Original Question: Any scholarly opinions that prohibit making purchases via Atome instalment payments? #

Atome is a digital consumer financing platform that offers a ‘Buy Now Pay Later’ (BNPL) facility. Through Atome, users can make purchases without upfront payment, deferring the payment to a later date with zero additional costs or charges.

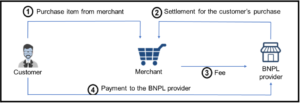

Before delving into the Shariah ruling on using Atome, it is essential to understand how the BNPL payment system operates. Generally, a BNPL facility enables consumers to purchase goods or services from merchants with the option of deferring payment or splitting the purchase price into installments. The BNPL provider advances full or partial settlement to the merchants on behalf of the consumers, who then make payments to the BNPL provider based on agreed terms and conditions.

Structure of BNPL Facility:

- A consumer purchases an item from a merchant using the BNPL facility.

- The BNPL provider makes full or partial settlement for the consumer’s purchase with the merchant.

- The BNPL provider imposes a fee to the merchant based on their contractual agreement.

- The consumer pays the BNPL provider based on the agreed terms, including the installment period and fee structure.

A BNPL facility offers flexibility on installment payments for goods and services without interest charges, making it an attractive alternative to traditional credit cards or personal loans. BNPL platforms typically generate revenue through fees charged to partnering retailers or merchants or by charging late payment penalties if users fail to make scheduled payments on time.

Shariah Compliance Factors for BNPL Platforms #

Having established an understanding of how BNPL facilities work, it is important to examine the factors that may lead to non-compliance with Shariah principles before determining their Shariah status. These factors include:

- Fixed Percentage of Processing Fee:

BNPL service providers often impose additional charges for users who choose the installment plan. If the processing fee is a fixed percentage of the total bill amount (e.g., 1%, 1.25%, or 1.50%) rather than based on the actual cost and includes indirect costs, it is considered Shariah non-compliant. Such conditions constitute a riba-based transaction, which is unlawful in Islam. - Late Payment Fee:

A late payment fee is charged to users who fail to make payments within the specified installment period. This fee is typically calculated as a percentage of the outstanding amount and is charged monthly. The inclusion of a late payment charge introduces an element of usury (riba), as any debt incorporating an additional fee for delayed payment falls under the category of riba al-qard, which is against the Shariah. - Delayed Delivery and Settlement of Ribawi Items:

BNPL facilities may also be considered Shariah non-compliant if they involve the sale and purchase of ribawi items (e.g., gold, silver, and cash) with deferred settlement and delayed delivery. Transactions involving ribawi items must be conducted on a spot basis, meaning both payment and delivery should occur immediately. If a BNPL transaction delays either the payment or the delivery of ribawi items, it results in elements of riba, rendering the transaction non-compliant with Shariah principles. - Non-Halal Goods/Products/Services:

If a BNPL facility is offered on a platform that also sells Shariah non-compliant goods or services (e.g., pork, alcohol, tobacco, pornography), the facility may be deemed Shariah non-compliant. Transactions involving non-halal items are considered void (null and void) in Islamic finance as they involve Shariah non-permissible goods or services.

Shariah Compliance of Atome’s BNPL Facility #

Based on our review of Atome’s official website, we have identified five key aspects of their BNPL facility that are important for evaluating its Shariah compliance:

- Revenue Source: Atome has disclosed that most of their revenue comes from fees charged to retail partners and brand merchants for every transaction processed through Atome. Essentially, Atome generates income by charging businesses that use their BNPL service as a checkout payment option. These fees are accumulated with each transaction and are used to promptly compensate the brand partners for users’ upfront orders.

- Interest-Free Installment Plan: Atome’s default installment plan allows users to split their payments into three equal, interest-free monthly payments at no additional cost. This feature aligns with Shariah principles, as it does not involve interest (riba).

- Processing Fee: Atome charges users a processing fee of up to 3% of the total purchase value if they choose a payment plan beyond three months. The fee is calculated as a fixed percentage of the final order amount, inclusive of the prevailing Goods and Service Tax (GST), and is intended to cover Atome’s operational and administrative costs. This fee is non-waivable and is charged only on the first bill payment upfront, not on subsequent payments. While this fee is necessary for covering costs, its fixed percentage nature requires scrutiny to ensure it does not fall into the category of riba.

- Transparent Fee Structure: There are no hidden or additional charges and no revolving interest, aside from the mentioned 3% processing fee for extended payment plans. This transparency is crucial for ensuring users are fully aware of the costs involved, helping maintain compliance with Shariah principles.

- Late Payment Charges: In the event of an unsuccessful scheduled payment, Atome imposes a late payment charge, known as an admin fee. This fee is S$15 for orders under S$1000 and S$30 for orders over S$1000. The inclusion of a late payment charge introduces a potential issue of usury (riba), as it involves an additional fee for delayed payment, which is prohibited in Islam.

- Merchants and Products: Atome’s partnering stores and merchants are generally in categories like beauty, fashion, home and living, baby and kids, electronics, lifestyle, accessories, travel, and food and drinks. However, some stores in the food and drinks category sell alcohol, wine, and pork, which are non-halal. Users must be cautious to avoid purchasing non-halal items through the BNPL service to ensure compliance with Shariah principles.

