ll be directed to a page to review the fields you have populated. Should there be any error in any of the fields, then click on the pencil button to edit it. You are almost there once you confirm the fields!

If you are redirected to the page above (Step 6), do not deposit money first. Instead, wait until you receive an email from IBKR (Step 7), as it means your account creation is under process.

How to deposit your money into IBKR?

Unfortunately, IBKR does not offer PayNow or Direct Debit Authorisation, unlike newer brokerages such as Tiger Broker, where you can link your DBS account and move the funds from your DBS or POSB bank account to your trading account. What it does offer is a classic bank transfer system, which may take time for the funds to be credited to your trading account.

Check your email regularly for your application’s approval, which will look like the one above (Step 7). This usually depends on the number of disclosures, errors and checks IBKR has to do.

Once you get your approval email, log in again to your account to initiate a deposit. The “Deposit” button is on the home page (to your left) beside the “Withdraw” button and under the “Your Portfolio” section. You must make a FAST transfer to the following account: DBS Bank LTD, 0720150775. Remember to include your IBKR account number in the reference section of your transfer to expedite the deposit. If you forget to do so, you’ll be sent an email to upload the proof of your payment.

Transfers might also take a while, especially on a weekend and outside of office hours, so take note of this if you wish to trade when the market opens.

If everything is in order, you’ll receive an email from IBKR (step 8.2), which states that the deposit to your IBKR account has been made available.

Converting your SGD currency in IBKR

To start trading on the different exchanges in IBKR, you’ll need to convert to the currency the ETF or stock is listed in. Note that some ETFs can only be bought using a different currency to where it is being listed, e.g., HSBC MSCI USA Islamic ESG UCITS ETF or HIUA, which is currently listed on the London Stock Exchange but can only be bought can only be using Pounds. For this example, we will be using Wealthsimple Shariah World Equity Index ETF or WSHR, listed in a Canadian exchange (Toronto Stock Exchange).

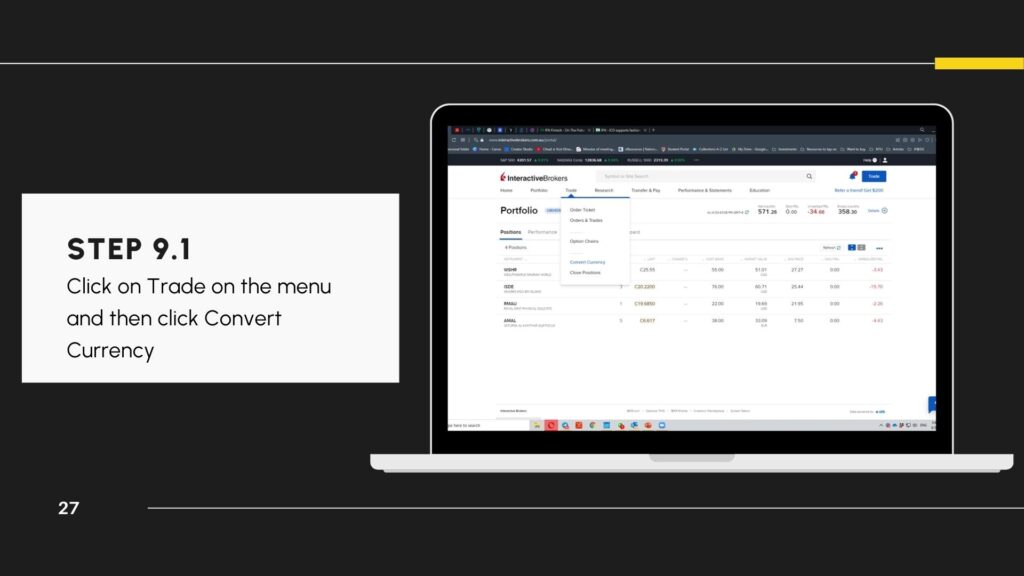

Since we are looking at a Canadian ETF, we will have to convert our currency to Canadian Dollars (CAD). To do this, hover over the “Trade” drop-down list and click “Convert Currency”.

