Islamic Fund Investment

Shariah-compliant mutual funds are not common in Singapore, nor are they numerous. While Singaporean Muslims can access funds abroad, the process is typically lengthy.

Thus, it was a pleasure for us at IFSG to interview Maybank Asset Management’s fund managers, Ms. Rachana Mehta, Mr. Mark Chua, and Mr. Damien Koh, as well as Mr. Zulkarnien, Maybank’s head of Islamic banking in Singapore, on the launch of their new fund, called called “Maybank Asian Growth and Income – Islamic Fund (MAGI-I)”.

During our IFSG More Than Just Money (MTJM) session with Mr. Zulkarnien back in July, he hinted that the Maybank Singapore team was working on something exciting, and they surely did not disappoint with the newly launched Islamic fund (watch the session here).

The Maybank Asia Growth & Income – Islamic fund in brief

MAG-I is Singapore’s first of its kind, combining Environmental, Social and Governance (ESG), Shariah compliance, and artificial intelligence. As the name suggests, the equity portion of the fund is centred on Asia-Pacific enterprises, while the sukuk portion is global in scope.

Building on its conventional twin, Maybank Asian Growth & Income Fund (non-shariah compliant), the fund utilises proactive strategies to allocate different percentages of equity stocks and sukuks holdings depending on the economic situation.

Who is the MAGI-I fund suitable for?

The fund aims to grow by 6 to 7% a year and would be suitable for investors looking for a medium risked fund with a time horizon of 5 years or more.

In this article, we look at the features of the funds and address issues surrounding the mutual fund industry.

MAG-I fund is Maybank’s second Islamic fund, following the Maybank Global Sukuk Fund, which focuses on dividends payout for investors. The new fund, however, aims to offer diversification of shariah-compliant asset classes, with an annual growth rate of 6% – 7%, to a wider segment of investors (both Muslims and non-Muslims).

Also, it is intended for investors seeking a moderately risky portfolio with a time horizon of five years or more.

Here, we will examine the fund’s features and shed some light on the issues surrounding the mutual fund industry.

Features of the Maybank Asian Growth & Income – Islamic fund

1. Shariah compliance:

Amanie Advisors has been appointed as the shariah advisor of MAGI-I fund, owing to their international reputation and experience advising fund managers globally on shariah compliance.

The fund employs the MSCI shariah screening methodology and procedures as of now. However, it may apply any other shariah screening methodologies (i.e., AAOIF, SC, S&P, DJI, and FTSE) as the fund grows, with Amanie Advisors having the final say.

How it works is that when Maybank fund managers identified a stock to be included in the fund, they would consult Amanie consultants to ensure its compliance. Only once Amanie consultants have screened the company’s business nature and financials and ascertained its shariah compliance, will it be added to the fund.

In addition, both Amanie and Maybank will work together to purify the stock’s dividends from any tainted income, such as earnings through interest or business activities that may not be compliant. This means, as investors, you would earn halal returns without worrying on how to purify any impermissible earning.

Overall, the securities are evaluated semi-annually to ensure its shariah compliance. And if one of the fund’s constituents is found to be non-compliant, the fund manager would be notified to monitor it over the subsequent period. If it remains non-compliant, it will be sold, but only after the fund has achieved a break-even point on its investment capital.

2. Environmental Social Governance:

Environmental Social Governance (ESG) is the buzzword in the banking and finance industry right now. How this is applied into investment funds is by identifying companies that champion all three elements:

- Environmental: taking measures to protect the environment; such as switching to carbo friendly instead of fossil fuels.

- Social: having concerned with more than just profits; for example, initiatives aimed towards channeling profits to educate the less fortunate.

- Governance: ensuring there are policies implemented to facilitate fair practices; such as having a fair level of female representation at the board level.

Applying the ESG stock screening criterion is not as straightforward as shariah screening due to the variety of approaches available, which mostly involve qualitative data. As a result, Maybank engages Sustainalytics to evaluate these firms using ESG standards. Hence, the greater the company’s ESG cumulative score, the more likely it will be included in the fund.

