TLDR: This 2025 guide provides essential financial planning advice for Singaporeans at every life stage. It covers building a strong financial foundation, setting realistic goals, balancing saving and investing, managing risk with insurance, and planning for retirement. The guide also emphasises avoiding common financial mistakes and the benefits of working with Relationship Managers to secure your future. Learn how you can maximise your wealth with Maybank’s personalised Islamic Wealth Management solutions.

1. Why Financial Planning Matters?

In today’s fast-paced economic landscape, financial planning has become more critical than ever. This is especially true in a global financial hub like Singapore, where the rising cost of living, increased retirement savings needs, and fluctuating global markets demand effective money management to ensure financial security. Whether you’re just starting your career, buying your first home, or planning for retirement, having a solid financial plan in place is the key to long-term success.

A recent survey revealed that 79% of Singaporeans have insufficient retirement savings, with many citing high living costs and limited income as major challenges. Another study indicated that only 33% of Singaporeans feel confident in their retirement savings. These statistics underscore the importance of starting financial planning early and maintaining a comprehensive strategy over time.

From an Islamic perspective, wealth management goes beyond individual success and extends to contributing positively to society. Islamic Wealth Management (IWM) operates on principles that ensure wealth circulation throughout the community, encouraging fairness and justice in all financial dealings. In this guide, we explore how IWM can help you achieve your wealth goals while remaining aligned with your faith and contributing to the broader community.

2. Building a Strong Financial Foundation

Establishing a solid financial foundation is crucial for achieving long-term financial stability. Basic budgeting frameworks like the 50/30/20 rule—where 50% of income goes to essentials, 30% to discretionary spending, and 20% to savings and investments—help individuals manage their resources effectively and create a foundation for financial growth.

Figure 1: Budgeting rule of 50/30/20

While these rules focus on personal financial discipline, Islamic Wealth Management (IWM) offers an additional layer, integrating ethical principles and community-focused values. IWM solutions are designed for those who wish to align their financial practices with Shariah-compliant principles, ensuring fairness, transparency, and social responsibility. Examples include Shariah-compliant savings accounts, halal investments, and ethically-structured fixed deposits, which cater to individuals striving to grow wealth while adhering to values that promote justice and equity.

By combining the discipline of budgeting rules with the ethical framework of IWM, individuals can build not just a robust financial foundation but also one that contributes positively to the larger community. This holistic approach ensures responsible wealth creation, supports equitable practices, and aligns personal goals with broader societal benefits.

Emergency Funds: A Buffer for the Unexpected

As you work towards building a solid financial foundation, one of the most critical components is establishing an emergency fund. This fund acts as a financial buffer, protecting you during unexpected events such as medical emergencies, vehicle repairs, or temporary loss of income. Experts often recommend setting aside enough to cover three to six months’ worth of essential living expenses to ensure financial resilience.

By prioritising an emergency fund, you’re taking an important step in securing your financial stability. It’s not just about having funds for unforeseen circumstances, but about ensuring that those funds are accessible in a way that aligns with responsible financial practices. Using savings accounts or investments that match your values, you can confidently build an emergency reserve that supports both your financial goals and personal principles.

Given Singapore’s high cost of living, this safety net can provide the peace of mind needed to navigate life’s uncertainties, reinforcing the strong financial foundation you’ve worked to create. As you continue your journey towards financial security, having this buffer in place ensures you are prepared for the unexpected, without compromising your broader wealth management strategy

3. Setting and Achieving Financial Goals

Financial planning goes beyond managing day-to-day expenses; it’s about setting clear, realistic goals that help you grow your wealth and secure your future. By establishing well-defined objectives, you create a roadmap that guides every financial decision, ensuring that each step brings you closer to achieving your aspirations.

A helpful approach to goal-setting is the SMART framework: goals should be specific, measurable, achievable, relevant, and time-bound. Whether your aim is short-term, such as saving for an emergency fund or a major purchase, or long-term, like buying a home or planning for retirement, having clear targets provides direction and helps maintain focus.

