Introduction to Spot Bitcoin ETFs

Understanding Spot Bitcoin ETFs and Their Emergence in 2024

Spot Bitcoin ETFs may seem novel, but they’ve been a topic of interest since 2013, when the first application was sent to the U.S. Securities and Exchange Commission (SEC). These financial vehicles essentially allow investors to tap into the price movements of Bitcoin without the direct ownership of the currency. On 10th January 2024, the narrative took a significant turn when 11 spot Bitcoin ETFs (these ETFs track current prices of bitcoin, BTCUSD) were approved by the SEC following months-long talks, marking a historical moment in the investment landscape (Source: Financial Times).

🔵Join the Islamic Finance Singapore community here!🔵

Historically, a similar innovation in the ETF space can be observed when the first gold-backed ETF (GLD) was launched on 18th November 2004 to much hype and investment inflows, $468.6 million on its first trading day and $6.5 billion in inflows on its first two years of existence (Factset data). GLD has since grown by 356% since its inception. If comparing the yellow metal to cryptocurrency might be too optimistic and naive, consider the first bitcoin-linked ETF, the ProShares Bitcoin Strategy ETF (BITO), which has 27.21% of its assets in Bitcoin Futures (Refinitiv). It had an investment inflow of $550 million on its first trading day and $2 billion in its first two years of existence before being hit by the FTX collapse in 2022. So, which route will the spot Bitcoin ETFs take?

What does the SEC’s approval of Spot Bitcoin ETFs mean

Mr Aziz Zainuddin, Core Contributor of ZaynFi, the first Shariah-compliant DeFi yield-generating protocol, mentioned that the approval by the SEC is critical for four reasons:

- Legitimacy: The legitimacy of cryptocurrencies, particularly Bitcoin, has been debated due to their novelty and complexity. Public scrutiny often centres on government endorsement and regulation, seen as crucial for safety and customer protection. Approving the 11 spot bitcoin ETFs and providing explicit regulatory support represents a significant step. This passing not only boosts confidence but also solidifies the status of the crypto asset class, marking a substantial win for its legitimacy.

- Accessibility & Exposure: The approval of the spot Bitcoin ETF facilitates access and exposure to cryptocurrencies as major financial entities like BlackRock and Fidelity introduce their Bitcoin ETFs. Traditional financial giants entering this space imply a broader range of investment products, leveraging their substantial financial resources. This development is significant, considering the vast capital these entities control. It also addresses clients’ long-standing interest in investing in cryptocurrencies, providing a more regulated and efficient avenue for investments into this asset class to take place.

- Capital inflows: Efficient capital inflow is contingent on the above two points. Previously, regulatory uncertainties and complex requirements hindered capital inflow. Still, regulator-endorsed confidence promises smoother on and off-ramps, significantly boosting the market.

- Accountability and transparency: With the passing of the SEC approval, risks associated with shady actors such as FTX and Binance are further mitigated, fostering infrastructure development and benefiting the industry positively.

Why an investor might consider the Spot Bitcoin ETFs over exchanges such as Coin Hako, Crypto.com, etc.

Sani Hamid, Director of Economy & Markets and head of Islamic Wealth Advisory at Financial Alliance, mentioned that some investors might be wary of the exchanges being hacked and shut down, thus pushing this group away. With the introduction of these 11 spot Bitcoin ETFs, they will feel more comfortable since they’re regulated and consumer protection protocols are in place.

Another group Mr Sani sees will take up these ETFs are those looking for convenience and already with brokerage accounts so that they can add the spot bitcoin ETFs inside their portfolio. Mr Aziz agrees with this as these users would also want to avoid the hassle of opening accounts on the centralised exchanges or self-custody when they can consolidate most of their investments in one place, i.e., their existing brokerage accounts.

The Mechanics of Spot Bitcoin ETFs

How Spot Bitcoin ETFs Work

By investing in an ETF, you are investing in a regulated fund, entitling you to a share of the funds, which are then invested in the specified products such as stocks or commodities. As a holder of these shares, you are entitled to a return determined by the product the fund tracks and also to trade it when the market is open, just like stocks but unlike mutual funds.

