Shariah Investment Policies

We have heard a lot about Muslim insurance advisors advising clients to invest in a unit trust to the point of even channeling unsuspecting Asatizah, who have little knowledge of Islamic Finance to “endorse” their initiative. I was also once approached by a non-Muslim financial consultant from Great Eastern who suggested investing in tech funds that were, according to them, “Muslim-friendly”.

The truth is that there is no fully Shariah-compliant insurance in Singapore. If there was, it would have been called takaful or Islamic insurance. The closest would be the investment-linked policy (ILPs), which underlying funds are either NTUC Takaful Fund or Franklin Templeton Investment Funds (FTIF) Templeton Shariah funds attached. Despite that, some insurance groups and financial consultants (FC), who are unable to offer these funds, still market their products as “Muslim-friendly”.

Disclaimer:

This article is intended to educate the Singapore Muslim masses as well as the insurance advisors on what is required for a fund to be recognised as Shariah-compliant and hence “Muslim-friendly”.

The “Shariah-Compliant” Fund

1. The Conversion Process

Let’s look at how a unit trust, aka a mutual fund, can be Shariah-compliant. From my experience working in Amanie Advisors, if a conventional fund were to be converted to an Islamic fund, it would need to go through multiple levels of evaluation:

·

-

Deep diving into the prospectus such that it does not contain non-prohibited terms such as guarantee, interest, finance income, etc

-

Reviewing the current assets of the fund and converting it into fully Shariah compliant securities.

-

A clear guideline in the prospectus that confirms the fund would only invest in securities (stocks or bonds) that are Shariah-compliant and available in an Islamic index.

-

A section clarifying what will happen when a security is deemed non-compliant.

-

Given the endorsement of Amanie Advisors or any other Shariah advisors that the fund is Shariah-compliant.

That is just a summary of the heavy lifting needed to be done by the Shariah advisors. Fast forward to when the fund is launched and the set monitoring takes place, the fund manager will then send a list of the securities it is holding to the fund Shariah advisor for annual auditing.

2. The Monitoring Process

The Shariah advisor then checks that all the constituents (stocks of the fund) are available in the index before giving the Shariah endorsement. Well, that’s in a good day, but what if the fund consists of securities that are non-compliant or not available in the index?

3. Non-Compliant Stock Detected

This is the beauty of Islam. Shariah scholars provide concessions for funds containing non-compliant security to hold that security until it reaches the investment cost. Say the stock was bought at $100 net; if the security is currently priced at $90, the fund can hold on to it until it reaches $100. Not having this concession would have made Shariah-compliant funds lose out since they will have to sell off any holdings that are non-compliant.

This also goes for retail investors. If you have invested in a stock that is currently non-compliant, you have two options. The first option is to wait until your security has reached its investment cost, inclusive of the dividends you receive. The other alternative option is to sell the security and take what is rightfully yours.

4. Off-Benchmark Screening

How about if the index did not contain a security that the fund manager wants to include?

The Shariah advisor will then conduct a security screening based on the index methodology of the subscription fund. For example, suppose the fund is benchmarked against MSCI Shariah World Index. In that case, the Shariah advisor will use the thresholds of that index to screen the security. This is after doing the necessary business screening on the security such as the business activity and its subsidiaries to ensure it is not involved in non-compliant activities.

Also, as funds are able to invest in initial public offerings, the Shariah advisor will be given the prospectus of the security and screen it according to the subscribed index or other indices should the fund mandate allow.

Once the necessary non-compliant issues of particular security have been highlighted and addressed accordingly by the Shariah advisor, it will then be inserted into the fund.

Now Let’s Contrast This To A “Muslim-Friendly” Fund

The often-touted fund being Muslim-friendly is the FTIF Technology Fund, despite not going through the necessary screening processes like other Shariah-compliant funds, such as the FTIF Shariah Global Equity Fund or FTIF Shariah Global Sukuk Fund.

Nonetheless, let us analyse how Muslim-friendly is the FTIF Technology Fund. Below are the top 10 holdings of the FTIF Technology Fund.

Since the top ten list holdings are available for public viewing, let us check whether they are available in the Shariah-compliant indices:

As you can see above, Amazon and PayPal are non-compliant. While a fund can choose more than one methodology to screen its securities, it generally follows one method. Surprisingly, the MSCI Shariah world does not contain any of the securities in the top ten holdings, even though it has 609 constituents as of June 2021. Even MSCI Shariah Global Equity uses this benchmark, and its constituents are different.

