Islamic Economics: Wage Maximisation by Prof. Dr. Belal Ehsan Baaquie

Abstract

It is proposed that the wage maximization is one of the fundamental principles of Islamic economics, and should be counterposed to the profit maximization principle of private capital. Wage maximization needs to be analyzed for both the macroeconomy as well as for the microeconomy, since wage maximization has to be realized at the level of the firms of the microeconomy. A mathematical model for the Islamic macroeconomy is postulated that determines how to maximize macroe conomic wages. A model for a firm is proposed that pays minimum wages based on macroeconomic wage maximization. Wages can be further augmented by wages having a variable component based on profit and loss sharing with the firm, and which entails a degree of risk. Fixing the variable wage component results in the rate of profit of all firms becoming equal to the macroeconomic wage maximizing macroeconomic rate of profit.

Introduction

Islamic economics has been discussed in [1] and a review of Islamic economics, including references, is given in [3]. The main conclusion of [3] is that an economic system is determined not by its microeconomy but rather by its macroeconomy. In this paper, the macroeconomy of an Islamic economic systems is studied further to understand how the teachings of the Qur’an can be realized in our contemporary era.

The guidance from the Qur’an is that economic activity should be undertaken for the purpose of providing livelihood for the people. Is it they who apportion their Lord’s mercy? We have apportioned among them their livelihood in the life of the world, and raised some of them above others in rank that some of them may take (yattakhit) labor from others; and the mercy of thy Lord is better than (the wealth) that they amass. – 43:32 (Pickthall).

The verse makes a number of points.

- The verse states that it is our Lord who apportions mercy and provides people with livelihood in the life of this world.

- The verse states that our Lord raises some individuals above others in rank so that they can take (akhatha) labor from others.

- Subsistence farming under feudalism is not based on taking the labor of others. Instead, each household engages in farming and pays a tribute to the landowner.

- In contrast to feudalism, entrepreneurs take labor of others to establish and run large economic entities that constitute modern day economic systems.

- The integral nature of the verse leads to the conclusion that taking labor is in the context of providing for people’s livelihood: permission is given for taking labor of other for providing livelihood for life in this world.

- … the mercy of thy Lord is better than (the wealth) that they amass. Amassing wealth is cautioned against as deviating from receiving our Lord’s mercy.

- Profit maximization, which aims at amassing wealth, is not the purpose of an enterprise based on taking labor from others.

The teaching that our Lord has raised some of them above others in rank that some of them may take labor from others is a key idea that encompasses all economic systems beyond self-sufficient subsistence farming. All urban-based modern societies require the collective effort of many individuals to create the economic system. The Qur’an permits some individuals (entrepreneurs) to organize and run the economic system by mobilizing and employing labor of others. Various aspects of this verse are discussed in [3].

Private capital owns enterprises and firms that employ workers – take labor from others – for working in offices and industries; the primary purpose of these firms is profit maximization for the owners and shareholders. Since the majority of people in a modern economy work in offices and factories and are wage-earners, it is proposed that for an economic system based on the teachings of the Qur’an, a fundamental principle of the economy should be maximizing the wages earned by the wage-earners. Wage maximization is an economic principle that provides the mechanism for an Islamic economic system fulfilling its objective of providing livelihood for the people as its primary goal and purpose.

The Qur’an allows private property and the possession of wealth. However, the amassing of wealth is not the purpose of economic activity in an Islamic economy, unlike the system of capitalism. An economic system based on wage maximization is unlike the capitalist economic system in which profit maximization of the owners (shareholders) of firms and enterprises is taken to be the main driving force of the economy.

The laws of the capitalist macroeconomy are geared towards facilitating the expansion of capital. The term ‘Islamic capitalism’, in the light of the Qur’an’s teaching, is inconsistent since profit maximization – the foundation of capitalism – contradicts wage maximization for the sake of providing livelihood. Some authors claim that ‘Islamic capitalism’ is a valid term for some Muslim countries; examples from historical economic systems of Muslim societies, that may have practiced some variant of pre-modern capitalism, are mistakenly taken to be founded on the principles of the Qur’an [18].

Many objections can be raised regarding wage maximization versus profit maximization, and these will be addressed in the concluding Section 12.

2 Rate of Profit and the Macroeconomy

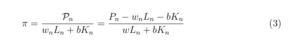

The rate of profit π and profit margin are two measures of the profitability of a firm. Only the measure of the rate of profit is used in this paper, and the discussion is based on [4].

Consider N firms, producing commodities Qn in a year, employing Ln labor and Kn capital per year. The firms have the following approximate gross profit per year:

Pn ≈ pnQn − wnLn − Kn ; n = 1, 2, · · · , N

where pn is price per unit of commodity Qn.

In applications, macroeconomic data is available for every quarter of the year. A parameter b is introduced to make the model more flexible since the parameter b can offset some inaccuracies in the indirect that way capital Kn is determined. A more accurate definition of the total yearly profit of a macroeconomy is

Pn = pnQn − wnLn − bKn ; n = 1, 2, · · · , N (1)

It is assumed that the wages on the average for the all firms producing commodity Qn is given by wn. Let the dollar value of the output be given by

Pn = pnQn ⇒ Pn = Pn − wnLn − bKn

Let Y be the GDP. From Eq. 1 the GDP Y is defined by

The rate of profit measures the rate of return per year from invested capital. Following Sraffa [15], the main assumption about the macroeconomy is that average rate of profit is taken to be independent of the firm – since it is expected that the mobility of capital should lead to the equalization of the rate of profit for all the sectors. This assumption can be improved if a more nuanced analysis is required. The rate of profit is defined by the following [7, 16]

wnLn + bKn=Pn − wnLn − bKn

wLn + bKn(3)

Note π is a dimensionless numbers.

