Shariah-Compliant Stock Guide

When it comes to food and beverages, Muslims would look for the halal (lawful for Muslims) logo or inspect the ingredients. Similarly, in investing, it is only natural for Muslims to be cautious in selecting which stocks fit with their halal principles. Unlike in food and beverages, where determining “halalness” is relatively simple, choosing halal (i.e., shariah-compliant) stocks is more complex and requires a degree of technical expertise. Therefore, over the years, Shariah (Islamic jurisprudence) scholars have laid out a specific methodology to determine if a stock is shariah-compliant for investing.

This methodology has been accepted globally, and it can be adopted by any investor, regardless of their religion, who is conscious of how their investments may affect the environment and society. And with the introduction of CGS-CIMB’s iCash trading account, investing in shariah-compliant stocks is now much easier and only a few clicks away.

Is investing in stock Halal or Haram?

In general, the shariah principle ruling on matters related to commerce is lawfu unless there is an unlawful (i.e., haram/non-halal) element involved. Therefore, when it comes to investing in stocks, one needs to look out for the unlawful elements. This is because companies nowadays, according to shariah compliancy, are either:

- Companies whose both business and financial operations are permissible.

- Companies whose both business and financial operations are impermissible.

- Companies which business nature is permissible but are involved with a degree of impermissible business dealings and financial operations.

The companies in the third category are the majority that shape the stock market. Very few existing companies are free of Shariah-non-compliant business activities and financial operations due to their debt profile and cash management. Thus, two sets of screening processes are developed to assess these companies’ shariah compliance in the global market: (1) business activities and sector (qualitative) screening and (2) financial (quantitative) screening.

The shariah-compliant stock screening process

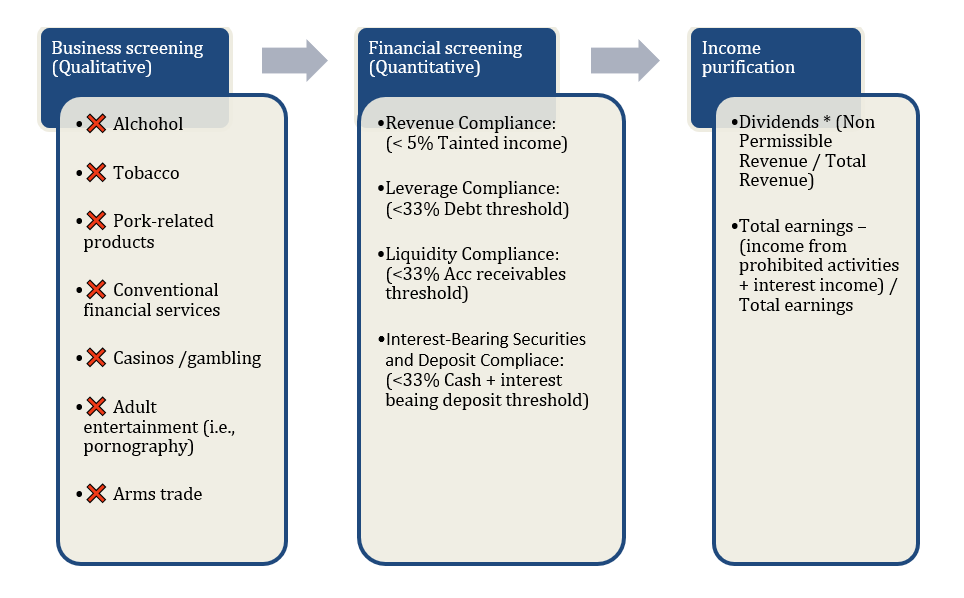

Significant efforts have been made to develop a set of screening methodologies and criteria to determine a stock’s Shariah compliance status. In summary, there are three sets of screening methodologies, as illustrated in the figure below.

The business screening is the first screening set applied to any stock/company. It is a qualitative screening that examines the company’s business sector to ensure that it operates in specific business areas that is permissible in Shariah.

Following that comes the financial screening. This second screening stage is an additional tool used to screen out companies with an unacceptable degree of conventional debt, interest-bearing investment, liquidity assets, and/or impure revenue. Below are the brief reasons behind each financial screening threshold:

Revenue compliance:

Because a fully Shariah-compliant company is rare in the market, and most do not operate entirely in a shariah-prescribed manner, Shariah scholars have allowed a small percentage of impermissible income if the core nature of the business is Shariah compliant. They based their position on the tenet of “what is independently impermissible is permissible when done together with permissible acts”, and “the majority has the ruling of the whole or the majority counts”.

