TLDR (Summary)

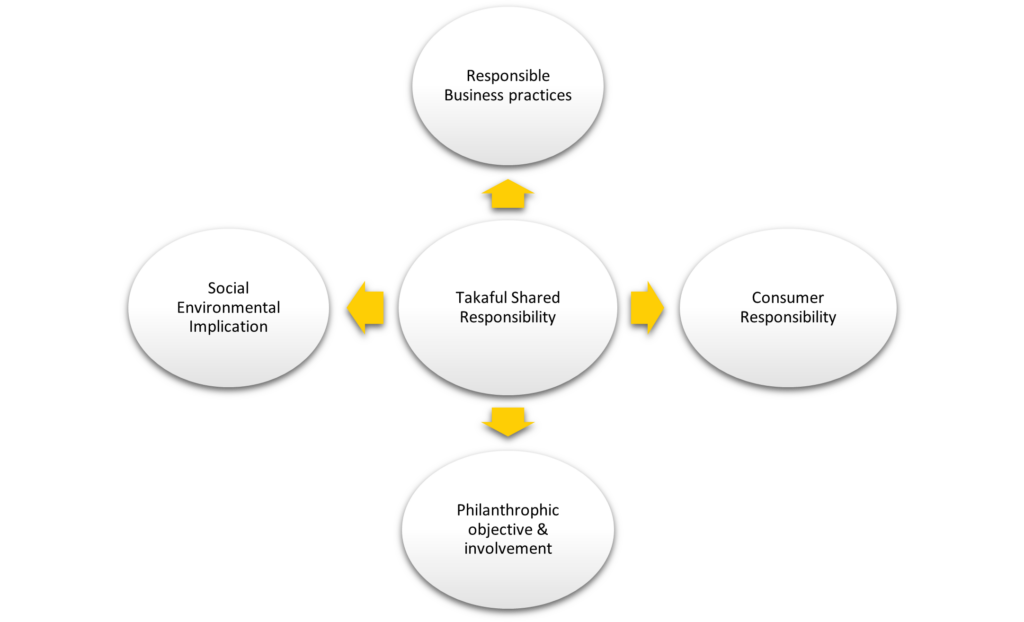

Takaful offers a values-driven, Shariah-compliant financial protection solution that emphasises shared responsibility, transparency, and investments aligned with societal well-being.

Participants have access to solutions that provide comprehensive coverage and long-term growth that can create meaningful impact on individuals, families, and communities.

Introduction: Takaful – A Refreshing Alternative to Conventional Insurance

Imagine a system of financial protection that not only secures your future but also upholds values that benefit society.

Takaful represents precisely this vision—a Shariah-compliant insurance model built on principles of shared responsibility, cooperation, and value-driven principles. It operates on a risk-sharing model, where participants pool contributions to collectively share risks, with any surplus distributed or reinvested for their benefit. In contrast, traditional insurance follows a risk-transfer model, where policyholders pay premiums to transfer their risk to the insurer, who assumes the financial risk and profits from the premiums.

Its structure eliminates elements of ambiguity (gharar) and zero-sum game (maysir), ensuring compliance with Shariah principles while focusing on fairness and trust.

By integrating value-driven practices with robust financial protection, Takaful stands as a modern, inclusive solution that resonates across diverse communities.

Through the collaboration of Maybank and Etiqa Insurance Singapore, Takaful is now available to Singapore residents, regardless of faith or financial background as long as it meets customers financial needs and goals.

Whether you’re aiming to protect your family’s future, aligning your financial planning with responsible practices, or embracing a values-based approach to wealth management, Takaful offers a refreshing alternative to conventional insurance models.

Understanding the Fundamentals of Takaful

At its core, Takaful offers a unique approach to financial protection grounded in universal values of cooperation, fairness, and collective well-being.

It is developed as an alternative to conventional insurance, providing a model that prioritises shared responsibility, mutual aid, and investments aligned with universal values.

The foundation of Takaful rests on collective support and mutual cooperation (ta’awun).

Each participant contributes to a common fund through tabarru’ – a voluntary donation that, in practice, establishes a shared pool of resources.