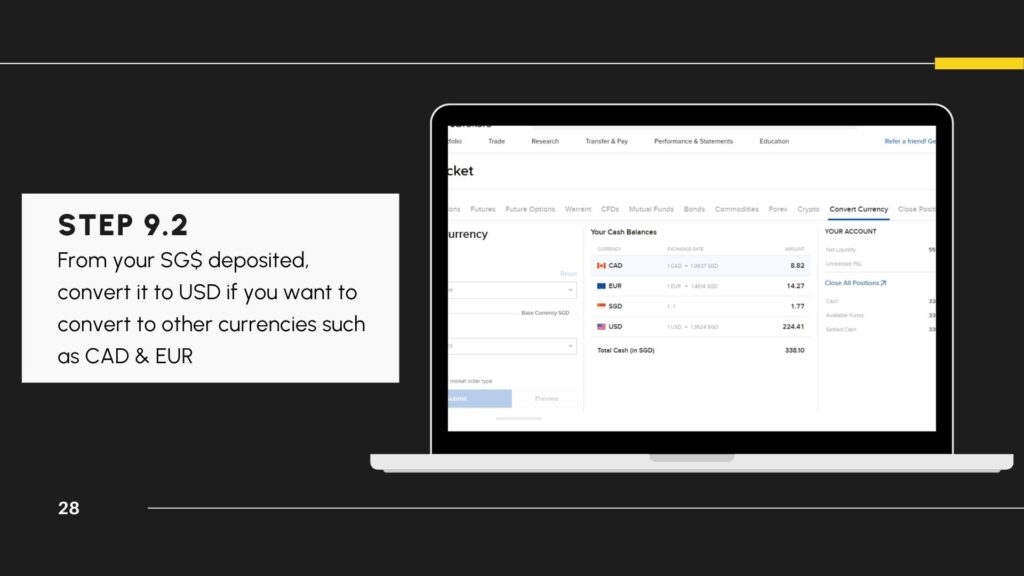

Following step 9.1, you’ll then be redirected to the page where you can convert your deposit amount. To convert to CAD from SGD, you’ll first have to convert SGD to USD. From the converted USD, you can convert into CAD and other currencies.

For reference, with SGD, you can convert to:

- AUD, CNH, EUR, GBP, HKD, JPY, and USD

With USD, you can now convert to

- AED, AUD, BGN, CAD, CHF, CNH, CZK, DKK, EUR, GBP, HKD, HUF, ILS, JPY, KRW, MXN, NOR,NOK, NZD, PLN, RON, RUB, SEk, SGD, TRY,ZAR

Your currency will be converted using the current market rates. Click on “Accept” so that the currency can be converted.

Now that you have USD, you can convert it into other currencies. For this example, we’ll be converting USD to CAD to purchase units of the Shariah-compliant ETF, Wealthsimple Shariah World Equity Index ETF, also known by its ticker as WSHR .

