TLDR: Islamic Dual Currency Investments (IDCIs) offer a Shariah-compliant alternative to conventional Dual Currency Investments, enabling investors to optimise returns through structured exposure to currency movements. IDCIs combine principles like risk-sharing, the avoidance of interest (riba), and adherence to value-based frameworks, providing flexibility for investors to receive returns in either the base or alternate currency. While promising higher potential returns, IDCIs come with risks, including capital, currency, and liquidity risks, requiring careful planning and understanding. Maybank offers tailored IDCI solutions as part of its comprehensive Islamic Wealth Management services, designed to align with your financial goals.

INTRODUCTION

In a global financial landscape marked by complexity and opportunity, investors are increasingly seeking strategies that align with their principles while addressing market demands. Islamic Dual Currency Investment (IDCI) provides a Shariah-compliant solution for individuals and businesses aiming to optimise returns through structured exposure to currency market movements. Rooted in Islamic financial principles, IDCI offers a reliable and transparent alternative to conventional investments.

This article explores the intricacies of IDCI, its adherence to Islamic financial principles, and how it empowers investors, both Muslims and non-Muslims, to achieve their financial aspirations while aligning with their ethical values. Whether you are an individual seeking portfolio diversification or a business navigating currency volatility, IDCI serves as a versatile tool, bridging the gap between financial goals and value-driven investment principles.

AN IN-DEPTH LOOK AT IDCI

IDCIs provide a structured, Shariah-compliant alternative to traditional Dual Currency Investments (DCIs), enabling investors to optimise their returns by engaging in currency-based transactions. Unlike conventional DCIs, IDCIs are carefully designed to adhere to Islamic financial principles, eliminating elements such as interest (riba), excessive ambiguity (gharar), and speculative transactions (qimar).

Furthermore, IDCI provides an opportunity for investors to potentially earn higher returns than ordinary time deposits by leveraging currency movements. At maturity, investors may receive their investment amount and profit back in either the base currency or the alternate currency, depending on the market dynamics of the selected currency pair.

Key Features of IDCI

- Currency Pair Selection: Investors engage in IDCIs by placing their funds in a specific currency pair. For instance, in a USD/SGD pair, the base currency might be SGD (Singapore Dollar) while the alternate currency is USD (U.S. Dollar). An investment amount, such as SGD 100,000, is placed in a deposit structure for a predefined period.

- Strike Rate and Spot Rate : Two key exchange rates drive the investment’s outcome:

- The initial spot rate is the prevailing exchange rate at the time of investment, such as SGD 1.3800 per USD 1.0000.

- The strike rate is a predefined target exchange rate, such as SGD 1.3500 per USD 1.0000, which determines the outcome at maturity.

- Tenor and Profit : IDCIs are short-term investments with a fixed tenor. For example, a one-month (30 days) tenor might offer an annualised profit rate of 3.60%. The return and final currency settlement depend on the performance of the currency pair relative to the strike rate.

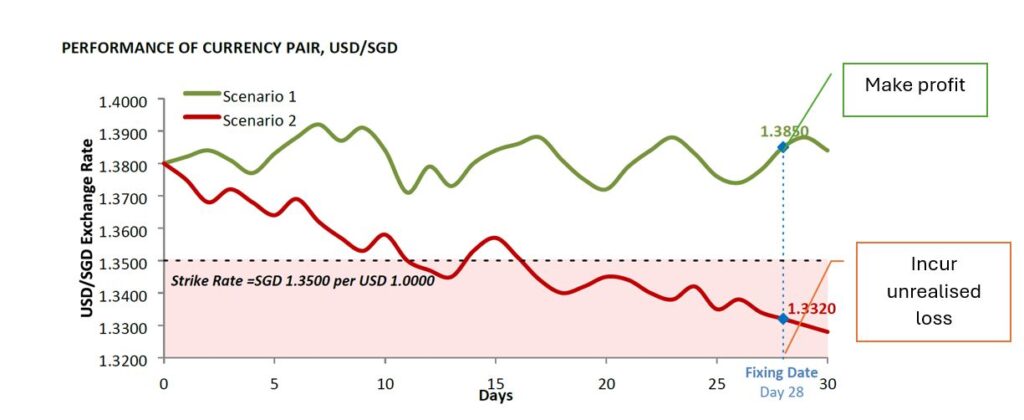

- Investment Scenarios: The outcome of an IDCI hinges on the currency movements during the investment period:

- If the exchange rate meets or exceeds the strike rate, the investor typically receives the principal and anticipated profit in the base currency.

- If the rate falls below the strike rate, the principal is converted into the alternate currency at the predefined strike rate, and the investor might incur a loss due to the exchange rate difference.

