Is Insurance Permissible or Forbidden? A Muslim’s Manual on Life insurance and Takaful in Singapore

Are you unsure whether to cancel your non-shariah-compliant insurance policies or if takaful is available in Singapore? Do you wonder if insurance is necessary for sole breadwinners?

At Islamic Finance Singapore (IFSG), we receive countless inquiries about insurance.

While we are not financial advisors, we hope this article can offer our community a simplified guide to understanding insurance in Singapore, from A to Z.

🔵Join the Islamic Finance Singapore community here!🔵

What is Insurance and Why is Having it Important?

At the core of every community lies a collective commitment to safeguard its members and their belongings.

That’s why we firmly believe that grasping the essence of insurance is paramount for everyone. Insurance, a fundamental pillar of wealth management known as “wealth protection,” encompasses a unique concept.

It involves a contractual agreement between you, the policyholder, and an insurance company, the insurer, who pledges to provide compensation in the face of unfortunate events such as death, total permanent disability, critical illness, or other unforeseen adversities. This agreement is based on your explicit consent.

But who can benefit from insurance, and why is it a necessity?

The answer is simple: Insurance is for everyone. Whether you’re a parent striving to secure your children’s future or a homeowner safeguarding your property, insurance serves as an invaluable safety net, granting you peace of mind. And the earlier you invest in insurance, the better off you’ll be.

Consider a couple with three children, for instance. In the event of hospitalization due to illness or an accident, the right insurance coverage can be a lifesaver by offering financial support to cover medical expenses, hospital stays, and related costs.

Moreover, if one or both parents were to experience a permanent disability, insurance can help alleviate the financial strain by covering long-term care and rehabilitation expenses.

This not only relieves the family’s financial burden but also ensures that the children receive the essential care and support they need.

So, what exactly is insurance, and how does it function? In essence, policyholders pay a specified amount, known as a premium, to the insurer, which then pools these funds into a collective pot.

In the event of an adverse occurrence, such as a house fire, the insurer taps into the pooled funds and compensates the policyholder, enabling the restoration of the house.

Insurance companies utilize data and intricate models to ensure that policyholder premiums align with the likelihood of the insured event occurring.

Consequently, insurance premiums may vary based on age, health, and lifestyle choices.

Is Insurance Halal?

This question delves into an intriguing exploration of risk management within the framework of Islamic principles.

Firstly, insurance, as highlighted earlier, has the potential to be a lifesaver. The concept of risk management in Islam is not only encouraged but also finds support in the Quran and Sunnah (the teachings and practices of the Prophet Muhammad, peace be upon him).

To illustrate the importance of saving for future uncertainties, we can look to the story of the Prophet Yusuf (Joseph) in the Quran, specifically in Surah Yusuf (Chapter 12), verse 47.

In this verse, the Prophet Yusuf advises the King of Egypt to store surplus excess grain during years of plenty, preserving it for the years of famine.

“(Yusuf) said: ‘For seven consecutive years, you shall sow as usual, and that (the harvest) which you reap, you shall leave it in the ears, (all) except a little of it which you may eat.'”

Another example emphasizing the significance of taking proactive measures to protect one’s property is found in a hadith reported by Anas ibn Malik (may Allah be pleased with him).

A man asked the Prophet Muhammad (ﷺ) whether he should tie his camel and trust in Allah’s protection or leave it untied and rely solely on Allah.

The Prophet (ﷺ) responded, “Tie her and trust in Allah.” (Sunan al-Tirmidhī, no. 2517)

However, due to the nature of the buy and sell contracts involved in conventional insurance policies, further scrutiny is required to assess whether these contracts comply with Islamic principles regarding interest (riba), uncertainty (gharar), and zero-sum game (maysir).

Let’s delve into the meanings of these three elements and examine how they relate to present-day insurance policies.

-

Interest (riba):

Interest refers to the unequal exchange of money. In the context of insurance, two forms of interest can arise.

Firstly, when policyholders pay monthly or annual premiums, the amount they contribute may be less than the sum assured they would receive in the event of an insured event, such as a house fire or total permanent disability (TPD).

The difference between the premiums paid and the sum assured constitutes interest.

The second form of interest arises from the investments made by insurance companies using the premiums received.

Although insurance costs are considered, the portion invested may be allocated to non-halal or Shariah non-compliant investments, such as conventional bonds and interest-bearing securities.

The returns on these investments are then passed on to policyholders as dividends or added back to their cash value.

This also applies to so-called “Muslim-friendly” investments recommended by certain financial advisors, both Muslim and non-Muslim.

The Quran and Sunnah strictly prohibit the consumption of interest, as stated in Surah al-Baqarah, verse 186, where Allah and His Messenger wage war against those who engage in interest.

The Prophet Muhammad (peace be upon him) also emphasized that consuming interest is second only to shirk, which refers to associating partners with Allah. Therefore, Muslims need to be aware of interest in its various forms and manifestations.

-

Excessive Ambiguity (gharar):

Gharar, often translated as uncertainty, pertains to situations where there is a lack of clarity or definite knowledge about a transaction. For instance, if a buyer sells a calf that has not yet been born, it is considered gharar because even the seller cannot predict if the calf will be born alive.

In the context of insurance, gharar arises from the uncertainty surrounding whether the insured event will occur. Despite extensive data and complex actuarial models, neither the insurer nor the policyholder can accurately predict whether the insured event will actually take place.

Moreover, there is also a level of uncertainty for the insurer, as they may have received only a year’s premium from the policyholder, but in the event of a claim arising from the insured event, they would be obligated to pay out the sum assured, which could be significantly higher than the premium received.

-

Zero-sum game (maysir):

While the term “maysir” is often translated as gambling, we can also understand it as a zero-sum game, where one party’s gain comes at the expense of the other.

In the context of insurance, maysir arises because either the policyholder or the insurer can be considered the “winner” depending on the occurrence or non-occurrence of the insured event. If the insured event takes place, resulting in a claim by the policyholder, they are seen as the “winner” since they receive compensation.