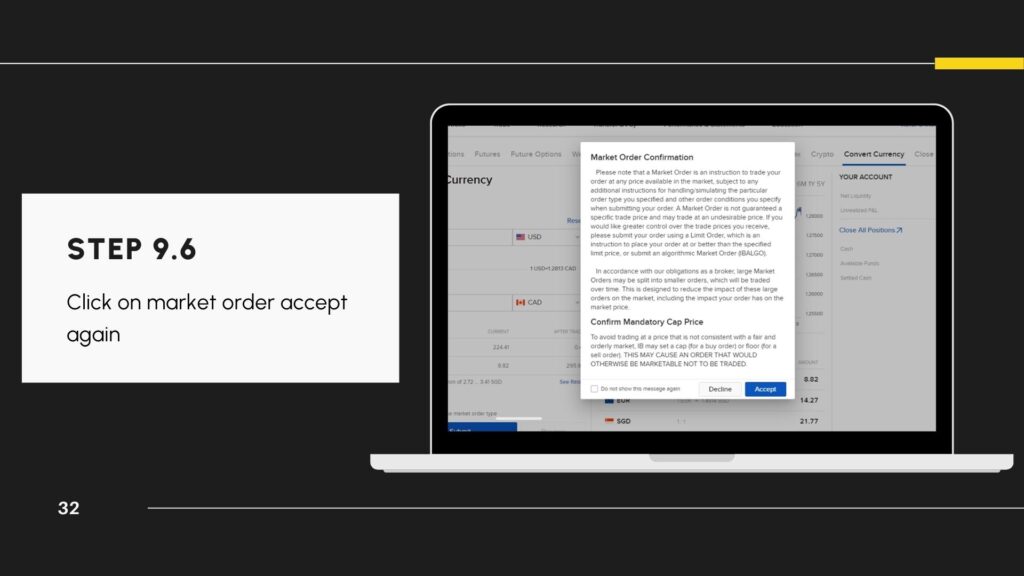

Again, once the pop-up appears to confirm your order, click on “accept”. You’ll then have some Canadian Dollars to purchase the ETFs.

Halal ETFs you can find in IBKR

Now that you have some Canadian dollars to buy the ETF (you’ll need USD for a US Dollar denominated ETF, a GBP for a Great Britain Pound denominated ETF and AUD for an Australian Dollar Denominated ETF), you can proceed to buy the ETF.

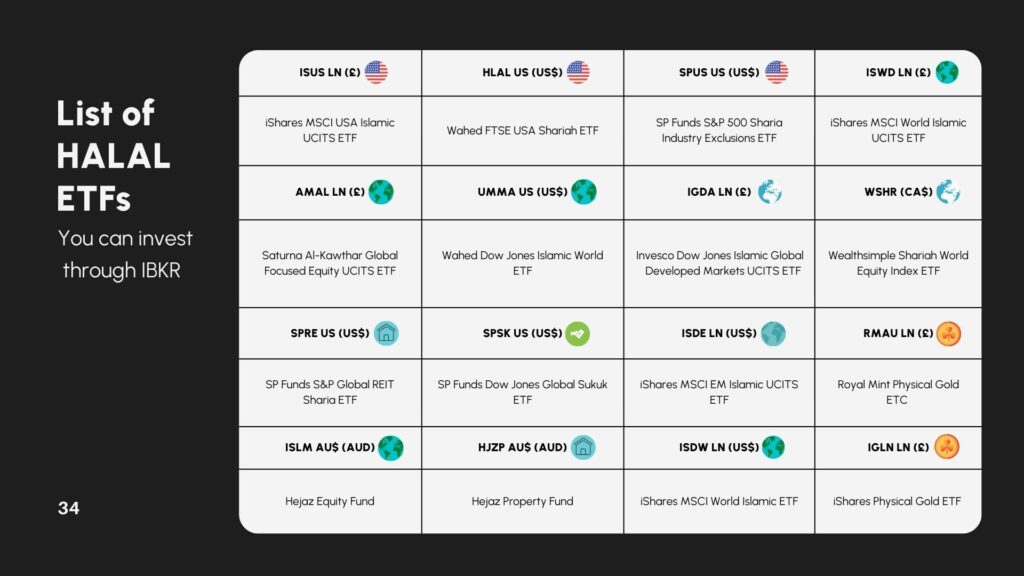

But before that, here’s a list of halal or Shariah-compliant ETFs we have found in IBKR.

As shown in the picture above, the list of ETFs is plenty; we’ll go through them individually in a while. But before that, here is how you can read the names below, e.g., iShares MSCI USA Islamic UCITS ETF (ISUS). The names at the front, such as iShares, SP, Wahed, Wealthsimple, Hejaz and so on, are the names of the institutions the fund is under. The name usually the second, such as MSCI, FTSE, S&P 500, or Dow Jones, is what the fund tries to replicate in performance and constituents. The third name in the ETF is usually which region the ETF focuses on, e.g., USA, Europe, Emerging Markets, Global, Developed Markets, REITs and Precious metals. The four-letter word such as ISUS, HLAL, SPUS, ISWD and so on can be deemed the nickname or short name of the fund for investors to call on or type in the search box.