3. Artificial intelligence:

Artificial intelligence (AI) is another popular word in the market. It could complement fund managers’ analysis and judgement brilliantly. It systematically analyses a company based on several factors, such as:

- Momentum

- Growth

- Profitability

- Analysts’ sentiment

- Valuation

- Revisions

- Quality

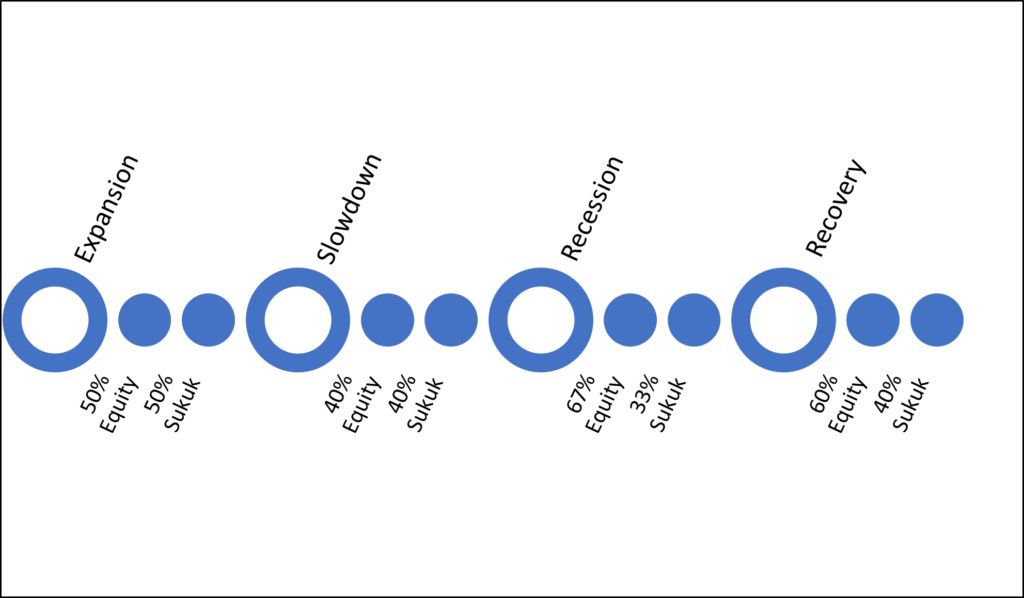

In addition, the fund’s AI component also classifies the state of the economy based on four states:

- Expansion

- Slowing down

- Recession

- Growth

The machine then gives a recommendation of the ideal allocation whether to:

- Have a heavier weightage on Sukuks

- Heavier weightage on equities

This brings us to the feature of active management.

4. Active management:

There are two ways of managing an investment. First is passive investment management, which means that we do not react to market conditions and ride through the market waves regardless of whether in times of recession or expansion. This is usually the case for index, exchange-traded, and mutual funds.

The other way is active investment management, which monitors the economic conditions and reacts accordingly by changing the allocation between Sukuk (considered safer investments) and equities. So if the economy is in an expansionary phase, there will be a higher allocation to equities vis-à-vis a higher allocation to sukuks during recessions.

The fund is also mandated to invest in gold ETFs, bringing us to the next feature of the 3 in 1 strategy.

5. Three in One:

While the fund’s default allocation is 50% equity and 50% sukuks, it can also allocate a portion to gold ETFs when taking a conservative approach.

What are sukuks?

It’s the plural form of the word Sakk in Arabic and refers to certificates or documents in which rights and transactions are written down.

In the financial world, corporations and countries could raise “I Owe Yous (IOUs)” or bonds where investors can invest and receive interest termed “coupons”. Since Islam prohibits any excess return over a loan, an income-generating asset is first identified (e.g., a highway with toll booths), thus to finance the highway construction, a country may raise sukuks where each sakk (certificate) says that the investor owns a part of the highway. These investors then earn profits from the money collected through the toll booths.

Where a bond refers to a loan, sukuks refer more to an ownership of an income-producing asset. By having ownership of the asset, they are also entitled to the profits, thus making the income earned halal. While both are means of financing a project, the contracts involved are different, thus having different rights and liabilities. For example, bondholders would expect their coupons no matter the state of the economy or the debtor. In contrast, sukuk holders, as owners, participate in the revenue-generating activity of the asset, thus share the risk for entitlement to profits. We could go on regarding the differences, but here is one book (from a practitioner & scholar) you may read to find out: Emirates Airline Sukuk by Dr Daud Bakar.