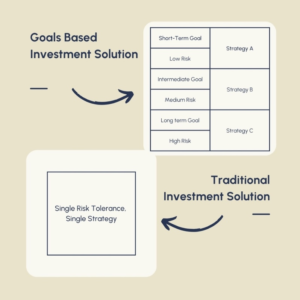

To effectively manage your goals, it’s useful to categorise them based on the time horizon:

- Short-term goals: These typically focus on immediate needs, such as building an emergency fund or saving for a holiday. Because the timeframe is short, safer, low-risk financial products, like Shariah-compliant savings accounts, are often the best option.

- Medium-term goals: These goals might include planning for your children’s education or buying a home. At this stage, a balanced approach to investment is ideal—blending lower-risk options with modest exposure to growth-oriented investments, such as sukuk(Islamic bonds) or Islamic equities.

- Long-term goals: Long-term ambitions, such as retirement planning, require investments that can withstand market fluctuations and have the potential for higher returns over time. Shariah-compliant financial instruments, like Islamic equities or unit trusts, can play a significant role here, allowing for wealth accumulation in a manner that aligns with ethical principles.

Figure 2: Goals-based Investment Solution

To achieve your financial goals, a personalised approach that matches your investments to your timeline is essential. Short-term objectives require more conservative financial strategies, while long-term goals can afford to take on greater risk in exchange for the potential of higher returns.

Setting financial goals is not just about identifying what you want; it’s about creating a structured plan that is flexible enough to adjust as life circumstances change, while remaining grounded in values that promote ethical wealth management. With a clear roadmap and the right financial tools, your financial goals can transform into actionable steps that steadily lead you toward financial security.

4. Saving vs. Investing: Finding the Right Balance

Achieving financial security requires a thoughtful balance between saving and investing. Both are crucial for long-term success, but serve different purposes. While saving provides immediate access to funds for emergencies and short-term needs, investing allows for potential wealth growth over time.

The Role of Saving

Saving is essential for building a financial cushion. Whether for unexpected expenses or planned short-term goals, maintaining liquidity is key to ensuring financial stability. In Singapore, the CPF serves as a reliable savings tool for retirement, housing, and healthcare. However, with inflation rising at 4.2% in 2023, according to the Monetary Authority of Singapore (MAS), the value of money saved in traditional accounts may diminish over time. Diversifying savings into Shariah-compliant products can help preserve purchasing power while aligning with ethical principles.

The Benefits of Investing

Investing allows wealth to grow over time, with potential returns that outpace inflation. It’s particularly important for long-term goals such as retirement. In fact, according to the Future of Retirement Report, 74% of retirees expressed regret, wishing they had started saving or investing earlier. Islamic investment options, such as sukuk and Islamic equities, offers a route for those looking to grow wealth in line with Shariah guidelines, promoting fairness and responsible investing.

By combining both strategies, you can create a robust financial plan that adapts to inflationary pressures while ensuring long-term growth without compromising on your values.

5. Managing Risk: Insurance and Protection

Protecting your wealth is as important as growing it. Effective risk management strategies, such as insurance, play a vital role in safeguarding your financial future. Unforeseen events—whether illness, accidents, or loss of income—can have a significant financial impact, and ensuring you have the right protection in place helps mitigate these risks.

The Role of Insurance in Financial Protection

Insurance provides a safety net that helps manage the financial consequences of unexpected life events. In Singapore, essential types of coverage include term life insurance, personal accident insurance, and hospitalisation insurance, which help protect against medical emergencies or the loss of income due to disability or illness.

For those seeking financial solutions, takaful offers a Shariah-compliant alternative based on mutual cooperation and shared responsibility. Though takaful options in Singapore are still developing, the Islamic finance industry is actively working towards establishing more comprehensive Shariah-compliant insurance products. In the near future, you can expect more options to become available, enabling you to protect your wealth while embracing financial dealings that humanise your approach and positively impact the community.

Wealth Protection through Shariah-Compliant Trusts

Beyond insurance, Islamic Wealth Management also offers solutions like Islamic trusts, which can be used to protect wealth and ensure its value-based wealth distribution across generations. Establishing a trust allows you to safeguard assets from unforeseen events and ensure your family is provided for in accordance with your wishes.

Risk management is a crucial element of any comprehensive financial plan. By securing appropriate coverage and exploring ethical solutions like takaful and Islamic trusts, you can protect your wealth from unexpected events while maintaining alignment with your values. This ensures that your financial future is safeguarded, providing peace of mind for you and your loved ones.

