How to Use the Hugosave App to Save and Invest in Singapore

What is the Hugosave App?

Hugo, which was made available to the public in April 202, is a mobile application that allows users to easily save and invest in physical gold regulated by MAS. Users can also track their spending, set savings goals, and round up their purchases to the nearest dollar before converting them to gold.

What is Hugosave? It is an app that helps users to achieve smarter spending, better budgeting, and sustainable saving. By downloading the app, you can be part of the HugoVerse and benefit from its financial advice.

Benefits:

Hugosave app users can purchase physical gold stored in a Singapore-based gold storage accredited by the London Bullion Market (LBMA) at a lower price than those listed on local pawnshops such as ValueMax, MoneyMax, and Maxi Cash.

How to get started:

To begin, you can simply download the app from the mobile app store and create an account by filling up the required particulars with Singpass. Your debit card will be delivered to your mailbox in about a week (as of the latest migration, new cards will be mailed end of February).

Create an account, download the app, fill in their particulars with Singpass and then begin your Hugosave Journey! Your debit card will also arrive in your mailbox in about a week.

How it works:

Once you have created your account, you can start by making a FAST transfer to your Hugosave account and allocate the transferred amount to your savings goal, physical gold in LBMA-approved gold storage, or debit card purchases.

What are the features of the Hugosave App?

Hugosave is an app designed to streamline the control of expenses and spending. It comes with a numberless Visa debit card that is fully functional as a regular Visa card, with no foreign exchange fees and extended Visa Platinum benefits. For added security, users can also temporarily ‘lock’ the card through the integrated feature of the app.

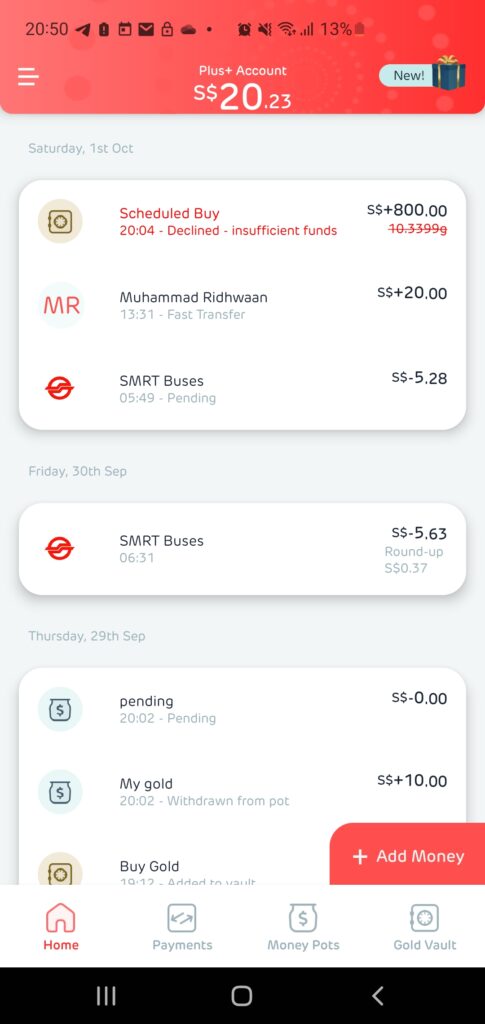

1. Hugosave plus account – view your account summary

On the home page, you would see “Plus+ Account”. This page is where you may view (1) the amount you have transferred from your bank account; (2) the amount deducted from your Hugosave debit card purchases; and (3) the option to allocate your amount to different sub-accounts:

Money pots: where you can set specific financial and saving goals

Gold vault: where you can buy and sell gold.

2. Gold Vault – buying and selling gold

In the gold vault, you can keep track of your gold trading activity, such as roundups, and schedule automatic buy orders for gold on a specified day of the month (please keep in mind that for the scheduled transitions to occur, you must have enough cash deposited into your main Hugosave account before the instruction can be executed).

Also, you can specify how much gold you want to buy after depositing money into your Hugosave account. This can be as low as S$0.01, which Hugosave will automatically convert to the gold amount equivalent. On top of that, there are no fees when purchasing gold.

