Singapore 2023: A year of transformation and innovative resilience

By Muhammad Ridhwaan Radzi and Zul Hakim Jumat

This article was first published in the IFN Annual Guide 2024.

Singapore’s 2023 stands as a testament to its mature political landscape, marked by significant transitions in leadership that would be pivotal in shaping its future trajectory. The nation welcomed Tharman Shanmugaratnam as its new appointed president, succeeding Halimah Yacob, whose tenure as the first female president was emblematic of Singapore’s progressive values. Furthermore, the announcement of the planned leadership transition from Prime Minister Lee Hsien Loong to Deputy Prime Minister Lawrence Wong sets a precedent for strategic succession planning. Amid these changes, the country’s rigorous legal and regulatory systems were put to the test with a major SG$2.8 billion (US$2.09 billion) money laundering scandal, resulting in decisive actions and multiple convictions — further reinforcing the nation’s international reputation for strong governance and the rule of law.

🔵Join the Islamic Finance Singapore community here!🔵

Review of Singapore in 2023

The financial sector’s resilience and regulatory robustness

The finance industry saw the Monetary Authority of Singapore (MAS)’s steadfast dedication to improving cross-border transactional efficiency and financial interconnectedness. With the authority’s successful integration of PayNow from Singapore and DuitNow from Malaysia, citizens now have a smooth real-time payment option, ushering in a new era of financial ease and integration. In addition, Singapore’s commitment to leading the way in financial technology and cooperation is shown by its partnership with Bank Indonesia to create a cross-border QR payment system. By examining the possibilities of central bank digital currencies via global partnerships, Singapore establishes itself as a trailblazer in the developing field of digital currencies.

The asset management industry in Singapore shows surprising resilience, with a rise in registered fund management businesses, despite global economic headwinds causing a 10% fall in assets under management. This tenacity is seen in the forceful reaction to the well-publicized money laundering case, which highlighted the robustness and dependability of Singapore’s financial supervision rather than discouraging investors. Stricter capital requirements for big insurers have been imposed by MAS as a proactive measure to improve market trust and financial stability.

Start-up ecosystem and environmental commitment

Singapore’s start-up ecosystem has emerged as a vital contributor to the region’s innovation-driven economy, with considerable investment in deep tech start-ups in greentech and health tech. The assistance of the Global Innovation Alliance, which offers a platform for growing enterprises to reach global markets and create an atmosphere to innovation and entrepreneurship, benefits these industries enormously.

Singapore’s sustainability efforts are vigorous, with the country committed to a lofty ‘net-zero emissions by 2050’ target. The innovative SolarShare 2.0 program permits the trading of solar-generated power, demonstrating Singapore’s commitment to renewable energy and its potential for scalable, long-term development.

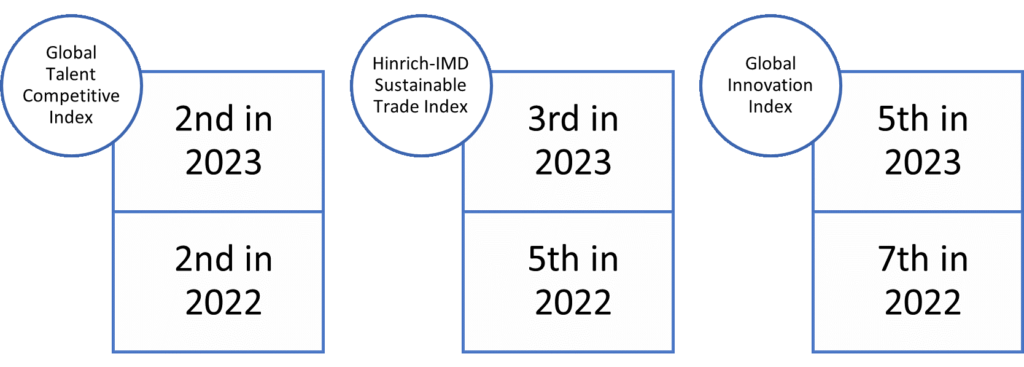

Figure 1: Singapore’s achievements globally

Source: The Business Times

Fostering a digital economy and stock market development

As digital assets gain international prominence, MAS’s strategic objectives seek to establish Singapore as a center for digital asset innovation. This involves using blockchain technology to improve payment processes and investigating the issue of digital currency. Coinbase’s complete licensure and Paxos’s in-principle acceptance are major advances toward building a solid framework for digital asset operations in Singapore.

The stock market reflects Singapore’s economic vitality, with MAS exploring changes to its corporate governance rules to support healthy business cultures. The strategic asset monetization by Singtel and Keppel demonstrates corporate Singapore’s proactive approach to using assets for development and sustainability. Furthermore, TD Ameritrade’s move in brokerage services indicates a strategy shift toward addressing a more sophisticated investor group.

