Turaths & Todays: Zakat in Practice

(Class #4, Summary of the class)

What is Zakat?

Literally, Zakat means purification. In Islamic tradition, Zakat is not only a religious obligation but also a spiritual means to purify one’s wealth from anything that may hinder the blessings of Allah. As mentioned in the Qur’an:

يَمْحَقُ اللَّهُ الرِّبَا وَيُرْبِي الصَّدَقَاتِ

‘“Allah destroys interest (riba) and increases charity (sadaqah).” [1]

Zakat covers both tangible and intangible aspects. What we earn today is not limited to material wealth — it includes blessings such as health, Iman (faith), marriage, and other forms of divine favour. Therefore, Zakat is a way to attain comprehensive blessings, not just a matter of financial giving.

As the third pillar of Islam, Zakat is a core component of Islamic identity. Interestingly, the words Zakat and Salah (prayer) are mentioned together 28 times in the Qur’an, reflecting their deep connection and spiritual significance. Being a Muslim is not only about belief in Allah, but also about embodying Islamic values through action and community engagement.

Zakat creates a communal space between the servant of Allah and His creation. It teaches social responsibility: when we are in a good economic state, we are encouraged to help uplift others to the same standard.

In today’s context, Zakat also serves as a lesson in financial discipline and literacy. By actively calculating and giving Zakat — not just paying it — a person learns how to manage wealth wisely. This financial awareness is particularly beneficial when preparing for other obligations like Hajj.

Furthermore, Zakat is calculated based on total wealth, not just profit or income. It emphasises holistic accountability and promotes ethical and balanced economic behaviour in the Muslim community.

Beneficiaries of Zakat

Zakat is not merely a financial obligation but a profound act of worship with specific wisdom and purpose. Allah has clearly designated the categories of zakat recipients, so Zakat must be distributed accordingly, not randomly. The Zakat rate is fixed at 2.5% and must be paid when a person’s total wealth reaches the Nisab threshold, demonstrating obedience to Allah’s commands.

Functions of Zakat for the Payer (Muzakki):

- Spiritual Awareness: Paying Zakat shows our obedience to Allah and gratitude for the blessings He has given. It elevates our understanding that all wealth is a trust from Allah and encourages us to seek His blessings through obedience.

- Fostering Compassion: Zakat encourages muzakki to empathise with the less fortunate by engaging directly with zakat distribution, helping them understand the struggles of the poor beyond just fulfilling a duty.

Active participation in Zakat distribution allows us to witness the real impact of zakat on society. Zakat plays a critical role in poverty alleviation and helps increase access to basic needs, thus improving the welfare of recipients.

Functions of Zakat for the Beneficiaries (Mustahik):

- Poverty Alleviation: Zakat helps poor families meet their basic needs and sustain their livelihoods.

- Increasing Disposable Income: Proper zakat distribution raises the spending power of the needy, contributing to economic upliftment.

- Free Access to Basic Necessities: Such as food, clothing, and shelter.

- Reducing Social Resentment: Zakat fosters social cohesion by eliminating feelings of envy and hostility.

Functions of Zakat for Society:

Zakat reduces income inequality, improves social services, and builds social trust and harmony. Historically, when zakat was properly distributed poverty was nearly eradicated. For example, when the Prophet Muhammad ﷺ sent Muadz bin Jabal to Yemen to teach Islam (include Syahadah, Shalah, and also Zakat), Muadz returned reporting that Zakat had been distributed so evenly that there was no one left to receive it.

Who Are the Zakat Beneficiaries?

According to Islamic law and the Shafi’i school of thought, Zakat recipients include (8 Ashnaf):

- Fakir: Those who have less than half of their basic living needs.

- Miskin: Those who have more than the fakir but still insufficient to meet their needs.

- Amil: Those entrusted to collect and distribute zakat responsibly.

- Muallaf: New Muslims, given zakat to support their Islamic education and strengthening their faith.

- Gharimin: People burdened with debt who need help to become financially stable.

- Riqab: Historically slaves; today, it refers to those trapped in modern forms of bondage, such as overwhelming educational debt.