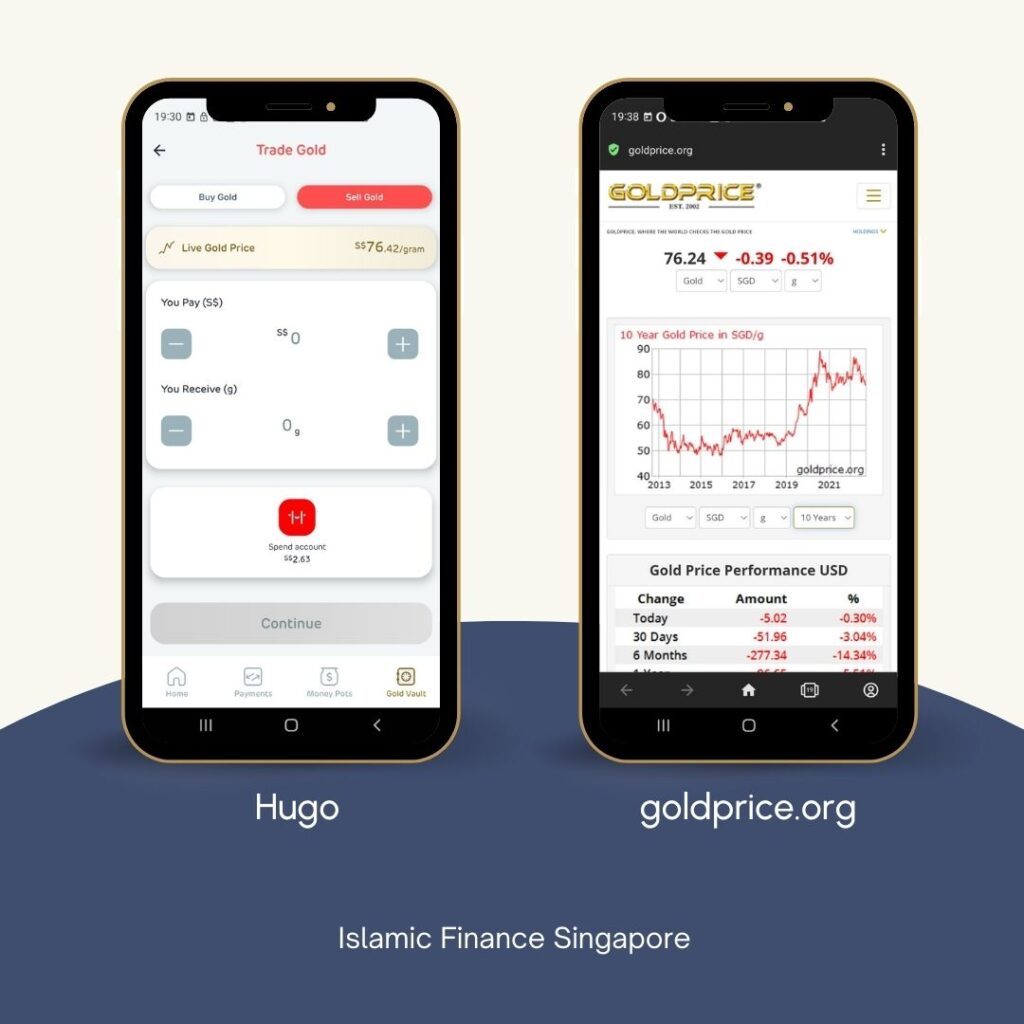

In addition, you can view the current live gold prices of Hugo, which are not too far off from the live gold market prices.

Moreover, the price listed in Hugosave Gold Vault is cheaper than the local pawn shops (see table below). This is because when you buy gold from these pawnshops, you are acquiring the gold physically and paying for the costs of security and other associated expenses incurred by the pawnshops to turn a profit.

With the gold you have purchased and accumulated, you can sell it by specifying how much gold you want to liquidate in dollars or grams. Unfortunately, it takes two days for the selling of your gold to settle before it is reflected in your Hugosave Plus account (your main account for spending).