On the other hand, if the insured event does not happen, the insurer is viewed as the “winner” since they do not have to make any payment.

These three elements, interest (riba), excessive ambiguity (gharar), and zero-sum game (maysir), arise due to the nature of the buy and sell contracts utilized in conventional insurance policies.

It is important to note that Islam does not demand or impose undue burdens; rather, it establishes divine rules that Muslims are obliged to follow.

Therefore, it becomes necessary to explore alternative forms of insurance that align with Islamic principles. In the subsequent sections, we will delve into the Islamic alternatives to conventional insurance and examine the general insurance landscape within the context of Singapore.

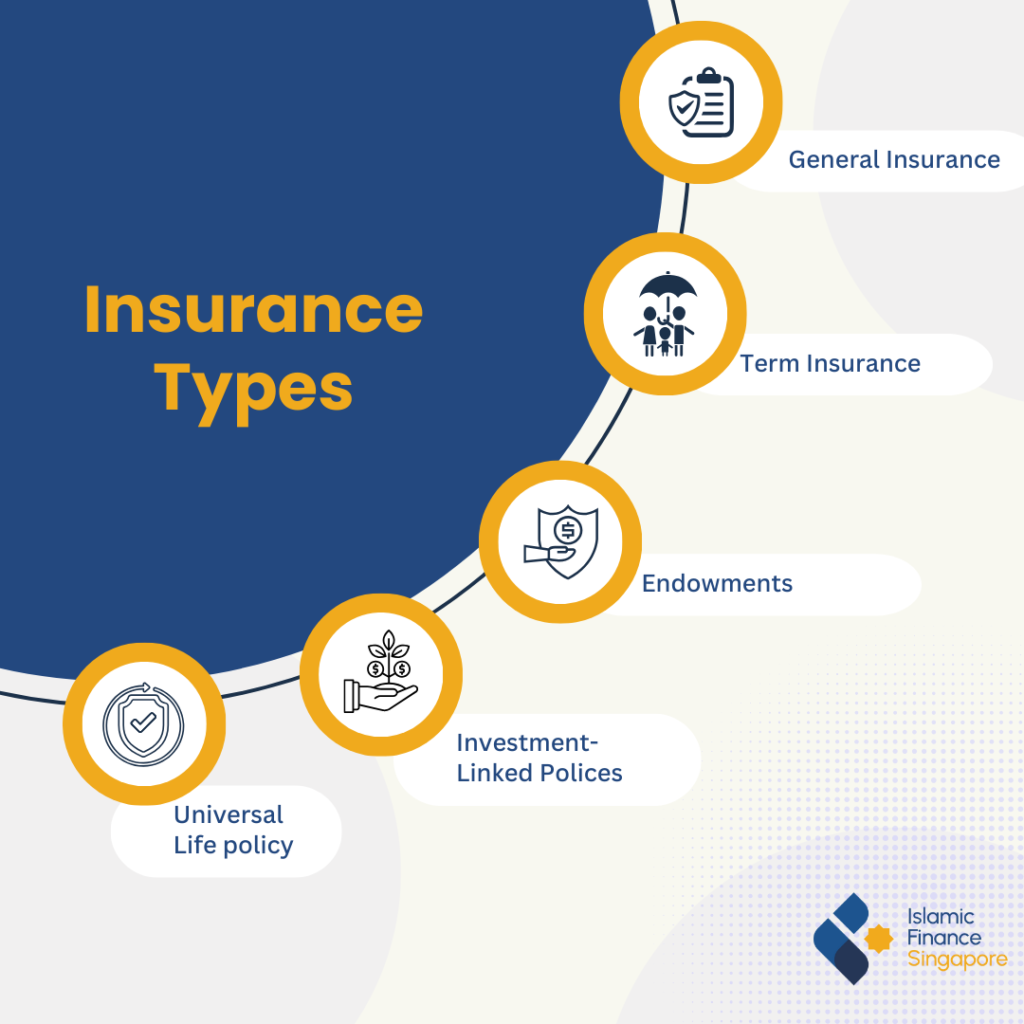

Exploring the Different Types of Insurance

Insurance can be categorized into three main types: life insurance, general insurance, and health insurance. Each type serves a specific purpose and provides coverage for different aspects of our lives.

Life insurance focuses on the individual’s life, offering protection in the event of death or total permanent disability. When such unfortunate circumstances occur, the policyholder or their beneficiaries receive compensation from the insurance company.

Some life insurance products also incorporate savings and investment components, which we will discuss further.

General insurance, on the other hand, is designed to protect the assets we own, such as our homes, vehicles, and valuables. It provides coverage against various risks, ranging from fire, accidents, and theft to natural disasters like floods, storms, and earthquakes.

Examples of general insurance include motor insurance, home insurance, health insurance, fire insurance, accident insurance, travel insurance, and theft insurance.

Lastly, health insurance helps cover the costs of medical expenses, offering financial support for hospitalization, surgeries, treatments, and other healthcare-related needs.

To better understand this landscape, the article will be focusing on the more popular types of insurance:

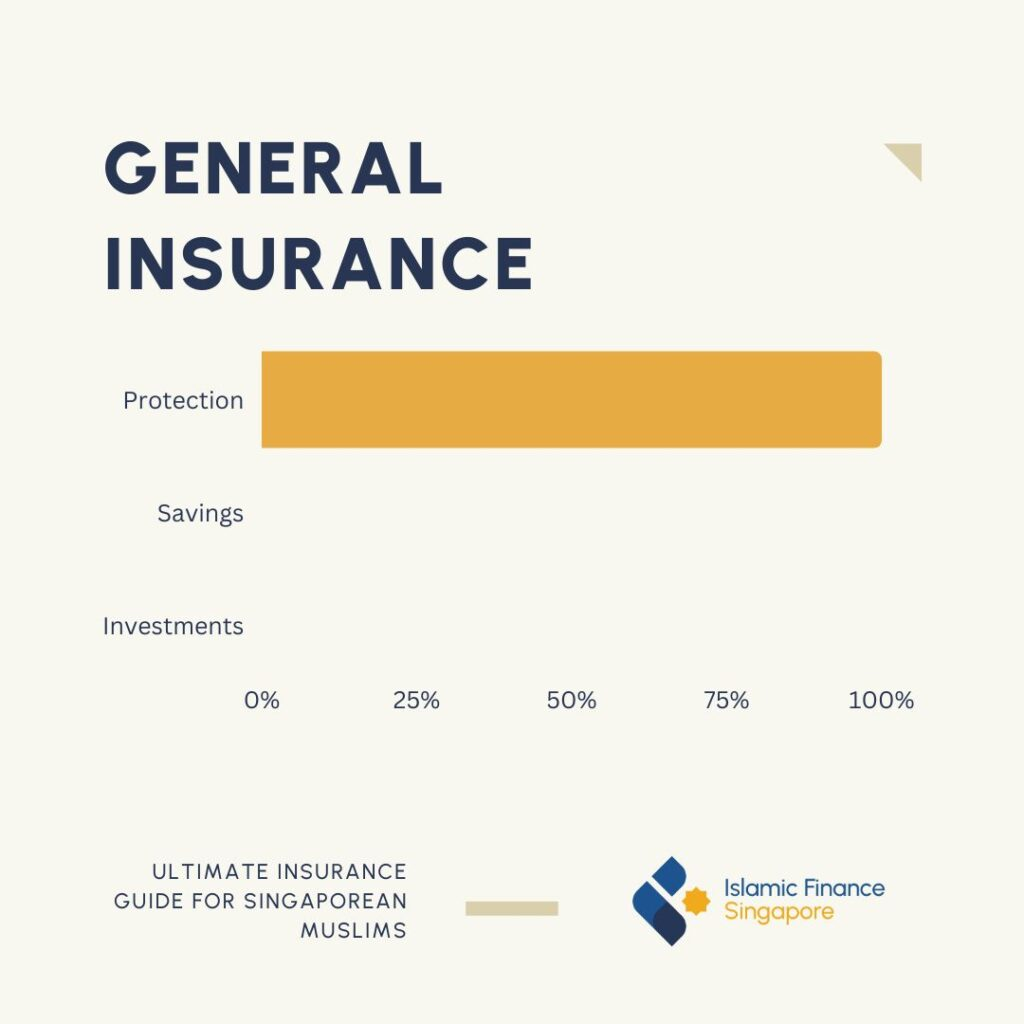

- General Insurance: This type of insurance covers a wide range of assets, including home insurance, motor insurance, and travel insurance. Each offers protection against specific risks associated with the respective asset.

- Term Insurance: Term insurance provides coverage for a specified period, typically a fixed number of years. It offers a straightforward and affordable solution to provide financial protection to your loved ones in the event of your death during the term of the policy.

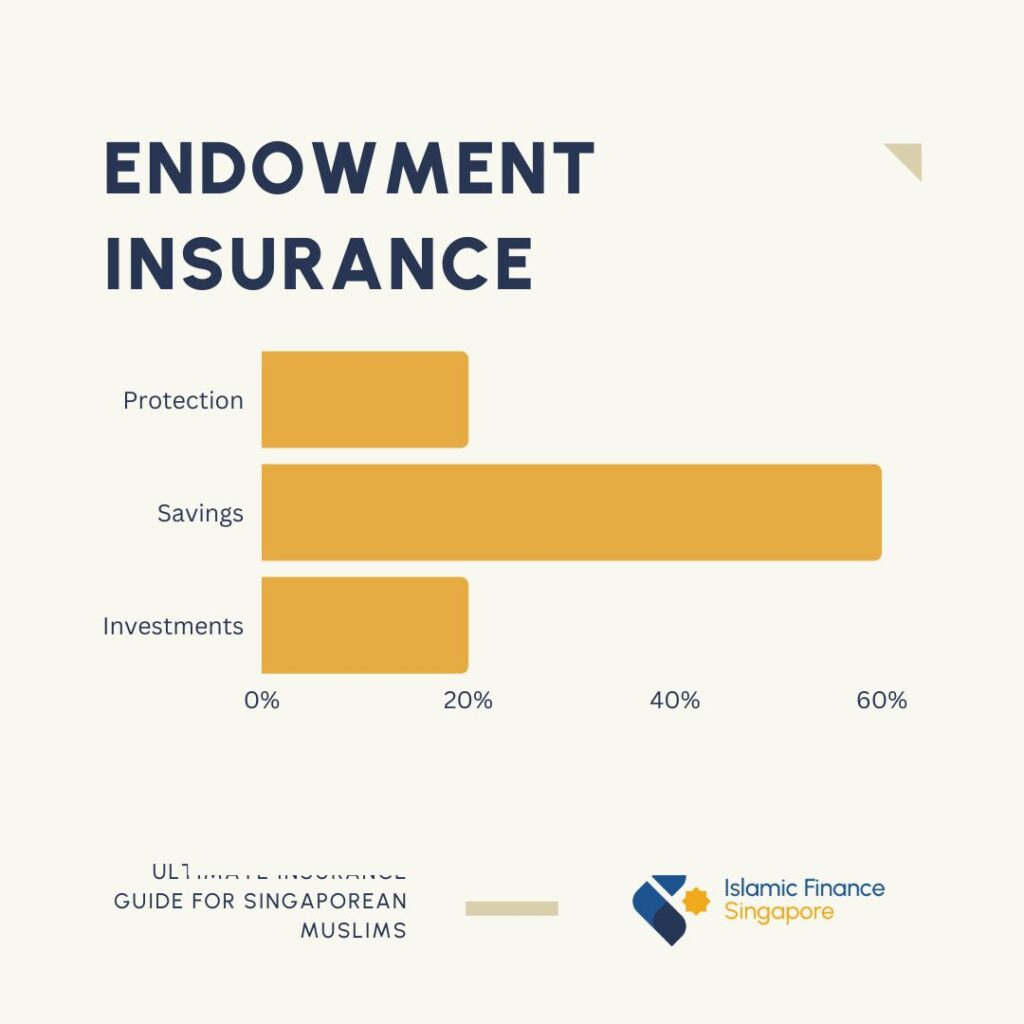

- Endowments: Endowment policies combine insurance coverage with a savings component. These policies not only provide a payout in the event of death but also offer a savings element, allowing policyholders to accumulate funds over a predetermined period. Endowments are often used for long-term financial goals, such as education or retirement planning.