- Fi sabilillah: Originally for military purposes to defend Islam; now includes building mosques and paying religious workers such as Imam.

- Ibn as-Sabil: Travellers who have run out of funds and need assistance to return home.

Definitions of Fakir and Miskin in the Shafi’i School: [2]

- Fakir: Has less than half of the basic needs. For example, needs $100 daily but only has $30.

- Miskin: Has more than fakir but still less than needed, e.g., has $60-$70 when needing $100.

Zakat plays a vital role in maintaining social and economic balance within the community. By paying zakat correctly and participating in its distribution, we not only fulfil a religious duty but also help build a just, prosperous, and harmonious society.

How Zakat is Different

The purpose of Zakat goes beyond merely supporting places of worship, which is often the focus in other religions. Instead, Zakat serves several broader goals: purifying wealth, reducing social inequality, and meeting the socio-economic needs of designated eligible beneficiaries.

Furthermore, the recipients of Zakat are explicitly defined by Allah and categorised into the eight specified groups (Ashnaf). In contrast, charity in other religions is generally intended for the poor and needy or for religious institutions without such specific classifications.

The collection and distribution of Zakat is typically managed by official Islamic authorities or trusted organisations—for example, MUIS (Majlis Ugama Islam Singapura) in Singapore—ensuring transparency and accountability. On the other hand, charitable giving in many other religions is usually informal and carried out independently by individuals.

Zakat is commonly distributed during Ramadan for convenience, though the timing is flexible. Meanwhile, other religions may not have a fixed schedule for charity or often give during particular festivals, such as the Hungry Ghost Festival, Deepavali, or other religious observances.

Type of Zakat

There are two types of Zakat: Zakat al-Fitr and Zakat on Wealth.

Firstly, Zakat Al-Fitr is a specific type of zakat that is due at the end of Ramadan, before the Eid al-Fitr prayer. It is also known as Zakat al-Abdan, which means it serves to purify ourselves spiritually—considering that our senses may have committed sins throughout the year. The primary purpose of Zakat al-Fitr is to help those in need participate in the Eid celebration, ensuring that even the poor can experience the joy of Eid without worry. This reflects Islam’s emphasis on communal well-being and social solidarity.

The amount of Zakat al-Fitr is generally fixed at 2.3 kilograms of staple food or its monetary equivalent. Local Islamic authorities usually determine the exact amount based on the prevailing cost of basic food items. The recipients are the poor and needy, who receive this zakat on the morning of Eid.

Regarding the question of whether one can pay zakat outside the country where they reside—for example, living in Singapore but paying zakat elsewhere—Islamic guidance encourages that zakat be paid locally. This is supported by the Quranic verse:

“…so that it will not become a fortune circulated only among the rich among you.”[3]

Therefore, it is recommended to pay Zakat in the country where one earns and holds wealth so that its benefits reach the needy in that community.

Secondly, Zakat on Wealth applies to various forms of assets including:

- Cash and liquid savings (such as cash in hand, savings accounts, current accounts, foreign currency accounts, time deposits, and structured deposits)

- Gold and silver (including bars, coins, and jewellery)

- Investment assets (stocks, shares, ETFs, unit trusts, REITs)

- Business merchandise

- Agricultural produce

- Livestock

Among these, the most relevant for the Singapore community are cash/liquid savings, gold and silver, and investment assets.

Conditions for Zakat on Wealth

- Muslim status: Zakat is obligatory only for Muslims.

- Nisab threshold: The wealth must reach the Nisab, the minimum amount that obligates zakat payment. This is based on the value of 85-86 grams of pure gold (approximately SGD 10,358 in Singapore, can be varying by location).

- Haul (holding period): The wealth must be held for a full lunar year (about 355 days) before zakat becomes due.

- Complete ownership: The person must have full ownership rights, including authority, access, and disposal rights over the wealth, either actual or constructive possession.

Special Cases in Singapore

- Zakat on CPF (Central Provident Fund) savings in Singapore: According to the MUIS Fatwa Committee, zakat on CPF lump sums is payable one year after receiving the funds if the Nisab is met, due to the need for access after retirement and recent CPF law amendments. Monthly CPF payouts under the Minimum Sum Scheme are not Zakatable as they do not fulfil the haul condition.