So for iShares MSCI USA Islamic UCITS ETF (ISUS), you can read it as

- iShares: A fund managed by a fund manager under the Blackrock group,

- MSCI: Tracking an MSCI index, which also has its Shariah-compliant screening methodology,

- USA: The fund primarily invests in USA-listed stocks

- ISUS: the nickname of the fund, so you won’t need to type every 7 words to retrieve a result

It may take a while to grasp this naming convention, but you’ll get a hang of it. Without further ado, here are the first 16 halal ETFs you can invest in:

- iShares MSCI USA Islamic UCITS ETF (ISUS)

- Wahed FTSE USA Shariah ETF (HLAL)

- SP Funds S&P 500 Sharia Industry Exclusions ETF (SPUS)

- iShares MSCI World Islamic UCITS ETF (ISWD), in pounds

- iShares MSCI World Islamic UCITS ETF (ISWD), in USD

- Saturna Al-Kawthar Global Focused Equity UCITS ETF (AMAL)

- Wahed Dow Jones Islamic World ETF (UMMA)

- Invesco Dow Jones Islamic Global Developed Markets UCITS ETF (IGDA)

- Wealthsimple Shariah World Equity Index ETF (WSHR)

- SP Funds S&P Global REIT Sharia ETF (SPRE)

- SP Funds Dow Jones Global Sukuk ETF (SPSK)

- iShares MSCI EM Islamic UCITS ETF (ISDE)

- Royal Mint Physical Gold ETC (RMAU)

- Hejaz Equity Fund (ISLM)

- Hejaz Property Fund (HJZP)

- iShares Physical Gold ETF (IGLN)

- HSBC MSCI World Islamic ESG UCITS ETF (HIWO)

- HSBC MSCI Europe Islamic ESG UCITS ETF (HIEU)

- HSBC MSCI USA Islamic ESG UCITS ETF (HIUS), in pounds.

- HSBC MSCI USA Islamic ESG UCITS ETF (HIUA), in USD

- HSBC MSCI Emerging Markets Islamic ESG UCITS ETF (HIEM)

In addition, we also found these mutual funds that you can buy directly from IBKR. Do bear in mind that mutual funds cannot be traded until after the market closes and, most of the time, incur higher fund expense ratios than ETFs. These funds are:

- Templeton Shariah Global Equity “I”

- Franklin Templeton Offshore Funds Templeton Shariah Asian Growth Fund

- Emirates Global Sukuk “A”

- HSBC Islamic Global Equity Index

How to buy halal ETFs from IBKR?

