Sarwa, A Shariah-Compliant Robo-advisor Alternative to Wahed and How To Reduce Remittance Fees

TLDR:

- Wahed invest remittance fees remain a stumbling block despite the app’s superb features.

- Sarwa is a viable alternative to those on Wahed’s waiting list and just starting out in investing.

- Don’t remit USD to Sarwa, but rather, AED using Wise (previously Transferwise)

- Use Wise for a more cost effective option to remitting money!

If you were to invest in a single stock, say, Tesla, the performance of your investment would be tied to that single stock. Sure, your returns may be high, but a company’s single issue could bring the share price down.

Ideally, you would want to invest in not just a single stock but multiple stocks so that you are well diversified. When one sector, for example, financials are hit, another industry, for example, consumer staples, can help stabilise the value of your investments.

In addition, when you focus on the US economy alone, you also invest in one single market. Thus if the US economy faces any issue, your investments might be affected since you are only diversified on a sectorial basis.

Ideally, you would also want to invest in different markets to capture growth opportunities.

While there are other technical reasons besides investing in different stocks or markets, not all investors have the time to do their research or capital to invest in various stocks across different markets. That’s where Robo-advisors come in.

What is a Robo-Advisor?

Ever sat with a financial planner to talk about investments? Well, a Robo-advisor, as the name implies, is the automated version of a financial advisor. It will first determine your risk profile based on a scale of whether you are a conservative or an adventurous investor.

Then the Robo-advisor will present a list of investments for you that already combines:

A theory in finance called modern portfolio theory

Different markets for you to invest in (developed and emerging markets)

An allocation of your investments in other asset classes (sukuks, equities, gold and cash etc.)

So in a sense, it takes out the guesswork and time for you to start investing while ensuring that your investments are well diversified and can weather different economic circumstances.

What type of investor are Robo-advisors for?

For those starting out in investing:

If you just started investing, then Robo-advisors can make it very easy for you to begin since the minimum investment can be as low as US$100.

Besides that, you can also determine the frequency of your deposits, whether monthly/quarterly/semi-annually/annually.

Looking for low platform fees

The fees are also reasonable at around 0.2% to 0.99% compared to a mutual fund which can reach up to 4%.

But these fees are on top of each of your fund fees, so for example, if you were to invest in an exchange-traded fund (basically a basket of stock that tracks an index), your fees might be 0.25% to 0.5% thus on the higher end, your total fees could reach 1.4% (0.99% + 0.5%) annually.

Looking for a fuss-free way to track your investments

There are multiple brokerage houses and investment opportunities out there but doing it your own may not inculcate proper diversification on a portfolio level.

That’s where Robo-advisors come in, instead of buying each ETF on the market, you are buying a basket of investments which include ETFs, sukuks and gold.

You can also set different goals for different portfolios such as emergency funds, education fund while also being given an overarching view of how your investment portfolios are performing.

In summary, investing through a Robo-advisor is ideal for those looking for an efficient and disciplined manner to invest.

When isn’t Robo-advisor a good option?

Disagree with the pre-allocated portfolio:

As mentioned, Robo-advisors have a pre-allocated investment portfolio based on your risk profile.

So you might want to go for a customised allocation of your investments instead. While some Robo-advisors allow you to do this like Wahed, some don’t have this feature.

You already invested in the funds inside the Robo-advisor:

With the advent of brokers that offer affordable and accessible investing, such as Tiger brokers and Moomoo, investors now have other means of investing in stocks and exchange-traded funds (ETFs).

So if you want to lower your fees or do yourself investing, these brokers are for you.

You want to invest in other asset classes:

Have you seen our 12-investments article here (part two coming soon)? Some of the investments are not available in such Robo-advisors, For example, private equity funds and crowdfunding.

In fact, it would be hard for Robo-advisors to offer these investments as well since they have to go through regulatory bodies. So for other asset classes, you’ll have to DIY for now.

All in all, while offering you an efficient way to invest and start out, a Robo-advisor does have its limitations since the more you know of investments, the more alternatives you can tap on.

How can a Robo Advisor be shariah compliant?

DBS Digiportfolio, StashAway, Endowus, Syfe etc. These are the Robo-advisors you see popping up in MRT adverts and on your browser for Singaporeans. But are they Shariah-compliant? The simple answer is no, but some do offer Shariah-compliant funds.

For example, Syfe and Endowus has one shariah compliant fund you can access through their platforms: Franklin Templeton Investment Funds (FTIF) Shariah Global Equity Fund.

In addition, Syfe now also allows you to trade US ETFs and stocks through its Syfe Trade app.

To be a fully Shariah-compliant Robo-advisor, these Robo-advisors have to include a shariah committee or advisor overseeing the operations of the Robo-advisor.

This role entails purifying the investments of tainted income and ensuring the Robo-advisor only offers Shariah-compliant funds.