Shariah-Compliant Structure

IDCIs operate under robust Islamic financial principles, ensuring compliance with Shariah guidelines. These key structural elements include:

- Agency Agreement (Wakalah): The investor appoints the financial institution as an agent to manage the investment. The bank charges a Wakalah fee for its services, ensuring transparency and alignment with Islamic values.

- Currency Exchange (Bai’ al-Sarf): Transactions are executed as currency exchanges on a spot basis, fulfilling the Islamic requirement for tangible asset exchanges.

- Unilateral Promise (Wa’d): A binding promise ensures compliance with the agreed terms, avoiding speculative practices. The structure adheres strictly to Shariah prohibitions against interest (riba), excessive uncertainty (gharar), and gambling (maysir).

Example: USD/SGD IDCI Investment

Consider an investor placing SGD 100,000 in a USD/SGD IDCI with a strike rate of SGD 1.3500 per USD 1.0000 and a one-month tenor. If the exchange rate at maturity exceeds the strike rate, the investor receives the principal and profit in SGD. However, if the rate falls below the strike rate, the principal and profit are converted to USD at the strike rate.

By incorporating principles such as Wakalah and Bai’ al-Sarf, IDCIs ensure that each transaction adheres to Shariah requirements while providing an opportunity for investors to optimise returns through structured currency exposure. These features make IDCI a compelling choice for investors seeking Shariah-compliant avenues for portfolio diversification and yield enhancement.

THE INFLUENCE OF ISLAMIC PRINCIPLES ON IDCI

IDCIs stand apart from conventional financial products due to their foundation in Islamic financial principles. These principles not only guide the structure and mechanics of the product but also ensure that investments are aligned with ethical and value-driven frameworks emphasising fairness, transparency, and mutual benefit. These principles are as follows:

- Avoidance of Interest (riba)

One of the fundamental tenets of Islamic finance is the avoidance of riba, or interest. Conventional financial products often derive returns through interest-based mechanisms. IDCIs, however, are structured to provide returns through profit-sharing agreements and real economic activities, ensuring compliance with Shariah principles. The profit earned by investors is derived from tangible currency exchange transactions rather than interest accruals.

- Risk-Sharing

Islamic finance promotes the equitable distribution of risks and rewards. Unlike conventional investments, where the burden of risk is often shouldered by one party, IDCIs share the risks associated with currency fluctuations between the investor and the financial institution. This mutual approach fosters fairness and reflects the Islamic principle of mutual cooperation (ta’awun).

- Elimination of Excessive Uncertainty (gharar)

IDCIs are carefully structured to eliminate gharar, or excessive ambiguity. All terms, including the investment tenor, strike rate, profit rate, and currency exchange process, are clearly defined and agreed upon at the outset. This ensures transparency and allows investors to make informed decisions without being exposed to speculative practices.

- Focus on Real Economic Activity

IDCIs emphasise tangible transactions by facilitating the actual exchange of currencies. The use of contracts such as Bai’ al-Sarf with asset-based underlying ensures that investments are backed by real economic activity, rather than speculative gains or notional trades. This adherence to tangible asset-based transactions strengthens the product’s compliance with Islamic values.

- Transparency and Accountability

IDCIs prioritise transparency in all dealings. Investors are fully informed of the investment’s mechanics, potential outcomes, and risks before entering into the agreement. This emphasis on accountability fosters trust and ensures that all parties are treated equitably, in line with the Shariah mandate for justice in business transactions.

- Ethical Considerations in Investment

IDCIs uphold ethical standards by steering clear of investments or transactions deemed impermissible under Islamic law. These include avoiding industries deemed as harmful such as gambling, alcohol, or those involving excessive speculation, ensuring that the investment aligns with Shariah guidelines.

IDCIs are designed to balance financial objectives with Shariah compliance, offering investors a pathway to diversify their portfolios while staying true to Islamic principles. At the same time, IDCIs’ alignment with ethical principles makes them an attractive alternative to non-Muslim investors who wish to focus on ethical and sustainable investment alternatives.

NAVIGATING THE IDCI INVESTMENT PROCESS

For investors seeking a structured and Shariah-compliant approach to currency-based returns, IDCIs offer a clear and transparent pathway. By understanding the steps involved, you can make informed decisions aligned with your financial goals, ethical values and risk appetite.

Step 1: Define Your Investment Goals and Risk Tolerance

Begin by evaluating whether IDCI aligns with your financial aspirations. This investment is suited for those seeking potentially higher returns than standard time deposits and who are willing to accept currency exchange risks. It would appeal especially to investors with diversified portfolios or a need for foreign currency.

Step 2: Understand Eligibility Requirements

IDCIs are generally available to private and accredited investors who meet specific requirements, such as:

-

- Possessing knowledge and experience in cash-type investments.

- Understanding the associated risks of currency-based products.