- Investment-Linked Policies: Investment-linked policies offer a unique blend of insurance and investment opportunities. They allow policyholders to allocate a portion of their premiums to investment funds, providing the potential for growth over time. These policies are suitable for individuals seeking insurance coverage alongside the potential for wealth accumulation through investment.

- Universal Life Policy: Universal life insurance is a flexible form of coverage that combines insurance protection with a cash value component. Policyholders have the ability to adjust the death benefit and premium payments, offering greater control and customization of their policy.

While these various insurance options offer benefits and advantages, it is important to consider their compatibility with Shariah principles. In the next section, we will explore the advantages and disadvantages of these insurance types, as well as the reasons they may not be permissible in the eyes of Shariah.

Additionally, we will look at the Islamic alternative and examine the reserves in the insurance landscape within the context of Singapore, and also explore the insurance market in Indonesia.

General Insurance: Protecting What Matters Most

General insurance is a vital component of our financial safety net, providing coverage for damages or losses in non-life situations. It acts as a shield for the things we hold dear, such as our homes, cars, and prized possessions, all managed in accordance with Shariah investing principles.

Whether it’s protecting us from the devastating impact of a fire, flood, or theft, or covering the costs of legal actions, general insurance offers peace of mind in the face of various risks.

The scope of general insurance is extensive, encompassing a wide range of areas. Some common types of general insurance include:

- Motor Insurance: Safeguards your vehicles against accidents, theft, and damage caused by natural disasters or unforeseen events.

- Home Insurance: Provides protection for your home and its contents from perils like fire, burglary, and natural disasters, ensuring that your investment remains secure.

- Health Insurance: Helps manage the rising costs of medical treatments, hospitalization, and healthcare services, giving you financial support during times of illness or injury.

- Fire Insurance: Covers damages caused by fire to your property, including buildings, assets, and belongings.

- Accident Insurance: Provides financial support in the event of accidental injuries, covering medical expenses and offering compensation for disability or death resulting from accidents.

- Travel Insurance: Offers coverage for travel-related risks, such as trip cancellations, lost luggage, medical emergencies abroad, and personal liability.

- Theft Insurance: Protects your valuable belongings, such as jewelry or electronics, against theft or burglary.

Given the vulnerability of tangible assets to damages, it becomes essential to protect their economic value. General insurance products act as a shield, mitigating unforeseen contingencies and providing financial recourse in the face of asset loss or damage.

In the event of an insured incident, your insurance company will provide compensation in the form of the sum assured or an agreed amount, helping to cover some or all of the losses incurred.

For instance, if you experience a loss of belongings while traveling or damage to your car or house, your insurance company will step in to alleviate the financial burden.

Advantages of General Insurance:

- Renewable: General insurance operates on a short-term contract basis, typically renewable on an annual basis. If you feel the coverage is no longer necessary, you have the flexibility to terminate the contract based on the terms and conditions outlined in the policy.

- Customizable: You have the freedom to choose the specific types of insurance coverage that best suit your needs. For instance, with motor insurance, you can decide whether to cover just the vehicle, yourself as the driver, or third-party damages.

Disadvantages of General Insurance:

- No Return of Premium Plans: General insurance operates on the principle of indemnity, offering coverage for unforeseen losses or liabilities. If you don’t make a claim during the policy period, there is no reimbursement of premiums.

- No Cash Value: Unlike some life insurance policies, general insurance does not accumulate cash value over time. The payout is limited to the liability or actual loss incurred, regardless of the policy amount.

Is general insurance halal or haram?

That’s the question we have been receiving from our events and inbox. The question could be framed in another way “why Can General Insurance Be Considered Shariah Non-Compliant?”

General insurance contains three elements that are abhorred in Islam. Firstly, the element of riba (interest) becomes apparent when the amount received by the policyholder, either upon the occurrence of an insured event or at the policy’s maturity, surpasses the total premiums paid.

There is an inherent inequality between the instalments paid by the insured and the compensation provided by the insurance company. This discrepancy gives rise to riba al-fadhl (unequal exchanges or charges).

Secondly, gharar (excessive ambiguity) exists as there is no certainty regarding the occurrence of insured events. Policyholders pay premiums in return for something that the insurer cannot guarantee in terms of the nature and precise timing of these events.

Lastly, maysir (zero-sum game) occurs when one party, either the policyholder or the insurance company, emerges as the “winner” upon the occurrence of an insured event.

For instance, if a calamity transpires, policyholders can claim a sum of money from the insurance company, while in the absence of such an event, they receive nothing. This results in an imbalance where one side gains an advantage while the other incurs a loss.

Understanding the implications of these prohibited elements, it becomes essential to explore alternative options that align with Islamic principles. In the subsequent sections, we will delve into the Islamic alternatives to conventional insurance and examine the general insurance landscape within the context of Singapore.

Term Insurance: Protecting Your Loved Ones

Term insurance can be defined as a policy that offers death, total and permanent disability (TPD), and optional critical illness coverage for a specified term, without any cash value component.

It serves as a life insurance policy tailored to provide financial protection for a specific duration, offering affordable rates that make it an attractive choice for individuals seeking substantial life coverage, known as the sum assured, at a relatively low premium cost.

If the insured individual passes away during the policy’s active period, the nominees named in the policy will receive a death benefit. However, once the term expires, no coverage or payout is provided in the unfortunate event of the insured’s passing.

