Halal Investment Guide

Are there halal ways to invest? What is meant by halal or Shariah-compliant investments? Why can’t we invest in certain investments? How to find Islamic investments in Singapore? What returns can you expect from halal investments?

These are the type of questions we at Islamic Finance Singapore receive regarding investments. Not surprising given that Singaporean Muslims have a relatively high household income and are looking for opportunities to grow their money. Yet, their financial advisor can only offer regulated investments such as mutual funds/unit trusts. Over the past seven years since I was first introduced to the Islamic finance world through a short course, I have observed a myriad of issues that hinder the industry’s success in the Singapore scene. Over time, I grew a passion for solving such problems and co-founded IFSG in the process. Below is my learning journey of discovering the nature of what Islamic/halal investing is all about.

What is meant by halal investments?

The fundamental practice and methodology go beyond man-made prescriptions for ethical finance. In essence, it propagates the divine prescriptions on the fair distribution of wealth by avoiding interest (riba), contractual uncertainty (gharar), and gambling or wagering (maysir). For certain investments such as stocks, we can not possibly erase the three elements mentioned. It involves a listed company such as Mapletree that has no intention of accommodating Muslim investors. But investing in stocks is one of the prudent ways to manage your wealth; thus, Islamic finance scholars created a “leeway” for Muslims by combining qualitative (filtering companies doing casino, adult entertainment, etc.) and quantitative (filtering companies with excessive interest). This gave birth to the term “Shariah-compliant”, as the investment implies, at best, being free from any elements that are violating Shariah rulings. This proved great during the 2008 financial crisis since Muslim investors are safeguarded from being embroiled with excessive risk-taking by global conventional financial institutions. This resulted in Islamic Finance gaining traction as an alternative financing model. Moreover, there is even evidence that Shariah-compliant investments offer much superior returns and impacts than conventional ethical finance/investments (read more on “Investing in Islamic funds” by Dr Noripah Kamsoh)!

Can Muslims invest wherever they want?

In short, no. There are clear and defined principles on what is prohibited for Muslims to invest. As mentioned earlier, halal investments principles negate interest (riba), contractual uncertainty (gharar), and gambling or wagering (maysir). Some investment products such as bonds earn you interest that is against our Shariah. Even peer to peer crowdfunding may earn you interest depending on the investment structure. In addition, some unit trusts invest in listed companies which are involved in sectors that violate our Shariah. On top of this spectrum of impermissible investment products, we as Muslims also need to be conscious of the environmental and social impact of our investments. It should be one of our principles as Muslim investors to uphold our Islamic values while seeking for healthy investment returns. We did a deep-dive article on Muslim friendly mutual funds provided by some Singaporean financial consultants, which neglect any Shariah compliance framework. Do have a read here.

Halal investment ideas for 2023

Suppose you have a financial advisor to examine your finances before recommending an investment scheme. Most can only offer you a mutual fund scheme that best suits your risk profile, and only a few that can offer a private equity fund or a packaged REITs scheme. Yet, all of these investment options hinge on the condition that they are regulated by the Monetary Authority of Singapore. Nonetheless, there are merits to both regulated and non-regulated investments. Essentially, it just boils down to whether the investment has to file reports to the regulator in Singapore. This article intends to uncover halal investments options for Singaporean Muslims and quell the misconception of the options being limited. Here is a mindmap of the investments in Singapore:*Disclaimer, I am not a financial advisor, and these are just the anecdotes of my learning journey of discovering the nature of what Islamic/halal investing is all about. Also, I am not affiliated with any of the companies listed below, and the list is non-exhaustive. Please do your own homework before investing.

How would you know which investments are considered halal?

Simple, based on what was mentioned earlier, there are shariah advisors for each of the investments presented below, who are specialist in the field of commercial transactions. We did an interview with one such advisor which you can watch here.

1) Exchange Traded Funds (ETFs)

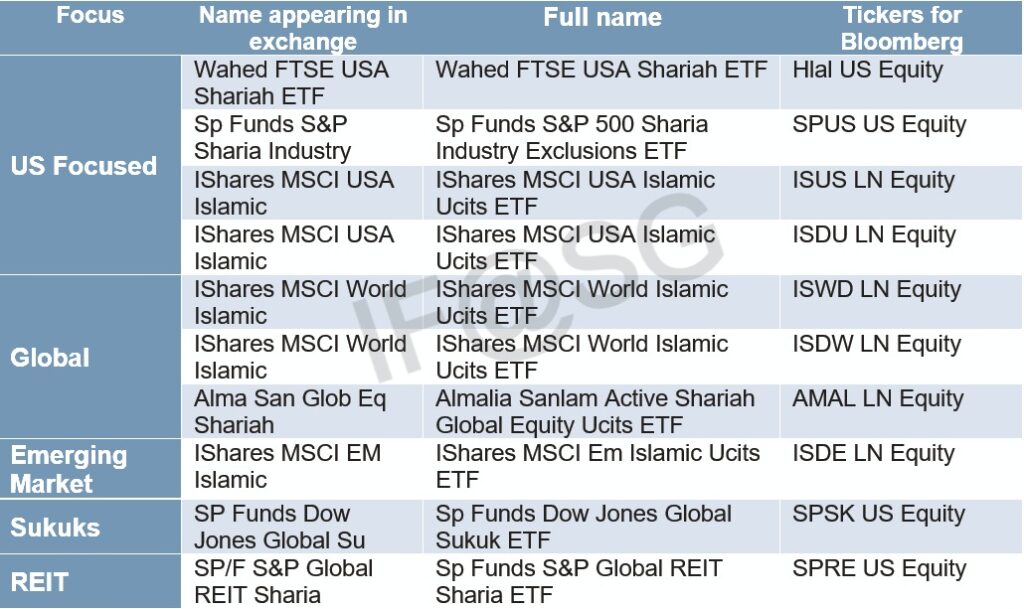

Mentioned as the next best alternative to index funds due to its diversification, low expenses and ability to own big companies for a small sum, ETFs are simply a basket of stocks traded on the exchange. Purchasing just one unit of Apple shares can cost you more than USD $100, and what more other securities. Thus, some institutions packaged these stocks then placed them on the exchange for retail investors to invest and sell-off in the future. Here you may see the returns of these Shariah-compliant ETFs on a year to date. For example, the first ETF, Wahed FTSE Shariah ETF, with its ticker HLAL is returning 22.58% on a year to date scale. Meaning, from 1st January 2021 up to when we captured the data on 13th November 2021, the fund returned 22.58%. The red arrow downwards indicates that it was lower from last week.