While this may be the wrong method to screen for Shariah-compliant securities since the FTIF Technology fund was not intended to be Shariah-compliant based on any six indices (table 1). However, it is the easiest way to know if a fund is even close to being Shariah-compliant or Muslim-friendly. Besides FTIF Technology Fund touted as Muslim friendly, below are other funds claimed to be “Muslim-friendly” plus their Bloomberg (BBG) tickers:

So are any of the eight funds possibly Shariah compliant? We partnered with Five Pillars to determine their Shariah compliance using proprietary methods involving the Bloomberg terminal. Here are our findings:

First of all, funds do not usually list their entire holdings, such as FTIF Templeton funds. Still, with a specific BBG formula on an excel sheet, this is possible, although not all the time.

Secondly, we used the 33% as an established threshold in the industry and have considered the minor differences in each benchmark. The established threshold is based on a hadith on estate planning, which we will cover in our upcoming article.

Through BBG data, we extracted the percentage of compliant companies by screening their Shariah business compliance and their Shariah financial compliance on four components: leverage, cash holdings, non-compliant income, and receivables.

Note that even with BBG data, we were not able to extract the data of some securities, thus the “insufficient data” portion. There is also a portion that is “likely compliant”; hence if you sum up the percentages, you would not get the full 100% score.

The alternative method is to sift through the annual reports of each security in the fund, identifying their business activity followed by extracting the financials to conduct the financial screening. Through this laborious process, there is a possibility that a higher percentage of the fund constituents would be Shariah-compliant.

On top of the fund constituents not being fully Shariah-compliant as per the Shariah filters, these funds do not have Shariah advisors nor Shariah board as a governance mechanism to endorse and ensure the Shariah compliancy of the fund.

Other Issues of A Non-Compliant Fund

When you look at the Net Asset Value of the FTIF Technology fund, $10.08 billion, you will realise that 1.24% of that pile consisting of cash. This may not be significant at first. However, 1.24% of %10.08 billion is a significant amount when it is placed in interest-bearing accounts. Of course, funds hold this amount to buy securities in the future, but the interest is still present and can be used by the fund. In contrast, Shariah-compliant funds deposit their cash in Islamic accounts that do not produce interest.

In Islam, interest, however small, is prohibited clearly such that it is the only prohibition that leads to a war with God and his messenger.

What if the constituents also have financial income that needs to be purified? Wouldn’t the meagre amount from the cash holdings be sizeable?

How then could a fund be termed “Muslim-friendly” when it contradicts Shariah principles so clearly?

Would a Muslim be comfortable with a war against his own God and His Messenger?

Would the Muslim financial consultant who labelled the fund “Muslim-friendly” be comfortable handling the burden of selling a non-Shariah-compliant product?

These are just some of the important questions a financial consultant needs to engage in when it comes to selling funds that are non-compliant when Shariah-compliant alternatives exist.

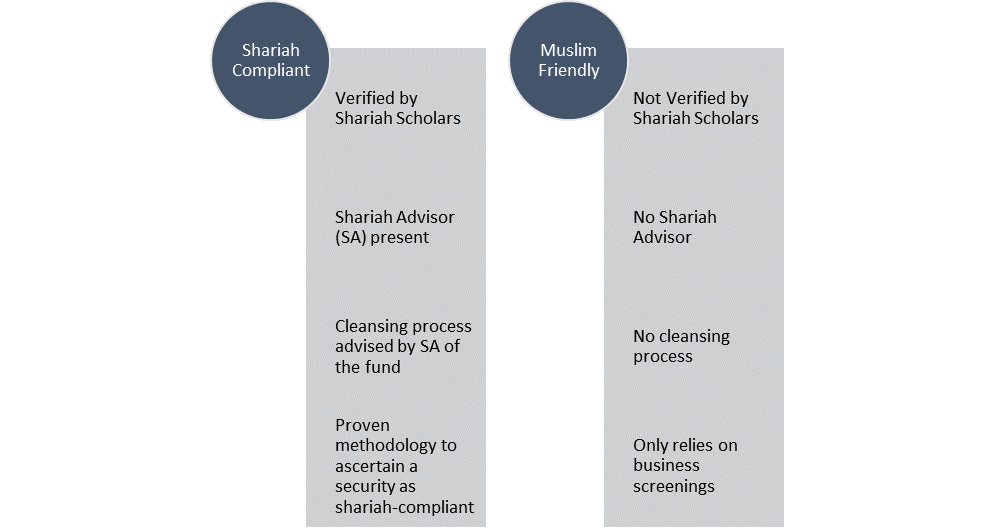

What’s The Difference Between Shariah Compliant And Muslim-Friendly?