Despite the obvious benefits of diversifying your holdings into gold, you should be aware of the risks involved. When the price of gold rises, so does the value of your gold vault, and vice versa. Please keep this in mind.

3. Hugosave Card – a secure and stylish debit card

After signing up for a Hugosave account, you will receive a sleek-red-coloured Visa debit card at your home address within 14 working days, which you can use for daily spending.

At first glance, the card does not look like a typical Maybank or DBS card because there are no numbers. However, you can use the Hugosave app to view these numbers and use them for your online purchases. In addition, you can prevent unauthorised purchases from being made on your card by locking it when you are not using it. This is especially useful when travelling internationally or when you do not have an RFID-blocking wallet.

To use the Hugosave Plus debit card, you must have a positive balance in your Hugosave Plus account, just like with a regular bank debit card. However, one of the unique features of using the Hugosave Plus debit card is the roundup to the nearest dollar function. For example, if the plate of chicken rice is S$3.50, Hugosave would round it up to S$4.00, so the S$0.50 difference will be added to your “Roundup Account”, which will be stored in your Money Pots.

(You won’t be able to use the debit card as Hugosave will be sending a new debit card to you by 28th Feb 2023)

4. Money Pots – setting a target for your goals

The Money Pots feature allows you to create multiple savings accounts, each with its own savings goal, scheduled transaction, and dollar amount. Here is how it breaks down:

Money Pots: Have a large expense coming up, like a trip to New Zealand or a wedding, and you need to save up for it? Hugosave makes it much easier to save for such plans. It would ask you for the total amount you wish to save and the deadline before providing you with a plan for how much to transfer to these pots each month to achieve your savings goal.

Simply click on one of your pots, create a savings schedule, and see Hugo’s different suggestions for how much you should transfer each month to reach your savings goal. Do note that if insufficient funds are in your Plus account, these scheduled transactions will not be carried out.

Schedule a transaction: You can set up recurring monthly deposits into your various savings accounts by clicking “Schedule a transaction.” However, the transfer can only go through if sufficient funds are in your Plus account.

Add money: To add funds, click “Add money,” and then specify how much to transfer from your Plus account into each of your money pots respectively. This feature can be quite helpful if you use your Plus account as a spending account and link it to the bank account where your salary is deposited. Furthermore, when you have money left over at the end of the month, you can easily allocate it to the various accounts you have set up.

Remember that your savings are still vulnerable to the eroding effects of inflation because the money in your various pots is really just one cash pile (not a goal amount) separated into separate savings goals.