With the advent of online brokers like Tiger Broker, they are much easier to invest in now. Furthermore, it allows investors reasonable diversification. If one stock within the ETFs is not performing, another stock will keep the price of the ETF steady. If you are interested to know more on Wahed, here’s our interview with them and the follow up article. Here is a list of ETFs you can invest in through our Tiger broker guide here.

Advantages of ETFs:

- Exposure to multiple securities for one price.

- Diversified investment, giving you peace of mind.

- Flexibility to invest and withdraw easily.

- Meagre management fee.

Disadvantages of ETFs:

- A form of passive investment can be a positive aspect, but you also ride the throughs.

- Some ETFs units can be costly such as the iShares MSCI, but you can purchase it through the Wahed app through their portfolios

- You might need to self-purify the gains yourself for certain ETFs such as S&P.

My thoughts on ETFs:

As you explore and read personal finance books, such as “Unshakeable” by Tony Robbins, you will realise that they all recommend retail investors to opt for index funds. However, since Muslims have limited access to such Shariah-compliant index funds, the next best thing are ETFs! I started investing eight years ago when there was minimal access to Shariah-compliant ETFs. Now, ETFs are easily accessible to Muslim Singaporeans at the comfort of their phones. For those who were lucky to be early subscribers of the Wahed Invest app (the world’s first automated Islamic investment platform), you would realise that some of your assets are already in ETFs, such as the Wahed Nasdaq ETF and iShares MSCI Shariah ETF. Where can I invest in this asset class? You can read our guide here if you want to make a DIY ETF purchase. Alternatively, you can also contact the iFAST representative by filling in the form here.

2) Mutual Funds

If you prefer a professional expert to manage your investment funds, you should consider opting for investing in mutual funds, which is also known as unit trusts. Your financial consultant would usually offer this investment class to you as it is professionally managed and can offer reasonable returns. With this, you will gain access to securities covering a wide geographical area that may not be available in the ETFs.

Things to take note of:

- Ask your financial consultant

- Are they investing in the funds

- How have the returns been so far

- Will they be updating you on the fund performance from time to time?

- What are the net returns after deducting the fees?

- When your financial consultant recommends you to subscribe to a fund on a regular savings plan, it means you would be paying them monthly over the duration of the investment scheme. Say you are paying SGD $100 monthly for the fund, there would also be a 4% rep fee recurring monthly. This can be substantial when accumulated, not to mention the opportunity cost and other fees.

- If a fund has been awarded for its strong performance, such as the Lipper rating award, it does not mean it would be awarded the same for the following year.

Advantages of mutual funds:

- Funds are professionally managed.

- Access to securities that ETFs might not have access.

- Fund managers will rebalance the fund according to market conditions, i.e., allocating more on cash due to uncertain news.

Disadvantages of mutual funds:

- Fees are substantial.

- No matter the performance of the fund, it will still incur expenses.

- Usually underperforms the market after fees deduction.

My thoughts on mutual funds:

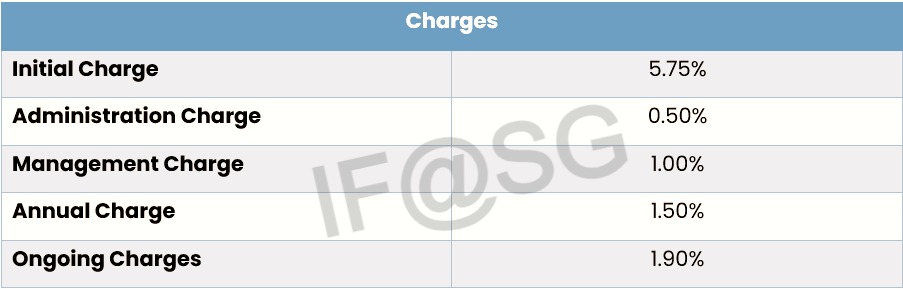

I started my investment journey with mutual funds, FTIF Shariah Equity and FTIF Sukuk funds. With time, I learned how the personal finance books disliked the mutual fund industry, which boils down to the fees. You might not realise that when your fund underperforms, the fund still charges you to keep itself running. Upon further inspection of the fund prospectus, I discovered the many charges among them (from FTIF Shariah Global Equity):

So finding out the fund charges is essential as it may affect your overall fund performance. On that note, I personally felt that I could do better off without the financial advisor fees recurring every month. Therefore, I withdrew my funds. Surprisingly I had more than SGD $8000! Not bad for a regular savings plan of 3.5 years, although the returns were more than SGD $200 on each of the funds. So if you want funds that forces you to save, then yes regular savings plan might work for you.

Where can I invest in this?

FAiWA being an independent advisory firm, can advise you on all of the funds mentioned. Simply fill in this form, and we will connect you to them.

3) Crowdfunding

As the name implies, rather than financing projects through banks, it finances projects through ordinary investors like you and me. There are two crowdfunding platforms that are fully Islamic and are established in Singapore. First is Ethis, Co-founded by Umar Munshi, who started financing businesses in Singapore through crowdfunding before moving to Indonesia for property crowdfunding. Now the Ethis group offers Peer-to-peer (P2P) crowdfunding in Indonesia and Equity crowdfunding in Malaysia. Next is Kapital Boost, founded by Erly Witoyo, a banker turned entrepreneur who focuses on Peer-to-Peer crowdfunding in Indonesia through the asset purchase or invoice financing structure. The difference between the two can be seen in their financing structures. Kapital Boost offers Shariah-compliant invoice financing and asset purchase P2P crowdfunding where Investors purchase goods for the company and sells it to the company. Ethis, on the other hand, provides partnership contracts wherein equity crowd-funders enter into a profit-sharing agreement with the business and asset purchasing structure. In other words, peer to peer crowdfunding is as though you are financing a business yourself. Only that now you would have other investors to share the risk and amount with. Whereas equity crowdfunding is a business divesting its shares to you, the crowd-funder, in return for capital to fund its expansion strategy. You gain through dividends and also returns on your shares if the company is listed in an exchange. Ethis is one of the few equity crowdfunding platforms licensed by the Malaysian regulator, Bank Negara, to conduct equity crowdfunding campaigns, allowing Singaporeans an avenue to invest!