Simplifying Eq. 3 yields

π(wLn + bKn) = Pn − wnLn − bKn (4)

Pn = (1 + π)(wnLn + bKn) (5)

Summing over n yields, from Eq. 4, the following

π(W + bK) = Y − W − bK (6)

The quantity π(W +bK) is the total yearly profit of a macroeconomy and is given in Eq. 6 in terms of the country’s GDP and yearly expenditure on wages and capital investments.

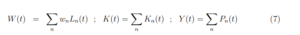

The total yearly wages W(t), total capital employed for one year K(t) and the GDP Y (t) are given by

wnLn(t) ; K(t) = n

Kn(t) ; Y (t) = n

Pn(t) (7)

Recall the time-dependent macroeconomic the rate of profit π(t) is defined from Eq. 6, by the output of N firms (which includes both industry and agriculture) and the following equation is used for empirically determining π(t).

Y (t) = [1 + π(t)][W(t) + bK(t)] ; b : constant (8)

The only macroeconomic variable whose data is not directly given and needs to obtained from market data, using Eq. 8, is

Rate of Profit = π(t)

The time dependent rate of profit π(t) is obtained using yearly (or quarterly) data [6].

Eq. 8 is a definition of π(t), and another equation is required to empirically connect π(t) with the macroeconomic variables: this is realized by postulating a nonlinear model for Y , and then using Eq. 8 to obtain a nonlinear model for π(t).

3 The Closed Macroeconomy

The macroeconomy of a country is the study of the aggregate properties and traits of all the economic agents such as firms, wage earners, government expenditure, money supply and so on. The rate of profit of a macroeconomy is a major indicator of the performance and dynamism of the country’s economy. A model has been postulated, in [4, 5], for both the open and closed macroeconomy that includes the rate of profit as one of the exogenous factors driving the economy. A closed economy is a macroeconomy where international trade is not taken into account and the exchange rate and foreign interest rate is also ignored. A closed economy is a necessary first step in studying an open economy – which is integrated into the global economy.

The closed macroeconomy is postulated, in [5], to be an algebraic model with six variables (all annualized), given by G, M, π, W, K, r, where government expenditure is G, money supply is M, wages W, capital goods K and rate of profit π. From an algebraic point of view, one can choose any three to be independent and exogenous with the other three being dependent and endogenous variables.

The symmetric choice made in [5] for the closed macroeconomy is three variables G, M, π are taken to be exogenous with three variables W, K, r being endogenous [5]. The closed macroeconomic model is adapted to an Islamic economic system by removing interest rate, and which entails setting r to zero. The Islamic macroeconomy has W, K as endogenous variables and the macroeconomic model determines their dependence on exogenous variables G, M. One needs to decide whether π is exogenous or endogenous.

3.1 Rate of Profit: Exogenous or Endogenous?

Whether the rate of profit in a macroeconomy is exogenous or endogenous is determined partly by the theoretical framework one is using, and in particular, by one’s macroeco nomic model. In some economic models, the rate of profit is treated as being exogenous, determined by factors external to the microeconomy such as the level of technology, the institutional framework, the international environment and so on. In contrast, there are models which consider the rate of profit to be endogenous, reflecting supply and demand, the efficiency of the firm, risks faced by the firm and financial constraints. Marxists include accumulation of capital, class struggle and other dynamics of the macroeconomy leading to the conclusion that the rate of profit is endogenous.

Whether a macroeconomic variable is exogenous or endogenous can be studied empir ically [8, 13, 14], and this line of inquiry can be pursued for the postulated macroeconomic model.

4 Closed Islamic Macro- and Micro-economy

For a closed Islamic macroeconomy, since interest rates are set to zero, r = 0, one is left with five variables for the algebraic model, given by G, M, π, W, K. One can only choose two variables to be exogenous and the remaining three variables are endogenous; choosing three variables to exogenous would lead to a set of equations where three exogenous variables would determine two endogenous variables, which in general would result in the over determination of the endogenous variables – leading to inconsistent results.

Hence, for the Islamic economic system, due to the mathematical model that is postulated for the closed macroeconomy, the macroeconomic rate of profit is chosen to be an endogenous variable. The exogenous variables are taken to be G, M and the en dogenous variables are W, K, π. This choice leads to a highly nonlinear algebraic model, the solution of which in general needs to be carried out numerically.

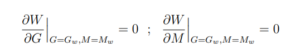

A quantitative and mathematical model is constructed to address the question how the macro- and microeconomy should be structured so that the Islamic economic system maximizes the worker’s wages. The following are the main concepts that are discussed in the remaining Sections of this paper.

- A macroeconomic model is defined based of macroeconomic models for conventional economic systems proposed in [4, 5]; the postulated model has been validated by an empirical study of the United States macroeconomy [6].

- The Islamic economic system is modeled with interest rate equal to zero for the macroeconomy, since the Qur’an’s teaches that interest rate is forbidden.

- The macroeconomic exogenous variables of the model are government expenditure G, money supply M and endogenous variables are wages W, capital goods K and rate of profit π.