- Meeting the minimum investment thresholds set by the offering institution.

For Muslim investors, Shariah principles require that there should be a material need for an alternate currency to make such an investment permissible. This ensures the investment aligns with the Shariah’s emphasis on fulfilling genuine economic needs rather than engaging in speculative transactions. Examples include planning for education expenses, overseas business transactions, or future foreign currency obligations.

Step 3: Choose Your Currency Pair

Identify the currency pair you wish to invest in. For example, if you are investing in the USD/SGD pair, you may designate SGD as the base currency and USD as the alternate currency. The choice of pair should support your financial needs, such as funding international obligations or managing exposure to currency fluctuations.

Step 4: Determine the Strike Rate and Tenor

Work with your financial advisor to establish the strike rate—a pre-agreed exchange rate that will define the outcome of the investment. Decide on the tenor, which can range from one week to several months, based on your liquidity needs and market expectations.

Step 5: Commit Your Investment

Transfer the agreed-upon funds in the base currency to your IDCI account. This amount represents the principal sum to be held for the investment period. Ensure the funds are available prior to the start date to avoid delays.

Step 6: Monitor Market Movements

Throughout the investment tenor, stay informed about currency market trends that may influence the outcome of your IDCI. While market conditions are beyond your control, a financial advisor can provide updates and insights to help you understand the potential impact on your returns.

Step 7: Review Maturity Outcomes

At the end of the investment period, assess the maturity outcome:

-

- If the exchange rate meets or exceeds the strike rate, you will receive the principal and profit in the base currency.

-

- If the rate falls below the strike rate, the principal and profit will be converted into the alternate currency, and you may incur a loss in base currency terms.

Practical Considerations

IDCIs are ideal for investors with specific financial needs, such as:

- Managing cash flow for future expenses in foreign currencies (e.g., education abroad or international business transactions).

- Hedging against currency fluctuations while earning returns.

- Optimising yield on short-term deposits with strategic currency exposure.

By following this process, you can maximise the benefits of IDCIs while maintaining alignment with your financial goals. Whether you’re focused on optimising returns or diversifying your portfolio, IDCIs provide a flexible and transparent solution tailored to your needs.

IDCIs IN ACTION: CASE STUDIES AND SCENARIOS

IDCIs offer tailored solutions for various financial needs, whether you’re planning for future expenses in foreign currencies or seeking to manage investment risks related to currency fluctuations. Here are two practical scenarios that illustrate how IDCIs work in real-life contexts:

Scenario 1: Saving for Overseas Education |

| Objective: A parent is planning for their child’s future education in Australia and needs to save in Australian Dollars (AUD) to cover tuition and living expenses. At the same time, they wish to optimise returns by earning a higher profit than traditional savings options.Step-by-Step Application:

Result: |

Scenario 2: Risk Management for International Investments |

| Objective: An investor has exposure to the U.S. market and is concerned about potential currency fluctuations affecting their returns. They wish to hedge this risk while earning additional income.Step-by-Step Application:

Result: |

Note: All investments involve an element of risk, including capital and principal loss. Past performance is not necessarily a guide to or an indication of future performance.”

Practical Benefits of IDCI in These Scenarios

- Customised Solutions: IDCIs allow investors to align their financial strategies with specific goals, such as saving in foreign currencies or managing risks.

- Yield Optimisation: By offering higher potential returns compared to traditional time deposits, IDCIs enable investors to enhance their savings or cash flow.

- Flexibility in Outcomes: Depending on the currency movements, investors can benefit from settlement in either the base or alternate currency, providing adaptability in various financial scenarios.

KEY RISK CONSIDERATIONS IN IDCI

IDCIs offer higher potential returns but come with inherent risks that investors must consider to make informed decisions. These risks include:

- Capital Risk

IDCIs are principal-at-risk investments, meaning capital preservation is not guaranteed. If the alternate currency depreciates significantly against the base currency, the investor may incur losses upon conversion at maturity.

- Currency Risk

IDCIs are exposed to foreign exchange rate fluctuations driven by global and local economic trends, central bank policies, and political events. If the exchange rate falls below the strike rate at maturity, the total return in base currency terms may be lower than the original investment.

- Liquidity Risk

Funds invested in IDCIs are locked for the investment period, which can range from weeks to months. This illiquidity requires investors to plan their cash flow needs carefully.

- Credit Risk

As with any bank-issued product, IDCIs carry credit risk. If the issuing bank defaults or becomes insolvent, investors may lose their capital. Additionally, IDCIs are not insured under Singapore’s Deposit Insurance and Policy Owners’ Protection Schemes Act.

- Exchange Controls

Regulatory restrictions in certain jurisdictions may affect currency transfers or repayments in the preferred currency, potentially impacting the investment outcome.