Types of crowdfunding:

- Peer to Peer Crowdfunding: Ethis and Kapital Boost.

- Equity Crowdfunding: Ethis Malaysia.

Advantages of crowdfunding:

- The returns and defined financing period gives you clarity on how much you gained.

- The meagre minimum investment for KB and Ethis Malaysia.

- Both try to be ethical and have their own Shariah screening processes.

Disadvantages of crowdfunding:

- As usual, your capital is at risk, although all three platforms try their best to mitigate default or late payment risk.

- Ethis P2P requires a higher minimum investment.

- It is not regulated in Singapore; thus, you can only rely on both platforms.

My thoughts on crowdfunding:

For Kapital Boost crowdfunding, you can invest with a minimum of SGD $200, but you got to be quick as their campaigns close in a few days. Popular campaigns such as PT SF and PT WTI can get fully funded in less than two days. With returns ranging from 2.4% up to 9.7% and a short financing period ranging from 0.9 months to 6 months, it sure beats putting your money in a savings account! Ethis P2P crowdfunding, on the other hand, requires a higher capital outlay, usually SGD $10,000. However, you may talk to them if you want to invest around SGD $5000 first. Because of the longer fund campaigns, they are sometimes over-funded. The returns are relatively high, ranging from 3.65% to 31.68%, while financing periods range from 2 months to 24 months. The high returns are due to the higher financing period, but it beat a standard fixed deposit again! As for equity crowdfunding, I personally feel it is an exciting space as we can now invest in a business that is, first and foremost, Shariah-compliant, and second, aiming to be listed while promising to pay dividends yearly to us. Also, the minimum investment amount is small at S$300 and may also form part of your diversification strategy. Where can I Invest? Kapital Boost: Click here. Ethis Equity Crowdfunding: Click Ethis P2P crowdfunding: Click .

4) Land Investment

Land investment comes in several forms. The traditional one is land banking where basically, pooling your money alongside with other investors to purchase a land area that has a prospect of being developed. Investors gain returns on their investments when a buyer agrees to purchase over the land. Others, like Walton International Group, is also dealing with land investment but as an alternative investment in the market. The only Shariah-Compliant land investment option is Walton, which has been certified compliant by Amanie Advisors. They have been in the land investment business for over four decades since 1979 and manage over $3.4 Billion in real estate assets located in North America. This investment tool may not be commonly known like stock and shares for Singaporeans, probably due to it having the stigma of Land being an expensive form of investment and very long holding period.Nevertheless, Walton, in 2019, revamped their investment offerings and came out with a new strategy which they termed as Exit Focused Pre-Development Land Investment (EFPDLI). While previous investment strategy had longer time frames of up to 10-15 years, recent projects launched (21 projects currently) under the EPFDLI strategy will likely receive exit offers in 2-3 years. Homebuilder will offer to buy and develop the land in phased takedowns. They will then start developing the land, estimated, on the 3rd till 6th year, which would also mean partial proceeds to investors. Walton estimates the ROI to be in multiples of 1.6-1.8 times or more, than the capital invested, IRR in the range of 13-18% per annum depending on the projects. Investors can expect yearly cashflows on their investment, starting from the time the homebuilder starts the 1st phase of the development, estimated from the 3rd year onwards. While it’s very hard to own a land in Singapore much more in other countries where regulations are plenty, Muslim investors now, have an avenue to diversify their investments through this asset class with a reputable company. While the US has plenty of land, the need to be strategic, forecast, administer and add value to the land such that it becomes a viable investment, is not something the normal investor would have the privilege to do. As EFPDLI is an alternative investment, the capital is not as high as the traditional land banking investment. The minimum investment is only US$20,000 compared to hundreds of thousands or even in millions of dollars. Thus, if I had US$20,000 to invest, this asset class would be an option I would seriously consider.Even Dennis Ng, author of “What your school never taught you about money”, recommended land investment for its average of 10% returns annually.

While it’s very hard to own a land in Singapore much more in other countries where regulations are plenty, Muslim investors now, have an avenue to diversify their investments through this asset class with a reputable company. While the US has plenty of land, the need to be strategic, forecast, administer and add value to the land such that it becomes a viable investment, is not something the normal investor would have the privilege to do. As EFPDLI is an alternative investment, the capital is not as high as the traditional land banking investment. The minimum investment is only US$20,000 compared to hundreds of thousands or even in millions of dollars. Thus, if I had US$20,000 to invest, this asset class would be an option I would seriously consider.Even Dennis Ng, author of “What your school never taught you about money”, recommended land investment for its average of 10% returns annually.

Advantages of land banking:

- Investment in sub-urban land surrounded by existing communities. If the investment comes to fruition, the returns are 10% per year or more, which is relatively high in this current economic condition

- Provide yearly cashflow in the case with Walton’s new strategy

- Secured ownership with Land Title Deed (Issued by the Land Registrar of the States) and Title Insurance (Under First American Title Insurance) – both directly under Investor’s name

- Almost hassle-free – The land investment company doesn’t just do research, they also add value, administer and maximise the potential returns from the land invested upon

- Facilitate legacy planning

- Lower capital outlay compares to normal property investments

- Good business ethic as it is Shariah Compliant Certified

Disadvantages of land banking:

- Only one shariah compliant option for now

- While their research has been thorough, there is always the chance of the land development not developed as scheduled e.g., due to economic downturn, thus delaying the returns

My thoughts on land banking:

I have no experience in this investment, but if you have the capacity, why not?

Where can I invest in this?