Zakat on Cash and Liquid Savings

- Calculation process: MUIS adopts the lowest balance method when determining Zakat liability for both single and multiple accounts over the lunar year (haul). If at any point the balance falls below the Nisab or if the Nisab is not maintained continuously for a full lunar year, Zakat is not due — even if the balance later exceeds the Nisab. This principle applies even when combining multiple accounts. Please see the illustrations through the tables below:

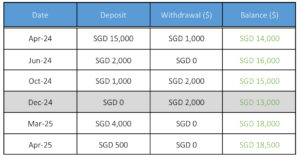

Table 1. Single Account on Cash and Liquid Savings (No liability to pay Zakat)

Assuming the Nisab is: SGD 9,000

- Explanation table 1: In April 2024, a person deposits $10,000. Assuming the Nisab is $9,000, this qualifies. In October 2024, the person withdraws $6,000, reducing the balance below the Nisab ($6,000). Although it increases back to $9,000 in March 2025 and even more in April to $9,500, no Zakat is liable for this year because:

- The lowest balance during the year fell below the Nisab.

- The Nisab threshold was not maintained or observed for the entire lunar year (Haul).

Table 2. Single Account on Cash and Liquid Savings (Liable to pay Zakat)

Assuming the Nisab is: SGD 9,000

- Explanation table 2: The table shows the monthly deposits, withdrawals, and resulting balances in a single cash and liquid savings account over the period from April 2024 to April 2025. The Zakat calculation is based on the lowest balance during the lunar year, provided it is above the Nisab threshold (the minimum amount of wealth a Muslim must have before being liable to pay zakat).

- Key Observations: In December 2024, another withdrawal of SGD 2,000 lowers the balance to SGD 13,000, which is the lowest balance during the lunar year.

- Zakat calculation: Lowest balance above Nisab: SGD 13,000 (we use this balance because the calculation of Zakat on cash/liquid savings in Singapore is based on the lowest balance that remained above the Nisab throughout the lunar year).

- Zakatable Amount: SGD 13,000 x 2.5% (or 1/40) = SGD 325

This means SGD 325 is due as Zakat for the lunar year ending around April 2025.

Note on Multiple Accounts:

As mentioned before, the same principle applies to individuals with multiple cash and liquid savings accounts. When calculating Zakat, all account balances should be combined and assessed collectively. If at any point during the lunar year the combined total falls below the Nisab or if the Nisab is not consistently maintained for the full lunar year, then no Zakat is due, even if the combined balance later exceeds the Nisab. Conversely, if the lowest combined balance throughout the year remains above the Nisab, then Zakat is due based on that lowest balance.

For example:

If I have savings in both Account A and Account B, their totals must be added together. Zakat is only due if the combined amount stays above the Nisab for the full lunar year.

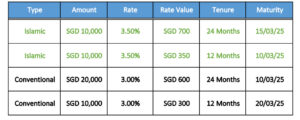

Time Deposits and Structured Deposits

- For time deposits and structured deposits, Zakat is due at the end of maturity.

- Profit received upfront from Islamic profits is calculated within the savings account.

- End-of-maturity profits from Islamic profits are calculated with the total amount at maturity.

- Conventional interest must be disposed of in charity, not as Zakat. Please see the illustration in the table below:

Table 3. Calculation process

Assuming the Nisab is: SGD 9,000

- Explanation table 3: Zakat is payable only at the end of the deposit maturity period.

This means Zakat is calculated once the deposit has fully matured. - Islamic Profit (from Sharia deposits):

- If profit is received upfront, it is treated as part of the savings account balance and zakat is calculated accordingly on the savings account.

- Zakat is calculated on the total amount (principal + profit) at maturity if profit is received at maturity.

- Interest Profit (from conventional Deposits): This interest (riba) is not subject to Zakat, and it should be given to charity (not considered as Zakatable wealth).