At its core, term insurance revolves around a straightforward concept: a fixed sum assured paid out to the nominee upon the insured’s demise within the specified policy term.

However, it’s crucial to note that such plans typically do not provide any benefits for the insured’s survival beyond the term’s end.

A basic variant of term insurance lacks a cash value, meaning that if the insured person survives the policy term, no returns are yielded by the policy itself—excluding specific plans like Return on Premium. By securing a term insurance policy, you can ensure that your dependents receive specific compensation in the event of your untimely passing.

This provides them with the means to maintain their current lifestyle, fulfill their dreams, and manage existing liabilities without compromising their financial stability, thanks to the sum assured they would receive from the life insurance policy.

Advantages of Term Insurance:

- Tax Exemption: Premiums paid toward term insurance policies are eligible for tax exemptions, subject to the terms and conditions specified in tax laws. This allows you to enjoy potential savings while safeguarding your loved ones.

- Cost-Effectiveness: Term insurance stands out as one of the most affordable life insurance products available. It offers significant cost advantages over permanent insurance alternatives, making it an accessible choice for individuals seeking financial protection.

- Financial Security: For those serving as breadwinners and primary earners in their families, term insurance serves as a crucial financial safety net. It provides income replacement and ensures the well-being of your loved ones even in your absence, offering peace of mind during uncertain times.

Disadvantages of Term Insurance:

- Temporary Coverage: Term insurance policies offer protection only for a specified period, after which the policy no longer provides coverage. This temporary nature necessitates periodic reassessment of your insurance needs.

- No Cash Value: Unlike certain types of permanent insurance, term insurance for death does not possess a cash value component. It solely guarantees a death benefit, which means policyholders cannot withdraw funds for personal use during the policy term.

- No Return of Premium Plans: If you survive until the end of the policy term, you will not receive any refunds for the premiums paid. This can be considered a disadvantage for those seeking a return on their investment in the form of a cash refund.

Is Term insurance halal or haram?

Another common question. Again, the question could be framed in another way “why Can Term Insurance Be Considered Shariah Non-Compliant?”

Similar to general insurance, term insurance contains three elements prohibited in Shariah:

- Riba (Interest): The sum insured often does not align with the premiums paid, creating an imbalance that resembles an interest-driven transaction. This disparity between premiums and coverage goes against the principles of equity and fairness.

- Gharar (Excessive Ambiguity): The occurrence of insured events in the future remains uncertain, introducing an element of doubt and unpredictability. This lack of clarity contradicts the principles of transparency and certainty in Islamic finance.

- Maysir (Zero-Sum Game): If policyholders survive until the maturity of the policy term, they will not receive any portion of the premiums paid. This one-sided advantage for the insurance company represents a zero-sum game, where one party gains at the expense of the other, contrary to the principles of fairness and justice.

Endowment Insurance: Balancing Protection and Savings

Endowment insurance can be described as a comprehensive financial product that offers both life coverage and a savings component. It combines the benefits of insurance protection with the opportunity for wealth accumulation.

Unlike term insurance, endowment insurance carries a cash value, and the death benefit is based on the premium chosen by the client. Upon maturity, the policyholder does not receive the sum assured. Instead, they receive the policy value, which comprises both the guaranteed and non-guaranteed portions.

In the unfortunate event of the policyholder’s death, the beneficiaries receive the sum assured, the policy value, and any bonuses declared. The entire sum assured becomes payable on a nominated date, ensuring financial security for the policyholder’s loved ones.

In addition to providing life coverage, endowment insurance facilitates regular savings over a specific period. If the policyholder survives the policy term, they receive a lump sum on the policy’s maturity. This maturity amount can serve various financial needs, such as funding retirement, children’s education or marriage, or purchasing a house.

Endowment insurance caters to the dual requirement of life cover and savings within a single plan, offering a balanced approach to financial planning.

Advantages of Endowment Insurance:

- Tax Exemption: Premiums paid toward endowment insurance policies are eligible for tax exemptions, subject to the terms and conditions specified in tax laws. This provides potential tax benefits and enhances the overall attractiveness of the policy.

- Investment Growth: A portion of the premiums paid is invested in various vehicles, allowing the policyholder’s money to grow over the contract term. This feature makes endowment insurance appealing for those seeking insurance coverage with built-in, planned savings.

- Dual Benefits: In the event of the insured’s demise, the beneficiary or nominee of the policy receives the sum assured along with any bonuses. If the policyholder outlives the policy term, they are entitled to receive the sum assured. This dual benefit structure ensures flexibility and caters to different scenarios.

Disadvantages of Endowment Insurance:

- Expensive and High Premiums: Endowment insurance tends to have higher premiums compared to other types of insurance coverage, including permanent insurance with a cash value component. It is crucial to carefully assess whether the benefits justify the cost and align with your financial goals.

- Limited Protection: Endowment policies have a specific duration and are generally not renewable or convertible. If you require coverage beyond the policy term, such as coverage for the remainder of your life, you may need to purchase additional life insurance, which can be expensive based on factors such as age and health status.

- Low Returns: Endowment insurance is designed to be low-risk, emphasizing stability over high returns. While the money invested in an endowment policy earns interest, the returns tend to be modest. Depending on your investment style and risk tolerance, you may find that investing your money in other avenues, such as the market, offers potentially higher returns.

Is endowment insurance halal or haram?

Not a common question but we still encourage our community to reframe it “why Can Endowment Insurance Be Considered Shariah Non-Compliant?”

Endowment insurance incorporates an element of riba (interest) as the premiums paid by policyholders are invested in interest-bearing instruments, leading to the growth of their cash value.

Additionally, the number of premiums received at the end of the policy may differ from the installments paid, reflecting an element of disparity. These elements contradict the principles of Islamic finance, which prohibit involvement in interest-based transactions and seek to promote fairness and transparency.

Investment-Linked Policies (ILPs): Blend of Protection and Investment

Investment-linked policies are insurance plans that offer a unique blend of protection and investment opportunities.