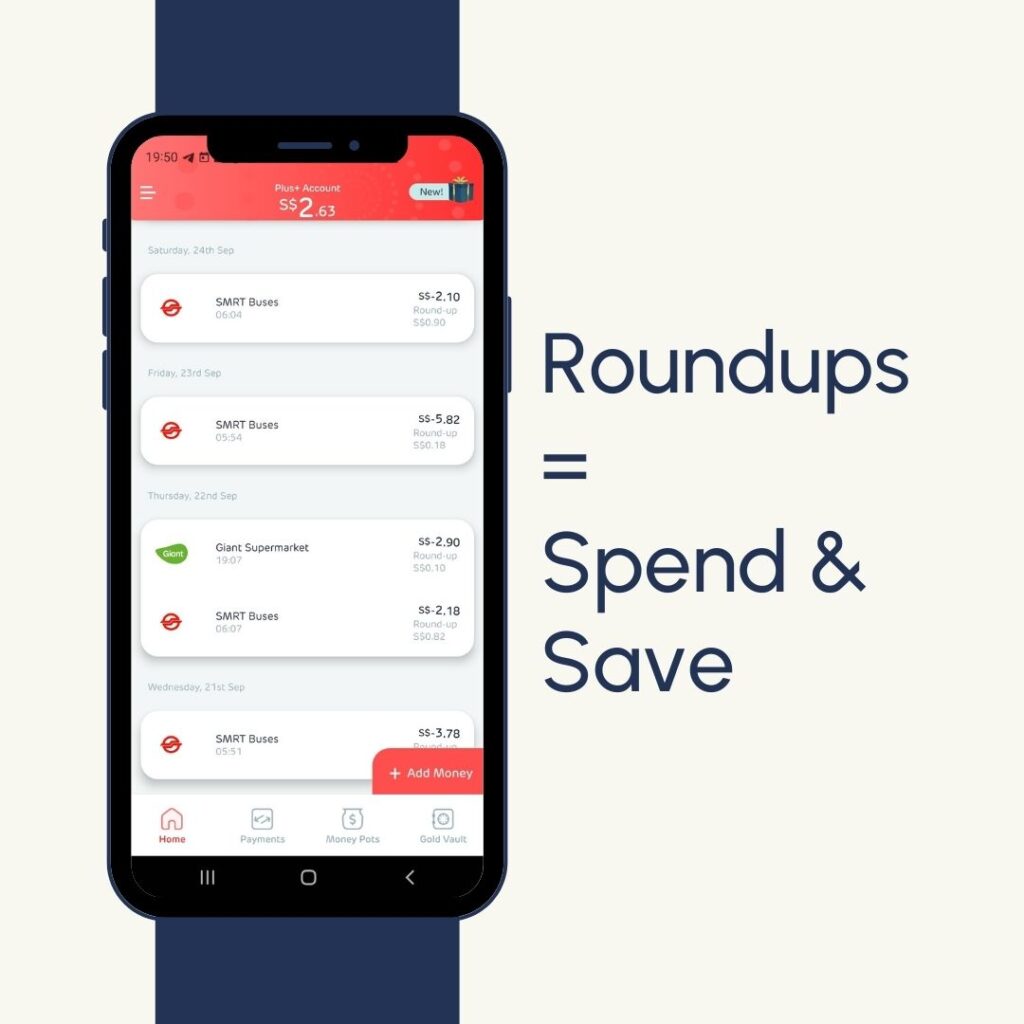

5. Roundups – saving while you spend

The Roundups feature, which is popular in the West but not in Singapore yet, simply rounds up your purchases to the nearest dollar before being used to purchase physical gold every Wednesday.

You must enable this roundup feature for it to function. I typically use it for my daily commute home by train and for small items. This would be more effective if you have already set aside the monthly amount to be spent on such expenses, taking into account the scheduled transfers between money pots.