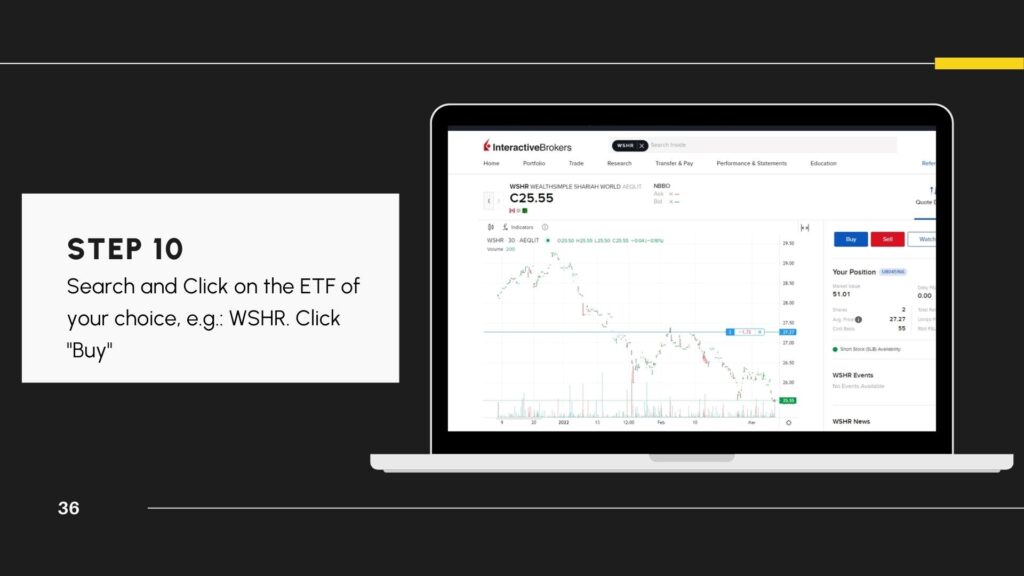

Now that you know what ETFs are available through IBKR, let’s continue our journey in making your first ETF trade. Search WSHR (or any other ETF mentioned above) in the search field, and click it. Once you do, you’ll be brought to the page where it says buy or sell in blue and red, respectively. Click buy.

A side window will appear on the right. You can only make a purchase based on the amount you deposited. For example, if WSHR was at CAD 25 and you have CAD 100, you’ll be able to buy four units. But hold on, you can’t buy 4 precisely as there is a commission that IBKR charges for each trade; thus, you would only be able to buy three units (Commissions IBKR charges for different countries: Click here). IBKR will also be rounding off (in the case you select the CAD button instead of the Share button) to the nearest whole number if the fractional option is unavailable.

When you have decided the amount/shares you want to buy, use “Market Order” or “Market” as it denotes that you will buy at the current market price. There are other options as well, such as limit order, which means your order will be executed if the price you stated is met in the market. In this case, you can do a market order as it’s the fastest way.

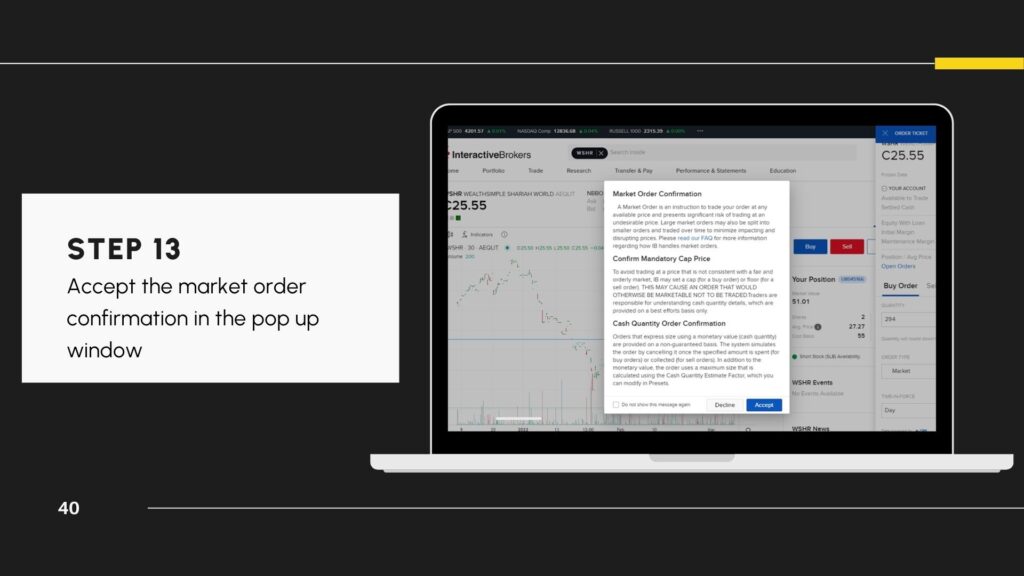

Once you have done the above, a window will pop up asking you to confirm your market order, the mandatory cap price (so you are not forced to buy at an outrageous price), and the cash quantity order. Simply accept the window.