- The macroeconomic variables G, M are varied to maximize the wages of the macroe conomy. To maximize the macroeconomic wages, one needs to obtain the values of the macroeconomic exogenous variables G = Gw; M = Mw that are determined by the following critical point equations

= 0 ;

aG IG-Gw,M=M

oW

= 0

AM IG-Gw,M=Mw

It needs to be shown by forming the second partial derivatives and using the Hessian matrix that the solution obtained is a maximum. In the absence of an Islamic macroeconomy, one can study the nature of the critical points using stochastic sim ulations. Let us assume for now that the parameters of the Islamic macroeconomy can be chosen so that the critical point is a maximum.

The maximum wage for the macroeconomy is given by

Wm = W(Gw, Mw)

The critical point also yields the macroeconomic rate of profit that maximizes wages and is given by

πE = π(Gw, Mw)

In other words, the rate of profit πE is determined by a given Gw, Mw – such that the macroeconomic wage of society is at a maximum. Hence, the macroeconomic rate of profit πE is fixed by the principle of wage maximization – the rate of profit πE maximizes macroeconomic wages.

- Macroeconomic wages can be maximized by imposing some constraints on all the firms of the microeconomy.

- The macroeconomic maximum wages Wm and the macroeconomic rate of profit πE are the key quantities that can be used for attaining macroeconomic wage maximization.

- The maximum macroeconomic wage Wm is realized in the microeconomy by fixing the minimum wages of all firms. The minimum wage is set equal to Wm/(NL), where NL is the total number of workers.

- Wages can be further increased to be more than the wages obtained by macroeconomic wage maximization. Wages can have a variable component that is based on a fraction of the firm’s profit being shared with the workers. The fraction is determined by fixing the rate of profit of all firms of the microeconomy to be equal to πE.

- The variable wage component is based on profit and loss sharing and entails a degree of risk. The workers, in principle, can be given the option of choosing the risky variable component or limiting themselves to minimum wages.

5 Nonlinear Model for GDP and Rate of Profit

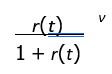

Money supply M is controlled by central banks and is one of key factors in driving the GDP Y . Among other things, in a macroeconomy based on interest rates, money supply controls the rate of interest r as well. Instead of following the usual formulation given in Eq. 9 below, the relation of GDP Y (t) with money supply M(t), based on the nonlinear model’s general framework, is postulated to be the following1

Y (t) = ψY M(t) + βY π(t)K(t) + αY W(t) + ηY K(t) (10)

1In macroeconomic textbooks, the following relation is widely used [12]

Y (t) = λMµ(t)

1 + r(t) (9)

where λ is a function of the aggregate price P.

Note that the interest rate r does not appear in Eq. 10, in contrast to Eq. 9 where interest rate r cannot be set to zero. Hence, from Eqs. 8 and 10

[1 + π(t)][W(t) + bK(t)]

= ψY M(t) + βY π(t)K(t) + αY W(t) + ηY K(t) (11a)

W(t) + (b − βY )K(t)

ψY M(t) + (αY − 1)W(t) + (ηY − b)K(t) (11b)

Note Eq. 11 is the only equation in the macroeconomic model that has the term π(t)W(t), and which arises from the definition of π(t).

5.1 Model for Government Expenditure

The GDP Y is defined by the total goods and capital produced by an economy. Y is the total supply that is equal to demand – given by consumption, investments and Government Expenditures. Supply equal to demand yields the following2

Y (t) = C(t) + I(t) + G(t) (12)

where I is investments, C is consumption and G is government expenditure. Eq. 12 defines government expenditure G and is an accounting of the sources of Y ; in contrast, Eq. 10 is a model of the relation of Y with money supply – based on the nonlinear model [5]. Government Expenditure is the only exogenous factor in Eq. 12.

The nonlinear model for the sum of consumption and investment is given by

C(t) + I(t) = αGW(t) + βGπ(t)K(t) + ηGK(t) (13)

The term βGπK for capital goods in Eq. 13 comes from both investment and consumption. The nonlinear model for Government Expenditure, from Eqs. 8, 12 and 13 yields

2Tax is included in G.

the following

[1 + π(t)][W(t) + bK(t)] = Y (t) = C(t) + I(t) + G(t)

= αGW(t) + βG π(t)K(t) + ηGK(t) + G(t) (14)

Hence

G(t) = [1 + π(t) − αG]W(t) + [b − βG]π(t) − ηG K(t) (15)

Define

ΩG(t) = 1 + π(t) − αG − αN (16a)

ΓG(t) = [b − βG]π(t) − ηG + b (16b)

Hence, from Eqs. 15 and 16

G(t) = ΩG(t)W(t) + ΓG(t)K(t) (17)

6 Money Supply Model for a Closed Macroeconomy

A macroeconomic equation for money supply M(t), consistent with the other macroeconomic variables, is postulated for the nonlinear model to be the following

M(t) = βMπ(t)K(t) + ηMK(t) + αMW(t) (18a)

⇒ M(t) = ΓM(t)K(t) + αMW(t) (18b)

where ΓM(t) = βMπ(t) + ηM (18c)

The two distinct terms multiplying capital stock K in Eq. 18(a) reflect the rate of profit π, and the employment of capital ηM. An empirical analysis of this postulate for the United States open economy shows that this assumption is quite robust [4, 6].