By relinquishing personal ownership of these contributions, participants enable the fund to compensate other Takaful participants who experience a covered loss.

This mechanism ensures that financial burdens are distributed across the group rather than falling on individuals alone.

Consequently, the ‘voluntary donation’ in tabarru’ directly fuels the broader aim of Takaful: creating a community-centred safety net where members protect one another’s well-being, thereby fostering social solidarity and collective care.

Building on this mutual cooperation principle, Takaful sets itself apart through its commitment to responsible financial management, through additional scrutiny i.e. Shariah review to ensure fairness to customers.

Contributions are directed toward ventures that align with values of societal well-being, avoiding industries considered harmful or exploitative, such as arms dealings, adult entertainment, and businesses with unsustainable financial practices, and those with excessively high debt ratios.

Instead, Takaful funds are invested in sectors that drive progress and sustainability, such as renewable energy, healthcare, and infrastructure development.

This focus ensures that participants’ contributions are used in ways that promote both personal security and meaningful socio-economic impact.

Integral to Takaful’s design is its risk-sharing model, which fundamentally differs from the risk-transfer mechanism of conventional insurance.

In Takaful, participants pool their contributions to collectively bear risks, ensuring that claims are covered from the shared fund.

This approach encourages fairness and transparency, avoiding the imbalances that can arise in profit-driven insurance systems.

By distributing risks and benefits equitably, Takaful creates a balanced framework that aligns financial protection with shared values of equity and care.

To support this system, Takaful relies on an operational structure built on trust and transparency.

The pooled fund is managed by a Takaful operator acting as an Administrator (Wakil), whose role is to ensure compliance with Shariah principles and protect the collective interests of participants.

Since contributions are made as donations, participants no longer retain individual ownership of the Takaful funds.

The operator uses the fund exclusively to pay claims, cover legitimate operational costs, and safeguard the fund’s long-term financial stability.

Any surplus – after fulfilling these obligations – is either reinvested to grow and fortify the fund (for example, by increasing its capacity to handle future claims) or distributed according to the specific Takaful model.

Through these measures, the system remains fair, transparent, and resilient over time.

By seamlessly integrating shared responsibility, purposeful investments, and a risk-sharing structure, Takaful presents a holistic alternative to conventional insurance.

It offers financial protection that balances personal aspirations with universal values as a system that benefits both individuals and the broader society while promoting progress, sustainability, and mutual cooperation.

What Makes Takaful Unique?

A hallmark of Takaful is its unwavering commitment to transparency and fairness, which underpins every aspect of its operations.

These principles encourage trust among participants, reinforce equitable treatment, and differentiate Takaful from conventional insurance systems.

In Takaful, all agreements and processes are structured to eliminate ambiguity, ensuring that terms and conditions are clearly defined and fully understood by participants.

This transparency instils confidence in participants that their contributions are used responsibly and ethically, free from speculative or exploitative practices.

The pooled fund is solely reserved for fulfilling claims and operational costs, with no overlap or misuse.

This segregation ensures that participants’ interests remain central and that their contributions are managed with integrity.

Regular disclosures of fund management practices, including detailed reports and updates, further enhance transparency and accountability, allowing participants to track how their funds are utilised and how surpluses are managed.

The surplus management process itself is a testament to Takaful’s fairness.

Any excess funds remaining after claims and costs are either reinvested to sustain the fund’s long-term stability or distributed among participants based on the specific Takaful model.

This approach works such that no single entity disproportionately benefits from the system and that participants share equitably in the outcomes of their collective contributions.

Additionally, Takaful’s operational structure advocates fairness by promoting shared benefits.

The Takaful operator acts as an administrator, prioritising the interests of participants while adhering to Shariah principles.

Fees for managing the fund are transparently outlined and agreed upon in advance, with the aim of all parties operating with mutual understanding and trust.

By combining these practices, Takaful ensures a financial protection system that is equitable, inclusive, and transparent.

It empowers participants to make informed decisions while fostering trust and confidence in a model that aligns financial security with shared values of fairness and mutual care.

