Introducing Halal Investment Funds

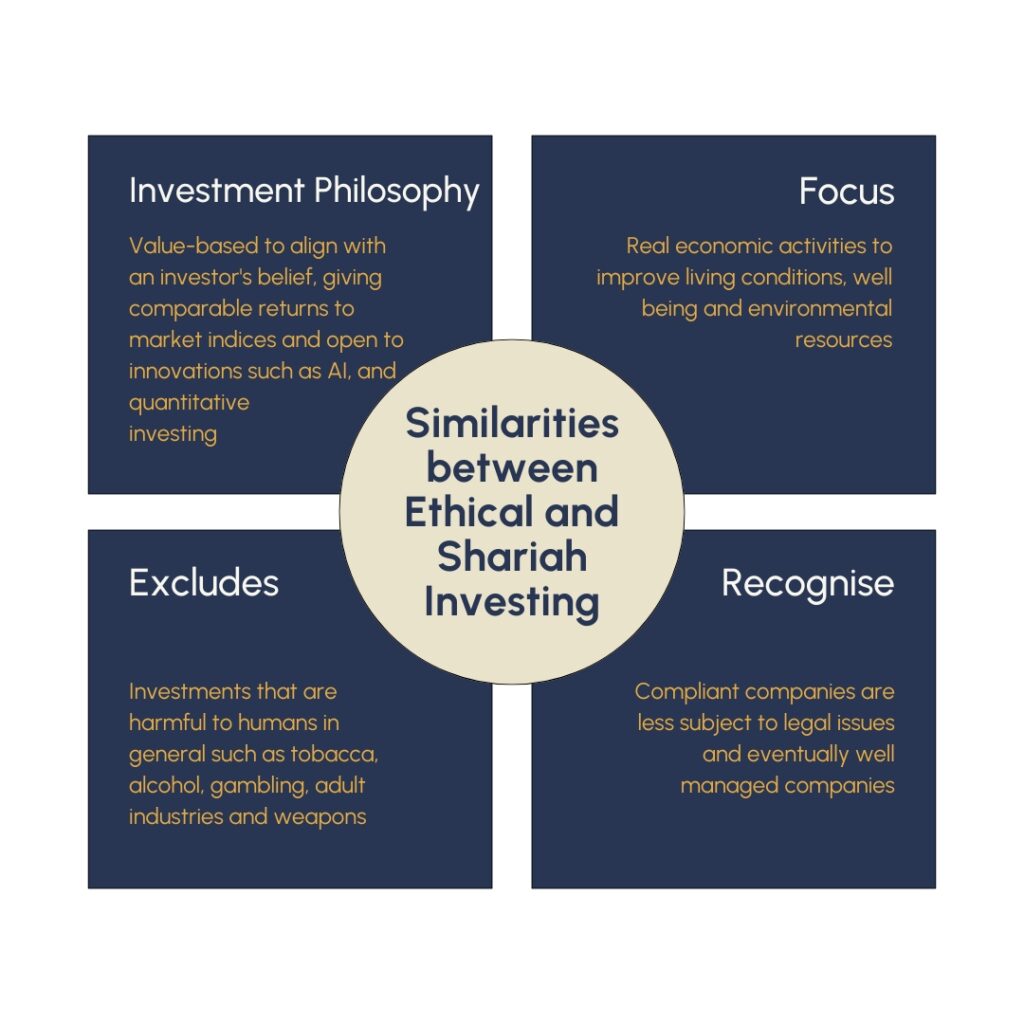

Halal investment (also known as Shariah-compliant investment) funds represent a growing trend in ethical investment, offering a unique opportunity for investors to align their financial goals with universal moral. Based on Shariah principles, these funds avoid investments in industries such as alcohol, gambling, and interest-based finance, focusing instead on sectors that promote social responsibility, economic fairness, and environmental sustainability. The following Figure 1, illustrates four other similarities between ethical and halal investment:

This ethical approach not only appeals to Muslim investors but also resonates with a broader audience seeking responsible or value-based investment options.