Gold is considered an inflation hedge and is an excellent asset for any portfolio; even in our current situation, where we have high inflation and low growth or a deflationary environment, gold hedges by appreciating on par with inflation numbers.

So, when equities are underperforming, you can count on gold to cushion the losses.

Gold is regarded an inflation hedge and is a good asset for any portfolio. Even in today’s context of high inflation and low growth, gold price appreciates at an equal rate of inflation.

As a result, when equity stocks underperform, you can rely on gold to cushion the blow.

Questions surrounding the Maybank Asian Growth & Income-Islamic Fund

This part will dive into issues surrounding the mutual fund industry and how it translates to this fund. Note that the answers are from the fund managers themselves.

1. Double Screening: Wouldn’t including ESG screening and shariah screening lead to a smaller universe of stocks for the fund managers to choose from?

Yes, because only assets with a high Sustainalytics ESG rating will be more likely to be included in the fund. On top of that, Amanie advisors will screen these high rated ESG stocks for shariah compliance.

Thus, from around 3000 stocks, the fund manager may be left with a smaller number of securities. Moreover, the AI will also be applied in the initial analysis of the portfolio. Despite all the lengthy layers of screening, it would ensure a basket of high-quality equities from which to choose.

But, it sort of filters the stock universe into a basket of quality stocks to choose from. At the moment, its top 5 holdings in equities are:

| Name of Stock | % of Holdings | Stocks are based in: |

| Zhangzhou Pientzehuang Pharmaceutical., Ltd | 0.7% | China |

| Asymchem Laboratories (Tianjin) Co., Ltd | 0.4% | |

| Thunder Software Technology Co.,Ltd. | 0.4% | |

| EVE Energy Co., Ltd. | 0.4% | |

| Shennan Circuit Company Limited | 0.4% |

2. The underperformance of shariah-compliant funds and ESG funds: Wouldn’t complying with shariah requirements or ESG lead to the fund’s underperformance?

That is a false perception. In reality, if you look at securities deemed shariah-compliant, you will find that they have:

- Low debt due to the leverage filter

- Optimal use of cash instead of simply having a cash pile of holdings

- Efficient control of its receivables with debtors paying on time

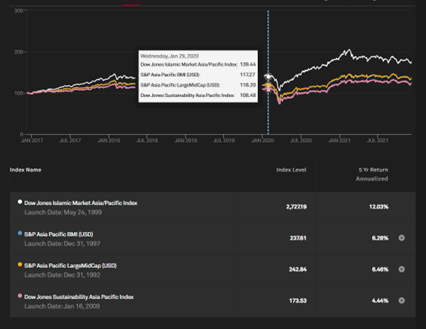

Below is a look at how the Dow Jones Islamic Market for Asia pacific has been performing relative to other indices in the region for the last 5 years:

Figure 2 shows Islamic funds are more resilient than conventional funds since with its business screening allows it to avoid cyclical companies such as banks. But how about ESG funds? Below is a graph comparing the performance of between an ESG index, shariah index and standard index:

From figure 3, you would observe that the performance movement of all three indices has been similar, with the S&P Shariah index performing better this year. But let us look at the performance over different periods to see the difference:

| 1 Year | 3 year | 5 years | 10 years | |

| S&P 500 ESG Index (USD) | 29.94% | 23.44% | 17.05% | 14.66% |

| S&P 500 | 26.98% | 21.32% | 15.92% | 14.31% |

| S&P 500 Shariah Index | 32.53% | 26.20% | 19.51% | 15.34% |

Table 1 indicates that while the S&P Shariah index outperforms both its ESG and conventional counterpart, ESG comes a close second for each four-period comparison. Thus, rest assured that you are not compromising any performance when you opt for shariah compliance or ESG.

A report by Morningstar, a fund research firm, revealed that ESG funds were more likely to outperform most of the standard funds in 2020 and the last five years. This implies that while securities with higher ESG risks will outperform those with lower ESG securities during strong economic growth, securities with lower ESG risks have a higher potential of outperforming their higher ESG risk counterpart over the long term.