- Zakat Calculation: Total Zakatable amount = SGD 51,050 (this includes all matured amounts that meet or exceed the Nisab)

- How does SGD 51,050 come? Sum of all deposits (principal amounts): SGD 10,000 + SGD 10,000 + SGD 20,000 + SGD 10,000 = SGD 50,000. Then, add profit from Islamic deposits only (because profit from interest is not Zakatable, but given to charity): SGD 700 + SGD 350 = SGD 1,050. Hence, Zakatable amount = SGD 50,000 + SGD 1,050 = SGD 51,050

- Zakat rate = 2.5% (equivalent to 1/40 of Zakatable wealth)

- Therefore, the Zakat due = 51,050 x 2.5% = SGD 2,276.25

Zakat on Gold and Silver

- There are many types of Gold and Silver: Gold and Silver as bars, Gold and Silver as coins, and Gold and Silver as jewellery.

Zakat calculation guidelines for Gold

- Gold bars and jewellery not intended for personal use: Nisab is 85-86 grams (20 Dinars). Zakat payable = weight of gold (>Nisab) x 2.5%.

- Gold jewelry intended for personal use: Nisab is 860 grams (ten times higher).

Zakat payable = weight of gold (>Nisab) x 2.5%.

Zakat calculation guidelines for Silver

- Silver: Nisab is 600 grams (200 Dirhams).

Zakat payable = weight of silver (>Nisab) x 2.5%.

Presented below are several examples outlining different circumstances related to Zakat payments on gold. Please review the accompanying tables for further details:

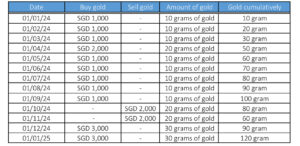

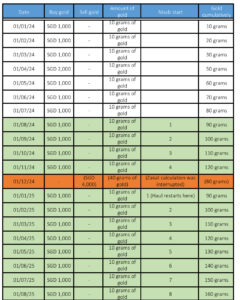

Table 4. Situation (A) Haul and Nisab are broken

Assuming the Nisab is 86 grams of gold

- Explanation table 4: In this table, the assumed Nisab for gold is 86 grams.

- The condition for Zakat to become obligatory is that the amount of gold must reach the Nisab and be held for one full lunar year.

- The gold holdings reached the Nisab in August 2024. Although purchases began in January 2024 (starting with 10 grams), the Haul only started once the total amount reached 86 grams.

- In October and November 2024, the amount of gold falls below the Nisab

- Consequences of falling below Nisab: According to the majority of Scholars, the Haul must be continuous, the amount of gold must not fall below the Nisab during the year

- If it does, the Haul is invalidated, and a new Haul must begin once the Nisab is reached again

- In this case, in August 2024, Gold reaches Nisab (86 grams)

- October and November 2024: Drops below Nisab → Haul is broken

- December 2024: Return to 86 grams

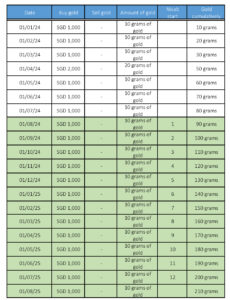

Table 5. Situation (B) Haul and Nisab are Met

Assuming the Nisab is 86 grams of gold

- Explanation for Table 5: Assuming Ahmad buys gold every month starting from 1 January 2024, and the amount of gold he purchases increases consistently until it reaches 200 grams in July 2025

- The Nisab assumed from this example table is 86 grams, and the market price for 1 gram of gold: SGD 100

- Based on the table, Ahmad reaches the Nisab on 1 August 2024, which, when converted to the Hijri calendar, corresponds to 26 Muharram 1446 AH; the Haul (Zakat holding period) begins from this date

- Zakat is due after one full Hijri year (354 days) from the date the Nisab is first reached. Therefore, 25 Muharram 1446 AH + 1 Hijri year = 26 Muharram 1447 AH

- Ahmad is obligated to pay zakat on 26 Muharram 1447 AH, which is approximately 21 or 22 July 2025, provided his gold holdings remain above the Nisab throughout the entire Hijri year

- Zakat may be paid slightly earlier, but not later than the due date, once the Haul (one full year) has elapsed