Note Eq. 18 is distinct from Eq. 10 since Eq. 18 is a nonlinear model for money supply M that postulates that the demand for money is determined by the requirements of production for the macroeconomy, and relates money supply and other endogenous variables as well as the rate of profit π(t). Eq. 10, on the other hand, is a generalization of money supply and r determining Y , as in Eq. 9. A different form could have been chosen for M, but the form postulated in Eq. 18 is based on the premise of the nonlinear model of a closed Islamic macroeconomy is determined by W, K, G, M, π.

7 Closed Islamic Macroeconomy: Sraffa-Keynes Equations

The two exogenous variables, from Eqs. 17 and 18 and provide the following equations

G(t) = ΩG(t)W(t) + ΓG(t)K(t) (19)

M(t) = αMW(t) + ΓMK(t) (20)

where

ΩG(t) = 1 + π(t) − αG

ΓG(t) = [b − βG]π(t) − ηG + b

ΓM(t) = βMπ(t) + ηM

Eqs. 19 and 20 provide the necessary two independent equations required for the defining the closed Islamic macroeconomy, and define the exogenous variable in terms of the endogenous variables.

Eq. 11 is a model for the rate of profit π(t) given by its definition via the GDP Y , and which defines π(t) in terms of the endogenous and exogenous macroeconomic variables.

W(t) + (b − βY )K(t)

ψY M(t) + (αY − 1)W(t) + (ηY − b)K(t) (21)

Eqs. 21 provide one of the Sraffa -Keynes macroeconomic equations.

To calibrate the model, the following constants need to be determined empirically.

b, αG, αM, αY , βG, βM, βY , ηG, ηM, ηY , ψY

Although there is no country that has an Islamic macroeconomy, an extended model that includes the interest rates r has been studied empirically for the macroeconomy of the United States and shows the model is quite accurate [6]. One can start with the parameters approximate value taken from the United States macroeconomy and then simulate the Islamic economic system using stochastic equations for the parameters.

In summary, the nonlinear model for Sraffa -Keynes equations for a closed macroe conomy consists of three equations, one equation that defines the exogenous variable π(t) and the remaining two equations determine the endogenous variables W(t), K(t) as a function of the exogenous variables M(t), G(t).

7.1 Solution of Islamic Macroeconomic Equations

The three coupled Sraffa-Keynes macroeconomic equations Eqs. 19, 20 and 21 are non linear algebraic equations. Eqs. 19 and 20 depend on three unknowns W, K, π. The first step in solving the algebraic equations is to replace K by π in Eqs. 19 and 20 so that then they have only two unknowns given by W, π.

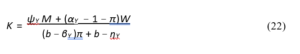

From Eq. 21

(b − βY )π + b − ηY(22)

Eqs. 19 and 20 yield

F1(G, M, W, π) = 0 (23a)

F2(G, M, W, π) = 0 (23b)

On (numerically) solving Eqs. 23a and 23b one obtains

W = W(G, M) ; π = π(G, M)

and which in turn, using Eq. 22 yields

K = K(W(G, M), π(G, M)) = K(G, M)

The solution obtained for the Islamic macroeconomy yields the following analytic depen dence of the endogenous variables on the exogenous variables.

W = W(G, M) ; K = K(G, M) ; π = π(G, M) (24)

Note the solution given in Eq. 24 is the result of solving the nonlinear coupled equations given in Eqs. 19, 20 and 21.

8 Wage Maximization

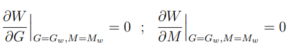

Recall to maximize the macroeconomic wages, one needs to obtain the values of the macroeconomic exogenous variables G = Gw; M = Mw that are determined by the fol lowing critical point equations

∂G

G=Gw,M=Mw

= 0 ;∂W

∂M

= 0

G=Gw,M=Mw

The maximum wage for the macroeconomy is given by

Wm = W(Gw, Mw)

The critical point yields the maroeconomic rate of profit that maximizes wages and is given by

πE = π(Gw, Mw)

Solving the maximization equations above requires solving a set of algebraic equations. To simplify the notation, the following definitions are made

Wm = W(Gw, Mw) ; πE = π(Gw, Mw) ; ∂GW =∂W

∂M (25)

∂GWm =∂W

∂G

∂Mπ =∂π

G=Gw,M=Mw

; ∂MWm =∂W

∂M

G=Gw,M=Mw

; ∂Gπ =∂π ∂G

∂M ; ∂GπE =∂π

∂π

G=Gw,M=Mw

; ∂MπE =∂π

∂M

G=Gw,M=Mw

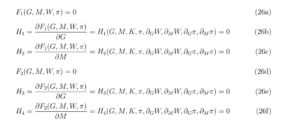

One differentiates the defining equations given in by the exogenous (independent) vari ables G, M, and which yields the following four equations for H1, H2, H3, H4

∂G = H1(G, M, K, π, ∂GW, ∂MW, ∂Gπ, ∂Mπ) = 0 (26b) H2 =∂F1(G, M, W, π)

∂M = H2(G, M, K, π, ∂GW, ∂MW, ∂Gπ, ∂Mπ) = 0 (26c) F2(G, M, W, π) = 0 (26d) H3 =∂F2(G, M, W, π)

∂G = H3(G, M, K, π, ∂GW, ∂MW, ∂Gπ, ∂Mπ) = 0 (26e) H4 =∂F2(G, M, W, π)

∂M = H4(G, M, K, π, ∂GW, ∂MW, ∂Gπ, ∂Mπ) = 0 (26f)