- Shariah Compliance Risk

For Muslim investors, IDCIs must serve a material need for the alternate currency to remain permissible under Shariah. Speculative transactions without tangible purpose are not compliant with Islamic principles.

Mitigation Tips

Investors can mitigate these risks by working with experienced financial advisors, maintaining sufficient liquidity buffers, and staying informed about currency trends and geopolitical developments.

By understanding these risks and taking necessary precautions, IDCIs can be a valuable addition to a well-considered investment portfolio.

MAKING INFORMED INVESTMENT DECISIONS WITH IDCI

IDCIs provide a structured and Shariah-compliant approach to enhancing returns through currency movements. By combining principles such as risk-sharing, avoidance of interest (riba), and adherence to transparent investment frameworks, IDCIs present a valuable alternative to conventional financial products for both Shariah-conscious and value-driven investors.

The flexibility of IDCIs lies in the ability to choose currency pairs and receive returns in either the base or alternate currency, depending on exchange rate fluctuations. This adaptability makes IDCIs suitable for a range of financial strategies, from hedging currency risks to preparing for future foreign currency needs.

Looking Ahead

As demand for Shariah-compliant financial products continues to grow, IDCIs are positioned as a key innovation in Islamic finance. With the increasing refinement of their structures and features, IDCIs are becoming an indispensable tool for portfolio diversification and yield optimisation. These developments cater not only to Muslim investors but also to a broader audience seeking reliable, ethical financial instruments.

Maybank: Your Trusted Partner

Maybank, as a leading provider of Islamic Wealth Management solutions, offers a comprehensive suite of Shariah-compliant investment options, including IDCIs. Backed by robust expertise and a commitment to Islamic finance principles, Maybank’s solutions are designed to cater to diverse investor needs while maintaining compliance with ethical and financial standards.

If you are considering IDCIs as part of your investment strategy, Maybank provides tailored advisory services through its premier and private branches. Review the product information statement and speak with a qualified advisor to assess the suitability of IDCIs for your financial goals and risk appetite.

Find out more about Maybank’s Islamic Wealth Management solutions, through the following channels:

- Email iwmsg@maybank.com

- Call 1800-MAYBANK (1800-629 2265) or (65) 6533 5229

- Visit your nearest Maybank branch

With Maybank as your partner, you can confidently incorporate IDCIs into your portfolio, leveraging their potential to achieve financial growth aligned with your values.

This article was brought to you in collaboration with Maybank Singapore – Islamic Wealth Management, and has not been reviewed by the Monetary Authority of Singapore.

This article is for information purposes only and under no circumstances is it or any part of it to be considered or intended as an offer to sell or a solicitation of an offer to buy any of the financial or investment products referred to herein (each, a “Product”, and collectively, “Products”), or an offer or solicitation to any person to enter into any transaction or adopt any investment strategy or enter into any legal relations, or an advice or a recommendation with respect to such Products.

Investments in collective investment schemes (“Fund(s)”) are not obligations of, deposits in, or guaranteed by the distributors or any of their affiliates. Investors should read the Prospectus, obtainable from Maybank, before deciding whether to subscribe for units in the Fund(s). All applications for units in the Fund(s) must be made on the application forms accompanying the Prospectus

Investors should note that income from such Products, if any, may fluctuate and that each Product’s price or value may rise or fall. Accordingly, investors may receive back less than what they have originally invested or they may also not receive back anything at all from what they have originally invested. All investments involve an element of risk, including capital and principal loss. Past performance is not necessarily a guide to or an indication of future performance.

This article is prepared for general circulation. It is not intended to provide personal investment advice and does not take into account the specific investment objectives, financial situation and particular needs of any particular recipient or reader and thus should be read with this in mind. An investor should therefore independently and separately evaluate and assess each Product and consider the suitability of the same and the risks involved, taking into account the investor’s specific investment objectives, financial situation, risk tolerance and particular needs, and seek independent financial, audit, tax, legal and/or other professional advice as necessary, before dealing, transacting and/or investing in any of the Products mentioned in this report or communicated to the investor as a follow-up to this report. All investments will be made solely upon and in reliance on the investor’s own judgment and discretion, notwithstanding any opinion, commentary or recommendation this report, Maybank or its Relationship Managers may provide. Unless expressly agreed otherwise, Maybank offers no investment, financial, legal, tax or any other type of advice to recipients or readers of this report. Maybank has no fiduciary duty towards any such recipients and readers, and makes no representation and gives no warranty as to the results to be obtained from any investment, strategy or transaction, or as to whether any strategy, security or transaction described herein may be suitable for the financial needs, circumstances or requirements of the recipients and readers.

Diversify Your Portfolio with Maybank: Halal Investment Funds to Grow Your Wealth

Maximise Wealth: Your 2025 Guide to Islamic Financial Planning in Singapore