The global acceptance of Islamic finance is evident, with major corporations and governments worldwide, including Shell, Nestle, and the German state of Saxony-Anhalt, issuing Sukuk (Islamic bonds), which is a testament to the commercial viability and ethical appeal of Shariah-compliant investments. As we explore the benefits of halal investing, it becomes clear that these funds offer a compelling blend of ethical integrity and financial performance, making them an attractive option for anyone looking for a positive impact on their investment.

The Rise of Halal Investment

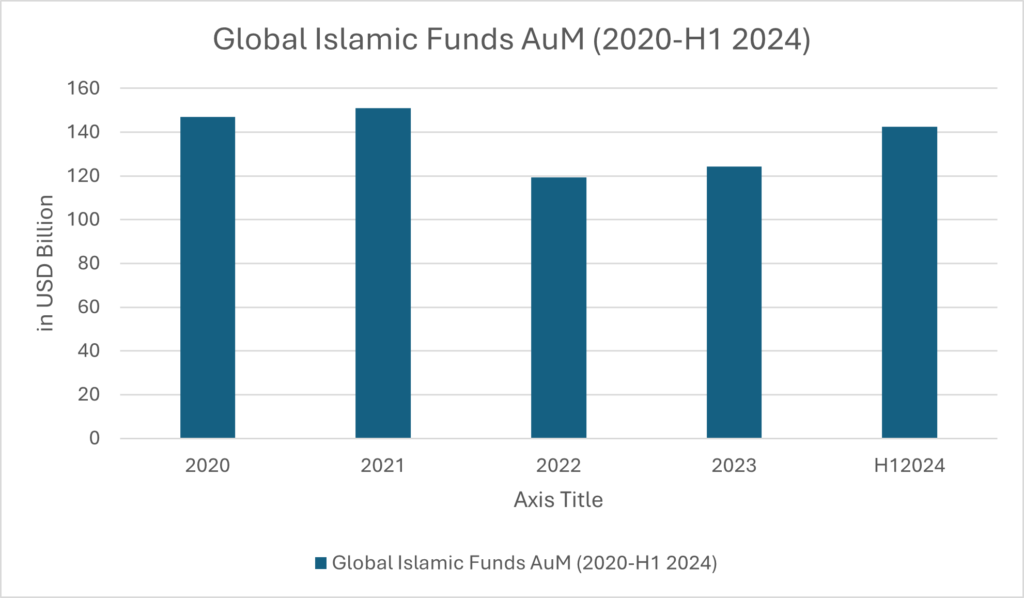

As noted by Shaykh Yusuf Talal DeLorenzo, “Investing is one way in which Muslims can be good stewards of their money” (DeLorenzo, Y. T. 2001). This idea is reflected in the growing appeal of Halal investing, as more Muslims seek to align their financial activities with Islamic values. In the first half of the year, Shariah-compliant funds experienced a 14% increase in Assets Under Management (AUM) (see Figure 2), exceeding the annual growth rates of the past two years. This rising demand has led to the expansion and introduction of new Islamic funds, which are now essential in attracting savings and providing capital across various sectors.

Several factors have contributed to this growth. Supportive government policies and strengthened regulatory frameworks have bolstered Islamic finance, ensuring Shariah compliance and protecting investors. Additionally, the unique asset-based structure of Islamic finance, which avoids interest-based transactions, offers a resilient risk-return profile that appeals to both Muslim and non-Muslim investors.

The demand for Shariah-compliant investments is growing among both individual and institutional investors worldwide. Islamic funds have adapted to meet diverse investor needs, from retirement planning to more speculative ventures. The global expansion of sukuk markets and the creation of Shariah-compliant stock indices have further broadened the appeal of Halal investing, making it a significant force in the global financial landscape.

Benefits of Investing in Islamic Funds

Investing in Islamic funds provides several key advantages, making them an appealing choice for those seeking ethical and stable financial growth. Here are five notable benefits:

- Risk Management: Islamic funds require rigorous screening of companies, ensuring they are well-capitalized and liquid, which reduces exposure to financial crises and economic downturns.