Conclusion on Shariah Compliance of Atome’s BNPL Facility #

Based on the analysis, IFSG has concluded that Atome is generally Shariah-friendly and safe for use by the Muslim community, provided that the BNPL facility is used with the default installment payment plan (three months) with zero-interest charges. As long as users, especially Muslims, use Atome and settle their payments within the agreed installment period, the BNPL service can be deemed permissible for one-time use. This approach helps prevent Muslims from engaging in transactions involving interest (riba).

However, if a customer is late in settling the payment and incurs a late payment charge, the transaction would involve usury, which is unlawful in Islam. Additionally, Muslims must refrain from purchasing non-halal goods or merchandise using any BNPL service providers to maintain compliance with Shariah principles.

It is important to note that this conclusion applies specifically to Atome and may not be applicable to other BNPL service providers in Singapore. Each BNPL service should be evaluated individually for Shariah compliance.

Seriousness of Debt in Islam #

As BNPL becomes more popular within our community due to its flexibility in micro-credits, IFSG feels it is important to emphasize the seriousness of debt in Islam.

Islam takes the matter of debt very seriously, warning against it and urging Muslims to avoid it as much as possible. The Prophet (peace and blessings be upon him) frequently sought refuge from the burden of debt in his prayers, saying, “O Allah, I seek refuge with You from sin and heavy debt.” When asked why he often sought refuge from debt, he replied, “When a man gets into debt, he tells lies and breaks promises.” (Sahih al-Bukhar, hadith no. 832; Sahih Muslim, hadith no. 589)

The gravity of debt is further emphasized by several narrations from the Prophet (peace and blessings be upon him). For instance, Imam an-Nasa’i narrated that Muhammad ibn Jahsh (may Allah be pleased with him) reported the Prophet’s alarm upon receiving revelation concerning debt: “By the One in Whose hand is my soul, if a man were killed in battle for the sake of Allah, then brought back to life, then killed again, then brought back to life again, and he owed a debt, he would not enter Paradise until his debt was paid off.” (Saheeh an-Nasa’, hadith no. 4367).

Furthermore, the Prophet (peace and blessings be upon him) also refrained from offering the funeral prayer for a man who died owing two dinars until Abu Qatadah (may Allah be pleased with him) promised to pay it off. The following day, the Prophet (peace and blessings be upon him) confirmed, “Now his skin has become cool for him.” (Musnad Ahmad, 3/629)

In addition, the early generations of Muslims (salaf) also warned against debt. ‘Umar ibn al-Khattab (may Allah be pleased with him) cautioned, “Beware of debt, for it starts with worry and ends with war” (al-Muwatta’, 2/770), and Ibn Umar (may Allah be pleased with him) advised, “Fear Allah and do not die in debt, lest it be taken from your good deeds when there will be no dinars nor dirhams. (Musannaf Abd al-Razzaaq, 3/57)

Negative Consequences of Debt #

The warnings about debt stem from its numerous negative consequences. On a personal level, debt can cause disgrace, preoccupy the mind, lead to humiliation before the lender, and result in broken promises and lies. Moreover, a person who dies in debt will be held accountable for it in the grave. The Prophet (peace and blessings be upon him) said, “The soul of the believer is held hostage by his debt in his grave until it is paid off.” (at-Tirmidhi, hadith no. 1078)

On a community level, debt can lead to economic instability, fostering a desire for immediate gratification, lack of responsibility, poor distribution of wealth, and other detrimental effects.

Conditions for Permissible Debt #

Given the serious nature of debt, scholars have stipulated three conditions for debt to be permissible in Islam:

- Intention to Repay: The borrower must be determined to repay the debt.

- Ability to Repay: It should be known or highly likely that the borrower can repay the debt.

- Permissible Purpose: The debt should be for something permissible according to Shari`ah.

Conclusion #

All in all, as Muslims, we must avoid all transactions involving usury, as its prohibition is explicitly stated in the Quran and Hadith.

As such, IFSG recommends that Muslims opt for spot-payment options rather than relying on credit/debt-based facilities. As for the BNPL facilities, it is crucial for individuals to understand and comply with the rules and conditions established by Shariah to ensure that transactions remain permissible.

May God grant us clear understanding in fulfilling all His commands. Let us conclude this question with the following doa:

اللَّهُمَّ اكْفِنَا بِحَلَالِكَ عَنْ حَرَامِكَ، وَأَغْنِنَا بِفَضْلِكَ عَمَّنْ سِوَاك

“O Allah, suffice us with the halal, without the need for the haram. Enrich us with Your grace, without us expecting anything other than You.”

References: #

- Atome Buy Now Pay Later in Singapore / I’m a consumer

- What is Buy Now, Pay Later?

- The Shariah Advisory Council of Bank Negara Malaysia (SAC) Ruling on Buy Now Pay Later (BNPL) Facility

- Isu-Isu Syariah berkaitan Buy Now Pay Later (BNPL) dan E-Wallet

- Isu Syariah Berkaitan Penggunaan Shopee Pay Later

- Mal Mutaqawwim menurut perundangan Islam dan implikasinya di dalam kehidupan manusia

- Menggunakan Kad Kredit Konvensional