That’s why Wahed invest has a shariah advisor in the form of Shariah Review Bureau. While the platform fees are a little expensive, they ensure that your investment returns and growth are fully halal.

What happened to Wahed Invest in Singapore?

Unfortunately, Wahed is not serving Singaporean investors for now. Early users of its app can be deemed lucky as those on the waiting list will stay there for a while more as Wahed ramps up its efforts to capture market share in Malaysia and Indonesia.

Fortunately, they will still try to serve pockets of investors in Muslim minority countries like Singapore, as indicated by the Senior Vice President of Business Operations, Mr Syakir Hashim, in our interview with them here.

What are the funds you are investing through the Wahed app?

Wahed offers multiple fund allocations based on your risk profile and goals. Based on information from Wahed personnel, international investors will have access to the funds below along with their tickers and descriptions in Bloomberg:

-

Ishares MSCI World Islamic UCITs ETF (ISDW):

iShares MSCI World Islamic UCITS ETF is an exchange-traded fund incorporated in Ireland. The MSCI World Islamic Index offers exposure to stocks from the MSCI World Index, which comply with Shariah investment principles.

-

Wahed FTSE Nasdaq ETF (HLAL):

Wahed FTSE USA Shariah ETF is an exchange-traded fund incorporated in the USA. It seeks to track the FTSE USA Shariah Index’s total return performance before fees and expenses. The Index is constructed using an objective, rules-based methodology that begins with an initial universe that mirrors the companies listed in the FTSE USA Index, which comprises large and mid-cap US Stocks.

-

HSBC Islamic Equity Index (HSBCGLE):

HSBC Islamic Global Equity Index Fund is an open-end investment fund incorporated in Luxembourg. The Fund’s objective is to track the performance of an equity market index representative of the top 100 global Islamic-compliant companies. The companies will conform to strict Islamic principals as interpreted and laid down by the Shariah Supervisor Committee.

-

iShares MSCI Emerging Market UCITS ETF (ISDE):

iShares MSCI EM Islamic UCITS ETF is an exchange-traded fund incorporated in Ireland. The Fund aims to track the performance of MSCI Emerging Markets Islamic Index which complies with Shariah investment principles.

-

Franklin Templeton Global sukuk (FTGSAAS):

Franklin Global Sukuk Fund is an open-end fund incorporated in Luxembourg. The Fund aims to maximize, consistent with prudent investment management, total return through income and capital apreciation. The fund invests in fixed and floating Shariah-compliant securities and short-term instru ments issued by governments and corporates in developed and developing countries

-

Royal Mint Physical Gold ETC Securities (RMAU):

The Royal Mint Physical Gold ETC is an open-ended, UCITS eligible Exchange Traded Commodity incorporated in Ireland. It is designed to track the Gold price, less fees, allowing investors to invest in the precious metals market. It is backed by physical allocated LBMA gold bars.

-

Emirates NBD SICAV – Emirates Global Sukuk Fund (EGSKAUA):

Emirates NBD SICAV – Emirates Global Sukuk Fund is an open-end fund incorporated in Luxembourg. The Fund is a Shari’a compliant sub-fund that will invest in a diversified portfolio of unsecured asset-based Sukuks both in the MENA region and globally. The Fund aims to achieve high income as well as capital growth.

-

SC Global Real Estate Equities (SCREITD LX):

The Fund aims to invest directly, in accordance with the Shariah Investment Guidelines, in equities of companies listed on stock exchanges, equity related securities of selected real estate investment trusts (REITs), real estate operating companies (REOCs) and other entities whose primary business is to own, operate, develop and manage real estate assets, with no restriction on where such real property assets may be located.

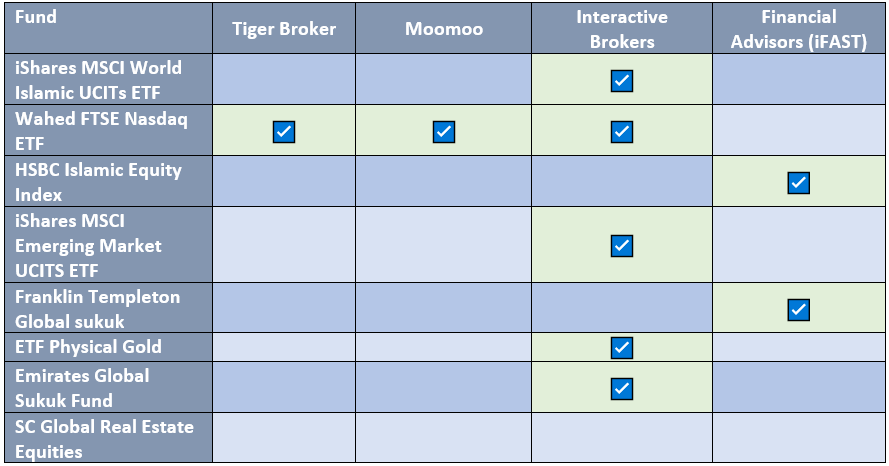

If you are an intermediate investor, you would realise that some of these investments are available in your brokerage accounts and through your financial advisors. Here’s a table to indicate where they can be accessed:

So yes, the funds are limited compared to conventional Robo-advisors, but it does provide adequate diversification.