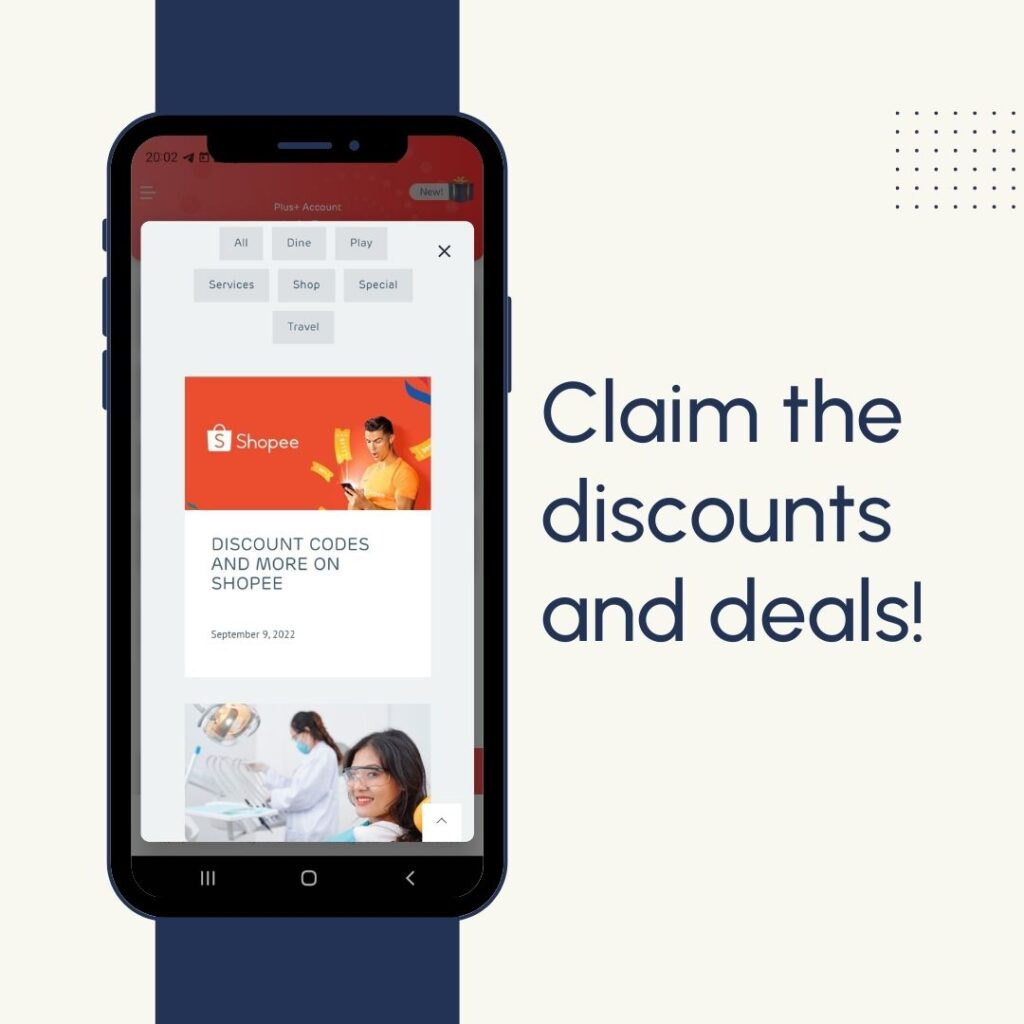

6. Hugosave Offers – shopping perks

Using the Hugosave app, you can take advantage of some interesting partnerships and discounts. This includes discount codes and vouchers for Shopee, H&M, and other participating businesses.

7. Payments – making a scheduled transfer

Money transfers to friends and scheduled deposits into your Gold Vault or Money Pot can be made through the “payments” tab.

In contrast to the PayNow feature in your banking app, Hugo’s Pay Now feature can only make a FAST transfer to a recipient’s bank account. This feature is rather basic and is only really useful if you insist on using Hugosave as your primary spending account and not switching to PayNow or PayLah. It would be great if the Hugosave app could perform PayNow functions in the future.

As for the schedule transfer function, you can view and plan for the various transactions you have scheduled for the month. For example, setting up monthly transfers of S$800 to your Gold Vault, S$200 to your savings pot, S$100 to your holiday fund, and S$300 to your Hugosave Debit card for day-to-day use (do note to have S$1,400 transferred to your Plus account from the account where your salary is deposited for the schedule transfers to work).

Why use the Hugosave App?

The Hugosave app is an excellent tool for saving and investing in Singapore. It provides an easy and convenient way to invest in physical gold and a number of features that make it simple to manage your finances.

Banks such as OCBC and DBS now offer similar features to the Hugosave app, such as savings goals and investing, but there is currently no roundup feature and no way to buy gold from LBMA.

In addition to being stored in an accredited LBMA vault in Singapore, the gold you purchase is additionally insured by Lloyd’s of London.

Therefore, while the Hugosave app will not replace your banking apps, it is certainly a great complement for your personal finance needs.

The Hugosave app offers a number of benefits to its users through its integrated Visa debit card, including zero foreign exchange fees, the ability to temporarily ‘lock’ the card as a form of security, and access to Visa Platinum benefits.

What are the limitations of using the Hugosave App?

Hugosave is a unique tool combining personal finance management and gold investing into one app. However, as a user since February 2022, I can say that it is not a one-size-fits-all personal finance app but rather a complementary app.

The Hugosave app, in particular, could benefit from the following enhancements:

1. Paynow function

The debit card, roundup, and funds transfer are all convenient features, but the arrival of services like PayNow and PayLah has made sharing your bank account information with a friend seem like something from the past.

2. QR code reader for payments

If you, like me, occasionally purchase a cup of tea or coffee from a coffee shop, you have undoubtedly used PayNow or, at the very least, see the QR code for the PayNow sticker on the side. Although Hugosave does not have this feature yet, it would be a great addition to the PayNow feature, as it would allow users to pay and round up using their debit card or PayNow.