6. Retirement Planning: Securing Your Future

Planning for retirement is essential for ensuring long-term financial stability. While Singapore’s CPF contributions provide a good foundation, it may not be enough to maintain your preferred lifestyle after retirement. With rising living costs, particularly healthcare and inflation, it’s vital to consider supplementary strategies to build a secure retirement plan.

Expanding Beyond CPF

Relying solely on CPF might leave gaps in your retirement savings. To fill these gaps, it’s important to explore additional avenues, such as investments that can help generate future income. By diversifying your portfolio to include Shariah-compliant products like sukuk (Islamic bonds) and Islamic unit trusts, you can grow your wealth positively while adhering to values of fairness and social responsibility. These financial instruments offer growth potential, helping you secure your future while maintaining your financial principles.

Proactive Planning for Peace of Mind

A significant portion of Singaporeans expect to work beyond retirement age due to financial necessity. If you would like to avoid this, it’s crucial to start retirement planning early and review your strategy regularly to ensure it aligns with your evolving needs and goals. Instead of focusing solely on accumulation, effective retirement planning also involves making informed decisions that prioritise sustainability and long-term security.

By integrating conventional CPF savings with diversified investments that align with your values, you create a holistic retirement plan. Whether you’re opting for Shariah-compliant pensions or other investment vehicles, a well-thought-out strategy ensures that your wealth not only grows but also sustains you and your family throughout your retirement years.

7. Financial Planning in Stages: A Macro Perspective with Islamic Wealth Management (IWM)

After exploring the different stages of financial planning, it’s essential to consider how these steps can align with values-driven financial principles. Islamic Wealth Management (IWM) provides a framework for managing wealth ethically and purposefully, ensuring that every financial decision promotes fairness, transparency, and social responsibility.

IWM serves as a complement to the structured stages of financial planning, offering tools and solutions that uphold Shariah principles while empowering individuals to achieve their financial goals. Whether through halal investments, Shariah-compliant savings, or zakat contributions, IWM ensures that wealth creation, accumulation, protection, and distribution are not only effective but also aligned with broader societal and spiritual values. By integrating IWM into your financial strategy, you can build a secure future while making a positive impact on your community.

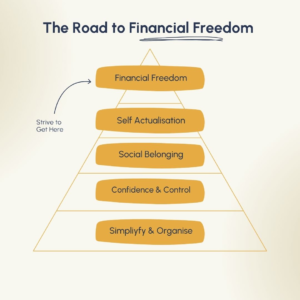

Stage 1: Simplifying and Organising (Wealth Creation)

The first stage of financial planning focuses on ensuring your essential expenditures—such as food, housing, and healthcare—are adequately covered. This stage ties into the Wealth Creation pillar of IWM, where the focus is on generating income through ethical and Shariah-compliant means, such as through a halal profession, business, or trade. It’s also about creating a simple budget that helps you track your income and expenses, ensuring that your financial decisions reflect ethical principles while laying the groundwork for future financial success.

Stage 2: Increasing Income and Reducing Debt (Wealth Accumulation)

As your financial stability improves, the goal shifts toward increasing your income and reducing debt. This stage is closely aligned with the Wealth Accumulation pillar, where the focus is on growing your wealth through investments that that promote ethical stewardship and align with broader social impact objectives. By investing in Shariah-compliant products such as sukuk (Islamic bonds) and Islamic unit trusts, you can enhance your wealth responsibly – not at the cost of environmental sustainability, social equity, or good governance. Reducing debt also plays a crucial role at this stage, ensuring that riba (interest-bearing liabilities) are minimized while protecting your wealth from erosion.

Stage 3: Confidence and Control (Wealth Protection)

Once you’ve built a solid foundation, you enter the “confidence and control” stage, where financial planning becomes more focused and sophisticated. This stage corresponds to the Wealth Protection pillar of IWM, which emphasizes safeguarding your wealth. Here, you take control of your financial strategy, fine-tune your investments, and begin planning for long-term goals like retirement. Incorporating takaful and Islamic trusts into your plan helps mitigate risks and ensure your assets are protected from unforeseen events.