And if you are serious about ensuring your returns are Shariah-compliant, then Wahed and the alternative Robo-advisor we will share soon is a viable option for you.

How much is the remittance fees for Wahed Invest?

If you are an existing Wahed user, you would realise how expensive it is to transfer funds since they request you transfer your funds to a Mauritius bank. If you do it through banks, your fees might range from S$20 to S$40.

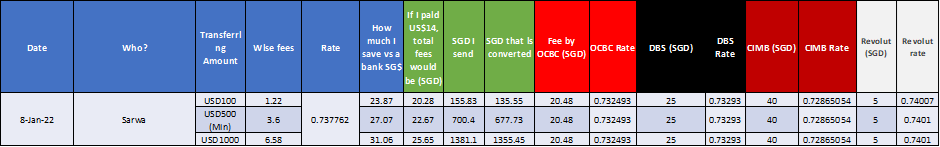

Fortunately, newer remittance players have emerged, namely: Wise and Revolut.

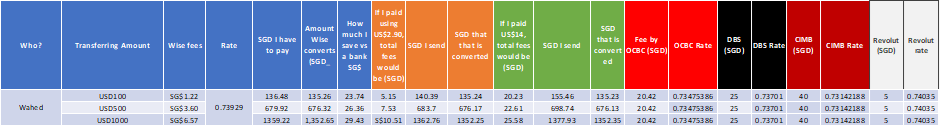

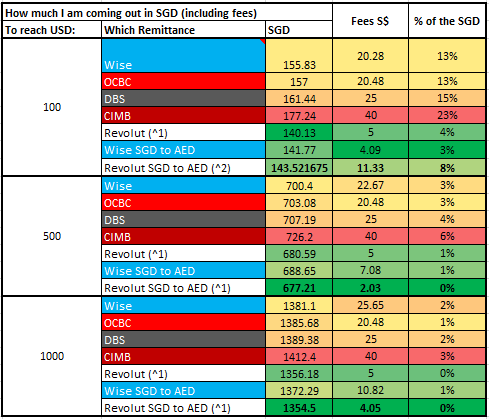

Here are the fee comparisons:

From the table above, banks such as OCBC, DBS and CIMB offered a fixed remittance fee of S$20 to S$40. Additionally, their exchange rates are marginally lower when converting SGD to USD, thus giving you lesser USD for your S$1.

On the other hand, Wise offers cheaper fees for different amounts remitted, but because it uses SWIFT (How banks communicate with each other) and must go through intermediary banks, thus the higher fees in total.

Revolut charges a fixed S$5 for the range of values remitted (USD100 – USD1000), and the rates offered are nearly interbank rates; thus, you get more US dollars for every S$1.

But before you go with Revolut, keep in mind that it doesn’t reveal bank intermediary fees unlike Wise. Here’s an excerpt from its FAQ:

“Heads up, when your money is in transit, an intermediary or recipient bank might deduct a fee, so the amount received might be less than the amount you sent.”

Meaning, while their fees are lower, the final amount the recipient gets is much lesser than intended due to intermediary bank deductions which Revolut doesn’t disclose.

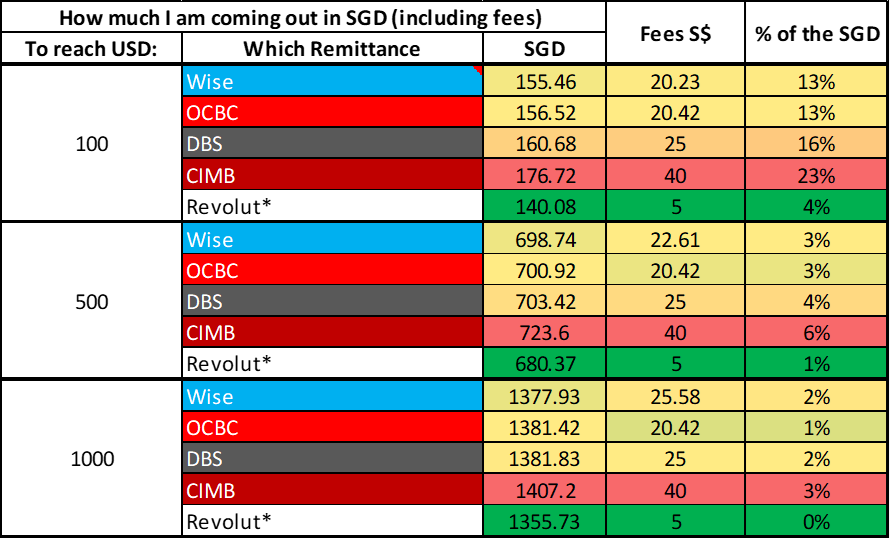

Here’s a summary of how much you are transferring for different amounts of USD:

With the colour coded, you will find that Revolut in green converts more (After fees have been included) SGD to USD, thereby giving you more savings. But again, it hasn’t included bank intermediary (or inter-bank) fees so the actual cost may be higher.