- Asset-Backed Investments: Sukuk (Islamic bonds) are backed by real assets, providing tangible security and stability, unlike conventional bonds.

- Transparency: Shariah-compliant investments emphasize clear terms and conditions, leading to more predictable and transparent outcomes.

- Diversification: Islamic funds offer better downside protection and stability during market downturns, helping to maintain a balanced portfolio.

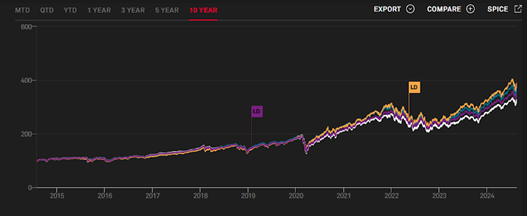

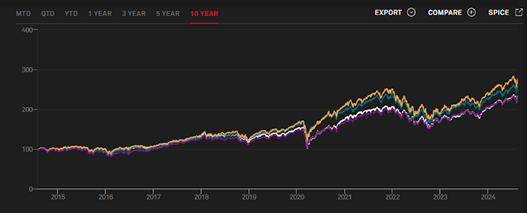

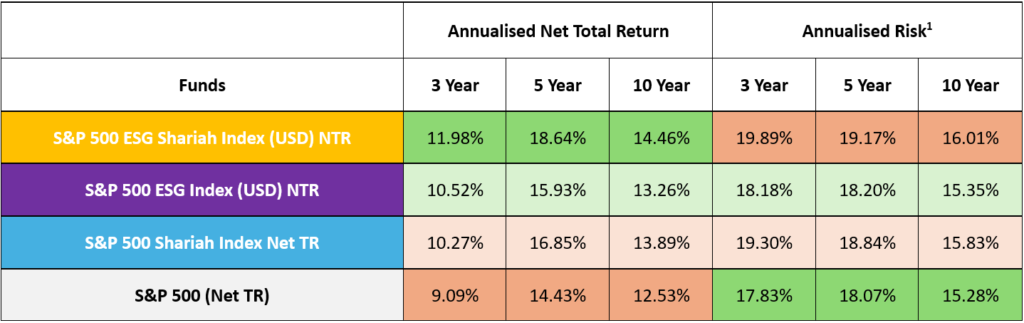

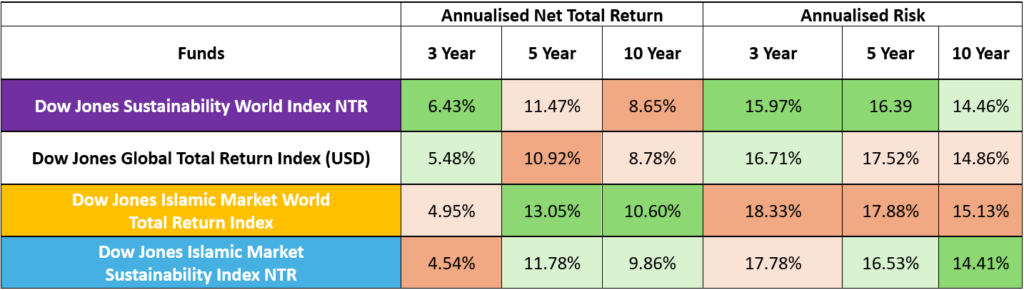

- Outperformance: While historical data is not an indicator for future performance, it’s worth noting that both Islamic indices – S&P 500 Shariah Index and Dow Jones Islamic Market World Index Total Return, have outperformed their conventional and ESG counterparts. More surprisingly, the Sustainability and ESG enhancements of both Islamic indices have also outperformed their conventional equivalents (see Figure 3 & 4 and Table 1 & 2).