They serve as a hybrid solution, where the premiums paid not only provide life insurance coverage but also contribute to specific investment funds based on your risk appetite.

As a policyholder, you have the freedom to allocate your investment funds within the available options, although the distribution of premiums between protection and investment is predetermined by the insurer.

For instance, 70% of the premiums may be allocated to insurance protection, while the remaining 30% goes into investment funds.

Advantages of Investment-Linked Policies:

- Flexibility: Investment-linked policies offer the flexibility to adjust your premium payments and coverage amounts to suit your changing financial circumstances. This adaptability ensures that your insurance and investment needs remain aligned throughout your journey.

- Choice of Funds and Diversification: These policies grant you access to a diverse range of funds managed by professional fund managers. You have the freedom to select the funds that align with your risk appetite and investment goals.Furthermore, you can reallocate your investments between funds to accommodate changes in your financial situation and risk profile. This versatility allows for effective diversification, reducing the risk associated with concentrating your investments in a single avenue within your investment portfolio.

- Potential for Higher Returns: Over the long term, investment-linked policies have the potential to deliver higher returns compared to traditional life insurance policies such as whole life and endowment plans. By participating in the growth of the investment funds, you can benefit from the appreciation of the allocated units, maximizing your returns.

Disadvantages of Investment-Linked Policies:

- No Guaranteed Returns: It’s crucial to recognize that investment-linked policies do not guarantee returns. The performance of the underlying funds plays a significant role in determining the potential returns you may receive. Higher-risk investments, such as equities, can yield greater returns, but they also come with increased volatility. Conversely, lower-risk investments offer stability but may result in lower returns. Understanding your risk appetite is essential in navigating this aspect of investment-linked policies.

- Hefty Fees: When it comes to investment-linked policies, your investment returns are influenced not only by the fund’s performance but also by the fees you incur. These fees, including management fees, trustee fees, sales taxes, and sometimes withdrawal charges, can significantly impact your overall returns. In some cases, a substantial portion of your investment returns may be eroded by these costs, reducing the actual returns you receive.

- No Cash Values: Unlike certain insurance policies, investment-linked policies do not offer guaranteed cash values. The policy’s value is tied to the price of the underlying units, which, in turn, is influenced by the performance of the invested funds. It’s important to note that premiums are utilized for expenses, fees, and insurance charges, with the remaining amount allocated to purchase units.

Are investment-linked Policies (ILPs) halal or haram?

With the advent of shariah compliant funds under the ILPs, our community has been asking the above question. Again, we encourage the community to reframe it “Why Can Investment-Linked Policies (ILPs) Be Considered Shariah Non-Compliant?”

A critical consideration for individuals adhering to Islamic principles is the alignment of their accounting and financial choices with Shariah-compliant practices.

In the case of investment-linked policies, the funds in your finance portfolio are commonly invested in interest-bearing instruments and engage in non-compliant business activities such as alcohol, tobacco, and gambling businesses. The profits or returns generated from these investments are then shared with the policyholders’ funds, augmenting the cash value.

Since the sources of these investment returns derive from non-halal activities, investment-linked policies are deemed Shariah non-compliant as well.

Universal Life and Whole Life Plan: Lifelong Coverage Assurance

Universal life and whole life insurance are two prominent types of life insurance policies that offer lifelong coverage and include a cash value component.

These policies ensure that as long as you pay your premiums on time, you will have coverage for the entirety of your life.

The cash value component grows over time, fueled by the premiums you invest, allowing you to enjoy its future cashflow benefits.

However, it’s important to note that the cash value is typically accessible only if you surrender the policy, forfeiting the sum assured, or upon your demise, when beneficiaries can benefit from both the cash value and the sum assured.

While both types of policies offer lifelong coverage and cash value accumulation, there are notable differences between them. Whole life insurance guarantees consistent premiums and predictable cash value accumulation.

On the other hand, universal life insurance provides flexibility in premium payments, death benefits, and savings portions.

Advantages of universal life or whole life plan:

- Cash Values: Both universal life and whole life insurance plans provide a savings component. The cash value of your policy grows over time, and you have the option to withdraw the accumulated funds or borrow against them. Moreover, the money in the cash value account can often be reinvested to earn additional returns or interest. Even if you decide to terminate the policy before its maturity date, you will typically receive a portion of the cash value, up to the amount of premiums paid, minus any charges or fees.

- Flexibility: Universal life insurance offers flexibility in terms of adjusting your insurance plan to align with your changing financial circumstances and needs. For instance, you can increase or decrease your premium payments or even skip payments if the cash value amount can cover the payment on your behalf.

- Fixed Premiums and Death Benefits: Whole life insurance policies provide fixed premiums and a fixed death benefit. These remain constant throughout the life of the policyholder as long as premiums are consistently paid. This means you don’t have to worry about increasing premiums as you get older. Moreover, your loved ones will know the exact amount they can expect when the life insurance benefit is paid out upon your demise.

Disadvantages of Universal Life or Whole Life Plans:

- Cost: Both whole life and universal life insurance tend to be more expensive than standard term life insurance. The cash value accumulation and additional features drive up the premium payments, making these policies costlier.

- Complexity: Both whole life and universal life insurance policies are complex products with various features and potential benefits. Fully understanding and maximizing these features can be challenging without the guidance of a knowledgeable professional.

Is whole life insurance plans or universal life plans halal or haram?

Not really a common question but we have been asked this question before. Now why can universal life or whole life plan be considered shariah non-compliant?

It’s crucial to recognize that both types of policies contain elements that are not compliant with Islamic principles, specifically the element of riba (interest). Aside from the interest-based investment activities associated with these policies, there is a lack of equality between the installments paid by the policyholder and the compensation provided by the insurance company.

The amounts paid by the company may be more, less, or equal to those paid by the insured, and achieving true equality is highly unlikely within this framework.