‘The Advantages of Takaful for Individuals and Families

Takaful presents a unique and meaningful approach to financial protection, offering benefits that go beyond conventional insurance.

By blending collective responsibility with values-driven financial practices, it caters to the needs of individuals and families while supporting societal well-being.

A Truly Inclusive Approach

Takaful is inherently inclusive, designed to accommodate people from all walks of life, regardless of faith or financial standing.

Risk-sharing model as the premise, Takaful creates a system rooted in fairness and equity, where participants’ needs are addressed without discrimination or bias.

Takaful transcends the boundaries of conventional insurance by aligning financial security with a broader vision of societal well-being.

Guided by the grand objectives of the Shariah (Maqasid al-Shariah), Takaful is more than a financial product — it is a tool for equity, justice, and long-term sustainability.

Beyond Conventional Investments

A significant advantage of Takaful is its focus on investments that support a brighter future.

Takaful funds are purposefully directed toward industries that prioritise sustainability and societal progress, such as renewable energy, healthcare innovation, and public infrastructure projects.

This proactive approach means that participants’ contributions generate value not only for themselves but also for the broader community.

By excluding harmful sectors like gambling or arms manufacturing, Takaful stands as a model of responsible financial stewardship.

Takaful stands out as a holistic financial solution that balances individual security with collective progress.

Its foundation in values of fairness, trust, and sustainability makes it an appealing option for those seeking more than just financial returns.

By choosing Takaful, families gain access to a system that empowers them to secure their future while contributing to the welfare of others, creating a ripple effect of positive change.

Collective Resilience

The cooperative nature of Takaful strengthens resilience within communities.

By pooling contributions into a collective fund, participants create a financial safety net that provides support in times of need.

Whether it is offering family support after a loss, or addressing unexpected medical challenges, this shared system ensures that resources are available when they are needed most.

The mutual aid approach goes beyond individual protection, cultivating a culture of empathy and collective responsibility.

Empowering Long-Term Financial Goals

Takaful is more than just a financial protection plan — it serves as a platform for achieving long-term goals in a way that aligns with deeply held values.

With its framework aimed to address participant needs, participants can look to Takaful for diverse purposes such as estate planning, creating a financial legacy, or fulfilling charitable objectives.

For instance, Takaful plans often integrate features like structured nominations or allocations for charitable causes (wakaf), ensuring a seamless and meaningful distribution of benefits.

Protecting What Matters Most

Takaful fosters a system that encourages fairness, accountability, and responsible financial practices.

Its risk-sharing model ensures that no single participant bears an undue burden, and its strict adherence to Shariah principles eliminates exploitative practices.

This commitment to ethical operations promotes trust and transparency, creating an environment where all stakeholders benefit equitably.

Moreover, Takaful’s investment framework reinforces responsible behaviour by channelling funds into ventures that contribute to societal progress.

Instead of pursuing profit at any cost, Takaful prioritises projects that align with values of care and long-term sustainability, such that financial growth is tied to positive outcomes for communities.

Promoting Responsible Behaviour

Takaful fosters a system that encourages fairness, accountability, and responsible financial practices.

Its risk-sharing model ensures that no single participant bears an undue burden, and its strict adherence to Shariah principles eliminates exploitative practices.

This commitment to ethical operations promotes trust and transparency, creating an environment where all stakeholders benefit equitably.

Moreover, Takaful’s investment framework reinforces responsible behaviour by channelling funds into ventures that contribute to societal progress.

Instead of pursuing profits, Takaful prioritises projects that align with values of care and sustainability, such that financial growth is tied to positive outcomes for communities.

Advancing the Common Good

Through its alignment with Maqasid al-Shariah, Takaful goes beyond individual benefits to champion the collective good.

Its holistic approach ensures that financial protection is provided in a manner that respects human dignity, promotes social cohesion, and uplifts communities.

Whether it is supporting families in times of need or contributing to the growth of ethical industries, Takaful represents a financial model designed to create a lasting, positive impact.

Why Choose Takaful with Maybank and Etiqa Insurance?

When it comes to safeguarding your financial future, trust and expertise are essential.