Singapore’s Islamic finance industry — 2023 overview

|

Area |

Institution |

Achievements & Initiatives |

|

Community Initiative |

Islamic Finance Singapore (IFSG) |

IFSG Ltd has emerged as a beacon for Islamic finance in Singapore, marking its inaugural year with significant expansion plans. These include RizqX, a platform designed to facilitate investments in line with Islamic principles; Halal 2.0, an initiative aimed at ranking stocks based on their shariah-compliant and ESG information; and ZakatX, a dedicated service for the efficient collection and distribution of Zakat, enhancing the socio-economic impact of charitable giving within the Muslim community. |

|

Investment Platforms |

RizqX |

RizqX has established itself in Singapore as a pioneering halal investing platform, methodically selecting investment options across a wide range of asset classes. It offers important independent analysis of all listed funds, allowing investors to make educated selections that are consistent with their ethical and religious values. The startup recently passed the NTUitive (NTU business incubator) Multidisciplinary Team Project Funding assessment to progress on their plans and product development. |

|

iFAST |

The iFAST platform has expanded its Shariah-compliant offerings, adding seven more ETFs listed on the London Stock Exchange. This expansion not only diversifies the investment options for clients but also offers a more tax-efficient investment route compared to traditional unit trusts or investment-linked policies, reflecting iFAST’s commitment to providing competitive and ethical financial solutions. | |

|

Asset Management |

HSBC Asset Management |

HSBC has leveraged its global expertise to introduce Shariah-compliant investment products, such as the Islamic Global Equity Index and Global Sukuk Index Funds, on regulated platforms in Singapore. The funds track established indexes like the Dow Jones Islamic Titan 100 and the FTSE IdealRatings Investment Grade Index, both incorporating extensive Shariah standards and managed by a dedicated team of experienced Shariah scholars. With a competitive total expense ratio, these funds are appealing for both standalone investment and integration into multi-asset portfolios, offering Islamic investors the opportunity to diversify their portfolios on par with conventional investment standards. |

|

Milltrust International |

The Climate Impact Asia Fund was set up by Milltrust in collaboration with WWF HK in 2019. The fund has performed positively in both relative and absolute terms, beating most Asian equity indices by a wide margin. It invests using Dark-Green Filter, developed proprietarily, to select stocks in Asia Pacific that are the key beneficiaries from the decarbonization theme. It has won a few awards in the short time span including Best ESG Fund Methodology (UK), WealthforGood Awards in 2023 and Best ESG Investment Initiative of the year (Asia) and Best Environmental Fund of the year (Asia) by Environmental Finance in 2022. Milltrust’ Singapore affiliate is First Estate Capital Management. The new Shariah-Compliant Climate Impact Asia Fund will start trading early next year alongside the Shariah Compliant Multi-Asset Fund, benefitting from the overlap between Shariah principles and climate investing. | |

|

Walton Global |

Walton’s Shariah-compliant Pre-Development Land Investment products have seen a distribution of over USD 2.3 billion to global investors. Adding to their achievements, Walton has attained Shariah-compliant certification for their EB-5 investment program, offering a pathway to U.S. residency through investment. | |

|

Banking |

Deutsche Bank |

Deutsche Bank has strengthened its Shariah custody capabilities in Southeast Asia. It has partnered with CIMB Islamic (Securities Services) to provide Shariah custody in Malaysia, and launched international Shariah-compliant global cash and custody services in Singapore. These capabilities complement the bank’s CustodyOne offering in the region, making global access simple for clients. |

|

Maybank Singapore |

Maybank Singapore continues to be an Islamic finance powerhouse, securing the title of Islamic Bank of the Year for the seventh consecutive year. The bank has been at the forefront of innovative Islamic financing, structuring the first Islamic Sustainability-Linked financing for a data centre in the city-state. Moreover, Maybank has facilitated the banking process for Islamic SMEs through user-friendly online applications, thereby enhancing the accessibility and efficiency of Islamic financial services. | |

|

Brokerage |

CGS-CIMB |

CGS-CIMB made significant inroads with the introduction of iCash, Singapore’s first Shariah-compliant trading account, empowering socially responsible and Islamic investors with ethical investment choices. The firm’s commitment to excellence was recognized with prestigious accolades such as ‘Best Broker’ by FinanceAsia and Alpha SEA. |

|

Decentralised Finance (DeFi) |

Zayn Finance |

In an ambitious move to expand its DeFi services, Zayn Finance integrated with Coinbase’s Base network to establish a Shariah-compliant gateway for investors in the decentralized finance space. This strategic initiative has streamlined liquidity contributions to DEXs and has seen a rapid increase in Total Value Locked, indicating a strong market reception and the potential for continued growth. |