How to make the overseas transfer from Singapore to Mauritius?

All five options (DBS, CIMB, OCBC, Revolut and Wise), provides the option to transfer your funds to Wahed’s Mauritius bank.

If you are an existing investor in Wahed then here are the details Wahed will send you through email, we have added certain details you might need for some of these remittance players:

- Beneficiary’s Name: WAHED SECURITIES LTD

- Beneficiary’s Account Number: 000446410101

- IBAN Number: MU68MCBL0944000446410101000USD

- Beneficiary Bank: The Mauritius Commercial Bank Ltd.

- Swift Code: MCBLMUMU

- Bank’s Address: Sir William Newton Street, Port-Louis, Republic of Mauritius

- Country: Mauritius (There’s a difference between this country and Mauritania!)

- Beneficiary Address: Suite 1909, 19th Floor, Citadelle Mall, Dr Eugene Laurent Street, Port-Louis, Mauritius

- Postal code: 0000 (Mauritius does not use postal codes)

- Email Address: globalsupport@wahedinvest.com

- Phone Number: +1 (765) 212-3831

While the remittance fees are very substantial at S$20 when accumulated over time, the nearest alternative being the lump sum transfer (S$1000 or above), withdrawal fees also apply, amounting to S$30 or more.

This is not charged by Wahed but rather by the banks in between.

So effectively, you are paying a substantial sum in bank fees unless a Robo-advisor in Singapore offers a suite of fully Shariah-compliant portfolios. Is there an alternative then?

Alternative to Wahed Robo-advisor: Sarwa

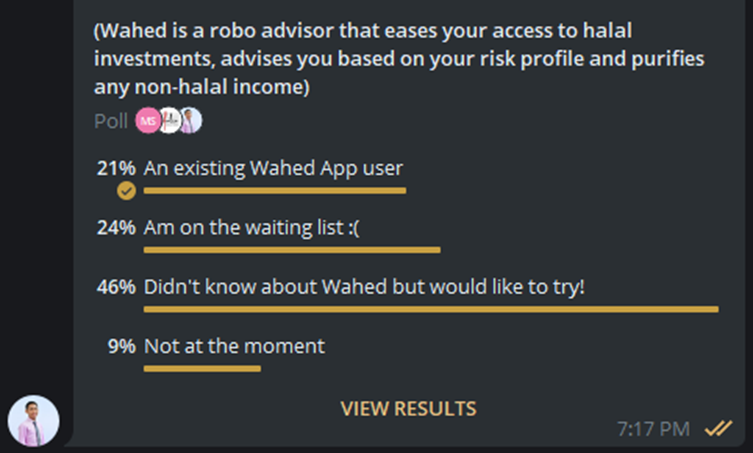

When we surveyed Wahed on our Telegram channel, nearly a quarter mentioned they were on Wahed’s waiting list.

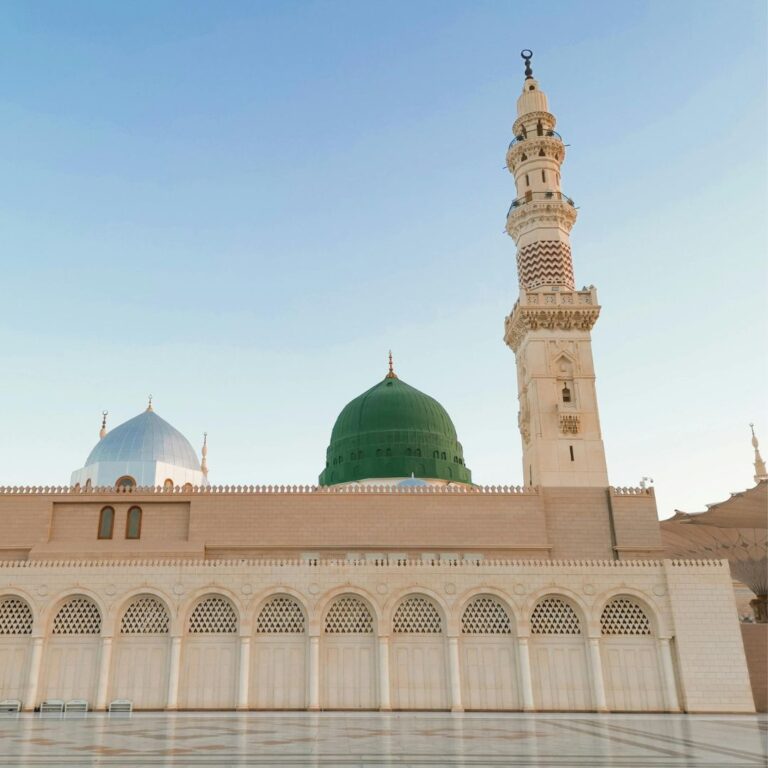

If the fees above didn’t dent your search for a Robo-advisor then allow us to Introduce Sarwa, a Robo-advisor based in the UAE and awarded the first innovation license by the Dubai International Financial Centre (DIFC).