Table 1: Comparison of annualised 3-year, 5-year and 10-year S&P 500 indices (spglobal.com, 19 August 2024)

Table 2: Comparison of annualised 3-year, 5-year and 10-year Dow Jones indices (spglobal.com, 19 August 2024)

Table 1 shows that Islamic indices of the S&P 500 outperformed their conventional counterparts over 3, 5, and 10-year periods. However, these investments may exhibit slightly higher volatility due to the exclusion of certain industries, such as financial services. Therefore, potential investors should take into account their risk tolerance and financial goals when considering Shariah-compliant investments.

Similarly, the Dow Jones Islamic Market World Index and Sustainability Index outperformed their conventional counterparts over 5-year and 10-year periods (see Table 2), highlighting the potential for higher mid- and long-term returns. While Sharia-compliant equities may experience higher short-term volatility, they may offer higher returns with lower long-term volatility, especially when it comes to sustainable investments.

Types of Funds in Halal Investment

The Islamic investing space has significantly expanded over the past 20 years, offering a much wider range of funds. We will highlight a selection of key types of funds within this diverse landscape.

Equity Funds

Equity funds offer potentially high returns but come with more significant risks than money market or bond funds. These funds invest in listed companies, generating profits mainly through capital gains and dividends. They can be tailored to specific sectors or goals, allowing investors to align with their risk tolerance.

Investing in equity aligns with Islamic principles, emphasising profit and loss sharing and risk acceptance without guaranteed returns. Since their inception in the early 1990s, Islamic equity funds have grown significantly, supported by benchmarks like the Dow Jones Islamic Market Index and FTSE Global Islamic Index Series, which help ensure compliance with Shariah guidelines.

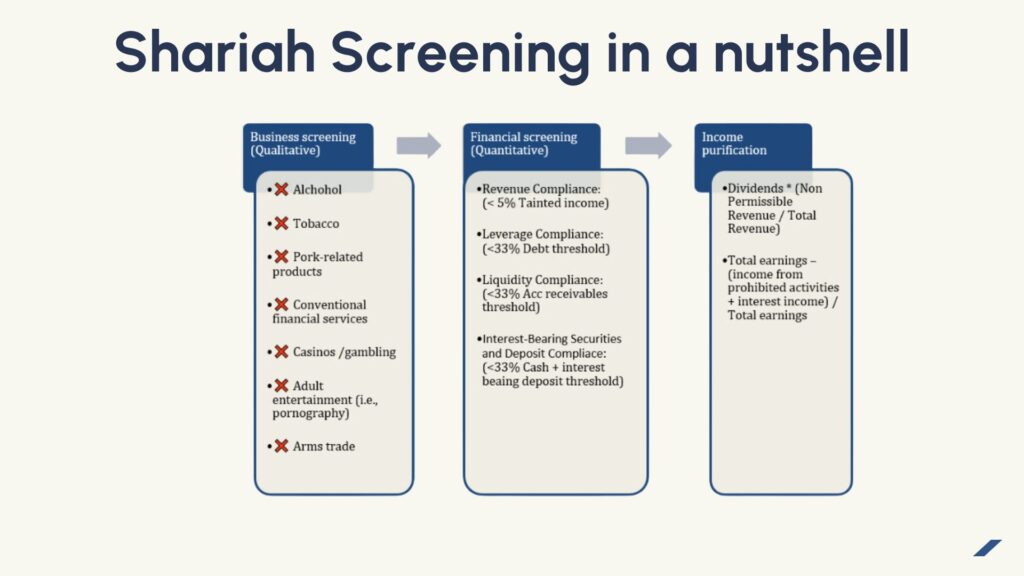

Shariah-compliant equity screening is crucial to ensure investments adhere to Islamic principles. This screening process occurs at two levels. The first level excludes companies involved in non-permissible core business activities such as alcohol, pork, conventional finance, entertainment, and weapons, hence ensuring only halal businesses are considered. The second level evaluates financial ratios, requiring companies to maintain debt below 30%-33% of total assets and manage their cash and liquid assets responsibly. Companies must also maintain a balanced ratio of accounts receivables to total assets to ensure financial stability (see Figure 5).