- It is advisable to track Zakat dates using the Hijri calendar, as the obligation is based on it, not the Gregorian calendar

- Zakat calculation: (Weight of gold x market price or current rate) x 2.5%. Market price for 90 grams of gold: SGD 100 x 90 = SGD 9,000. Zakat to be paid: SGD 9,000 x 2.5% = SGD 225

Table 6. Situation (C) Haul and Nisab restarted

Assuming the Nisab is 86 grams of gold

- Explanation for Table 6: Assuming that Muhammad buys gold regularly every month starting from 1 January 2024, gradually increasing his total gold holdings

- The Nisab threshold for Zakat in this example is 86 grams

- The “Nisab start” column indicates the month count since Muhammad’s gold holdings first reached or exceeded the Nisab of 86 grams

- On 1 August 2024, Muhammad’s cumulative gold reaches 90 grams, marking the start of the Haul since it is above the Nisab of 86 grams

- From August 2024 onwards, Muhammad’s gold holdings remain above the Nisab, and the Haul continues to count upwards each month

- However, on 1 December 2024, Muhammad sells 40 grams of gold, reducing his total holdings to 80 grams, which is below the Nisab threshold

- Because the gold holdings fell below the Nisab, the Haul is interrupted/stopped at this point and resets.

- After the sale, on 1 January 2025, Muhammad’s gold holdings rise back to 90 grams, which restarts the Haul counting again from month 1.

- The haul count continues from January 2025 as long as the gold remains above the Nisab

- The Haul (minimum holding period of 1 full lunar year before zakat is due) must be continuous, with the gold holdings remaining above the Nisab threshold throughout the period

- If the gold holdings fall below the Nisab at any point, the Haul stops and must restart when the holdings rise above the Nisab again.

- In this example, the Haul started in August 2024 but was interrupted in December 2024 due to the sale dropping holdings below Nisab. The Haul then restarts in January 2025 since it is above the Nisab of 86 grams

- This means that zakat will be payable in January 2026, provided that the total amount of gold does not fall below the Nisab threshold at any point during the Hijri year.

As stated by Imam An-Nawawi, “If the wealth falls below the Nisab during the Haul, the calculation of the Haul is interrupted, and Zakat is not obligatory, even if the wealth later increases and reaches the Nisab again”. [4]

Zakat on Investments

Includes:

- Stocks, shares, ETFs.

- Unit Trusts and REITs.

Types of unit trusts:

- Equity.

- Fixed income (Shariah-compliant = sukuk).

- Balanced funds (Combination between Equity and Fixed income).

Zakat rules for investment assets:

- The haul (lunar year) observations start from the purchase date.

- If multiple purchase dates, haul can be consolidated based on an average purchase.

- Nisab is reviewed at the end of the Haul or financial year.

- If above Nisab → zakat is obligatory.

- If below Nisab → zakat is not obligatory. Kindly see the illustration below:

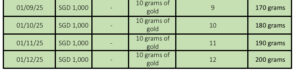

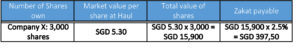

Table 7. Calculation process on Shares/Stocks, ETFs, and Unit Trusts (Equity Fund)

Assuming the Nisab is: SGD 9,000

- Explanation table 7: This table demonstrates how to calculate Zakat on investment assets such as: Shares, Stocks, ETFs, REITs, and Unit Trusts.

- The Nisab is assumed to be SGD 9,000

- Since the total value of the shares (SGD 15,900) is above the Nisab (SGD 9,000), Zakat is obligatory.

- Zakat is calculated based on the market value of the shares at the end of one lunar year (haul) from the date of purchase.

- If the market value of your investments is above Nisab at the end of the Haul, you must pay Zakat at 2.5% of the total value.

- If the total value is below Nisab, Zakat is not required. It is also applied in multiple shares/stocks (see the table below).

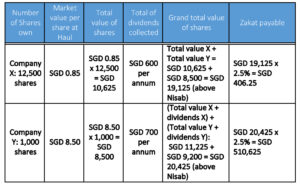

Table 8. Calculation process on multiple Shares/Stocks, ETFs (Equity Funds)

Assuming the Nisab is: SGD 9,000

- Explanation table 8: This table demonstrates how to calculate Zakat on multiple investment assets such as: Shares, Stocks, ETFs, REITs, and Unit Trusts.