Although they are not fully Islamic as compared to Wahed, they offer five different portfolios:

- Conventional

- Halal

- Crypto

- Socially Responsible

- Socially responsible & Cryptos

This article will only focus on the Halal portfolio to provide an alternative investment option for Singaporean Muslims.

Although Sarwa is a Robo-advisor, they also offer personalised financial advisors on-demand and a trading platform. Additionally, they are strong proponents of passive investing; therefore, your investments are geared towards ETFs, Sukuks and Gold.

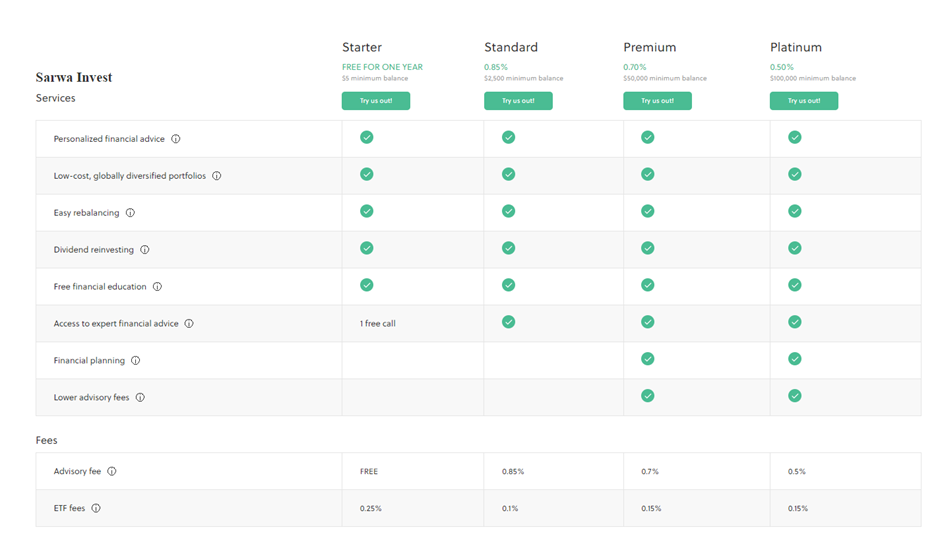

What is the Sarwa fee structure?

With as little as US$500 to start making your money work, starters get 0% platform fees for one year. Different platform fees range from 0.85% to 0.5%, depending on your investment amount.

In addition, the fund fees you invest in range from 0.07% to 0.15%, bringing your total fees to the higher end of 1%+. Here are the different price tiers:

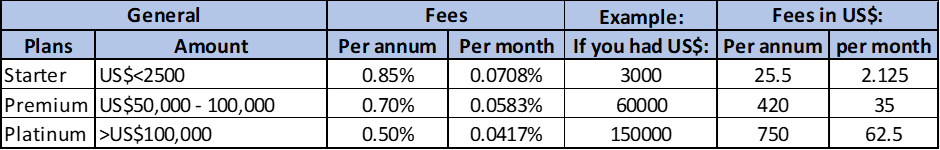

How much are the Sarwa fees?

Based on the table above and after the first year 0% platform fees have passed, you will be charged monthly based on how much of your holdings are in Sarwa.

For example, if you have US$2500 inside, you’ll be charged 0.07% monthly (from 0.85%/12) or US$1.75 (from 2500 * 0.07%).

You might think that this sounds expensive, but 0.85% is way lower than the 3 to 4% your mutual funds charge.

Here’s a table indicating how much you can expect to be charged based on the Sarwa website:

What are the funds you are investing in Sarwa?

Suppose you compare the halal portfolio in Sarwa with their four other different portfolios offered.

You’ll discover that the halal portfolio only offers five asset classes instead of six and seven asset classes of their other portfolios.

These Shariah-compliant investments include:

-

iShares MSCI USA Islamic UCITS ETF USD (ISDU):

iShares MSCI USA Islamic UCITS ETF is an exchange traded fund incorporated in Ireland. The Fund aims to track the performance of the MSCI USA Islamic Index. The MSCI USA Islamic Index offers exposure to stocks from the MSCI USA Index which comply with Shariah investment principles.

-

iShares MSCI World Islamic UCITS ETF USD (ISDW):

iShares MSCI World Islamic UCITS ETF is an exchange-traded fund incorporated in Ireland. The MSCI World Islamic Index offers exposure to stocks from the MSCI World Index which comply with Shariah investment principles.