The condition (constraint) of wage maximization

![]()

is imposed on H1, H2, H3, H4 and yields

H1(G, M, K, π, ∂GW, ∂MW, ∂GπE, ∂MπE) → J1(Gw, Mw, Km, πE, ∂GπE, ∂MπE) = 0

H2(G, M, K, π, ∂GW, ∂MW, ∂GπE, ∂MπE) → J2(Gw, Mw, Km, πE, ∂GπE, ∂MπE) = 0

H3(G, M, K, π, ∂GW, ∂MW, ∂GπE, ∂MπE) → J3(Gw, Mw, Km, πE, ∂GπE, ∂MπE) = 0

H4(G, M, K, π, ∂GW, ∂MW, ∂GπE, ∂MπE) → J4(Gw, Mw, Km, πE, ∂GπE, ∂MπE) = 0

There are six unknowns given by Gw, Mw, Km, πE, ∂GπE, ∂MπE. The four equations J1, J2, J3, J4, together with two equation F1(Gw, Mw, Km, πE), F2(Gw, Mw, Km, πE) yield six equations that provide, as expected, a solution to the problem of wage maximization by uniquely fixing the values of Gw, Mw, Km, πE, ∂GπE, ∂MπE. The six equations can be reduced to four equations for four unknowns by solving analytically for ∂GπE, ∂MπE as these appear linearly in equations J1, J2, J3, J4. The remaining four equations are then numerically solved for the unique solution given by

Gw, Mw, Wm, πE

Eq. 22 the fixes the value of Wm = W(Gw, Ww).

In summary, wage maximization for a macroeconomy is given at the critical point with the macroeconomic exogenous variables having the value of

Gw, Mw

From Eq. 24, the maximum wages is given by

Wm = W(Gw, Mw)

The critical point yields, from Eq. 24, the maroeconomic rate of profit that maximizes wages and is given by

πE = π(Gw, Mw)

The macroeconomic rate of profit that maximizes macroeconomic wage provides the basis for deciding what is rate of profit for profit and loss sharing wages for the firms of the microeconomy. The capitalist principle of profit maximization does not hold for the Islamic macroeconomy.

The macroeconomic maximum wages Wm and the rate of profit πE resulting from the maximization of wages can be compared with the W and normal endogenous rate of profit π; it is expected that Wm > W and that πE < π.

Given that the model provides the analytic dependence of the endogenous rate of profit on the macoreconomic exogenous variables, one can do another calculation and find the values of exogenous variables, given by Gπ, Mπ, that maximizes the macroeconomic rate of profit, and yields

πmax = π(Gπ, Mπ)

One can compare the maximum rate of profit πmax with πE and it is expected πE < π < πmax. The model provides a basis for assessing how much change (reduction) is brought about – by comparing both πmax − πE and π − πE – in the macroeconomic rate of profit by the maximization of macroeconomic wages.

9 Islamic Microeconomy

The microeconomy consists of individual firms and enterprises. The theory of the firm, also called an enterprise, is a vast subject that addresses many economic and social aspects of the firm. For instance, why does a firm exist in the first place, how large can a firm can become, the relation of the firm to the market and to the management, the ownership structure of the firm, and so on [17].

The interpretation of the Qur’an, which is being followed in this paper, is that the primary reason for an enterprise to exist is for providing people with their livelihood. As discussed in the Introduction, a realization of the Qur’an’s principle for Islamic economics is postulated to be wage maximization for the macroeconomy – and can be taken to be one of the foundations of Islamic economics. All the rules of an Islamic micro- and macroeconomy, in principle, should be founded on the principle of wage maximization.

As discussed in [3], in a microeconomy privately owned and administered firms do not differ in form from the firms in a capitalist or a socialist market economy. The differences appears only when one situates and locates the firm in the macroeconomy within which it functions. The Islamic principle of macroeconomic wage maximization, and the concomitant negation of profit maximization, completely changes the nature of a firm in an Islamic economic system.

10 Minimum Wage for Workers

A first step for the principle of macroeconomic wage maximization to be realized in the microeconomy is that the minimum wages of workers should be based on the maximum of macroeconomic wages given by Wm. Suppose in a year the firm employs L number of workers and uses k amount of capital. Let w0, the market wage of the workers, be determined by the supply and demand for labor. Let the firm produce quantity Q of the commodity for the market price p, and let the firm’s revenue R be given by R = pQ. The gross rate of profit per year of a firm is the difference between its revenue R and 20

the total cost of production C incurred to generate this revenue. Hence, gross profit πg is given by

πg = pQ − C0

C0 = w0L + k (28)

Revenue R, using the Cobb-Douglas model, is given by

Q = αLAKB ⇒ R = αpLAKB; A + B ≤ 1 (29)

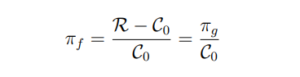

where A, B are empirically determined. The firm’s rate of profit πf is the gross profit divided by C0. Hence

C0=πg

C0(30)

For a macroeconomy that has N enterprises, the total number of workers employed is LN. Instead of wages being determined by the market and given by w0, the minimum wage needs to be determined by the maximum macroeconomic wages Wm. The regulatory bodies set the minimum wage to be equal to ωm, and which is given by

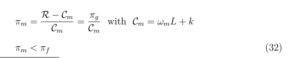

NL≡ ωm (31)

For a firm paying minimum wages given by ωm the rate of profit is πm Cm=πg

Cmwith Cm = ωmL + k

πm < πf (32)

3The Cobb-Douglas model relates the output to the labor and capital input. The Cobb-Douglas production function has been studied empirically using data from US industries [11]; consider the output given by its generalization [9, 10]

11 Wages and Rate of Profit

As discussed in Appendix A, for many reasons the macroeconomic rate of profit π is expected to be lower that a firm’s rate of profit πf : π < πf . Moreover, one expects πE < π since profit is being re-distributed, at the macroeconomic level, to the workers. If one combines these result, one has

πE < π < πf

To further achieve the Islamic macroeconomic principle of maximizing wages, for firms paying minimum wages ωm, another avenue for increasing the workers wages is to reduce the rate of profit given by πm to πE, with the difference given by πm − πE going towards increased wages.