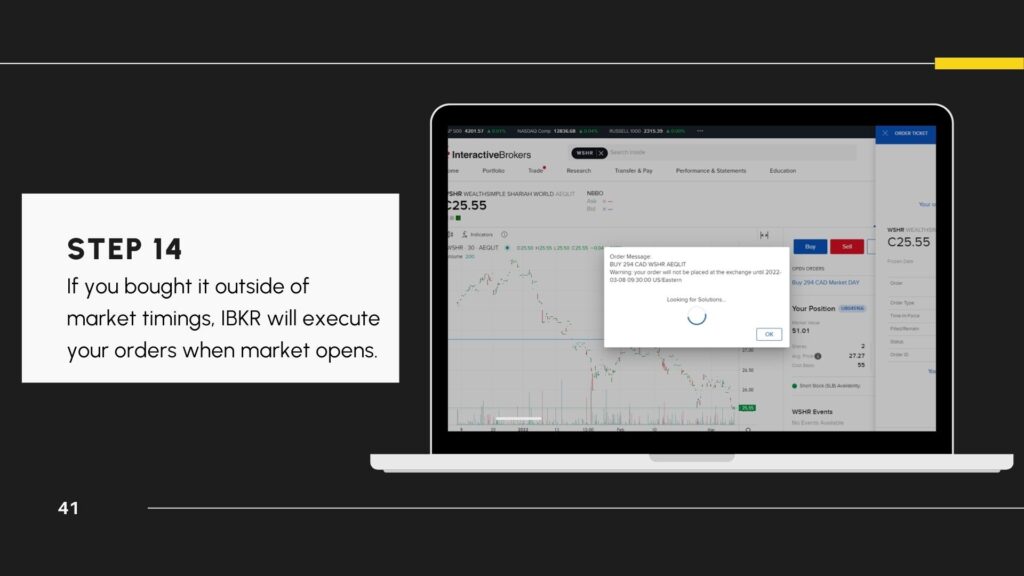

If you bought the ETF when the market is closed, then don’t worry, as the order will be executed once the market opens. You can check out what time the market opens in Europe, the US, Canada and Australia based on Singapore timing.

Congratulations, you have successfully bought a Shariah Compliant ETF and are on your way to growing your wealth over the long term. Depending on market conditions, your ETF might be going up or down, but generally, the market will go up over the long term.

If you find this article beneficial, please consider using the referral code here so that you can help to cover our running costs.

Click here to start investing!

What are the drawbacks of using Interactive Brokers?

Besides having all the core features and capabilities you would expect any modern trading platform to have, Interactive Brokers has a couple of drawbacks you need to know about before you start using it. Some of these drawbacks include the following;

·Complexity for Beginners: Compared to other platforms, Interactive Brokers has a more complex account opening process that can be frustrating for beginners. Their desktop trading platform has advanced features and extensive options that can be overwhelming for novice investors. Newcomers may find it challenging to navigate the platform and understand all the available tools, potentially leading to confusion or making suboptimal decisions.

·Data Subscription Fees: Even though Interactive Brokers provides access to a wealth of market data, some of the real-time data and advanced research features may come with additional subscription costs. It is only worth paying these fees if you’re an experienced trader who can truly use the provided information to make more money.

·Customer Support: While Interactive Brokers offers customer support, some users have reported mixed experiences with the responsiveness and effectiveness of their support services. This can be a concern for traders who value timely assistance in resolving issues or queries.

·No promotions: Interactives Brokers doesn’t offer any incentives to new users that several other trading platforms offer.

IBKR Commission/Pricing for Stocks & ETFs

IBKR Commission/Pricing for Stocks & ETFs (From a Singaporean’s perspective)

Interactive Brokers (IBKR) offers two pricing plans for Singapore-based investors: IBKR Lite and IBKR Pro. Let’s explain how these two plans vary.

·IBKR Lite: This plan has no base commission for stocks and ETFs but charges 65 cents per contract for options trades. You will also have to pay a monthly inactivity fee of $10 if you don’t trade at all if you’re on the Lite plan. This fee is to encourage users to be active all through the year, but it can be inconvenient for some users.

·IBKR Pro: This plan has a base commission of $0.0035 per share for stocks and ETFs, with a minimum commission of $0.35. One of the benefits of the IBKR Pro plan is that there is no inactivity fee. You can always use your account whenever you need without facing any penalties.

In addition to the above fees, you will be charged a spread on every trade you make. For those hearing about this concept for the first time, a spread refers to the difference between the bid and ask prices of a security or financial asset like a stock or bond. For instance, if the bid price for a stock is $100 and the asking price is $100.01, then the spread is $0.01.