-

iShares Physical Gold ETC Fund (IGLN):

iShares Physical Gold ETC is a UCITS eligible exchange-traded commodity incorporated in Ireland. The ETC seeks to track the day-to-day movement of the price of gold, less fees, by holding gold bullion. The gold bullion backs the securities issued and is valued daily at the London PM fixed price. The gold bullion is held as allocated gold bars with the custodian.

-

iShares MSCI EM Islamic UCITS ETF USD (ISDE):

iShares MSCI EM Islamic UCITS ETF is an exchange-traded fund incorporated in Ireland. The Fund aims to track the performance of MSCI Emerging Markets Islamic Index, which complies with Shariah investment principles.

-

Franklin Global Sukuk Fund (FTGSWQD.MFU):

Franklin Global Sukuk Fund is an open-end fund incorporated in Luxembourg. The Fund aims to maximize, consistent with prudent investment management, total return through income and capital appreciation. The fund invests in fixed and floating Shariah-compliant securities and short-term instruments issued by governments and corporates in developed and developing countries

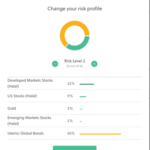

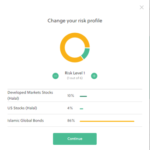

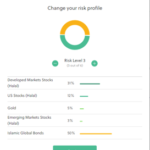

As Robo-advisors normally do, Sarwa will first determine the ideal allocation based on your risk profile, which you can then change adjust later on.

Although the funds offered are not as extensive, it provides sufficient diversification for investors while lowering their fees to a minimum.

How to reduce remittance fees for Sarwa?

Sarwa is based in the United Arab Emirates; the currency is in AED but don’t worry as your investments will be in USD.

Sarwa also allows you to transfer funds in AED, and they will automatically convert it for you into USD with a predetermined exchange rate of 3.6797 that is better than what the banks in the UAE offer.

Since Sarwa offers two ways to remit the money, we’ll compare the remittance fees similar to what we did with Wahed (SGD ➡ USD).

Then we will investigate whether sending SGD ➡ AED ➡ USD is better.

As you can see, Wise actually charges meagre fees from S$1.22 to S$6.58, but again, due to the Swift and interbank charges, the amount matches the remittance fees by banks OCBC, DBS and CIMB.

On the other hand, Wise rates when exchanging SGD to USD are marginally better than the banks. Revolut, due to its fixed S$5 fees and better exchange rates, is definitely the best option for now (we haven’t added the intermediary bank fees).

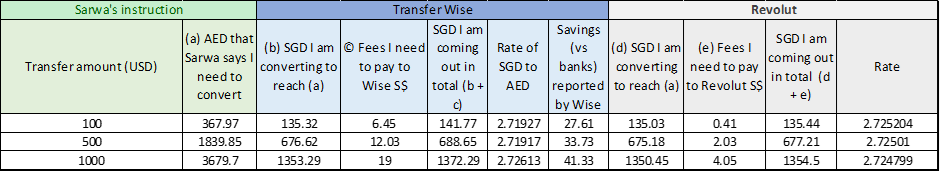

What if we used the SGD ➡ AED ➡ USD route by leaving the exchange rate from AED to USD for Sarwa?

Since bank remittances have been proven to be expensive although fixed, we’ll only be focusing on Wise and Revolut. Here’s our comparison table:

Sarwa on its app will indicate how much AED you need to convert to USD; thus, by using that amount, we can then dictate in both Revolut and Wise the AED we want to remit.

On the fees charged by both players, Revolut again edges out by offering a cost-effective option to sending in AED.

The same can also be said on the exchange rate offered by Revolut.

But is the SGD ➡ AED ➡ USD a better option than the simply SGD ➡ USD remittance?

Here’s our comparison table with colour codes where we total the SGD (including fees) you will have to send to the remittance players:

While Revolut fees may be lower than Wise, the latter actually indicates clearly the fees you should expect to incur from the intermediary banks thus charging you upfront so that the recipient gets the intended amount.

Regarding the Revolut fees, we discovered that you’ll be charged US$8.08 or S$10.92 for a US$100.55 transfer, bringing the total fees to S$11.33.

This US$8.08 (or 8% of US$100) will be deducted from the US$100, thus showing US$92.47 on your Sarwa account. The fee will probably decrease in percentage as you transfer more than US$500.

So just based on the table, here is what you should use to transfer lump sum or recurring:

- US$100: Wise SGD ➡ AED

- US$500: Wise SGD ➡ AED (Assuming the inter-bank fees in Revolut will still be higher)

- US$1000: Wise SGD ➡ AED (Assuming the inter-bank fees in Revolut will still be higher)

- > US$1000: OCBC, since the fees are fixed and lowest.

You should still do your own fee comparison to factor in exchange rate fluctuations.

If you intend to transfer US$500 or US$1000 using the Revolut app, Please do inform us so we can update the fees we estimated.