The collaboration between Maybank Singapore and Etiqa Insurance Singapore brings together decades of experience and a deep commitment to delivering Takaful solutions that prioritise fairness, transparency, and shared benefit.

Expertise and Reliability

As Malaysia’s largest local insurer, with a strong presence in Singapore, the Philippines, Cambodia, and Indonesia, Etiqa Insurance is a leading provider of Takaful services in Southeast Asia and a trusted partner in offering values-driven financial solutions.

Participants benefit from robust, well-managed Takaful plans tailored to diverse financial needs.

As a distribution arm of Etiqa Insurance, Maybank enhances the delivery of Takaful solutions with its comprehensive banking services and regional reach.

Together, they offer a seamless experience, integrating Takaful with broader financial planning tools to support participants in achieving their goals while staying aligned with universal values.

Comprehensive Solutions

The partnership between Maybank Singapore and Etiqa Insurance Singapore offers more than just wealth preservation — it delivers comprehensive solutions that empower participants to align their financial planning with their personal values.

One such offering is the Invest future Takaful plan, a ground-breaking initiative that reintroduced Takaful to Singapore after more than a decade.

This innovative plan combines Wealth Protection with sustainable investment opportunities, presenting participants with a holistic approach to financial security and growth.

Takaful plans by Etiqa Insurance Singapore are designed for flexbility to adapt to participants’ evolving needs.

Features such as flexible premium payment options and nomination instruments simplify wealth planning while ensuring a peace of mind.

For example, participants can designate beneficiaries or even direct a portion of their plan toward charitable causes like Islamic perpetual endowments (i.e. Waqf Masyarakat Singapore), creating a lasting legacy that supports societal well-being.

More Than Protection

Choosing Takaful through Maybank Singapore and Etiqa Insurance Singapore means accessing more than just financial protection—it’s an opportunity to integrate your financial goals with meaningful impact.

Beyond protection, participants benefit from Wealth Accumulation features, ethical investment opportunities, and the flexibility to structure their plans to meet personal and family needs.

Leveraging a strategic partnership built on trust, expertise, and shared values, Maybank and Etiqa Insurance Singapore are delivering solutions that empower individuals and families to navigate life’s uncertainties with confidence.

Working together, they ensure your financial future remains secure, purposeful, and aligned with principles of care and responsibility.

Invest future — A Takaful Plan for Wealth Protection and Growth

For those seeking a comprehensive approach to financial security, Invest future by Etiqa Insurance Singapore offers an innovative Takaful solution that combines protection with purposeful financial growth.

Designed to meet both immediate and long-term needs, this plan reflects the values of fairness, sustainability, and adaptability.

What is Invest Future?

Invest future is an investment-linked Takaful plan tailored to provide participants with both financial protection and wealth-building opportunities.

The plan offers coverage against death until the age of 100 and Total and Permanent Disability (TPD) until the age of 65, ensuring a robust safety net for life’s uncertainties.

Flexible premium payment terms — ranging from 10 to 20 years — enable participants to customise their contributions based on personal financial goals.

Key Benefits of Invest future

- Boost Your Financial Growth

- Start-Up Bonus: Participants receive a bonus of up to 80% of their first-year premium, depending on the premium amount and payment term chosen.

- Loyalty Bonus: To reward long-term commitment, annual bonuses equivalent to 0.2% of the account value are awarded after the premium payment term is completed.

- Special Bonus: From the sixth policy year onwards, an additional 5% of regular premiums paid annually is provided, amplifying financial growth.

- Flexible Features for Changing Needs

- Premium-Free Period: Participants can pause premium payments for up to 132 months on a 20-year plan, offering flexibility during life’s transitions.

- Partial Withdrawals: Up to two free partial withdrawals, capped at 5% of premiums paid, can be made from the fourth policy year, ensuring accessibility to funds when needed.

Why Choose Invest Future?

The Invest future plan stands out for its unique combination of financial security and purposeful investment opportunities:

- Aligned with positive impact: Contributions are allocated to Shariah-compliant investment funds, which avoids harmful industries to the society and environment, ensuring that participants’ financial growth is aligned with societal benefit.