You’ll have to contact a Walton Representative. Simply fill in the form here, and we’ll connect you to them.

5) Private Equity

This asset class is essentially a fund with an investment manager who invests in privately owned businesses instead of stocks or bonds like a typical fund manager. For example, in the Montreux healthcare fund, you have a fund manager who would invest in the privately owned business in the healthcare sector that sells hospital beds to the medical institutions. With the growing importance of the health sector, you could really ride on the growth that other retail investors would not be able to enjoy. The reason is that you need to be an accredited investor or have a minimum outlay of SGD $200,000. The former means you must have at least SGD $2 million in assets, hence, very few get to invest in this fund. I am reminded of Mr Sani Hamid’s words when he said in a symposium featuring the fund managers of Montreux:

“You don’t call yourself private equity if you can’t achieve returns of 20%.”

Unfortunately, I have not reached that level yet, but my uncle did, and he was adamant about investing in this fund despite my constant “are you sure, uncle?”. Now he is enjoying more than 7% returns, so he is pretty happy. The fund is also an innovation by FAiWA since it was not Shariah-compliant previously. However, they worked with International Shariah Research Academy (ISRA), who is led by Prof Dr Akram Laldin, to provide Shariah solutions.

Advantages of private equity:

- You might be the only few who has exposure to this fund.

- The fund tries to limit its correlation to traditional asset classes such as stocks and bonds; thus, this fund does not follow suit if they go down.

Disadvantages of private equity:

- Only restricted to the rich!

- There is a performance charge[1], annual management charge (2%) and redemption charges (5%)[2].

My thoughts on private equity:

I have not achieved this status, but I would definitely consider this investment if I were an accredited investor looking to diversify.

Where can I invest in private equity?

The fund is exclusively distributed through FAiWA, simply fill in this form, and we’ll connect you to a representative from their side.

6) Investment Linked Policies (ILP)

ILP, in simple terms, means insurance plus investments. Some financial gurus discourage ILP as you effectively rely on your asset to cover your insurance needs. However, if you are looking at it solely to capture the fund’s growth, it could be a different argument. Two funds that are only accessible via ILPs are NTUC Takaful Fund and HSBC Islamic Index fund [3] Some Muslims might remember when HSBC offered takaful in Singapore. While they are only servicing those “early bird” customers, you can still invest in this fund which is currently gaining 20.8% Year to Date[4]. NTUC takaful fund is also performing well at 18.28% Year To Date. There are other funds that can be an underlying fund for ILPs but here we are only focusing on funds that are only accessible via the ILP route. If you understand Islamic finance, you would know that takaful, aka Islamic insurance, available in Singapore is far from its Shariah ideals when compared to the rest of the world. However, ILP is the closest takaful concept in Singapore, which FAiWA has a fatwa on (yes, since MUIS left it to the individual, they took the initiative to consult a scholar in Malaysia on this to provide his opinion after an extensive study). Why is it the closest and not fully Shariah-compliant is due to the Shariah issues on the guaranteed element in ILPs. Issues we need to highlight:Recently, Muslim financial advisors have banded the “Muslim friendly” term to funds that are not Shariah-compliant. Muslims ought not to abet with those financial advisors as earning a halal income is vital for our outcome in the hereafter. A hadith narrated by Ibn Mas’ud (may Allah be please with him) narrated that the Messenger of Allah (peace be upon him) said: “The feet of the son of Adam shall not move from before his Lord on the Day of Judgement, until he is asked about five things: about his life and what he did with it, about his youth and what he wore it out in, about his wealth and how he earned it and spent it upon, and what he did with what he knew.” Thus we need to highlight these points to you so you may be aware.

- If your Financial advisors say there is a limited number of funds, then yes, it’s true. However, the Fiqh legal maxims dictate that “a matter permitted on account of an excuse becomes unlawful on cessation of the excuse”. In other words, when halal funds are now available, there are no excuses for us to engage with impermissible funds.

- Suppose your financial advisor says there is a difference of opinion in Shariah screening. In that case, the FA probably could not offer Shariah-compliant funds through his insurance company, thus resorting to calling a fund “Muslim-friendly”. We did a deep dive on this, which you can read here.

Advantages of ILPs:

- Compared to other mutual funds, the two funds mentioned early in this section are performing remarkably well.

- ILPs also cover critical illness, thus adding to your coverage needs.

Disadvantages of ILPs:

- If you subscribe to the viewpoint that we should not mix insurance with investments, then this is not an investment asset.

- There is also a lock-in period for some ILPs, so you will get $0 or lesser than the amount you invested if you decide to withdraw early or during the lock-in period. This could be due to the investment proceeds being used to cover your insurance, aka the cost of insurance.

- You might need to be aware of any fees, such as the fund expense ratio and Shariah advisory fees.

My thoughts on ILPs:

I once invested in the NTUC Takaful fund, putting around $150 monthly. Once I realised that ILPs were not for me, I withdrew and got back lesser than the capital. This is considered lucky compared to some individuals who took in an ILP with a Muslim friendly fund or ILP that contained a mix of “Muslim-friendly” funds and could not withdraw until two or three years. Even then, the amount would be peanuts, so do be careful!

Where to invest?

The NTUC takaful fund can be accessed through Helmi Hakim. At the same time, both the NTUC takaful fund and HSBC Islamic Index funds are accessible through FAiWA. If you are interested, fill in the form here, and we’ll connect you to them.