Applying it to the Bitcoin ETF, you thus own a tradeable share of a fund that invests in spot Bitcoin.

Comparing Spot Bitcoin ETFs to Other Types of Bitcoin Investment Vehicles

When investing in Bitcoin, you’re not short on options. But how does a Spot Bitcoin ETF stand out among the rest? Here’s a brief compass to navigate this landscape:

Bitcoin Spot ETFs vs. Futures ETFs: Spot ETFs hold the actual Bitcoin, offering direct exposure to its price. Conversely, futures ETFs deal with Bitcoin futures contracts. With spot ETFs, you’re closer to the real deal — the Bitcoin itself, not a derivative.

Bitcoin Spot ETFs vs. Direct Investment: Buying Bitcoin through a cryptocurrency exchange is as direct as possible. However, Spot Bitcoin ETFs bring simplicity and security under the shield of regulatory compliance and the convenience of traditional brokerages.

Bitcoin Spot ETFs vs. Crypto Funds: Crypto funds and trusts work similarly to ETFs but often come with higher fees and might not trade on major exchanges. On the other hand, Spot Bitcoin ETFs are traded like stocks, providing ease and lower costs.

Bitcoin Spot ETFs vs. Stocks of Bitcoin-Related Companies: Investing in companies with Bitcoin-related activities might sound similar, but it’s not the same. You’re investing in a company, not Bitcoin itself, which means your investment success hinges on the company’s performance — not purely Bitcoin’s market movements.

In the FAQ section, we’ll determine whether Spot Bitcoin ETFs are Shariah-compliant. For now, be aware of the different ways you can access Bitcoin.

Advantages of Investing in Spot Bitcoin ETFs

Lower fees

Fees are an essential indicator of how much you pay the fund manager; thus, if you invested S$1000 annually for a fund with a 0.25% fund expense ratio, you are paying S$2.50 annually. Therefore, the lower the fees, the better, as it will eat up your returns.

While the S&P 500 Index funds can go for as low as 0.1% in fees, the fierce competition between fund managers over the simultaneous launch of 11 Spot Bitcoin ETFs meant they had to compete and change their fees. Aside from Grayscale Bitcoin Trust (GBTC), with a 1.50% expense ratio, the ten other Spot Bitcoin ETF provider ranged their fees from 0.12 to 0.6%. In addition, eight of these 11 have also decided to waive their fees until the fund reaches a certain mass or until a few months have passed.

| ETF Name | Ticker | ETF Sponsor | Benchmark | Fees | Fee disclosed | After waiver | Notes on waiver (as of 16 January 2023, 7:22 pm) |

| Grayscale Bitcoin Trust | GBTC | Grayscale Investments | CoinDesk Bitcoin Price Index | 1.50% | 1.50% | 1.50% | No Waivers |

| Bitwise Bitcoin ETF | BITB | Bitwise Investment Advisers | CME CF Bitcoin Reference Rate – NY | 0.20%, waived on first $1bn of assets for 6mo | 0.20% | 0% | Waived on first $1 billion of assets for six months |

| iShares Bitcoin Trust | IBIT | BlackRock iShares | CME CF Bitcoin Reference Rate – NY | 0.25%, cut to 0.12% on the first $5bn in assets for one year | 0.25% | 0.12% | No Waivers |

| Valkyrie Bitcoin Fund | BRRR | Valkyrie Digital Assets | CME CF Bitcoin Reference Rate – NY | 0.2%, all fees waived for the first three months | 0.20% | 0% | Fees are waived for the first three months |

| ARK 21Shares Bitcoin ETF | ARKB | 21Shares, sub-advised by ARK | CME CF Bitcoin Reference Rate – NY | 0.21%, fees waived on first $1bn in assets (or for the first 6mo of trading if it doesn’t reach $1bn by then) | 0.21% | 0% | Fees are waived on the first $1bn in assets (or for the first six months of trading if it doesn’t reach $1bn by then) |

| Invesco Galaxy Bitcoin ETF | BTCO | Invesco Capital Management | Lukka Prime Bitcoin Reference Rate | 0.39%, waived on first $5bn of assets for 6mo | 0.39% | 0% | Fees waived on first $5bn of assets for six months |