- The Nisab is assumed to be SGD 9,000

- We need to combine the multiple investments (total value of shares of company X + total value of shares of company Y)

- Since the total value of the multiple shares (SGD 16,250) is above the Nisab (SGD 9,000), Zakat is obligatory

- Zakat is calculated based on the market value of the shares at the end of one lunar year (haul) from the date of purchase.

- Haul can be consolidated to the average date of purchase for the funds

- If the market value of your investments is above Nisab at the end of the Haul, you must pay Zakat at 2.5% of the total value

- If the total value is below Nisab, Zakat is not required.

Notes:

- Singapore and Malaysia follow a Zakat approach where, for investment assets like shares, stocks, ETFs, and unit trusts, the haul (1 full lunar year of ownership) must be observed first, before checking whether the asset value reaches Nisab (the Zakat threshold).

- It can be said that we must own the investment for a full lunar year first, then at the end of the year, check if the market value of the asset reaches or exceeds the Nisab. If yes, → Zakat is mandatory. If no, → no zakat is due.

- This method is seen as more suitable for fluctuating assets like stocks and mutual funds, becausemarket prices can rise and fall rapidly, and someone might temporarily own high-value assets, but they may decrease significantly before the year ends.

- For example, assuming that the Nisab of investments and business-related is SGD 9,000. You bought shares worth SGD 7,000 → not yet above Nisab (SGD 9,000). After 1 year, their market value increases to SGD 15,000 → now above Nisab. Since the shares were owned for a full year, and their value now exceeds Nisab, you must pay Zakat:

2.5% × 15,000 = SGD 375 - Dividends must be included in the total Zakat calculation. If the investment generates dividends that reach the Nisab and are held for one Haul, these dividends should also be added and Zakat paid on them. Please see the table below:

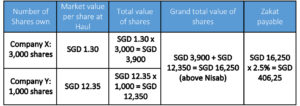

Table 9. Calculation process on Unit Trusts (Balanced & Fixed income) & REITs

Assuming the Nisab is: SGD 9,000

- Explanation table 9: This table shows how to calculate Zakat payable on investments in shares from multiple companies (Company X and Company Y), including both the market value of the shares at Haul (the Zakat calculation date) and the dividends collected

- The Nisab is assumed to be SGD 9,000

- Step 1: Calculate the total value of shares owned for each company

Company X shares value = SGD 10,625

Company Y shares value = SGD 8,500

- Step 2: Calculate the combined total value of shares (Company X + Company Y)

Combined shares value = SGD 10,625 + SGD 8,500 = SGD 19,125

Since SGD 19,125 is above the Nisab threshold (SGD 9,000), zakat is payable on this amount.

- Step 3: Calculate Zakat on the total shares’ value

Zakat = 2.5% × SGD 19,125 = SGD 406.25. This represents the total amount of Zakat payable upon reaching the Nisab threshold and completing one Haul, excluding any dividends

- Step 4: Include dividends to calculate the total Zakatable amount

Total value including dividends for Company X = shares value + dividends = SGD 10,625 + SGD 600 = SGD 11,225

Total value including dividends for Company Y = shares value + dividends = SGD 8,500 + SGD 700 = SGD 9,200

- Step 5: Calculate the total Zakatable amount (shares + dividends)

Grand total = SGD 11,225 + SGD 9,200 = SGD 20,425 (above Nisab)

- Step 6: Calculate zakat on the total amount

Zakat = 2.5% × SGD 20,425 = SGD 510.625. This denotes the total Zakat payable upon reaching the Nisab threshold and completing one Haul, including dividends accumulated over one Haul that have also reached the Nisab.

Notes:

Zakat is calculated first based on the market value of shares if it meets the Nisab. If dividends have been received and held for one year, they may also be included in the calculation of Zakat on shares. Zakat is payable at 2.5% on the total value of shares plus dividends once the combined amount exceeds the Nisab and has reached one Haul. Zakat is individual and cannot be combined among family members (e.g., for a spouse or child), similar to how prayer cannot be performed on someone else’s behalf.