7) Stocks

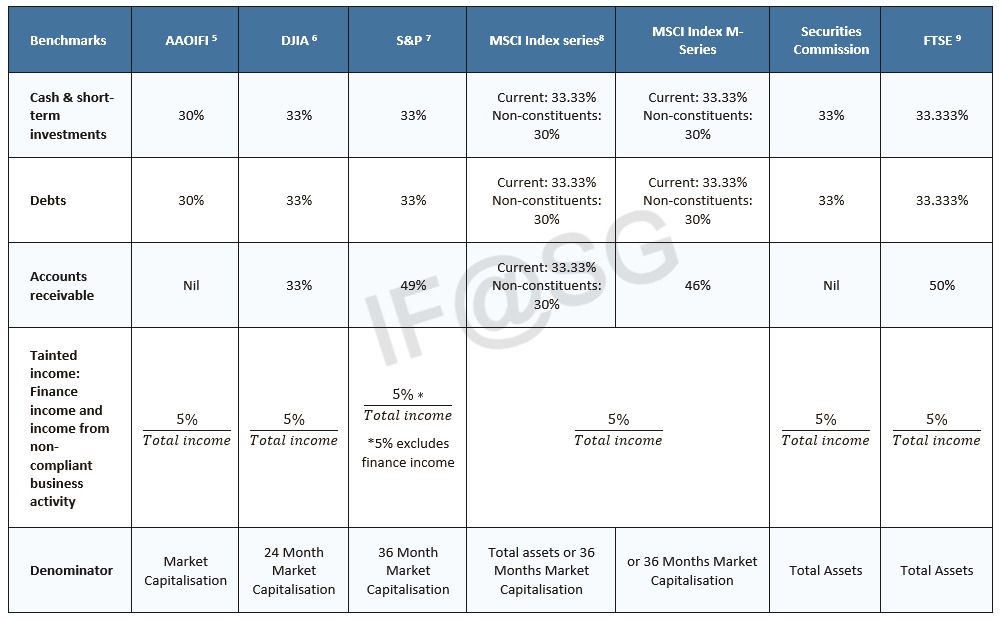

Aka: Securities or shares.These are companies listed on the exchange where you can buy their shares and be a part-owner of their business. It is also one of the best ways to grow your money and counter inflation compared to placing it at the bank. Imagine owning a share of Apple or Adobe. Should they launch a new product and gain fame, the share price increases, and so does your wealth. Usually, after doing their due diligence on whether a stock is good to buy, investors leave it there for a few years. This has been proven to grow your share since businesses will not remain stagnant or their senior management faces the wrath of other investors. Scholars realised that investing in the stock exchange is an important contemporary tool for wealth preservation, which is a part of the Shariah objectives (Maqasid Shariah). After five years of thoughtful deliberation, they have formulated a robust Shariah screening methodology. It is sort of like a filter that assists investors to exclude securities based on their business activity and financials. The Shariah screening methodology, as you can see below, is not complex but requires meticulous care. You need to sift through the companies’ annual reports to identify their business and ascertain whether the security does not go above the threshold. There are currently six screening methodologies, but you can choose one with which you are familiar. Essentially all six has a qualified scholar to back the methodology. To determine whether a stock is Shariah-compliant, first, we identify its primary business activity. Here is an excerpt of my colleague, brother Zul Hakim’s thesis where he lists the differences in business screenings: Then we go on the financial screening of the companies:

So while it’s simple, it’s pretty meticulous with the balance between promoting the concept of investments to Muslim investors and complying with Shariah. Some scholars come up with their own methodologies. This is permissible only if the person is qualified.

Advantages of stocks:

- You can now ride on the growth of securities such as Apple, Adobe, Cisco etc.

- It has been known to outperform other asset classes such as bonds over five years.

Disadvantages of stocks:

- Giving high returns also comes at the cost of higher risks, so invest with caution and diversify properly.

- Singapore market is relatively small, and so is the basket of Shariah-compliant securities. Luckily, you now have the world to invest in, from Samsung to Alibaba.

- Need to find the right diversification strategy which will require you to invest time, money and effort.

- Albeit expensive per share unless you have a substantial amount to invest.

My thoughts on stocks:

Singapore securities are very few, and those that are Shariah-compliant do not give much in terms of returns, but this could be just my personal assumption. To be successful in stock investing, you would need a combination of knowing how to conduct an analysis of a company as well as proper Shariah screening. Having said that, I would instead invest in ETFs, which give me broad diversification since I am not strong in that area.

Where to invest?

We have good news on this. You do not need to go through all these screening procedures. We at IF@SG can do it for you at a fee. Also, we are in the process of creating a basket of securities Singaporeans to which you can subscribe. In the meantime, you can read up our guide to using Tiger broker, which you can also use to invest in shares. An iFAST representative can also execute your trade. Other options include opening a brokerage account at brokers such as Philips Capital and CGS-CIMB..

8) Real Estate Investment Trusts (REITs)

If you realise, successful investors always have at least a sum of their investments on property. It makes sense for landlocked Singapore, where developments are going up almost everywhere, and prices of properties are expected to grow. But what if you do not have the capital to do so? This is where REITs come into the picture. They are a publicly listed company where the REIT manager identifies commercial properties to invest in. The rent received is then returned to the investors as dividends. In Singapore’s case, 90% of the rent has to be returned to investors. Currently, there are 42 REITs[5], and the properties focus ranges from malls, industrials, and healthcare, while some also have properties overseas. But how can you invest in these REITs? Simple, if you have a brokerage account on your phone, you can purchase it when the market opens. But then again, how do you know if a REIT is Shariah-compliant. Singapore used to have a born-Islamic REIT named Sabana REIT, but it has since withdrawn its Shariah-compliant status. For a further breakdown on why it went uncompliant, you can watch our interview with its former Shariah advisor here (He was my first teacher on Islamic Finance). This does not negate the fact that it could be Shariah-compliant without that “halal” stamp. Like other REITs, it could also be compliant when we do the proper screening, as shown above. Just remember to do your purification from the dividends received. If you want an easier way with the money to back it up and you are like my uncle, who has SGD $20,000 to spare, FAiWA has another innovative investment product called I-REITs Managed Account, launched back in April 2019 in partnership with Philips Capital. With the I-REITs Managed Account, you will be exposed to global suite of REITs but with a primary focus on Singapore REITs. An I-REITs Managed Account is simply a discretionary investment management, in which buy and sell decisions are made by a portfolio manager or investment counsellor for the client’s account. The client, however, still holds individual REITs, unlike mutual funds. The money is pooled together among many retail investors and invested in institution money manner under Phillip Capital as the representative. Furthermore, through Phillip Capital as the fund manager, retail investors can enjoy institution competitive brokerage fees, corporate action rights of issuance, and the fastest in and out movement of the markets. On top of that, the Shariah screening of the REITs universe is done by Ustaz Haron Masagos, the internal Shariah advisor of FAiWA. Despite the gains being Shariah-compliant, you would still need to purify 5% of your dividend received every year, if a percentage of the dividend income comes from non-permissible business income. However, no purification is needed on the capital gains as the investment is already Shariah Compliant. For those who cannot afford it, here are some REITs samplers included in the FTSE ST Singapore Shariah Index, which is updated every quarter for the insertion and deletion of the Shariah-compliant REITs list. (This index is not available for retail investors):

Advantages of REITs:

- If you want exposure to the property sector but do not have the capital, this is a cost-efficient way to start.