You can also read our answer here: https://islamicfinancesg.com/docs/insurance/are-whole-life-insurance-plans-permissible/

Takaful: The Islamic Alternative to Insurance

Takaful investment plan is based on uqud tabarru’at (benevolent contract) which operates on the concept of mutual cooperation and joint guarantee among participants.

When you join a Takaful scheme, you not only seek protection for yourself but also collaborate with others to provide mutual assistance and financial support in times of need. It promotes brotherhood and solidarity, creating a sense of shared responsibility among participants.

Unlike conventional insurance, Takaful plans are not a transaction of buying and selling services. Instead, it functions as a collective arrangement where individuals contribute fixed amounts to a common fund on the basis of benevolence.

Compensation for losses is paid from this pool of funds, reflecting the spirit of cooperation and assistance among participants.

The Quran emphasizes the importance of cooperation and goodness among believers. In Surah Al-Maidah, verse 2, it states: “…cooperate with one another in goodness and righteousness, and do not cooperate in sin and transgression….” This provides the foundation for the concept of Takaful, fostering a culture of mutual help and support.

The essence of Takaful can be traced back to ancient Arab tribal customs, particularly the system of mutual help regarding blood money, which was subsequently approved by the Prophet Muhammad SAW. The practice of shared responsibility, known as “Aquila,” between the Muslims of Mecca (muhajirin) and Medina (ansar), laid the foundation for mutual insurance.

The companions of the Prophet followed this practice, wherein contributions were driven by a sense of brotherhood and mutual responsibility to help those in need.

Insurance Fatwa in Singapore

In Singapore, the Islamic Religious Council of Singapore (MUIS) has not issued a specific fatwa regarding insurance subscriptions, except for Group Insurance. According to the fatwa, Muslims are discouraged from subscribing to commercial insurance.

However, due to ambiguity in classifying Group Insurance as cooperative insurance, MUIS allows Muslims to make their own choice based on their needs and circumstances.

The Proposed Method for Muslims in Singapore – Cooperative Insurance

As Takaful products are currently not available in the Singapore market, it is advisable for Singaporean Muslims to opt for cooperative insurance products. Commercial insurance, with its prohibited elements, should be avoided.

The Islamic Fiqh Council of the Organization of Islamic Cooperation (OIC) has also resolved that Muslims residing in non-Muslim countries, including Singapore, can subscribe to cooperative insurance in the absence of Takaful products.

The Importance of Insurance in Financial Planning

Including insurance in your financial planning is essential, as it helps protect your wealth and mitigates the risk of loss.

Islam encourages the mitigation of risks in life, as stated in a hadith: “Anas bin Malik (may Allah be pleased with him) narrated that the Holy Prophet Muhammad (ﷺ) told a Bedouin Arab who left his camel untied trusting in the will of Allah Almighty, to tie the camel first, then leave it to Allah Almighty” (Sahih Muslim, 59).

However, the timing of including insurance in your financial plan depends on your financial stability. If you are still struggling to meet basic needs, it may be best to prioritize achieving financial stability before adding insurance to your plan.

Cost of Insurance – Factors and Considerations

The cost of insurance varies depending on the type of insurance and coverage. Factors such as age, lifestyle, and occupation can also influence the price of an insurance plan.

According to Pacific Prime, Singapore ranks among the five most expensive countries for individual and family health insurance, with costs ranging from $6,265 (SGD8,978.72) to $17,803 (SGD25,514.46).

Dispelling Misconceptions About Insurance:

- Insurance is only for old people: Insurance is relevant for everyone, regardless of age. It is actually more cost-effective to purchase insurance at a younger age, as premiums are generally lower. By obtaining insurance early, you can protect yourself from potential health issues that may arise as you grow older.

- Company-provided medical insurance is enough: While the medical insurance provided by your employer is beneficial, it is limited to your employment period. Having a personal insurance policy in addition to your workplace coverage provides an additional safety net and ensures continuous protection.

- Young people don’t need critical illness insurance: Critical illnesses can occur at any age. Obtaining proper insurance coverage early on is crucial, as it can help alleviate the financial burden associated with medical treatment and recovery costs.

Distinction Between Independent Financial Advisory Firms and Tied Financial Advisors

The distinction between an independent financial advisory firm and a tied financial advisor often sparks curiosity among financial enthusiasts. Surprisingly, only a select few in the public realm truly comprehend this disparity.

The question of what sets apart an independent financial advisory firm from a tied financial advisor often arises in financial circles, yet only a handful of people in the public truly grasp the nuances.

An associated financial advisor (AFA) is typically affiliated with well-known insurance companies like AIA, AXA, NTUC Income, Prudential, and Manulife. Even if a financial advisor claims to represent a different group under a unique name, a quick glance at the app they utilize will likely reveal the insurance company they are associated with.

Conversely, an independent financial advisor (IFA) is not bound to a single insurance or financing company and possesses the flexibility to offer products from various insurance or financing providers.

Beyond this fundamental distinction, there are other notable differences to consider. One key advantage of an IFA is their ability to offer a wider range of investment products that AFAs may not have access to.

For instance, an AIA insurance advisor might be confined to AIA funds with underlying investments from Franklin Templeton or Blackrock. In contrast, an IFA has the freedom to present funds from multiple reputable entities, such as Franklin Templeton, Blackrock, Maybank Asset Management, and HSBC, amplifying the array of options available to clients.

Independently Owned Financial Advisory Firm vs Independent Financial Advisory Firm

Now, what about independently owned financial advisory firms? While the Monetary Authority of Singapore (MAS), the governing body regulating financial activities, imposes stringent criteria for firms to be labeled as independent, it’s crucial to distinguish between independent and independently owned financial advisory firms.

The latter are, in fact, subsidiaries of insurance companies and can offer diverse insurance products. However, they receive higher commissions when promoting products from the main company. To gain a deeper understanding of this topic, you can explore further by clicking here.

Noteworthy examples of independently owned financial advisory firms in Singapore include industry leaders like Financial Alliance and Professional Investment Advisory (PIAS), which epitomize the essence of impartiality and client-centric practices. These firms have demonstrated their commitment to offering unbiased financial advice and recommendations that align with clients’ best interests.