3. Active management: Doesn’t having an active management strategy usually underperform?

According to personal finance and investment books, active fund management usually performs poorly in the market. However, the same assumption may not be accurate for MAG-I fund. With MAG-I fund, investors would be exposed to equity and sukuk, a generally safer investment, for growth. In addition, it is monitored by a quant engine (the AI system mentioned earlier) to recommend the optimal fund allocation.

So instead of holding to a portfolio passively, the fund will look to allocate different percentages of equities and sukuks depending on the economic period.

You’ll be able to observe that during recessions and recovery, the fund will look to acquire more stocks. Although currently, the AI indicates that the economy is in expansion mode after the Covid-19 recession, it will not be looking to acquire as much as the two economic states mentioned.

In addition, Ms Rachana mentioned that we live in a high geopolitical risk environment; thus, you won’t want to commit yourself fully to equities and suffer performance drawbacks. Hence the inclusion of sukuks and gold ETF to cushion return drawbacks.

4. Political risk: Isn’t political risk very high in Asia?

Yes, there is a relatively high political risk, as observed in China, where there is currently a crackdown of Chinese tech companies, leading to the delisting of these companies from the US stock market.

Although the MAGI-I fund has a 30 – 40% allocation in China equities, history has shown that such crackdowns had occurred in China before. Such as in 2018, when the healthcare sector was heavily regulated, it led to the collapse of equity stock prices in that sector. However, in 2019 when regulation eased, the prices of such companies went up, providing valuable returns to investors.

While the political risk in Asia is high, it does present buying opportunities for undervalued stocks.

Having said that, the fund is not overly exposed to riskier Asian countries, some of its investments are also in developed countries such as Japan, Australia and Hong Kong. Here are its country allocation as of Nov 2021:

| Country | % of Allocation |

| Japan | 22% |

| India | 22% |

| China | 19% |

| Taiwa | 12% |

| Australia | 7% |

| Hong Kong | 7% |

| Thailand | 5% |

| Malaysia | 4% |

| USA | 2% |

| Others | 1% |

5. Going against the norm: The fund is different because it does not take a portion of the securities of an index and then package it into a fund, which is the usual way an Islamic fund would operate. Why is this better?

Yes, the fund is aware of benchmarks such as the Dow Jones Islamic Market Index, MSCI Islamic Market index, etc. Nevertheless, due to the fund construction of combining ESG filters, Shariah screening, AI fund optimization of equities and sukuks allocation, there is no comparable benchmark out there to which the fund can be compared.

Moreover, you would get a different portfolio from a quantitative investment strategy than an index since it analyses a company based on factors such as value, growth, and much more. In addition, since it is an early mover with all these features, the fund is banking itself to be an early mover to capture opportunities that could generate good returns for investors over the long term.

6. High cost: Isn’t the fund management industry notorious for charging high fees compared to index funds and ETFs?

Yes, investing in ETFs and index funds is cheaper than investing in mutual funds. However, the added cost of investing in a mutual fund like MAG-I is justifiable. Firstly, the entry-level to invest in sukuks is relatively high, which require an investor a minimum of S$200,000 to start. On top of that, there are also not many sukuks available in the market.

In addition, purchasing sukuks or stocks respectively on their own leads to a higher concentration risk for investors. With MAG-I fund, it helps to diversify these risks and provide more consistent returns.

In short, when you buy a mutual fund, you are paying a professional to diversify, research, allocate and bring the entry barriers down for retail investors.

7. DIY: With the advent of brokerage accounts that allow an individual investor to invest in stocks at meagre fees, what’s a case for sticking to mutual funds?

A recent UK Chartered Financial Analyst (CFA) survey highlights that most investors have an average of 7-8 stocks only in their portfolio with little diversification. This means that most investors are exposed to sectorial risk if their portfolio is skewed towards the tech industry.

Moreover, while we can buy equities on our own, not all of us are able to purchase sukuks due to their high entry level. Therefore, mutual funds lower the barrier to entry for retail investors to participate in these investments.