- They give out dividends from the rents received, so you have a sort of income from these properties.

- It is pretty regulated, and you can see the tangible result of your money by visiting the properties.

Disadvantages of REITs:

- If you are looking at getting a return from the increase in share price, you might be disappointed. On the other hand, you can also look at the REIT dividends as part of your returns.

- The I-REITs fund may be out of reach for someone who does not have that much.

My thoughts on REITs:

I invested more than SGD $1000 in Sabana when it was Shariah-compliant way back in 2017. I also went through the share split, changed my account to a normal CDP account from a sub CDP account as a part of my dividends, went to a broker and finally received dividends of around $25 quarterly. Not bad, and it tells you how much you can earn from these REITs if your capital is more significant. Besides going for the Montreux, my uncle also went for the I-REITs Management Account by FAiWA as he wanted to see his investments in a tangible form. So if you are like him and do not want to worry about the zakat, the purification, and strategic allocation, this could be a fund for you.

Where can I invest in REITs:

For the I-REITs Management Account, you can fill up the form here as FAiWA is the product’s creator. If you want to do DIY style, then you can use the screening methodology above in the stock section and purchase your own REIT.

9) Precious Metals

For those who are read the Financial Times or Bloomberg, you will notice that they will usually report fund managers repositioning their funds to Gold. Especially during uncertain times or when the stock market is coming down, such as the start of the global lockdown due to Covid-19. That is because Gold is inversely related to the stock market, meaning when the stock market goes down, Gold values goes up. Though you can invest in Gold ETFs through online platforms like Wahed’s app, it is not as straightforward. The other alternative is to buy precious physical metals from pawn shops or bullion centre and keep it in your safe or somewhere secret! When Covid-19 struck, Gold prices went up to as high as SGD $2063 per ounce, which was the highest it had been since 2001, as fund managers and institutional investors rushed for a safe haven asset. Unfortunately, I sold off my Gold before covid happened and only got SGD $40 in return .

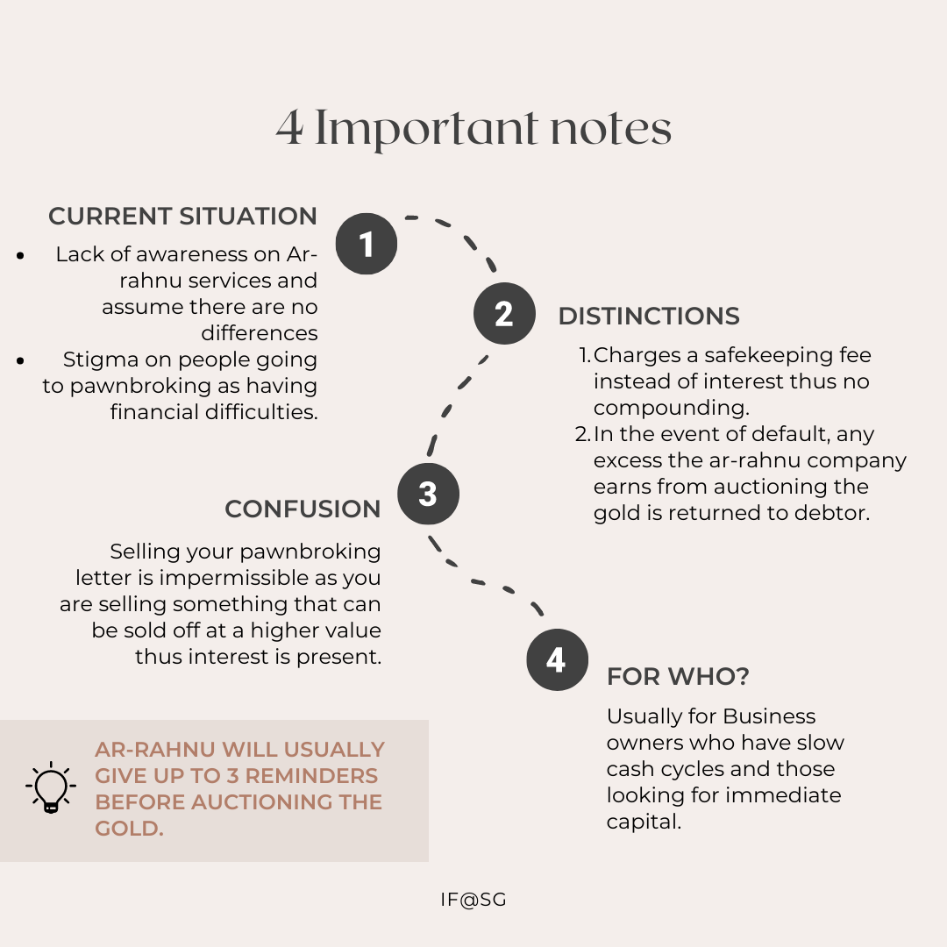

Having said that, if you are looking for a loan and have some gold but do not want to meddle with interest and riba, the best option is to go for Islamic pawn shops, aka Ar-Rahnu, where you can change your goal in return for some cash. There are currently two service providers. One is 916 Pawnshop, located in Tampines street 81, and the other is ValueMax, situated in Joo Chiat Complex. When I tried to charge my 10g of gold for some cash with the former, I was able to get around 60% of the gold value, and when I wanted to redeem my Gold, I had to pay a small safekeeping fee. Yes, the loan to valuation is smaller than the conventional loan, which is 90%, but we need to avoid riba’ at all costs. Additionally, the lower LTV was meant to discourage higher debts.