Suppose the rate of profit of a firm is given by πs < πf . One would like to achieve

πf → πm → πs = πE ⇒ πm > πs = πE (33)

Profit and loss sharing wages provide a framework for reducing πm to πE.

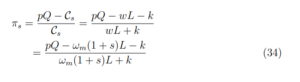

A model has been proposed in [2] where the wages have a profit sharing component. Consider a model that pays wages that scales the minimum wage ωm, resulting in the firm’s annual rate of profit πs; the wages are given by

w = ωm(1 + s)

where s depends on πs; both s, πs are dimensionless. The cost of production Cs is given by

Cs = wL + k = ωm(1 + s)L + k

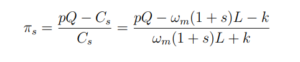

The firm’s rate of profit (revenue is R = pQ) is given by

Cs=pQ − wL − k

wL + k

=pQ − ωm(1 + s)L − k

ωm(1 + s)L + k(34)

Eq. 34 yields

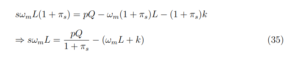

⇒ sωmL =pQ

1 + πs− (ωmL + k) (35)

A fundamental shortcoming of the result is that the rate of profit of the firm πs is based on information asymmetry, with the owners of the firm having access to privy information and deciding what is declared as profit of the firm. This information asymmetry has been one of the main stumbling blocks in all the profit and loss sharing contracts developed in Islamic finance.

Replacing πs by πE removes the information asymmetry and makes the fraction of profit that is shared with the workers uniform across the macroeconomy. The replacement yields the following (Q = αLAkB, A + B ≤ 1)

(1 + πE)− (ωmL + k) ⇒ s = s(Wm, πE; Q, L, k) (36)

and the total wages paid by a firm is given by

w = ωmL + sωmL

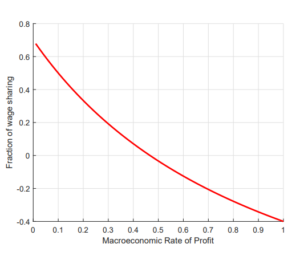

This replacement leads to a variable component that shares in the profit and loss of the macroeconomy, determined by the value of πE. Note that in principle s varies between positive and negative values

−smin < s < smax ; 0 < πE < 1

As shown in Figure 1, for some typical case of pQ, L, k one has

−0.4 < s < 0.6 ; 0 < πE < 1

Macroeconomic Rate of Profit

Figure 1: Fraction of wage sharing as a function of macroeconomic rate of profit πE.

As shown in Figure 1, the fraction accruing to wages fall as the rate of profit rises. The result is what one expects, since for higher the rate of profit the revenue pQ increases for example if the price p increases and so the total profit increases. Hence the fraction of profits accruing to wages may increase in absolute but not in relative terms.

The variable component of wage based on profit and loss sharing is given by sωmL and entails a degree of risk, since the variable component of wages can increase or decrease with the change in revenue pQ, and in the number of workers or capital.

Recall πm be the rate of profit based on the minimum wage being fixed to be ωm. The profit sharing wages results in the rate of profit given by

πs =pQ − Cs

ωm(1 + s)L + k 24

where the cost of production is

![Cs = k + ωm(1 + s)L = k + ωmL + ]](https://islamicfinancesg.com/wp-content/uploads/2024/02/Screenshot-2024-02-07-153633-300x29.png)

After some simplifications

(1 + πE)− (ωmL + k)

=pQ (1 + πE)

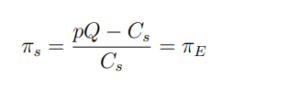

πs =pQ − Cs

Cs= πE (37)

From Eq. 37, profit and loss sharing wages determined by πE as in Eq. 36 reduces the rate of profit of every firm in the microeconomy to the macroeconomic rate of profit that maximizes macroeconomic wages.

πs → πs = πE

We have the result that fixing the profit sharing fraction s using the macroeconomic rate of profit πE, as given in Eq. 36, reduces the firm’s rate of profit πs to precisely πE as given in Eq. 37: this was the objective expressed in Eq. 33.

Wage maximization for the macroeconomy fixes the minimum wages, with a variable wage component based on profit and loss sharing determining the firm’s rate of profit and yields the following

πf → πm → πs = πE ⇒ πf > πm > πs = πE

This reduction of the firm’s rate of profit from πf to πE is possible only in an economy based on principles similar to what the Qur’an prescribes. It is not viable in a capitalist economy; whether it is possible in a socialist market economy is an open question [3].