Mr Sani Hamid, Head of the Financial Alliance Islamic Wealth Advisory (FAiWA) unit, mentioned in a call with us that usage of the Muslim-friendly term is better suited for other industries. For example, the hotel industry uses the Muslim-friendly label to indicate that their facilities cater to Muslims needs, such as a dedicated prayer hall or a halal menu option. But can it be applied to the finance industry?

The apparent answer is a straight no since it is clear what fund is or is not Shariah-compliant from the get-go. Scholars took five years to formulate the fatwa for the Dow Jones Islamic Market Index methodology in 1999. Even in this fatwa, we could see the concessions being made.

The concern here is labelling a fund as “Muslim friendly” that could mislead the Muslims on the street into thinking it is alright for them to invest. Furthermore, engaging asatizah, who have a strong social media following but a limited knowledge of Islamic finance, could send a wrong signal that the fund offered is permissible for Muslims to invest.

Can We Still Sell These Funds To Muslim Clients?

We often hear the Islamic legal maxim “necessity allows the unlawful.” However, when there are alternatives funds that are fully Shariah-compliant, can we still use necessity as justification?

The same scenario can be applied to our food consumption. Should we consume from stalls that label themselves as “no pork, no lard” when there are halal-certified options in the market?

All in all, when Shariah-compliant funds were not available in the early days, numerous financial advisors took in their stride to sift through the holdings of available funds. They laboriously screen each constituent to determine its Shariah compliance. But when the Shariah-compliant funds entered into the Singapore market, they quickly switched their client’s investments to these funds.

But back to the question, can we offer these funds to Muslims since most of our insurance company does not offer Shariah-compliant funds? To answer that, the financial consultant must answer these questions:

-

Does the financial consultant help to purify the returns such that it is now free of any tainted income?

-

How does the financial consultant ascertain the amount of purification needed?

-

How frequent is the purification done?

For example, the Wahed FTSE Nasdaq ETF, which has a supervisory board, declares dividends that are have been purified of any tainted income. This can happen because their Shariah board, Shariah Review Bureau (SRB), has full information of the fund holdings and transactions.

But, what if the client still prefers non-compliant securities compared to the Shariah-compliant alternatives? Mr Sani Hamid shared two points of view:

-

You may decline as you are uncomfortable handling non-compliant investments. In this scenario you effectively “lose” the client.

-

You accommodate to the clients request but more so as a means to keep the client. In this way, you get to engage with him/her, in hopes that one day, by providing ongoing education and awareness, he/she would accept Shariah-compliant investments.

Shariah Compliant Unit Trusts/ILP Sub-Funds

While we note that a solution for this matter requires substantial work from different stakeholders, but what we can do to support the situation is to is compile all Shariah-compliant available funds and list them accordingly. This list can be shared with financial consultants and their directors for their consideration to offer these funds. It can also be a reference point for Singaporean Muslims to make an informed decision regarding their finances.

A Call For Solutions

Now we know that most of the funds available in the market are non-Shariah-compliant. Is there a possibility that a fund out there could be unknowingly compliant? Yes, FAiWA’s Montreaux Health Care Fund is one example.

Then could a fund director decide one day to make a fund compliant? Yes, but very unlikely. However, we are working on a solution for that.

This solution involves us as consumers to create significant demand for the fund management companies to consider offering Shariah-compliant solutions.

We believe that through education and raising awareness on Islamic finance matters via information platforms and sharing sessions may soon unify our voices for a truly “Muslim-friendly” financial solution.

References

[1] AAOIFI Shariah Standards page 563.

[2] Dow Jones Islamic Market Indices Methodology page 30.

[3] S&P Shariah indices methodology.

[4] MSCI Islamic Index Series Methodology May 2019.

[5] FTSE Global Equity Shariah Index Series v3.8, March 2021 page 9.

[6] They are Dr Ahmad Shahbari, Prof Dr Asmak Bte Ab.Rahman and Dr Azrul Bin Iskandar. Dr Yusuf bin Ramli replaces Dr Azrul in the Equity fund

Ridhwaan found his passion for Islamic finance at the school where he graduated from – Madrasah Aljunied Al-Islamiah – after taking an Islamic Finance Qualification offered by Chartered Institute of Securities and Investments (CISI), UK. He is currently a business undergraduate in NTU and the Pro Tem Committee Chair at Islamic Finance @ Singapore.

Zul Hakim is a researcher for the Center of Islamic Economics and Finance (CIEF), and a PhD candidate in Islamic Finance and Economy at the College of Islamic Studies, Hamad Bin Khalifa University. Before joining CIEF, he was a research editor with the Dow Jones Risk & Compliance team that focuses on Sanction Ownership Research.