In a financial landscape filled with intricate choices, understanding the distinctions between independent financial advisory firms, tied financial advisors, and independently owned firms empowers individuals to make well-informed decisions that pave the way for a secure financial future. For a good read on this, you can click here.

Financial Advisors with Shariah-Compliant Funds

While there are more than 60 Financial advisory firms with a licence to conduct financial advisory services (MAS), the number of independent financial advisors number more than 5000 whereas the rest include 15,000 financial advisors in insurance firms (The Straits Times).

For this reason, the lists below are not exhaustive. Should you wish to feature your advisory, email us (contact@islamicfinancesg.com) , and we’ll update the list:

While there are various financial advisories in Singapore, it’s worth noting that not all of them offer Shariah-compliant funds. If you’re interested in financial advisors with access to such funds, you can refer to the list of advisories provided by The Business Times in 2019. However, keep in mind that this list may not be exhaustive, and it’s always a good idea to do your own research.

In Singapore, there are numerous financial advisors who have access to Shariah-compliant funds. While the list below is not exhaustive, it provides an overview of some reputable advisory firms. To feature your advisory on the list, please reach out to us via email for updates.

| Financial Advisories | Under | Type: | Funds ( ILP as well/ ILP as well/ ILP Only/ ILP Only/ AI only) AI only) |

| FAiWA | Financial Aliance Ptd ltd | Independent Financial Advisory |

|

| TAQWA Organisation | AIA | AIA Global Shariah Diversified Fund🔲 | |

| Advisor Aliance Group | AIA | AIA Global Shariah Diversified Fund🔲 | |

| PIAS | Independent Financial Advisory |

|

|

| iFAST Global Markets (iGM) | Independent Financial Advisory |

|

|

| Finexis | Independent Financial Advisory |

|

|

|

IAM Advisory |

AXIA |

Independent Financial Advisory |

|

|

Infinitum |

Independent Financial Advisory |

|

|

|

Ascent Islamic |

Manulife |

|

Conclusion: Paving the Way for Halal Financial Solutions

While there are other insurance products that are not covered, such as riders, critical insurance, and so on, the four insurance products elaborated on above are the first few insurance products you will be offered or come across.

Granted, they are different from the actual takaful we need but rest assured that efforts are underway to bring it to the public.

Once it does launch then we hope the Singapore Muslim community will support it so that more halal financial solutions can be offered.

To conclude our exploration of insurance, it is important to note that there are various other insurance products available, such as riders and critical insurance, that have not been covered extensively in this discussion.

However, the five insurance products we have delved into above represent the primary offerings you are likely to encounter as you embark on your insurance journey.

While they may differ from the ideal takaful solutions we seek, rest assured that concerted efforts are underway to bring halal financial alternatives to the forefront.

Once these halal financial solutions are launched, we sincerely hope that the Singapore Muslim community, alongside others seeking ethical and Shariah-compliant options, will wholeheartedly support them.

By doing so, we can foster a financial and banking landscape that not only aligns with our religious beliefs but also opens up a realm of possibilities for more halal banking solutions to be made available.

Let us strive together to create a future where individuals can confidently secure their financial well-being without compromising their faith.

Through the collective support and demand for halal financial products, we can contribute to a thriving ecosystem that caters to the unique needs and values of our diverse community.

Together, we can shape a brighter and more inclusive financial future for all.https://islamicfinancesg.com/docs/insurance/my-friend-recommended-me-to-opt-for-islamic-insurance-instead-of-conventional-insurance-i-wonder-whether-there-is-such-a-product-referred-to-as-islamic-insurance/

🔵Join the Islamic Finance Singapore community here!🔵

Writers:

Ezzat Ezzuddin, CPSA

Ezzat Ezzuddin is a young Shariah advocate in the Islamic finance industry. He kick-started his career journey as an Assistant Consultant in Amanie Advisors Sdn Bhd, a global-renowned Shariah advisory firm, where he was entrusted to supervise and oversee Islamic funds by local and international asset management companies. Ezzat then joined Hong Leong Islamic Bank Berhad as an Islamic Graduate Trainee, where he attached with the Shariah department and exposed to wide Shariah issues in Islamic banking operations. Currently, he works as an Executive in Shariah section in BIMB Securities Sdn Bhd, an Islamic stockbrocking services in Malaysia. Upon holding a Bachelor Degree of Shariah Muamalat Management from Academy of Islamic Studies, University of Malaya Kuala Lumpur, Malaysia, Ezzat Ezzuddin then pursued his postgraduate studies in Masters of Islamic Finance Practice (MIFP) in INCEIF University. Aside of his strong proficiency in Arabic language, he also a Certified Professional Shariah Auditor (CPSA) by Islamic Banking and Finance Institute Malaysia (IBFIM).

Muhammad Ridhwaan Radzi, CSAA

Ridhwaan found his passion for Islamic finance at the school where he graduated from – Madrasah Aljunied Al-Islamiah. He is currently a business undergraduate in NTU and the Managing Director at Islamic Finance Singapore (IFSG). While in the university, he has taken three qualifications: IFQ by CISI. ACIFE in Financial Analysis by Ethica institute and CSAA by AAOIFI.

Editor:

Zul hakim Jumat, CSAA

Zul Hakim is a certified Shariah advisor and auditor under AAOFI. He received his bachelor’s degree (Hons) in Jurisprudence and Principles of Jurisprudence while minoring in Economics from Kuwait University (2015) and his MSc (Hons) in Islamic Finance from Hamad Bin Khalifa University (2018). Currently, he is a researcher at the Center for Islamic Economics and Finance, Qatar Foundation, and a PhD candidate in the Islamic finance and economy program at Hamad Bin Khalifa University, Qatar. In addition, he is the deputy managing director at Islamic Finance Singapore (IFSG).

Are there different zakat rulings for different insurance products? ie wholelife, term etc.