How user-friendly is the Interactive Brokers website?

Interactive Brokers is a user-friendly platform from a functional standpoint, offering advanced trading tools and research resources that empower traders to analyze markets and execute complex strategies. Additionally, it provides multi-device access, enabling traders to manage investments from anywhere.

However, the platform’s numerous functional features can lead to a steep learning curve for beginners. Its interface may also seem cluttered due to the abundance of tools and financial jargon that could be intimidating to new users. Fortunately, Interactive Brokers addresses this by providing educational resources and a mobile app that offers a less cluttered and more accessible experience for beginners.

What types of market data does Interactive Brokers provide?

As stated earlier, one of the major benefits of using Interactive Brokers is that it offers an extensive range of market data to keep traders informed and up-to-date. Some of the types of market data you should expect to find on this platform include the following;

·Real-Time Quotes: Interactive Brokers offers up-to-the-second pricing data for various financial instruments.

·Level I and Level II Market Data: You will also get to see detailed market depth, showing the bid and ask prices and sizes beyond basic quotes.

·News Feeds: Besides the pricing details, Interactive Brokers also provides real-time news updates related to financial markets and specific companies or industries. Such news affects the prices of stocks and other assets, so investors and traders need to know about it when making decisions.

·Fundamentals: Essential financial data, including company financial statements and key ratios.

·Technical Analysis: Interactive Brokers also offers advanced charting tools with various technical indicators to aid in market analysis.

·Research Reports: You will also get to see in-depth research and analysis from reputable sources to support investment decisions.

It should be noted that some of this market may require paying a small subscription fee before gaining access.

How does Interactive Brokers compare to other brokers?

To help you understand Interactive Brokers’ reliability as a trading platform, we will conduct a comparison with two notable competitors: Fidelity and Webull. Below is a summary table illustrating the key differences between these platforms.

|

Feature |

Interactive Brokers (IBKR Lite) |

Webull |

Fidelity |

|

Trading Platforms |

TWS, IBKR Mobile, Webtrader |

Webull Desktop, Webull Mobile |

Active Trader Pro, Fidelity Mobile, Fidelity website |

|

Trading Tools |

Advanced charting, multiple order types, research tools |

Advanced charting, multiple order types, research tools |

Advanced charting, multiple order types, research tools |

|

User Interface |

Complex, customizable |

Easy to use, mobile-friendly |

Easy to use, desktop-friendly |

|

Research Tools |

Extensive research tools, including Morningstar ratings, analyst reports, and streaming news |

Limited research tools |

Extensive research tools, including Morningstar ratings, analyst reports, and streaming news |

|

Education |

Extensive educational resources, including video tutorials, webinars, and articles |

Limited educational resources |

Extensive educational resources, including video tutorials, webinars, and articles |

|

Account Minimum |

$0 |

$0 |

$0 |

|

Fees |

Fixed percentage fees |

$0 per trade |

$0 per trade for online U.S. stocks and ETFs |

|

Promotions |

None |

Offers up to 12 free fractional shares (valued up to $3,000) when you open and fund an account with Webull. |

Offers $100 when you open a new, eligible Fidelity account with $50 or more. Use code FIDELITY100. Limited time offer. |

|

Best For |

Active traders who want low fees and access to a wide range of trading tools |

Beginner and intermediate traders who want a commission-free platform |

Investors who want a comprehensive research platform and educational resources |

Final thoughts

This article has provided comprehensive information to help you determine whether Interactive Brokers is the right trading platform for you, especially if you’re in Singapore. Compared to other platforms, Interactive Brokers stands out as an excellent option thanks to its low fees, diverse trading tools, and extensive educational resources. However, we also observed that Interactive Brokers may have some drawbacks, such as the steep learning curve, particularly for absolute beginners. Nevertheless, considering all its other advantages, Interactive Brokers remains a strong and compelling platform for trading.

➡Start your halal investing journey via IBKR in Exchange-Traded Fund here!⬅