- Fair and transparent governance: The plan is governed by Takaful principles, ensuring transparency in fund management and a commitment to equitable treatment for all participants.

- Comprehensive protection: Coverage benefits provide peace of mind, with payouts of at least 105% of the total premiums paid or the account value, whichever is higher.

Certified and Trusted

The Invest future plan is certified Shariah-compliant by the Financial Shariah Advisory and Consultancy (FSAC) of Pergas.

This certification affirms that the plan adheres to the highest standards of transparency, fairness, and Shariah compliance, offering participants confidence in their financial journey.

By choosing Invest future, participants gain access to a solution that protects their wealth while contributing to progress and prioritising sustainable protection over maximising profits.

It’s more than a financial plan—it’s a commitment to building a secure and meaningful future for future generations.

Is Takaful Right for You?

Choosing the right financial protection plan is an important decision, and Takaful is a compelling proposition for those seeking more than just conventional insurance.

With its emphasis on shared responsibility, purposeful investments, and fairness, Takaful aligns well with individuals and families looking to integrate financial security with values of collective care and social impact.

Aligning Financial Goals with Values

If you value financial solutions that go beyond individual gain and contribute to the greater good, Takaful might be the right choice for you.

Its focus on investments that promote societal progress —such as renewable energy, education, and healthcare — means that your contributions support initiatives with a meaningful impact.

For those who prioritise aligning personal goals with universal values, Takaful offers an opportunity to protect your future while contributing to positive change.

Understanding the Risk-Sharing Model

Takaful operates on a Mutual Co-operation Framework where participants share risks collectively through a pooled fund.

This model promotes fairness and mutual support, as contributions are used to help those in need. Unlike conventional insurance, which transfers risks to the insurer, risks and rewards are distributed equitably among participants in a Takaful plan.

If you appreciate a system built on collaboration and care, Takaful’s risk-sharing structure aligns well with these principles.

Flexibility to Suit Your Needs

Takaful plans are designed to adapt to life’s changes.

Features such as flexible premium payment terms, partial withdrawal options, and premium-free periods gives participants the ability to customise their plans based on evolving circumstances.

Whether you’re planning for long-term goals like wealth preservation or immediate needs like family protection, Takaful has the flexibility to adjust your plan without compromising its core benefits.

Universally Accessible

Takaful is open to everyone, regardless of religious or cultural background.

Its principles of transparency, fairness, and mutual benefit make it a universal financial solution for individuals and families who value equity and shared responsibility.

By choosing Takaful, you can be certain that your financial protection aligns with values that resonate globally.

Making an Informed Decision

Before committing to a Takaful plan, consider your financial priorities, risk tolerance, and long-term aspirations.

Speak with a trusted financial advisor to explore how Takaful fits within your broader financial strategy.

With its unique attributes of collective benefit, ethical governance, and flexibility, Takaful offers a pathway to achieving financial security in a way that is meaningful and impactful.

Your Path to Financial Protection with Takaful

Embarking on your Takaful journey is a simple and rewarding process, designed to align your financial goals with a framework of shared responsibility and collective well-being.

With Maybank Singapore and Etiqa Insurance Singapore, you are able to access tailored Takaful solutions that prioritise both your financial security and values-driven investments.

Step 1: Assess Your Financial Needs

The first step in choosing the right Takaful plan is understanding your financial priorities.

Whether your goal is wealth preservation, family protection, or long-term growth, consulting a Maybank Appointed Representative can help you identify a plan that aligns with your objectives.

Through personalised advice, you can explore options that offer the right balance of protection and flexibility for your unique circumstances.

Step 2: Start Your Journey

Sign up for a Takaful plan – you can thus embark on your path to financial protection and growth.

Your contributions will be invested in Shariah-compliant sectors that prioritise sustainability and societal benefit, such as renewable energy, healthcare, and education.

This approach not only safeguards your future but also contributes to a system that promotes collective well-being.

Integrating Takaful with Wealth Management

The benefits of Takaful becomes even more impactful when integrated with broader wealth management solutions.

Maybank Singapore offers a suite of services which are complementary to Takaful participants such as:

- Estate planning: Streamline the distribution of your assets to ensure smooth inheritance and minimise legal complications.