Advantages of precious metals:

- It is a buy and hold strategy but will take a long time to appreciate.

- It can also as a contingency plan in case you require a loan since there are now Ar-Rahnu services.

Disadvantages of precious metals:

- Usually, crises will come in once every ten years, and that’s one of the best ways to liquidate your Gold. The question is whether you can wait?

- You will need to go to different branches to identify which shop would offer you the best price for your Gold, a hassle definitely.

My thoughts on precious metals:

I started having 30g of Gold back in 2016 and bought it by visiting each pawn shop at Tampines Central to get the best price. From ValueMax to the legendary standalone pawn shop. They all had different prices, but if you are lucky, they might have a promotion on each 10g or more than 20g of Gold. I thought that Gold investing was very slow to reap my returns. Hence, I sold it off before covid happened. I had to do the same work of visiting each pawnshop to get the best price, only to get SGD $40+ from my gold investment. I have since recovered my gold position while holding on to my silver. Nevertheless, there are exciting digital gold investment options in Malaysia which you might want to explore.

Where to invest?

If you are looking for Dinar: Click here. If you are looking for Gold ETF, you can access it through your Wahed App.

10) Sukuks

Sukuks, or simply say, Islamic bonds, are pretty stable investments that can give you modest returns. There is currently an undersupply of Sukuks globally, and most of it is usually oversubscribed. What are Sukuks?It’s the plural form of the word Sakk in Arabic and refers to certificates or documents in which rights and transactions are written down. In the financial world, corporations and countries could raise “I Owe Yous (IOUs)” or bonds where investors can invest and receive interest termed “coupons”. Since Islam prohibits any excess return over a loan, an income-generating asset is first identified (e.g., a highway with toll booths), thus to finance the highway construction, a country may raise sukuks where each sakk (certificate) says that the investor owns a part of the highway. These investors then earn profits from the money collected through the toll booths. Where a bond refers to a loan, sukuks refer more to an ownership of an income-producing asset. By having ownership of the asset, they are also entitled to the profits, thus making the income earned halal. While both are means of financing a project, the contracts involved are different, thus having different rights and liabilities. For example, bondholders would expect their coupons no matter the state of the economy or the debtor. In contrast, sukuk holders, as owners, participate in the revenue-generating activity of the asset, thus share the risk for entitlement to profits. We could go on regarding the differences, but here is one book (from a practitioner & scholar) you may read to find out: Emirates Airline Sukuk by Dr Daud Bakar. Retail investors do not usually have access to these investments except through mutual funds and ETFs, since it can cost more than SGD $200,000 just for one coupon. The often touted Sukuks in Singapore is the Franklin Global Sukuk Fund, which reinvests the dividends gained back into the fund. However, three other Shariah-compliant mutual funds also offer Sukuks while an ETF by S&P also offers Sukuk:

Advantages of sukuks:

- If you want a stable return on your investments from the dividends received, this is an investment you may want to consider.

- The current state of the Sukuk market is that demand over exceeds supply even during covid, so it does point out to be a very resilient asset.

Disadvantages of sukuks:

- If you are looking for growth and can handle market volatility well, there are better investments for you out there.

My thoughts on sukuks:

I invested around SGD $4,000 in the FTIF Sukuk. While I was happy to see the reinvested dividends, I did not think it met my financial goals. Thus, I liquidated my investments and placed them in other asset classes. I think it is a good start, just that we need to be careful of taxes on dividends when it comes to the ETF Sukuk by S&P.

Where can I invest?

For FTIF Global Sukuk, Maybank Asian growth & income Islamic Fund, Maybank Global Sukuk Fund and Principal Islamic Global Sukuk Fund, you can access it through FAiWA by filling in the form here. FTIF Global Sukuk is available for investment by other financial advisors such as Manulife and AXA. You can invest through tiger brokers for SP Funds Dow Jones Global Sukuk ETF with our guide here.

11) Islamic banking

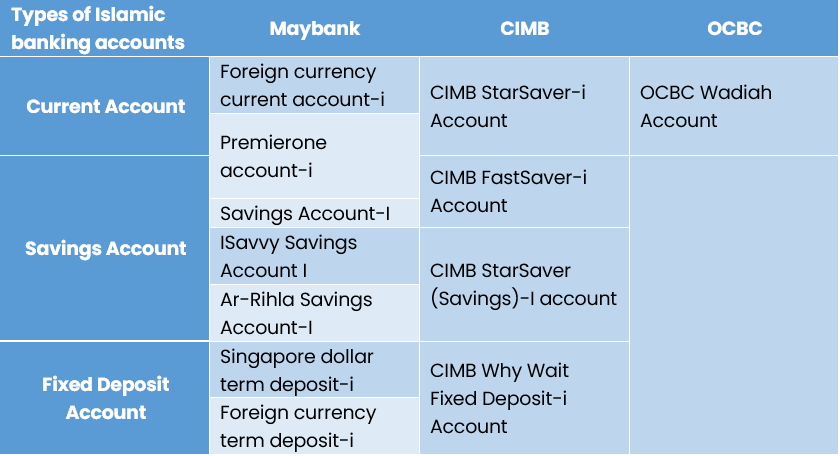

Okay, this is not an investment, but we have three banks offering different Islamic banking services to Singaporeans, if you have not already known. They are: Maybank, CIMB and OCBC. They operate on different structures, but I think you are more interested in their functions, so here it is:

Maybank provides a variety of products, from investments all the way to banking. If you are serious about avoiding riba, then why not consider taking their Islamic vehicle loan too. Based on the IFSG interview with the Maybank Islamic team, led by Mr Zul, we can safely suggest that they are trying their best to fulfil the Singaporean Muslims financial needs, from house financing to even insurance (watch it here). Thus, I believe we should support them by at least opening an account with them or the other two banks. My thoughts on Islamic banking: I honestly have accounts with all three banks. However, I do not look at their returns; instead, their resources. For example, CIMB only has two branches, which is ideal for a savings account since you wouldn’t easily withdraw money. Their ATM card is also just an ATM card, nothing more, so unless you are at Raffles Place or Orchard near Al-Falah mosque, I don’t think you would need to bring the card. When I first started learning Islamic finance, I was so keen to invest in the CIMB Why-Wait-Fixed-Deposit-i which gives returns upfront, meaning, If deposited $1000, I’ll get the returns immediately. Now I just use it for savings and have also linked my account to my brokerage account with CIMB. On the other hand, I use OCBC Wadiah and Maybank Ar-Rihla interchangeably. The former because I can use the card on UOB ATMs, its debit card has a visa feature, and you can withdraw SGD $10 from the ATMs for small expenses. Maybank is a bit tricky. Despite the ATM5 network where you can withdraw from the other five participating banks, such as Citibank, I have never been able to withdraw any amount from the other bank ATMs. Nevertheless, I find that in Tampines especially, there is enough Maybank ATMs. Moreover the debit card with Mastercard enabled is an excellent alternative to my daily expense, of which I can just PayWave or NETs. Although the banking app is lackluster when compared to DBS or OCBC, I still use it for my PayNow but switch to OCBC when I make significant transfers overseas. There are new features in the OCBC app, such as the OCBC Financial OneView, but I think I might be using Maybank due to the sentimental feeling I have towards it for now. On the internet banking side, OCBC app and the website interface is definitely the best with Maybank coming second.

12) Cryptos

IF@SG did two webinars on this topic which you can find here in the footnotes[6], so I had to do some research on this topic which may sound complex but is actually quite remarkable once you hold a grasp of it. Here we are looking at crypto investing as a commodity; thus, it is investable. I have only placed money on four cryptos Bitcoin, Ethereum, Cardano, Zilliqa because of the following reasons:

- Bitcoin: The Adam Smith of cryptos, so it is a must.

- Ethereum: The use cases are exciting, and how it circumvented the energy consumption concern is genuinely innovative.

- Cardano: They are doing something with it in Africa, the next frontier market.

- Zilliqa: By NUS, so support local!

I have other reasons to invest in these cryptos; even though it may sound superficial, it is really up to you to decide whether to invest in them. I placed SGD $25 on each crypto back in July 2021, and my holdings have more than doubled the original SGD $100 in early Nov 2021! Is it risky? I believe yes, so that is why I am only putting small increments. If you want a good guide on cryptos, I recommend Dr Wealth and SG Budget Babe!

Advantages of crypto:

- It’s been the best asset class for 2021, and I think it might be for a while.

- Read the white papers of the cryptocurrencies. You’ll find how each creator is trying to solve a specific problem such as high inflation etc.

Disadvantages of crypto:

- There still exists differences of opinion among Muslim scholars when it comes to cryptos.

- Some countries are clamping down on cryptos. I highly doubt Singapore will do so.

- There were issues of hacking on cryptos exchanges, so be wary of that as well.

My thoughts on crypto:

All in all, I believe people are attached to the notion of it being a currency and not just an asset class. Thus, the mismatch between the role a medium of exchange plays compared to a store of value. However, I think cryptos are here to stay, especially with the advent of Web 3.0 and the noble reasons for specific cryptos that were created. On the flip side, there are also dodgy cryptos that just don’t fit the logic, such as doge coins. That being said, there is yet to be a robust Shariah screening methodology that sifts through various categories of the cryptos market universe. But I know of people who are working on this, and maybe when you are reading this, it is already out.

Where can I invest?

There are many apps out there that allow you to buy cryptos. I personally use Coinhako and Coinbase. These articles by Dr Wealth and SG budget babe give an excellent comparison of the available platforms.

CONCLUSION

Having a head start on investing should not just be for those specialising in the finance industry or those with huge sums at their disposal. I started investing back when I was 17 years old. Over the years, I have observed from the investment gurus and the people who put their money on the line is that experience from making losses is the best teacher. In other words, you still need to read and learn about investing from the many resources out there. Gone are the days where there were only limited investment options, where only one or two asset classes such as precious metals and stocks were available. Now, Muslim investors in Singapore can grow their money in multiple other asset classes in hopes of sustaining their lifestyle. In addition, there are many other Halal investment opportunities in the UK, and we hope to cover that in the future. While you are here, why not join our telegram group to get the latest updates on our initiatives, such as events and educational content! You can even ask questions inside; who knows, the question you ask is another person’s question as well! Click here to be part of our community! THE ISLAMIC FINANCE COMMUNITY in SGIslamic Finance Singapore is an independent organisation gathering students, professionals, and scholars studying or working in Islamic Finance. The mission of this organisation is to bridge finance professionals and Islamic scholars in providing advice to community financial problems. For more educational Islamic finance material, head on over to our social media accounts! Click the links below.

Written by:

Muhammad Ridhwaan Radzi (Linkedin)Ridhwaan found his passion for Islamic finance at the school where he graduated from – Madrasah Aljunied Al-Islamiah – after taking an Islamic Finance Qualification offered by Chartered Institute of Securities and Investments (CISI), UK. He is currently a business undergraduate in NTU and the Pro Tem Committee Chair at Islamic Finance @ Singapore.

Edited by:

Zul hakim Jumat (Linkedin)Zul Hakim is a researcher for the Center of Islamic Economics and Finance (CIEF), and a PhD candidate in Islamic Finance and Economy at the College of Islamic Studies, Hamad Bin Khalifa University. Before joining CIEF, he was a research editor with the Dow Jones Risk & Compliance team that focuses on Sanction Ownership Research.

Footnotes

[1] 20% of any profits after a monthly hurdle of 0.65% is achieved. [2] Reduces by 1% p.a over 5 years [3] Other funds include Franklin Templeton Shariah Equity funds as the underlying fund in the ILP. [4] From January 2021 up till 30 Oct which was the current time of writing.[5] https://www.REITas.sg/singapore-REITs/overview-of-the-s-REIT-industry/[6] “CRT: Is there value in numbers?” and “Cryptos: the Question on Everyone’s lips”

Evaluating Maybank’s Asian Growth & Income Islamic Fund | IFSG