3. Expense tracker

Currently, I’m using a different app to keep track of my monthly income and expenditures. Still, I’d be happy to switch if Hugosave could categorise my spending and provide me with a breakdown by category.

For the time being, you can click on an expense and add notes or upload a receipt, but you would not be able to see an overview of all expenses incurred.

4. Report

Hugosave.com’s homepage claims that the app will “use insights to help you spend less by suggesting switching, substitution, and reduction opportunities without sacrificing the things you love.” Still, after seven months of using Hugo, I have yet to come across this feature. A report detailing my spending habits and suggestions for improving our financial situation over time would be very helpful.

5. Gold asset value

While it is natural to wonder how much your gold is actually worth after storing it in the Gold Vault for some time, you’ll be disappointed to learn that the Gold Vault only displays your gold’s current dollar value without reflecting the real-time fluctuations in gold prices. Gold’s value tends to rise over time, so it would be fantastic if Hugosave could implement a feature that would allow us to track its growth over time in the same way that stock prices do.

How to make the most of the Hugosave App to save and invest in Singapore?

We believe this app has great growth potential, but with the current features, you could take the following steps.

I think there is a lot more room for this app to grow, but with just the currently available features, you may still use it to your benefit with the following steps:

Spend some time setting up your money pots. This can be for an emergency fund (6 months of your salary is recommended), a vacation fund, or any other large financial commitments you have.

Start using your Hugosave debit card for all transactions, including public transportation and savings. Moreover, the new Ez-link card offers cashback, and you can also earn GoldBacks by referring friends to the app.

Set a monthly plan to buy gold: since your money is losing purchasing power due to inflation, you might as well put some of it toward something that will appreciate in value and complement your overall investment portfolio.

Create a Hugosave budget and stick to it. After using the app for a month or so, calculate how much money you need to transfer to the app each month based on your various money pots, the amount of gold you want to buy each month, and your monthly spending on the debit card. Then, set up a GIRO or automated FAST transfer to your Hugosave account before these scheduled transfers occur.

Refer your friend so that he/she can also start a better personal finance journey while you can earn GoldBacks!

Physical Gold vs Hugo’s gold?

What if you have gold in hand but only recently learned of this app? Should you part with your gold bullion and invest in Hugo’s gold instead?

It is best to continue holding on to the gold bullion and accumulate Hugo’s gold. This is because you can liquidate your gold bullion immediately with pawn shops, whereas selling gold through the app takes approximately two days for the amount to be reflected in your Plus account.

Furthermore, if you are short on cash and require it urgently, rather than taking out a bank loan and being charged interest that is not halal, you have the option to go for Ar-Rahnu (Islamic pawn contract) at either:

- 916 pawnshop – Blk 824 Tampines Street 81, #01-20 Singapore 520824 (with 1% safekeeping fee)

- ValueMax – 1 Joo Chiat Road #01-1023 Joo Chiat Complex, 420001 (with 1.5% safekeeping fee)

Holding gold bullion is beneficial for your asset management strategy as it offers you the option of obtaining a non-interest loan via Ar-Rahnu. Even though Ar-Rahnu will only provide 70% of the value of the item pawned, as opposed to the 90% offered by conventional pawnbrokers, the lower value means you will be able to repay the loan faster and only pay a 1% safe keeping fee.

Isn’t there arbitrage if you sell your gold bullion and then buy the gold in Hugo?

For those unfamiliar with finance, an arbitrage opportunity exists when an investment asset is mispriced. In this instance, it may be true, and for illustrative purposes, I’ll use 10g of gold as an illustration:

The price of 10 grammes of gold when you sold it at MoneyMax was approximately S$450, or S$45 per gram.

With the S$450 proceeds, you can deposit them into your Hugosave account and purchase Hugo’s gold, priced at S$40 per gram.

In other words, because S$450 can buy approximately 11 grammes of gold, you would earn an additional 1 gramme of gold from this arrangement.

Is HugoSave shariah compliant?