Leverage and liquidity compliance:

From the Shariah perspective, all liquid assets, either cash or debt must be traded at par value. However, trading at par value is impractical in the current market since the market price of a stock fluctuates, resulting in the price not necessarily representing the book value of cash and debts but the forecasted cash flow, thus the expectation price value. As a result, in the current market, it is almost impossible to trade based on the company’s par value. To address this issue, Sharia scholars set a reasonable limit on the proportion of cash and receivables to total assets or market capitalisation.

Interest-bearing securities and deposits compliance:

Dealing with interest, whether by giving or receiving interest-based debt, is against the Shariah principles. This includes interest-based deposits or interest-based securities such as government and corporate bonds. Again, in response to public needs, Shariah scholars have established thresholds indicating the extent to which it is permissible. This threshold serves to reduce investment in interest-bearing deposits or securities, thereby reducing interest income.

Lastly, the final stage of the screening process is income purification. While the financial threshold ratios have permitted Muslims to invest in companies with mixed (lawful and unlawful) business and financial activities, they are still prohibited from benefiting from the unlawful portion of income earned. Thus, the unlawful portion earned by investors is recommended to be given to charity.

Why are there multiple shariah-screening methods?

One may wonder why multiple screening methodologies exist when the religious text rulings are derived from the same source. One of the reasons is the geographical differences in where these shariah screening methodologies originate. For example, the Securities Commission is based in Malaysia, while AAOIFI is based in the Middle East, FTSE is in the UK, and the rest are in the US. In addition, these differences are attributed to the different individuals who make up the Shariah Board members who are responsible for formulating stocks’ compliance assessment criteria. In other words, various organisations with different Shariah members may have different opinions on the screening criteria.

Nonetheless, a fund manager or investor can leverage any of the six screening methodologies, considering the differences in industries and financial ratios. The table below shows the differences between the screening methodologies.

Introducing CGS-CIMB iCash Trading Account

With the advancement of the modern Islamic finance market, you will be pleased to know that CGS-CIMB has launched its fully shariah-compliant brokerage service in Singapore. Only a few clicks away, investors are now able to determine whether a stock is shariah-compliant or non-compliant. As the name suggests, iCash requires a cash deposit or uses your bank’s PayNow function to execute a trade.

Maintaining the Shariah compliance of the Islamic trading account are the Shariah Advisors and Executive team of CGS-CIMB. The former is Prof Aznan Hassan, a global Shariah Advisor based in Malaysia who is consulted widely for his expertise in Shariah matters related to finance and the economy. The day-to-day operations of the Islamic trading account are maintained by a team of executives who are well versed in Shariah and finance. Furthermore, CGS-CIMB has also engaged Refinitiv Eikon, a global screening provider used by corporations worldwide, to determine both the Shariah compliance and ESG score of the listed stocks. This is definitely a step in the right direction as scholars all over the world are trying to integrate both Shariah and ESG screening into one cohesive screening methodology.

Through CGS-CIMB Singapore’s first ever Islamic Trading account, retail investors can now tap into Singapore, Hong Kong and US stocks. These stocks are available in the Singapore Exchange (SGX), Hong Kong Exchange (HKEX), NASDAQ (technology stocks), NYSE (the world’s largest equities exchange) and AMEX (Younger and entrepreneurial companies and traded at a much smaller volume).

There are also plans to offer other exchanges as CGS-CIMB has access to 33 exchanges worldwide. The next potential exchanges accessible for iCash Trading Account holders are the Malaysian Bursa exchange and the Indonesian exchange so open your trading account today as the process is simple with Singpass and can be done in less than five minutes!

What is an Islamic trading account?

There are multiple brokerages in Singapore market. However, none are geared towards halal investing nor have an end-to-end Shariah-compliant brokerage service, which an Islamic trading account offers.

In brief, an Islamic trading account allows investors to trade shariah-compliant stocks with indications of whether the stock they trade is compliant. Moreover, it excludes all non-halal options, as with conventional trading accounts. This includes margin trading, shorting, and generating interest on your cash balances. Most importantly, a Shariah Advisor reviews and monitors whether the brokerage service complies with Shariah principles. The executives in the brokerage service must also be well-versed in Shariah in order to uphold the Islamic principles of the trading account on a day-to-day basis.