| VanEck Bitcoin Trust | HODL | VanEck Digital Assets | MarketVector Bitcoin Benchmark Rate | 0.25% | 0.25% | 0.25% | No Waivers |

| Wisdom Tree Bitcoin Fund | BTCW | WisdomTree Digital Commodity Services | CME CF Bitcoin Reference Rate – NY | 0.3%, waived for the first $1bn for 6mo | 0.30% | 0% | waived for the first $1bn for six months |

| Fidelity Wise Origin Bitcoin Fund | FBTC | FD Funds Management | Fidelity Bitcoin Reference Rate | 0.25%, waived through 31st July | 0.25% | 0% | waived until 31st July 2024 |

| Franklin Bitcoin ETF | EZBC | Franklin Holdings | CME CF Bitcoin Reference Rate – NY | 0.29% | 0.19% | 0% | Waived for the first 10 billion in assets until 2nd August. |

| Hashdex Bitcoin Futures ETF* | DEFI | Hashdex | Hashdex is omitted here because it hasn’t yet converted its futures ETF to a spot ETF | ||||

Source: Refinitiv. You can find the latest fees in the excellent compilation by Financial Times here.

Access to Real-Time Bitcoin Prices

Spot Bitcoin ETFs provide you with an excellent advantage: access to real-time Bitcoin prices. This means that the ETF’s price closely mirrors Bitcoin’s current market price without the delay that can come with other investments like futures. With spot ETFs:

- Investors can make informed decisions based on the latest market data.

- The prices reflect Bitcoin’s immediate supply and demand, not projected future prices.

- This real-time tracking can help execute timely investment strategies, especially in the volatile world of cryptocurrencies.

Rather than having a separate app such as Coinbase to purchase a bitcoin, you can use your trading app such as IBKR to invest in the spot Bitcoin ETFs.

The Ease of Trading Through Traditional Investment Accounts

For many, the simplicity of Spot Bitcoin ETFs is critical. They allow you to trade Bitcoin as easily as stocks through your investment accounts. It’s about:

- Convenience: No need to handle crypto wallets or keys; you can buy and sell with a click through platforms you’re already familiar with.

- Integration: They fit seamlessly into conventional portfolios, making diversification a breeze.

Spot Bitcoin ETFs extend a bridge to Bitcoin markets for traditional investors, aligning the novel asset within the comfort of a familiar system. You won’t have to worry about losing passwords or fraud, which permanently causes holders to lose their investments.

Risks and Considerations for Investors

Market Volatility and Regulatory Challenges

When considering Spot Bitcoin ETFs, you should be aware of the two considerable ‘R’s – Risk and Regulation:

Market Volatility: Bitcoin’s price can go on a roller-coaster ride. Your investment could leap or plummet within hours, making it an asset for those with a substantial risk appetite.

Regulatory Challenges: The regulatory environment for cryptocurrencies, including Bitcoin, is a patchwork quilt still being sewn. Rules can change, affecting Spot Bitcoin ETFs’ legality, compliance, and operational aspects.

SEC’s chair, Gary Gensler, mentioned that while the approval has taken place, it didn’t mean the SEC endorsed these ETFs: “I’d note that the underlying assets in the metals ETPs have consumer and industrial uses, while in contrast, bitcoin is primarily a speculative, volatile asset that’s also used for illicit activity including ransomware, money laundering, sanction evasion, and terrorist financing. While we approved the listing and trading of certain spot bitcoin ETP shares today, we did not approve or endorse bitcoin. Investors should remain cautious about the myriad risks associated with Bitcoin and products whose value is tied to crypto. (SEC)

Even MAS has warned that trading cryptos for the general public is “highly risky and not suitable for the general public, as the prices of DPTs are subject to sharp speculative swings” (MAS)

To illustrate, bitcoin has indeed been very volatile, and this is not helped by the many significant failures that have occurred in recent years, such as FTX bankruptcy and Terra’s collapse, as shown below:

Thus, an investor has to note such price volatilities that may affect the returns.