Unfortunately, Hugosave does not have a shariah advisor to endorse for its shariah compliance. Unlike our neighbouring country, which has both Ar-Rahnu and a Hugosave equivalent (HelloGold), with the latter having Amanie Advisors as their Shariah advisor, Hugosave Gold does not currently have any form of Shariah-compliant endorsement.

So, if you are shariah-conscious and prefer to engage with only things marked “halal”, HelloGold is your best option. However, while Hello-Gold is available for Singaporeans to download and register, you would find it difficult to transfer money to the HelloGold account despite the various methods available for Singaporeans, such as cash, GrabPay wallet, and Touch ‘n Go eWallet.

But if you view the Hugosave app as a neutral tech solution that enables you to trade gold and manage your finances easily, the only shariah concern that requires scrutiny is the gold purchase and delivery arrangement. All in all, it will need to satisfy the following conditions:

The price must be paid or transferred to the seller’s account immediately.

Following the transaction, the seller must immediately deliver the gold/silver to the buyer or the person they have authorised to receive it on their behalf. However, the seller (as a trustee) may retain the gold as long as:

- with the buyer’s agreement;

- the status of the gold/silver belonging to the buyer remains;

- the gold/silver is not used without the buyer’s permission;

- the gold/silver’s amount/weight does not change (either increases or decreases);

- and the buyer has the option to either take the gold/silver whenever they want or order the party that sold the gold/silver to sell their gold/silver on their behalf whenever they want.

Alternative ways of buying gold

As far as I know, there are four other ways you can buy gold :

- Physical (pawn shops, UOB bars, bullion stores, etc.)

- Paper (e.g.: OCBC’s Precious Metals account)

- Exchange Traded Commodities: Royal Mint Precious Metals (RMAU) and ishares Physical Gold, (IGLN)

- Gold mining companies

- Unit trusts focused on precious metals: Deutsche Precious Noor Metals

Option 2, paper gold, is not permissible as there is no actual gold being owned by the buyer and you are actually just riding on the price movements.

Physical gold: Hard to gauge the performance of your gold as there are different premiums from each pawn shop when you sell your gold bar.

Exchange Traded Commodities (RMAU and IGLN) is an alternative. The former is down -4.01% YTD, and the latter is down by -10.04% YTD (Refinitiv Data)

Gold mining companies will require you to screen first the stock in question, you can do this either through the CGS-CIMB securities iCash trading app or other screening tools like Musaffa or Islamicly.

The mutual fund focused on precious metals is quite volatile, as shared by a financial advisor so you have to be prepared for this.

In essence, you won’t expect gold to be a superstar except when a pandemic/recession/turmoil occurs, e.g., Covid-19. Thus it’s called a safe haven asset.

Conclusion on Hugosave

Despite being barely older than a year, the Hugosave app has already achieved a number of important benchmarks, the most notable of which was receiving a Major Payment Institution License from the Monetary Authority of Singapore in April 2022.

If you give the app a try and ease into it, I think you’ll enjoy it as much as I do as the number of users grows and Hugosave continues adding new features.

Do use the referral link here to support IFSG initiatives, click here!

Writer:

Muhammad Ridhwaan Radzi, CSAA (Linkedin)

Ridhwaan found his passion for Islamic finance at the school where he graduated from – Madrasah Aljunied Al-Islamiah. He is currently a business undergraduate in NTU and the Managing Director at Islamic Finance Singapore (IFSG). While in the university, he has taken three qualifications: IFQ by CISI. ACIFE in Financial Analysis by Ethica institute and CSAA by AAOIFI.

Zul hakim Jumat, CSAA (Linkedin)

Zul Hakim is a certified Shariah advisor and auditor under AAOFI. He received his bachelor’s degree (Hons) in Jurisprudence and Principles of Jurisprudence while minoring in Economics from Kuwait University (2015) and his MSc (Hons) in Islamic Finance from Hamad Bin Khalifa University (2018). Currently, he is a researcher at the Center for Islamic Economics and Finance, Qatar Foundation, and a PhD candidate in the Islamic finance and economy program at Hamad Bin Khalifa University, Qatar. In addition, he is the deputy managing director at Islamic Finance Singapore (IFSG).