In summary, while the Revolut app offers lower fees than Wise, not disclosing the bank fees ultimately eats up on the intended transfer amount.

With other emerging Robo-advisors and investment options available internationally, Muslims in Singapore have a viable avenue to reduce their initial capital outlay and transfer much more conveniently.

Here’s our guide to making a Sarwa account and remitting your money through Wise:

Do use our referral link so both you and us can be rewarded:

Referral link: You will also get US$50!

Wise referral link: Get discounts on your transfer!

Can Sarwa be trusted?

When you first access the Sarwa website, you’ll find them featured in Forbes, World Economic Forum and CNN.

Despite being founded in 2017, this Robo-advisor has been granted the first innovation license by the Dubai International Financial Center and is regulated by the Dubai Financial Services Authority.

The team boasts experienced finance and tech professionals while their advisors include stellar names in their respective fields.

On whether your investments are safe, yes, since Sarwa is simply an intermediary that channels funds to the respective funds, big players in the finance industry, namely, Blackrock and Vanguard.

And while the market conditions may cause your investments to underperform, diversification will help to smoothen out these shocks.

How much does it cost to withdraw from Sarwa?

An area that we haven’t tried, but as depositing includes fees, there will also be fees to withdraw, not by Sarwa but by your receiving banks.

This is similar to those who invested in Wahed and wanted to withdraw; the bank charges can amount to S$20, thus eating up your investment returns or the amount you deposited.

While Wise may provide a more cost-effective option, investors can be comforted by the US$50 reward Sarwa offers for those who join through the referral link.

In a sense, if such fees are ever to be charged, you still keep your investment returns since the charges will only affect your S$50 reward.

How long does it take to withdraw from Sarwa?

Based on the FAQ shared by Sarwa, the Robo-advisor will need up to 7 business days to liquidate your shares before transferring them to your account.

You can also specify the number of shares you want to liquidate and withdraw.

Since bank remittances also take up to 3 business days to complete, expect your withdrawn amount to reach your bank account in 10 days from the day you decided to withdraw.

Can you lose money on Sarwa?

As with all investments, the performance of your portfolio will ultimately result in whether you make a return or a loss.

But that’s the aspect of investing; when you invest, you also accept the risk that your investments can fall and grow, but over time and based on history, investing will consistently grow your money.

Wahed’s new UMMA fund would also probably be included in the existing portfolio bringing the number of funds to 9.

While there exist more complex products out there that go against the paradox of “high risk, high returns”, suffice to say, for conservative retail investors, the option to choose a reflective risk profile also exists where more of your allocation will be towards Sukuk and gold.

How does Sarwa compare to Wahed?

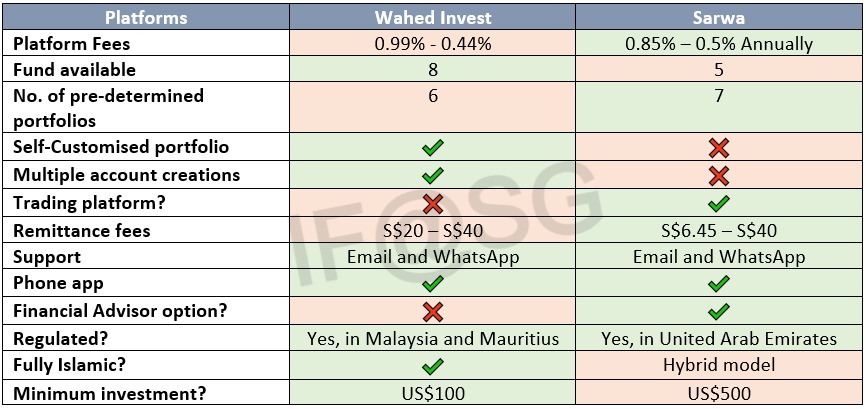

While the two are drastically different, we figured that a comparison would be interesting since Wahed’s remittance fees seem to be a stumbling block for existing investors, would Sarwa be an alternative?

Here’s the comparison table:

We can observe that while Sarwa’s fees are lower, Wahed does offer more features on its app such as customizing your own portfolio and creating multiple accounts with specified portfolio allocations.

Investors may also question why Wahed Invest chose to be regulated in Mauritius instead.

On the other hand, Sarwa, despite its lower fees, has lesser fund options. The minimum investment of US$500 may also cause some hesitation among would-be investors.

Still, with remittance fees significantly lower than Wahed’s and the choice to use its trading platform, it’s a viable alternative for those on the waiting list or looking for Wahed’s alternative.

Which Robo-advisor should you pick?

Given a choice, Wahed definitely offers features you would want in a Robo-advisor: setting seperate funds for different life goals. They also offer more funds with some of it not easily accessible to the Singaporean investor.

But as long as the remittance fees remain high and investors can access it, then Sarwa is simply the viable option for those keen on starting. The other alternative include opening your own brokerage accounts or looking for other asset classes.