IFSG thoughts on the Maybank Asian Growth & Income – Islamic fund:

First and foremost, we must commend the Maybank Islamic team and Maybank Asset managers on developing an innovative fund for Singaporean Muslim investors. The combination of ESG, Shariah compliance, machine learning, and active allocation across three asset classes (equities, Sukuk and Gold ETF) is a novelty for Singapore’s Islamic investment space.

The nearest comparable mutual fund to MAG-I Fund is xxx from Malaysia, which incorporates AI, ESG, and shariah compliance. However, it is only available to accredited investors (having $2 million in assets or at least $200,000 to start). In addition, the fund does not invest in sukuks and has a 98% allocation towards equities in Malaysia and other countries.

The table below (Table 4) is the breakdown of the MAGI-I Fund. Suppose you are comfortable with the fees involved, have a substantial holding in shariah-compliant ETFs, and have $1000 waiting for investment opportunities. We believe that MAG-I Fund is an unique investment to be added to your ultimate portfolio.

| Type of fees | Percentage |

| Sales Charge | 5% |

| Management Fee | 1.25 – 1.75% |

| Realisation Fee | 0 – 3% |

| Switching Fee | 0 – 1% |

| Trustee Fee | 0.1% of NAV |

| Other Fees (Shariah Advisor, Admin, Custodian) | 0.1% of NAV |

It is an excellent investment opportunity because it would expose us as investors to Asia Pacific equities. Furthermore, the returns from sukuks will be reinvested in the holdings, allowing investors to enjoy the best of both worlds. All and all, the advent of AI coupled with ESG and shariah compliance is still at its early stage, and it will be exciting to see where this fund goes.

How to invest in the Maybank Asian Growth & Income – Islamic fund?

There are three ways you can invest in this fund with a minimum investment of S$1000:

Physically: If you live near a Maybank branch, you can open an account with them through their customer service officers.

Online: If you already have a Maybank account (you should at least have their Islamic bank accounts), you can subscribe to the fund through Maybank iBank

FAIWA: if you prefer first to determine your financial situation and ascertain whether the fund is suitable for you, FAiWA consultants could do that. Click here to arrange a consultation.

Maybank Islamic current plan & the future:

So what’s next for Maybank? The MAGI-I fund is the second stage of investment products offered by the bank’s asset management arm, after the Maybank Global Sukuk, which was more for conservative investors who preferred income generation through the dividends gained.

There are five areas of wealth management, as Mr Zul mentioned, and Maybank has plans for each as listed below:

- Wealth creation: These are your savings products which Maybank and other banks offering Islamic Financial services.

- Wealth accumulation: This is where your investments come in, such as the Maybank Global Sukuk and MAGI-I fund. There’ll be more to come.

- Wealth preservation: This is where your insurance needs come in, and as you know, there is no fully shariah-compliant takaful product in Singapore besides the Investment-linked policies with underlying shariah compliant funds. But the Maybank Islamic is exploring to offer this in the future.

- Wealth purification: This is your zakat and donation, which you can also do through your Maybank online banking account.

- Wealth distribution: Basically, estate planning, an essential aspect of financial planning but often neglected. While there are many service providers for Islamic estate planning (faraidh, wasiat, etc.), the Maybank Islamic team is also looking to offer this service in the future.

What about Islamic financing services by Maybank?

While Maybank Islamic only offers shariah-compliant auto financing and commercial property financing for Singaporeans, they acknowledge that our community needs other shariah-compliant financing services. Especially housing loan service, where there is no shariah-compliant loan facility at the moment due to the complexities abound from the external stakeholders and on the structure of the loan facility.

Currently, the Maybank team is addressing those queries, and hopefully, we will have one soon. Nevertheless, we as a community should support these shariah-compliant products and services to generate more demand to facilitate the smooth rolling of more financing facilities.

Conclusion on the Maybank Asian Growth & Income – Islamic Fund:

This is our analysis of the Maybank Asian Growth & Income – Islamic fund; you should always do your due diligence. If you have been reading personal finance books, you would know their arguments in and against mutual funds, but there are always different sides to both views.

To watch the recording, click the links below:

MTJM E5: Islamic Banking – Different sides of the same coin? With Mr Zulkarnien, Maybank Islamic SG (Watch here)

MTJM E13: Maybank Asian Growth & Income – Islamic Fund: The New Fund on the Block (Watch here)