Counterparty risk

While an investor may rely on an ETF issuer to track the performance of Bitcoin or any other asset, any fund mismanagement or financial difficulties the issuer faces will definitely impact the investor’s return and ETF value.

It will be interesting to see the commonality of performances between the ETFs as all of them are invested in Bitcoin

Should You Include a Spot Bitcoin ETF in Your Portfolio

Current performance of bitcoin

2023 was eventful, to say the least, and despite rumours of a bloodbath on Wall Street, the markets provided positive returns generally between January and December:

| Indices |

Individual Shares |

||

| Nasdaq 100 | +49.5% | Coinbase | +310.8% |

| S%P 500 | +20.5% | Nvidia | +225.7% |

| Dow Jones Industrial Average | +9.8% | Tesla | +121.7% |

| ASX 200 | +4.1% | Apple | +54.5% |

Source: Forbes Advisor

On the other hand, Bitcoin gained 180%, rising from $16,000 to $45,000 in Early December, which is a whopping 180%. This was despite the crypto world facing several hurdles and fines on the regulatory side, as shown in Figure 3. From a purely returns perspective, it’s nearly impossible to achieve these kinds of returns with typical ETFs; even Halal ETFs were no match for this:

While we can’t know what will happen to Bitcoin in 2024, there will be a halving event, which may provide potential growth since Bitcoin seems to ride on significant events.

So, should you include a Spot Bitcoin ETF in your portfolio?

Firstly, it depends on your current risk profile, monetary objectives and financial standing. While one may argue that even countries such as the USA are holding on to big bitcoin stashes (Nasdaq), It is still best to consult your financial advisor on the best allocation that may benefit you in the long run.

FAQ: Navigating the World of Spot Bitcoin ETFs

What’s next after Spot Bitcoin ETFs?

Spot Ethereum ETF? While the comments by the SEC chair may sound unfriendly, the launch of the 11 spot bitcoin ETFs is a giant leap for crypto fans. An ETF analyst from Bloomberg, James Seyffart, also told Crypto News that there is more than a 50% chance that an Ethereum ETF is next, whereas other cryptos will be further behind.

And not just the U.S., the Australian exchange is also understood to be reviewing a similar Spot Bitcoin ETF, paving the way for different.

Are spot Bitcoin ETFs halal / Shariah compliant?

It’s not as easy as that since some jurisdictions still do not view Bitcoin as Shariah Compliant, e.g., Indonesia (Reuters). While there have been numerous research papers, such as the one done by the Shariyah Review Bureau, to determine, from a Shariah angle, whether specific cryptos are Shariah compliant, the Islamic world still seems divided on this topic.

We spoke to Ustaz Aminuddin Abu Bakar, Principal Consultant at S Tradition, who mentioned that if an investor adopts the Shariah view of bitcoin as permissible*, then it shouldn’t be a problem if the spot bitcoin ETF meets the Shariah requirements of holding digital assets in trust such as holding actual possession of the bitcoins, and not engaging in Shariah non-compliant activities of those assets or its ETF operations. He urges individual investors to do their due diligence when there are no Shariah advisors and look out for red flags such as lending activities with interest, trading and short selling of these assets, utilisation of hedging instruments, etc., that are performed by the bitcoin ETFs (if any).

Mdm Suhaida Mahpot, CEO of Amanie Advisors, added that while the underlying asset of a fund can be Shariah compliant, the investor should also look at the cash placement of the fund (as this could be interest-bearing), the hedging instruments utilised (if any), and other terms to determine that the fund meets Shariah requirements and thus the earnings are permissible in the eyes of the Shariah.

On the bright side, Mr Aziz foresees that the Islamic Finance sector can take this as an opportunity by implementing a Sharia framework for analysing and certifying crypto now that it is seen as a legitimate financial product.

*SAC of Securities Commission Malaysia, Jawatankuasa Fatwa Negeri Perlis, Sheikh Prof Dr Muhammad Bin Abdul Razak Al-Tabtabae, Sheikh Dr Ali El-Gari, Tan Sri Datuk Dr Daud Bakar etc.

Which brokers in Singapore offer access to these spot bitcoin ETFs?