|

Financial Advisory |

Aman Amanah Advisory Group |

Celebrating its 10th anniversary, Aman Amanah has been at the forefront of providing specialized Islamic financial advisory services under the umbrella of Financial Alliance. It has cemented its reputation as a trusted name in aligning financial strategies with Islamic values. |

|

Ascent Islamic |

Ascent Islamic has been serving 5000 Muslim families in providing for Islamic Financial Planning services. They have started a regular free Islamic financial planning walk-in clinic with Masjid Anggulia. They also conducted a well-received Muslimah financial workshop with Masjid Anggulia. | |

|

Ethiqal Wealth Advisory- an authorised representative of AIA Singapore |

Specializing in more than just insurance, EWA ensures the meticulous transfer of wealth through comprehensive financial planning, including Islamic Estate Planning and Business Succession Planning, to provide peace of mind and financial security in accordance with Islamic tenets. | |

|

Financial Alliance Islamic Wealth Advisory (FAiWA) |

The introduction of the Horizon Capital Shariah Fund – Global Trade Finance positions Financial Alliance as a prominent hedge fund house provider within Singapore’s Islamic finance sector. Registered under MAS’s restricted scheme, it targets accredited investors and is designed to achieve absolute return performance with USD returns of 7-9% per annum and low volatility, marking a new investment avenue for those seeking Shariah-compliant financial products. | |

|

Modern Muslim Finance |

With a passionate approach to serving the Muslim community, Modern Muslim Finance, led by Mr. Syed Afiq Syed Ismail, has provided extensive Islamic finance planning services. Their expertise has aided over 500 families, with the team conducting numerous Halal investing sessions and crafting over 100 wasiat (last will) documents, illustrating their commitment to financial education and empowerment based on Islamic principles. | |

|

TAQ Wealth Associates (TAQWA) – an authorised representative of AIA Singapore Pvt Ltd |

TAQWA has continued to excel within the Islamic finance advisory domain, achieving consecutive team awards within AIA. The co-founder, Mr. Qayyim Isa, received the Top Director award, highlighting TAQWA’s leadership and excellence in representing Singapore’s Islamic finance sector on a global stage. | |

|

Fintech |

Hugosave |

As a major financial institution, Hugosave caters to a growing client base with diverse financial services, including investments in precious metals. With a commitment to serving the Muslim market, Hugosave is advancing toward Shariah compliance, demonstrating its adaptability and dedication to inclusivity in the financial sector. |

|

Insurance |

Etiqa Insurance |

Etiqa has been actively exploring opportunities to reintroduce takaful to the Singaporean market. By assessing consumer demand and focusing on value-added solutions, Etiqa is poised to revitalize the Islamic insurance offerings in the region. |

|

Legal |

Dentons & Rodyk |

The firm received the esteemed title of Asset Management & Islamic Funds Law Firm of the Year at the 16th IFN Law Awards 2023, highlighting their its legal prowess and commitment to the Islamic finance sector. |

Source: Authors’ own*.

The broad range of operations undertaken by Singapore’s Islamic finance sector and institutions is indicative of a healthy, varied market that is continually expanding and evolving. Every institution’s initiatives have helped create a more welcoming financial environment that permits increased Islamically compliant market participation. It is anticipated that these advancements will carry on evolving in the future, offering a favorable environment for additional innovation and expansion in the Islamic financial sector.

Preview of 2024 and conclusion

Singapore, famed for its ingenuity and perseverance in the face of shortage, has maintained its success trajectory in 2023. Sustained prosperity in the country has been attributed to its strategic focus on developing a highly qualified workforce, promoting a vibrant digital economy, preserving top-notch infrastructure and sustaining a strong regulatory framework.

On the other hand, the Islamic finance industry, which has been largely founded on the efforts of private citizens and organizations, might seem young. Nonetheless, 2023 established the framework necessary for the success of creative Islamic financing projects. In the upcoming year, these programs aim to establish stronger foundations, promoting increased collaboration and growth.

Looking ahead to 2024, Singapore looks like a very interesting place to be. Its steadfast dedication to development, coupled with the development of its Islamic finance industry, portends a year full of opportunity, creativity and expansion.

🔵Join the Islamic Finance Singapore community here!🔵

Authors:

- Muhammad Ridhwaan Radzi is the managing director of Islamic Finance Singapore, Singapore.

- Zul Hakim is currently a researcher at the Center for Islamic Economics and Finance, College of Islamic Studies, Hamad bin Khalifa University, Qatar.

*If you have an update to be published in this report, please email us at contact@islamicfinancesg.com