Once a company meets the screening criteria, it can be included in a Shariah-compliant index. To maintain compliance, continuous monitoring is conducted, and any income from non-compliant activities must be purified by donating it to charity, as directed by the Shariah Supervisory Board of the fund. This comprehensive process ensures that ethical standards are upheld, giving investors confidence that their investments remain aligned with their faith and value principles[i].

Fixed-Income Funds

Fixed-income funds, which invest in bonds, sukuks, and preference shares, offer steady income and are popular among investors who prioritise stability and lower risk. While they provide higher income than money market funds, they still carry moderate risk, particularly concerning principal stability.

In Islamic finance, sukuk funds offer a Shariah-compliant alternative to traditional fixed-income funds. Although they share similarities, Table 3 highlights the key differences between them. These sukuk funds typically consist of corporate, government, and municipal sukuks, providing income while adhering to Shariah guidelines. Despite exposure to market and credit risks, sukuk funds remain a vital option for those seeking ethical investments that generate income.

Table 3: Comparison between sukuks and Bonds (Source: Islamic Finance Qualification: The official workbook)

|

Differences |

Sukuk |

Bonds |

| What is it? |

Certificate of ownership on an asset or enterprise |

IOUs or loans allow their holders to receive interest |

| Abide to |

Regulation and Shariah Rules |

Only regulation |

| Contract |

Variety of contracts, excluding loan contracts that create financial obligations between issuer and investors, e.g., Lease contracts |

Loan contract |

| Returns |

Derived from in-built profit elements in the sale, lease or partnership contracts |

From the interest charged on the loan |

| Losses |

Holders have the right to profits but also bear losses |

Bondholders are not exposed to losses except for issuer insolvency |

| Tradability |

Depends on the nature of the underlying asset |

Normally with discounting |

| Underlying Asset |

Requirement |

Not a requirement |

Multi-Asset Funds

Islamic multi-asset funds offer a diversified approach to investment by combining various asset classes, such as equities, sukuks, and cash equivalents, within a single portfolio. These funds are designed to balance risk and return while adhering to Shariah principles, providing investors a way to achieve their financial goals through a more holistic investment strategy. By spreading investments across different asset types, Islamic multi-asset funds aim to reduce volatility and enhance long-term stability, making them an attractive option for those seeking growth and income while complying with Islamic financial guidelines.

Overview of Maybank’s Islamic Investment Funds

Maybank is making significant strides in Islamic wealth management (IWM) across Singapore, Malaysia, and Indonesia, with a [ii], and has ambitions to double this number.

In Singapore, bank clients have greater exposure to global asset classes, particularly those targeting the higher affluent and high-net-worth segments. This initiative is part of Maybank’s broader strategy under its M25+ plan, which aims to position the bank as a global leader in Islamic banking by offering hyper-personalised products and enhancing customer centricity[iii].

With an annual growth rate of Islamic Assets Under Management (AUM) increasing from 12% in 2021 to 22% in 2022 and a target of 30% growth by the end of this year, Maybank is well on its way to becoming the preferred partner for wealth accumulation in the region. The bank currently manages around S$100 billion in wealth management AUM, with 15% to 20% from the Islamic segment, and aims to add another S$2-3 billion in the next five years[iv].