Here’s our guide to opening a brokerage with Tiger Brokers.

How do I choose a Robo advisor?

As mentioned earlier, there are several Robo-advisors in Singapore but until they do offer a shariah compliant portfolio, then Sarwa, Wahed and other investment alternatives that are shariah compliant remain the default choice.

Here are some questions you may want to ask yourself when a Robo-advisor does come up:

- Do they have a reputable shariah advisor supervising their operations?

- What are the funds available?

- How much is the minimum investment?

- Is there a remittance fee, and if so, how much?

- Can you self-customise your portfolio?

- How much are the platform fees?

- How much are the fund fees?

- How easy is it to withdraw my funds?

- Are there charges to withdrawing my funds?

- Are there charges to rebalancing my portfolio?

- Are there sound and reputable investors of this Robo-advisor?

- Is the Robo-advisor platform regulated?

- What makes each of their portfolio different?

- How long does a withdrawal take?

If you have further tips, please do share it in the comments!

Final verdict and review on Sarwa

While the investment options are lesser for the Islamic portfolio in Sarwa, it is definitely a viable alternative for Wahed’s waiting list investors and those just starting out on investing.

It also provides a disciplined manner of diversified investing where you can deposit money based on your desired frequency, e.g., monthly or quarterly.

Conversely, those who know how to access investments through brokers can further reduce their fees and choose which ETF or investment may fit their investment portfolio.

All in all, Singaporean Muslims now have another avenue for investing to complement their whole portfolio.

If you decide to invest through Sarwa, then here’s our guide for you, do click on the referral link so we can both be rewarded $50:

Referral link: You will also get US$50!

Wise referral link: Get discounts on your transfer!

Update:

What’s the best way to withdraw from Sarwa?

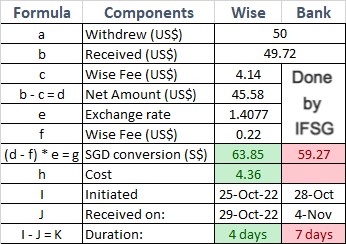

Using US$50 as an example, we found that withdrawing your funds to your Wise account is the best option. Here’s the comparison:

Lower fees with Wise!

Wise Payments has reduced its fees for transfers to the UAE! Thus you can break even faster!

2024 Update on Wahed

We reported it here in January 2024 and Wahed has just officially announced it on 28 February – You can now open a Wahed account by downloading it from the:

App Store (https://apps.apple.com/us/app/wahed/id1440724971)

Play Store (https://play.google.com/store/apps/details?id=com.wahed.mobile&hl=en&gl=US&pli=1)

There are six funds you can invest in through the app, and based on your answers to their risk questionnaire, you’ll be allotted a pre-defined allocation of the following funds :

1. Wahed FTSE USA Shariah ETF – HLAL (US Focused)

2. Wahed Dow Jones Islamic World ETF – UMMA (Global Mandate)

3. Emirates Sukuk Fund (Sukuk)

4. Franklin Global Sukuk Fund W(Qdis) USD (Sukuk)

5. Royal Mint Physical Gold ETC (Gold)

6. SP Funds S&P Global REIT Sharia (REITs)

Min Investment: US$500

The Pros:

+ Fully Halal Portfolios

+ Purification done by them

+ User friendly app

+ You can track your portfolio easily

+ They will be adding new funds – Property fund coming up

The Cons:

– 0.99% a year in annual fees

– Fees above does not include the fund’s fees

– Remittance fees are seperate

– SWIFT fees are seperate

Our view:

Since our last article on Wahed here (https://islamicfinancesg.com/sarwa_vs_wahed/), the robo-advisory has removed the following funds: HSBC Islamic Equity Index, iShares MSCI Emerging Market ETF and SC Global Real Estate Equities. While the remittance is to a USD account in Dubai, it also means you will have to pay both remittance fees and SWIFT Fees (the latter may not be apparent and you might have to add a bit extra just so that you meet the USD500 minimum requirement) and thus affects your breakeven point.

Wahed opening up to Singaporean investors after a nearly three year hiatus will be good for new & beginner investors looking for a fully halal user friendly investment companion but it also comes at a time when there are more DIY and diverse halal investment options.

Investors looking to start should open a cost effective remittance option such as Wise/Revolut to reduce the fees when transferring funds abroad (Our guide can be found here (https://islamicfinancesg.com/sarwa_vs_wahed/)).

Writer:

Muhammad Ridhwaan Radzi (CSAA)

Ridhwaan found his passion for Islamic finance at the school where he graduated from – Madrasah Aljunied Al-Islamiah – after taking an Islamic Finance Qualification offered by Chartered Institute of Securities and Investments (CISI), UK. Following that, he has taken the ACIFE in Financial Analysis by Ethica institute and is also a certified Shariah advisor & auditor under AAOIFI. He is currently a business undergraduate in NTU and the Managing Director at Islamic Finance Singapore (IFSG).