What halal investments can you make with the CGS-CIMB iCASH Islamic Trading account?

Besides individual halal stocks, you can also invest in halal Real Estate Investment Trusts (REITs) for dividends, such as SPH REIT or Parkway Life REIT.

Investors looking to diversify can consider leveraging Mutual Funds or Exchange Traded Funds (ETFs), a basket of stocks packaged into a fund and tradeable on the exchange, such as:

- Wahed FTSE USA Shariah ETF (HLAL)

- SP Funds S&P 500 Sharia Industry Exclusions ETF (SPUS)

- SP Funds Dow Jones Global Sukuk ETF (SPSK)

- SP Funds S&P Global Reit Sharia ETF (SPRE)

- Wahed Dow Jones Islamic World ETF (UMMA)

In the future, when more exchanges are made accessible through the CGS-CIMB iCash, retail investors will also be able to invest in Sukuks and warrants that are Shariah-compliant.

Fees: How much commission will I incur?

While mobile trading platforms are enticing investors with low commissions for their brokerage services, how does CGS-CIMB compete?

The commissions for CGS-CIMB’s trade execution service is relatively on the premium side at 0.18% or a minimum of S$18. However, CGS-CIMB is currently running a promotion at a special rate of 0.09% for all five exchanges until 30th September 2022. During this period, you can tap on their advanced charting models, fundamental analysis, in-house research, and the latest data available on the stock. Moreover, you get to enjoy the premium suite of services offered by CGS-CIMB.

Further information on the iCash trading account can be found here:

New retail investors should be aware of other fees and charges such as:

- Clearing fee for Singapore stocks: 0.0325% of the trading value

- SGX trading fee: 0.0075%

- SGX settlement fee: S$0.35

- GST: 7% of the total commissions, clearing, SGX trading fee and SGX settlement fee

How much should I minimally invest?

This is subjective to the investor’s financial situation. It is always advisable to consult your financial advisor to find out how much you can set aside and how much you should optimally invest without causing financial distress. Nonetheless, the rule of thumb is that the earlier you invest, the better.

Factors to look out for before investing

Before investing in a stock, it is important to have an in-depth understanding and grasp of the current and short-term macroeconomic situation. While macroeconomics should not be the basis for investing, it can tell investors which portion of their investment portfolio (e.g., mutual funds, ETFs, value stocks, growth stocks) to focus on during an economic phase and what actions you should take to move forward.

The four stages of an economic cycle are expansion, peak, contraction, and trough. Some stocks will perform better at different stages of the economic cycle. For instance, growth stocks generally perform better in a supportive economic expansion environment due to expansionary monetary policies implemented vis-a-vis during an economic contraction where high inflation and rising interest rates prevail. To identify which economic cycle we may potentially be in, it is essential to know what statistics to look out for. Below are several areas to look at to get a better understanding of which economic cycle we are in.

1. Leading Indicators

-

Yield Curve

A graphical representation of the yields of similar bonds across different maturities. Characteristically, the natural shape of a yield curve should be upward sloping. A yield curve inversion based on a two-to-10-year treasury yield spread reflects expectations of higher short-term interest rates than long-term interest rates, which can be further inferred that interest rates may be increasing in the near future to cool down the economy.

-

United States ISM Purchasing Managers Index (PMI)

Based on five survey areas with more than 400 companies in 19 key industries (new orders, inventory levels, production, supplier deliveries, and employment). PMI data is released monthly by the Institute for Supply Management (ISM). A PMI reading above 50 indicates an economic expansion, while a PMI reading under 50 often suggests an economic contraction.

2. Lagging Indicators

-

Consumer Price Index (CPI)

The CPI measures the monthly changes in prices paid by U.S consumers over time based on a representative basket of goods and services. A high inflation rate may indicate a possible economic downturn in the near future, while a low inflation rate indicates possible economic expansion.

-

Personal Consumption Expenditure (PCE)

Like the CPI, PCE measures the price changes in goods and services. The PCE price index is weighted by data acquired through business surveys, while CPI data is aggregated and acquired via consumer surveys. PCE price index also accounts for substitution effects while CPI data does not – and hence, a more comprehensive measure of inflation.