In summary, the minimum wage ωm is fixed by maximization of wages Wm, and which needs to determined every year from the macroeconomy. The macroeconomic rate of profit πE determines the rate of profit for all the firm’s of the microeconomy, and which 25

is achieved by wages based on profit and loss sharing. Let Wt be the total wages paid to the workers that is equal to the minimum wage augmented by the profit and loss sharing component of wages. Hence

Wt = (1 + s)Wm = ωm(1 + s)NL

Augmenting minimum wages with a profit and loss sharing variable component, de pending on the value of πE, leads to a degree of risk-taking by the workers. As mentioned earlier, it may be appropriate to let workers decide whether they want to opt for the risk sharing variable component or choose to have only the minimum wage ωm.

12 Possible Shortcomings: Market; Capital

There are a number of objections that can be raised to the concept of the wage maxi mization for an Islamic economy.

- There is a view that wages need to be determined by supply and demand in the labor market. This view is premised on the assumption that labor is a commodity, like other commodities such as land, raw materials, machinery and buildings and so on, that can be purchased for a price. Labor considered to be a commodity is determined by the capitalist macroeconomy; in an Islamic economy, labor is not a commodity but instead is a means for sustaining livelihood.

- Reducing the firm’s rate of profit from πf to πE by maximizing wages will discourage the innovation and entrepreneurial drive. This objection is premised on profit maximization being the main basis of entrepreneurial drive, negating the fact that a Muslim entrepreneur looks beyond only self interest. This is discussed in some detail in [3].

- The higher wages being paid to the workers could be shifted by the firm’s owner, with the consumer paying higher prices for goods and services. This is objection is not valid since all the firms have the same constraints, and hence competition between equally constrained firms creates a level playing field in which the market plays a central role in determining prices.

- Reducing the firm’s rate of the profit from πf to πE will lower the GDP and, in particular, deter consumption and investments. The macroeconomic model yields, from Eqs. 10 and 13

Y (t) = ψY M(t) + βY π(t)K(t) + αY W(t) + ηY K(t) = Y (G, M)

A(t) ≡ C(t) + I(t) = αGW(t) + βGπ(t)K(t) + ηGK(t) = A(G, M) (38)

The macroeconomic model needs to studied to evaluate the change in GDP, con sumption and investment in going from G, M to Gm, Mm.

If Y (Gm, Mm) < Y (G, M) and A(Gm, Mm) < A(G, M) – and there is a significant drop in investments – then in a capitalist economy, since all investments are generally made by private capital, there will be a shortfall. In contrast, the State for an Islamic economy has the means to intervene in the economy and can undertake investments to off set a fall in investments. The State has at its disposal fiscal policies linked to taxation that can re-distribute the output of the economy and compensate the short fall by making major investments in infrastructure and other sectors.

- There may be corruption in assigning the profit and loss wages in favor of corrupt private capital. This possibility is minimized since the fraction of profits being shared is πE, and which is fixed by the macroeconomy.

- An Islamic economy, based on the principle of wage maximization, needs to trade and exchange commodities and capital with other systems that are based on profit maximization and debt market based on interest rates. How this exchange can take place needs a separate study.

13 Discussion

Islamic economics is a paradigm shift from private capital serving the holders of capital to private capital serving the workers who work for private capital. It is based on maximizing the livelihood of people and is radically different from a profit maximizing and interest based economic system.

A country’s leadership, who are holding political power, determine the nature of the macroeconomy and, in particular, the country’s regulatory framework. An Islamic economic system can be implemented only if the leaders are righteous. (They are) those who, if We establish them in the land, establish regular prayer and give regular charity, enjoin the right and forbid wrong: with Allah rests the end (and decision) of (all) affairs. 22:41 (Ali).

To realize wage maximization, the State needs to makes laws to realize this goal. A ‘Wage Board’ needs to formulate the country’s regulatory framework for all sectors of the economy as well as ensure its implementation. In particular, the Board needs to determine every year a) the maximum macroeconomic wages and hence the minimum wages for the workers and b) the macroeconomic rate of profit to fix the profit and loss sharing wages.

Maximizing macroeconomic wages is one way of maximizing the people’s livelihood, with the macroeconomy providing a quantitative measure of the minimum wages for firms. Every year, the minimum wage ωm is fixed based on the maximization of the macroeconomic wages Wm.

The macroeconomic rate of profit πE that maximizes macroeconomic wages needs to be evaluated every year. The rate of profits of all firms is made equal to πE by the mechanism of profit and loss sharing wages. Workers need to be given the option of either choosing to settle for minimum wages or opt for the risky scheme of having a variable wage component based on profit and loss sharing.

Maximizing wages increases the buying power of the vast majority of people and hence creates a strong demand for product and services. This in turn is a powerful force for increasing the supply of goods and service thus creates opportunities for profitable investments – leading to the expansion of the economy. The expansion of the economy would further increase wages as well as the rate of macroeconomic profit πE, creating a virtuous cycle for further improving the well being of the people and increasing their livelihood and so on.

The transition from a market-based capitalist economy to an Islamic economy based on wage maximization needs to be done in well thought steps that maintains synergy and inter-locks changes being made in the macro- and microeconomy. Wage augmentation can be done in two steps and hence the transition can follow a similar procedure.

- The first step to be taken is to set the minimum wage equal to ωm = Wm/(NL): resulting in rate of profit for the firm being given by πm. The first step allows a variation in the rate of profit of firms, thus rewarding the more efficient and innovative firms.