- Zakat planning: Fulfil charitable obligations efficiently by aligning your financial goals with social impact through the services offered by the Islamic Wealth Specialist.

- Family protection strategies: Develop customised plans that provide security for your loved ones while supporting long-term aspirations.

These additional services enhance your Takaful plan, enabling you to create a holistic financial strategy that balances personal security with meaningful contributions to society.

Build Your Legacy with Confidence

Choosing Takaful is not just about securing your future — it’s about leaving a legacy that reflects your values.

Whether it is through protecting your family, supporting causes close to your heart, or contributing to societal progress, Takaful empowers you to achieve financial security with purpose.

Your path to financial protection is guided by our expertise, transparency, and a commitment to collective well-being.

Start your journey today and experience a financial solution that combines security with impactful values.

Conclusion: Empowering Your Future with Takaful

Takaful is more than just financial protection — it’s a commitment to fairness, shared responsibility, and purposeful growth.

By aligning individual security with values of mutual care and sustainability, Takaful provides a holistic alternative to conventional insurance.

Begin your journey with Maybank Islamic Wealth Management Singapore, where you can explore managing your wealth holistically while contributing to the greater good.

Through Takaful, you have the opportunity to build a secure, lasting, and meaningful legacy.

To find out more about Maybank IWM solutions, get in touch with a Maybank representative or arrange an appointment with their Islamic Wealth Specialists through the following channels:

Email: iwmsg@maybank.com

Contact: 1800-MAYBANK (1800-629 2265) or (65) 6533 5229

Visit: Maybank branch

Your future and the well-being of your community starts here.

This article was brought to you in collaboration with Maybank Singapore – Islamic Wealth Management, and has not been reviewed by the Monetary Authority of Singapore.

This article is for information purposes only and under no circumstances is it or any part of it to be considered or intended as an offer to sell or a solicitation of an offer to buy any of the financial or investment products referred to herein (each, a “Product”, and collectively, “Products”), or an offer or solicitation to any person to enter into any transaction or adopt any investment strategy or enter into any legal relations, or an advice or a recommendation with respect to such Products.

Investments in collective investment schemes (“Fund(s)”) are not obligations of, deposits in, or guaranteed by the distributors or any of their affiliates. Investors should read the Prospectus, obtainable from Maybank, before deciding whether to subscribe for units in the Fund(s). All applications for units in the Fund(s) must be made on the application forms accompanying the Prospectus

Investors should note that income from such Products, if any, may fluctuate and that each Product’s price or value may rise or fall. Accordingly, investors may receive back less than what they have originally invested or they may also not receive back anything at all from what they have originally invested. All investments involve an element of risk, including capital and principal loss. Past performance is not necessarily a guide to or an indication of future performance.

This article is prepared for general circulation. It is not intended to provide personal investment advice and does not take into account the specific investment objectives, financial situation and particular needs of any particular recipient or reader and thus should be read with this in mind. An investor should therefore independently and separately evaluate and assess each Product and consider the suitability of the same and the risks involved, taking into account the investor’s specific investment objectives, financial situation, risk tolerance and particular needs, and seek independent financial, audit, tax, legal and/or other professional advice as necessary, before dealing, transacting and/or investing in any of the Products mentioned in this report or communicated to the investor as a follow-up to this report. All investments will be made solely upon and in reliance on the investor’s own judgment and discretion, notwithstanding any opinion, commentary or recommendation this report, Maybank or its Relationship Managers may provide. Unless expressly agreed otherwise, Maybank offers no investment, financial, legal, tax or any other type of advice to recipients or readers of this report. Maybank has no fiduciary duty towards any such recipients and readers, and makes no representation and gives no warranty as to the results to be obtained from any investment, strategy or transaction, or as to whether any strategy, security or transaction described herein may be suitable for the financial needs, circumstances or requirements of the recipients and readers.

Diversify Your Portfolio with Maybank: Halal Investment Funds to Grow Your Wealth

Maximise Wealth: Your 2025 Guide to Islamic Financial Planning in Singapore