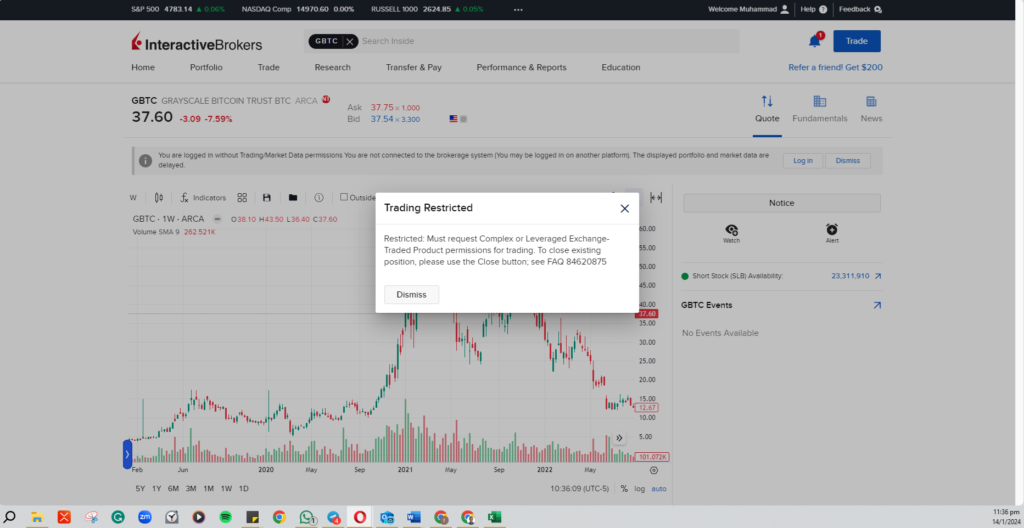

A check on some brokerages in Singapore revealed that locals can buy a share of these bitcoin ETFs. These include mobile-friendly broker apps such as Moomoo, Tiger, Webull and Syfe. More traditional brokerages such as CGS-CIMB, FSMOne, Phillip Securities and DBS Vickers also listed the ETF. Still, IBKR restricted investors without permission to trade complex or Leveraged Exchange-Traded Products.

Conclusion:

In conclusion, the SEC’s approval of Spot Bitcoin ETFs in 2024 marks a significant milestone reminiscent of the introduction of gold-backed ETFs in 2004. The decision carries immense implications for the legitimacy, accessibility, and exposure of cryptocurrencies. With significant financial entities entering the space, efficient capital inflow is expected, streamlining on and off-ramps for investors. Additionally, regulatory approval enhances accountability and transparency and mitigates risks associated with centralized exchanges. Investors now have a convenient and regulated avenue to access real-time Bitcoin prices through traditional investment accounts, offering advantages like lower fees. However, potential risks, including market volatility, regulatory challenges, and counterparty risks, should be carefully considered. Despite the positive performance of Bitcoin in 2023, the decision to include Spot Bitcoin ETFs in a portfolio depends on individual risk profiles, financial objectives, and consultation with a financial advisor. The future may see Shariah-compliant Bitcoin ETFs emerge, with opportunities for the Islamic finance sector to implement a Sharia framework for crypto certification.

🔵Join the Islamic Finance Singapore community here!🔵

Written by:

Muhammad Ridhwaan, CSAA

Ridhwaan found his passion for Islamic finance at the school where he graduated from – Madrasah Aljunied Al-Islamiah in 2013. He has over 6 years of financial working experience, spanning from banks such as ING Bank N.V. and OCBC to Islamic finance-focused firms such as Amanie Advisors and Kapital Boost. He has a Business degree from Nanyang Technological University and is an AAOIFI Certified Shariah Advisor and Auditor (CSAA).

Edited by:

Salihin Samsudin

Salihin Samsudin is currently pursuing a degree in Public Policy & Global Affairs with Economics and Entrepreneurship at Nanyang Technological University in Singapore. Concurrently, he is also a researcher in the university’s prestigious Undergraduate Research Experience on Campus (URECA) programme. His research areas include international law, foreign policy, diplomacy, politics, and the international political economy.