FAQ:

What if the Haul and Nisab of my investment are met, but not a Sharia-compliant investment? Do I have to pay the Zakat?

There are two ways to solve this question:

- According to MUIS, Zakat on Shares is obligatory to be. Fulfilled once the market value of your investments tools i.e. shares, stocks exceeds the Nisab. All investment such as stocks, shares, ETFs, unit trusts, REITs, and others are payable for Zakat. However, they do not explicitly address the situation in which the investment employed is not Sharia-compliant. Therefore, it is possible to calculate the whole amount.

- Alternatively, we can pay zakat using the principal amount we invested.

Zakat on Insurance

- Zakat on Endowment Plans (Par fund insurance): MUIS stipulate that zakat is only payable on the surrender value once it reaches the Nisab, because endowment plans in Singapore are based on conventional systems. The premiums paid year by year are not immediately Zakatable; zakat is calculated only when the surrender value meets or exceeds the Nisab. See the table below:

Table 10. Calculation process on Par Funds Insurance (Endowment Plan)

Assuming the Nisab is: SGD 4,000

- Explanation table 10: The table shows the yearly progression of the endowment plan

- Since insurance companies in Singapore only offer conventional insurance, the Zakat calculation is made solely on the surrender value.

- The Nisab (minimum threshold for Zakat to be due) is assumed to be SGD 4,000.

- The Zakat is payable at 5% of the surrender value when the surrender value exceeds

- At the end of year 8, the total surrender value is SGD 4,069, which is above the Nisab of SGD 4,000.

- Therefore, Zakat is due on the surrender value: Zakat Payable = 2.5% x SGD 4,069 = SGD 101,725

- Zakat on Inherent Wealth: MUIS also explains that inherited wealth cannot be used for zakat payment before any debts or obligations of the deceased have been settled. Zakat on inherited wealth is calculated using the lowest balance method, similar to savings, and is only payable if the amount reaches the Nisab.

- Investment-linked policies (ILP): Zakat is 2.5% on net asset value at year-end if above Nisab.

- For portfolios with Multiple Asset Classes (stocks, ETFs, unit trusts, REITs, endowments, cash), Zakat is calculated on total Zakatable assets minus deductible liabilities ( such as outstanding loans).

- Example: Total assets = SGD 52,000, deductible liabilities = SGD 5,500, Zakat payable = (52,000 – 5,500) × 2.5% = SGD 1,162.50.

Conclusion

In summary, Zakat constitutes a foundational pillar of Islam that transcends mere financial obligation to embody a comprehensive system of spiritual purification, social justice, and economic responsibility. It serves not only as a personal act of worship but also as a vital mechanism for fostering communal solidarity and reducing socio-economic disparities within the Muslim ummah. The distinct classification of zakat recipients, as delineated in Islamic jurisprudence, underscores the targeted and purposeful nature of this obligation, ensuring that its benefits reach those most in need according to clearly defined criteria.

The practice of Zakat encourages disciplined wealth management and active engagement with community welfare, which aligns closely with contemporary objectives of financial literacy and social accountability. Particularly in the context of Singapore, adherence to the prescribed conditions and guidance—such as the Nisab threshold, haul period, and zakat on specific assets like CPF savings—reflects an adaptive yet faithful application of Islamic principles in a modern financial environment.

Ultimately, the institution of Zakat exemplifies a holistic approach to ethical finance by integrating spiritual growth, economic equity, and social cohesion. It remains an essential instrument not only for individual piety but also for the sustainable development of a just and prosperous society, consistent with the values upheld by Islamic finance in Singapore and beyond.

[1] Al-Qur’an, Surah Al-Baqarah (2:276).

[2] Al-Imam An-Nawawi, Al-Majmu’

[3] Al-Qur’an, Surah Al-Hasyr (59:7).

[4] Al-Imam An-Nawawi, Al Majmu’ sharh Al-Muhadhzab, Volume 5, p. 342.