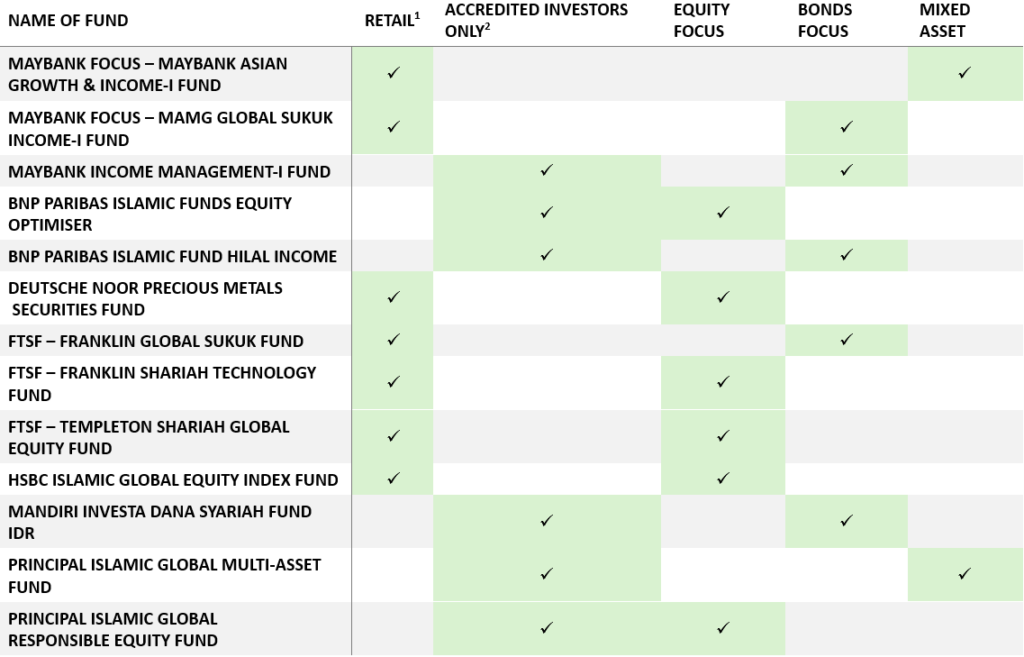

Table 4: List of Islamic Investment funds available for retail and Accredited Investors

To access or ask your questions on Maybank funds in above table, get in touch with a Maybank representative today through the follow channels:

- Contact us at 1800-MAYBANK (1800-629 2265) or (65) 6533 5229 (Overseas)

- Email us at iwmsg@maybank.com

- Visit your nearest Maybank branch

Conclusion

Maybank’s Halal investment funds offer a compelling opportunity for investors to grow their wealth while maintaining ethical standards and focusing on positive, impactful investments. By adhering to Shariah guidelines, these funds appeal to those seeking value-based investment options that align with socially responsible and sustainable practices. The growing popularity and global acceptance of halal investing, supported by strong regulatory frameworks and the involvement of major financial institutions, underscore its potential for sustainable financial growth. With a commitment to humanising financial services, Maybank’s strategic focus on expanding its Islamic wealth management services positions it as a key player in the global market for value-based and impact-driven wealth management.

Footnotes

[1] Accredited investors can also invest in retail investments

[2] Accredited investors will have to meet at least 1 of the following three criteria:

- Income in the preceding 12 months is not less than SGD300,000 (or its equivalent in a foreign currency)

- Net personal assets exceeding SGD2 million (or its equivalent in a foreign currency) in value, of which the net value of the investor’s primary place of residence can only contribute up to SGD1 million

- Net Financial Assets exceeding SGD1 million (or its equivalent in a foreign currency) in value.

References

[i] Alchaar, Mohamad Nedal, and Abboud Sandra. Islamic Finance Qualification (IFQ): The official workbook. 2009. London, United Kingdom: Securities & Investment Institute ; Ecole Supérieure des Affaires, 2009.

[ii] Chuo, Deviana. “Alvin Lee: ‘ASEAN Wealth Management Is Bullish.’” finews.asia, June 22, 2023. https://www.finews.asia/finance/39531-alvin-lee-asean-wealth-management-bullish-maybank.

[iii] Maybank. “Maybank Grows Wealth Management Business with Introduction of Islamic Portfolio Financing Solution.” Maybank, January 23, 2024. https://www.maybank.com/en/news/2024/01/23.page.

[iv] Maybank. “Maybank Launches Refined M25+ Strategy to Drive Differentiated Sustainable Long Term Growth Anchored on a Deeper Purpose.” Maybank, October 27, 2022. https://www.maybank.com/en/news/2022/10/27.page.