-

Unemployment Rate

A percentage of people in the labour force that is unemployed and or seeking employment. The natural unemployment rate, or full employment of a healthy economy, should fluctuate between 4% – 5%. If the unemployment rate increases beyond the natural unemployment rate, it may indicate a possible recession.

3. Company

Apart from market supply and demand, a company’s intrinsic value and share price are driven by its financial performance and how the business can ride on secular tailwinds while withstanding cyclical headwinds. Below are several factors that determine the strength of a company’s financial position:

-

Revenue Growth

To ensure that the business generates year-on-year growth while maintaining its position in the industry. Lack of revenue growth may indicate that the management cannot capture market share or optimise their assets to generate revenue.

-

Profit Margins

To ensure that there are thick margins to sustain through economic downturns. Particularly in the event of an economic contraction where companies with thin margins may potentially incur huge losses.

-

Bottom Line Growth

To ensure that the business is profitable and sustainable in the long run to avoid solvency.

-

Earnings Per Share (EPS)

Indicates how much profit a company generates for each outstanding share. By evaluating EPS, you can compare a company’s past performance with its current performance. It is also important to ensure that EPS is positive and growing year-on-year.

-

Current Ratio

A liquidity ratio derived by dividing current assets over current liabilities to determine a company’s ability to pay for short-term obligations (those within a year). A liquidity ratio above the nominal value of 1 indicates that the company is in good financial health, while a liquidity ratio below the nominal value of 1 indicates that the company is unable to pay off its short-term liabilities with its current liquid assets. Another alternative to the current ratio is the quick ratio, which it gives a more conservative outlook on the company’s liquidity as it excludes less liquid assets such as inventories.

-

Return On Equity (ROE)

ROE can be derived by dividing net income over average shareholder’s equity. ROE indicates management’s ability to generate a return for each dollar of common equity invested.

In conclusion, investors must always perform their due diligence before investing in a stock or company. Investing should not be perceived as a method to make quick returns, and if active investing is not what you want to spend time on, diversified funds are also available to consider. Ultimately, the key to creating a sustainable portfolio is to stay invested and diversified for the long run!

This article is for information purposes only. The information contained herein does not constitute an offer, recommendation, or solicitation to buy or sell any security or other financial instrument or enter any transaction. All capital market products contain risks and may not be suitable for everyone. Please refer to the Risk Disclosure Statement in the General Terms and Conditions of CGS-CIMB Securities (Singapore) Pte. Ltd. (Co. Reg 198701621D) for more details. None of CGS-CIMB and its respective directors, employees, officers and representatives shall be liable in any manner whatsoever for any consequences (including but not limited to any direct, indirect or consequential losses, loss of profits and damages) of any reliance on the information contained in this article.

Footnotes:

[1] AAOIFI Shariah Standards page 563.

[2] Dow Jones Islamic Market Indices Methodology page 30.

[3] S&P Shariah indices methodology.

[4] MSCI Islamic Index Series Methodology May 2019.

[5] FTSE Global Equity Shariah Index Series v3.8, March 2021 page 9.

Writers & editor:

Muhammad Ridhwaan Radzi (CSAA)

Ridhwaan found his passion for Islamic finance at the school where he graduated from – Madrasah Aljunied Al-Islamiah – after taking an Islamic Finance Qualification offered by Chartered Institute of Securities and Investments (CISI), UK. Following that, he has taken the ACIFE in Financial Analysis by Ethica institute and is also a certified Shariah advisor & auditor under AAOIFI. He is currently a business undergraduate in NTU and the Managing Director at Islamic Finance Singapore (IFSG).

Kok Wei Luo

Kok Wei Luo, currently an undergraduate (year 2) in SIM-University of London for BSc (HONS) in Banking and Finance. His overall academic performance was among the highest in the world awarded by London School of Economics. He is passionate about the financial market and investing.

Editor:

Zul Hakim Jumat (CSAA)

Zul Hakim is a certified Shariah advisor and auditor under AAOFI. He received his bachelor’s degree (Hons) in Jurisprudence and Principles of Jurisprudence while minoring in Economics from Kuwait University (2015) and his MSc (Hons) in Islamic Finance from Hamad Bin Khalifa University (2018). Currently, he is a researcher at the Center for Islamic Economics and Finance, Qatar Foundation, and a Phd candidate in the Islamic finance and economy program, Hamad Bin Khalifa University, Qatar. In addition, he is the deputy managing director at Islamic Finance Singapore (IFSG)