Stage 4: Social Belonging and Self-Actualisation (Wealth Purification and Wealth Distribution)

The final stages of financial planning focus on legacy building. These stages correspond to the Wealth Purification and Wealth Distribution pillars. Wealth Purification is achieved through zakat and sadaqah (charitable giving), ensuring that your wealth is not only purified but also benefits those in need. Meanwhile, Wealth Distribution involves planning how your wealth will be passed on to future generations through tools such as wasiat (Islamic wills), hibah (gifts), and waqf (endowments). These steps help you leave a meaningful legacy that reflects your values while ensuring the fair and responsible transfer of wealth.

Figure 3: Stages to Financial Freedom

8. The Role of Relationship Managers

While managing your finances independently is feasible, there are times when professional advice can significantly enhance your financial strategy. Relationship Managers bring the expertise needed to handle complex decisions, ensuring that your wealth is managed both efficiently and effectively. For those incorporating Islamic Wealth Management (IWM) principles, working with an advisor familiar with Shariah-compliant options can provide valuable guidance.

When to Seek Professional Help

Relationship Managers are particularly beneficial when navigating intricate financial areas such as estate planning, tax strategies, and retirement. Whether planning for Wealth Protection through insurance or ensuring Wealth Distribution is carried out in line with Islamic values, an advisor can help you make informed decisions.

Tailoring Solutions to Evolving Needs

As your life progresses, your financial needs evolve—whether due to marriage, starting a family, or approaching retirement. A financial advisor helps adjust your plan as you transition from wealth-building to wealth-preservation stages. They ensure that your strategy remains flexible and relevant, particularly when balancing Shariah-compliant investments with your changing goals.

Selecting the Right Advisor

Choosing an advisor who understands both your financial objectives and your values framework is crucial. Many Relationship Managers in Singapore have experience with Shariah-compliant products and Islamic estate planning, making it easier to find one who can align with your values.

Ultimately, a Relationship Manager ensures that your wealth is not only optimised for growth but also managed in line with ethical principles, helping you stay on track to achieve your long-term goals.

9. Conclusion: Take Charge of Your Financial Future

Financial planning is an ongoing journey, one that requires careful thought, clear goals, and detailed decision-making. By integrating Islamic Wealth Management (IWM) principles, you can build a robust financial strategy that not only secures your future but also aligns with your values of fairness, transparency, and social responsibility.

Starting with a strong foundation, you can create a comprehensive plan by setting clear financial goals, balancing saving and investing, managing risks through insurance, and planning for retirement. Each stage of financial planning—whether focusing on Wealth Creation, Wealth Accumulation, or Wealth Protection—plays a crucial role in securing long-term success.

Avoiding common mistakes such as failing to set clear goals, neglecting an emergency fund, or overlooking wealth purification ensures that your plan remains effective and sustainable. Meanwhile, seeking the guidance of Relationship Managers who understand your personal and values-driven needs can further enhance your financial outcomes. Taking proactive steps today will ensure you are prepared for tomorrow’s challenges, allowing you to enjoy financial freedom while staying true to your values. Whether you are just starting your financial journey or are already planning for future generations, Maybank’s personalised Islamic Wealth Management solutions can help guide you every step of the way.

To find out more about Maybank Islamic Wealth Management solutions, you may get in touch with a Maybank representative through the following channels:

- Contact us at 1800-MAYBANK (1800-629 2265) or (65) 6533 5229

- Email us at iwmsg@maybank.com

- Visit your nearest Maybank branch

Notes

[i] OCBC Financial Wellness Index. (2023). Survey of 2,000 working adults in Singapore aged between 21 and 65 conducted in August 2023. OCBC Bank.

[ii] HSBC Future of Retirement Report. (2015). Survey of more than 16,000 people across 15 countries, including 1,000 participants from Singapore.

[iii] Channel News Asia. (2024). Singapore’s core inflation rose to 3.3% in December, averaged 4.2% for 2023: MAS, MTI report. Retrieved from https://www.channelnewsasia.com/singapore/singapore-core-inflation-rose-33-december-42-2023-mas-mti-4067326

[iv] HSBC Future of Retirement Report. (2015)