- The second step is the more drastic step and should be taken when the system of Islamic finance is well established, including the required moral and ethical values being widely practiced. It requires the entrepreneurs and owners of the firms to be equally efficient and well versed regarding the Islamic economic system. The second step can then be taken of fixing the rate of profit of all firms to be equal to πE by fixing the variable component of wages to be determined by πE.

In the absence of any contemporary economy following the Islamic economic model based on wage maximization, one can carry out stochastic simulations of the model proposed to ascertain the stability and sustainability of such a system. In particular, one can study the impact of wage maximization on various aspects of the macro- and micro economy such as consumption, GDP, investments, growth of private sector and so on. Simulations can give an impetus to studying quantitative models of Islamic economics.

14 Acknowledgments

I thank Imran Majeed, Muhammad Mahmudul Karim, Saad Azmat, Sultan Hafeez Rah man, Mohammad Eskandar Shah Rasid and Wang Qing-hai for many useful discussions.

A Marco- and Micro-economic Rate of Profit: π < πf

The macroeconomic rate of profit π is expected to be lower than the rate of profit of an individual firm πf for many reasons. A major feature of firms is competition, forcing prices down for less competitive firms, leading to a drop in their average rate of profit leading to a lowering of the macroeconomic rate of profit. Infrastructure projects, especially if carried out by private capital, lead to long gestation period for accruing profits leading to a lowering of π. Fluctuations in supply and demand may lead to oversupply or to fall of aggregate demand, pushing prices down affecting and affecting π.

Large firms have advantage of scale and reap higher profits than smaller firms, leading to a fall in the average of profit for some sectors. Other factors pushing down π is that capital-intensive firms lead to a lowering of rate of profit, competition from global competitors, cyclical factors and so on. The last but not unimportant factor is the Government regulations, taxation, incentives to some sectors adversely that affecting other sectors and so on.

In summary, individual firms that have more efficient management, innovative products and advantage of first arrival may achieve higher profit rates πf. The macroeconomic rate of profit π is determined by economic conditions existing across all sectors of the economy. These factors include the mobility of capital that moves from sectors with lower to higher rates of profit due to competition; the distribution of profits across the entire economy also tends to lower the macroeconomic rate of profit π.

For a macroeconomy based on interest rates r, there are further constraints on π. If the entire sum being employed by a productive firm is liquidated and loaned out as money capital, then the interest rate would be the return on sum. Hence, for any enterprise to make investments in production π > r, and the effective rate of profit of a productive firm is

Effective rate of profit = π − r

Interest rate r is endogenous and π is may be edogenous or exogenous. A requirement from the general arguments relating interest rate to the rate of profit requires [13]

r < π

The condition of interest rate being lower than the rate of profit is due to the fact that interest rates are paid from the real economy. If money capital yields interest rate that is above the rate of profit, no productive enterprise can make profit by taking loans from financial institutions. However, for a turbulent macroeconomy, as was the case for the United States in the period of 1978-1991, the macroeconomy had π(t) < r(t) [13].

References

[1] Belal Ehsan Baaquie. Islamic economics : Journeying on a straight path. https://library.ium.edu.mv/cgi-bin/koha/opac-detail.pl?biblionumber=30258, 4, 2017.

[2] Belal Ehsan Baaquie. A statistical model of the firm. Physica A: Statistical Me chanics and its Applications, 524, 2019.

[3] Belal Ehsan Baaquie. Islamic economics: Comparisons. WS Annual Review of Islamic Finance, 1–32, 1, 2023.

[4] Belal Ehsan Baaquie. A nonlinear model of an open macroeconomy and the rate of profit. To be published, 2024.

[5] Belal Ehsan Baaquie. A nonlinear model of closed macroeconomy and the rate of profit. To be published, 2024.

[6] Belal Ehsan Baaquie, Muhammad Mahmudul Karim, and Imran Majeed. Empiri cal analysis of the nonlinear macroeconomic model: Case study of the usa. to be published, 2024.

[7] F. A. de Aruajo. Sraffa and the labour theory of value: a note. Brazilian Journal of Political Economy, 39, Dec 2019.

[8] Andrew Glyn. Capitalism Unleashed: Finance, Globalization, and Welfare. Oxford University Press, UK, 2006.

[9] D.F. Heathfield and W Sören. An Introduction to Cost and Production Functions. Macmillan Education, UK, 1987.

[10] G Renshaw. Maths for Economics. Oxford University Press, 2012.

[11] Barro R.J. and Sala i Martin X.I. Economic Growth, volume Second. MIT Press, 2004.

[12] D. Romer. Advanced Macroeconomics. McGraw-Hill Series Economics, USA, 2011.

[13] Anwar Shaikh. Capitalism: Competition, Conflict, Crises. Oxford University Press, Uk, 2016.

[14] R. M. Solow. Technical change and the aggregate production function. 39(3), 312– 320, The Review of Economics and Statistics, 1957.

[15] Piero Sraffa. Production of Commodities by Means of Commodities: Prelude to a Critique of Economic Theory. Cambridge University Press, UK, 1960.

[16] M. Tucci. A mathematical formalization of a sraffa model. Metroeconomica, 28, Aug 1976.

[17] P Walker. The Theory of the Firm: An overview of the economic mainstream. Routledge, 2016.

[18] Murat Çizakça. Islamic Capitalism and Finance: Origins, Evolution and the Future. Studies in Islamic Finance, Accounting and Governance, Turkey, 2011.