Hadith on Islamic Finance #19

Theme: The Virtue of Merchant & Business Allah’s messenger (ﷺ) said: “By the being in whose hand is my life,

Hadith on Islamic Finance #20

Theme: The Virtue of Merchant & Business Allah’s messenger (ﷺ) said: “O people of trade! Indeed the Shaitan and sin

Hadith on Islamic Finance #21

Theme: The Virtue of Merchant & Business Allah’s messenger (ﷺ) said: ““No doubt, one had better take a rope

Hadith on Islamic Finance #22

Theme: The Virtue of Merchant & Business Allah’s messenger (ﷺ) said: “Two wolves free among sheep are no more destructive

Hadith on Islamic Finance #23

Theme: Business Etiquette in Islam Allah’s messenger (ﷺ) said: The Prophet (ﷺ) said, “The haughty, even with pride equal to

Hadith on Islamic Finance #24

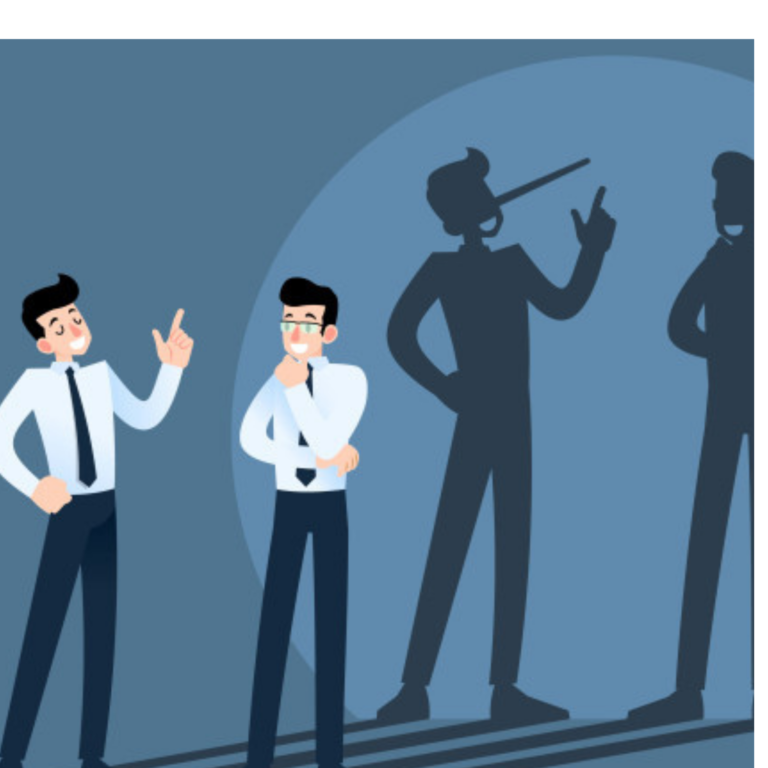

Theme: Business Etiquette in Islam Allah’s messenger (ﷺ) said: “Whoever has the following four (characteristics) will be a pure hypocrite

Hadith on Islamic Finance #25

Theme: Business Etiquette in Islam Allah’s messenger (ﷺ) said: “Whoever (agrees) with a Muslim to rescind transaction (which he/she regretted),

Hadith on Islamic Finance #26

Theme: Business Etiquette in Islam Allah’s messenger (ﷺ) said: “Beware of excessive swearing in sale transactions, for it sells (the

Hadith on Islamic Finance #27

Theme: Business Etiquette in Islam The Messenger of Allah (ﷺ) happened to pass by a heap of eatables (corn). He

Hadith on Islamic Finance #28

Theme: Business Etiquette in Islam The Messenger of Allah (ﷺ) said, “The Muslim is the brother of another Muslim, and

Hadith on Islamic Finance #29

Theme: Business Etiquette in Islam It was narrated that ‘Abdullah bin ‘Amr bin al-Aas ( ) said that: “Allah’s Messenger

Hadith on Islamic Finance #30

Theme: Business Etiquette in Islam It was narrated that Jabir bin ‘Abdullah( ) said that: “A townsman should not sell

Hadith on Islamic Finance #31

Theme: Business Etiquette in Islam Allah’s Messenger (ﷺ) said:“Flesh which has grown out of what is unlawful will not enter

Hadith on Islamic Finance #32

Theme: Muamalah Virtues Allah’s Messenger (ﷺ) said: “Give the worker his wages before his sweat dries.” (Source: Sunan Ibn Majah,

Hadith on Islamic Finance #33

Theme: Business Ethics in Islam It was narrated by Ibn ‘Umar (may Allah be pleased with them both) that a

Hadith on Islamic Finance #34

Theme: Business Ethics in Islam Narrated by Abu Hurairah (may Allah be pleased with him), that the Messenger of Allah

Hadith on Islamic Finance #35

Theme: Muamalah Virtues Narrated by Abu Hurairah (may Allah be pleased with him), that The Prophet (ﷺ) said, “There was

Hadith on Islamic Finance #36

Theme: Muamalah Virtues Sakhr al-Ghamidi (may Allah be pleased with him) that the Prophet SAW said: “O Allah, bless my

Hadith on Islamic Finance #37

Theme: Muamalah Virtues It was narrated from Abu Hurairah (may Allah be pleased with him) that the Messenger of Allah

Hadith on Islamic Finance #38

Theme: Muamalah Virtues It was narrated that Anas (may Allah be pleased with him said): when this verse was revealed

Hadith on Islamic Finance #39

Theme: Muamalah Virtues It was reported by Jabir bin Abdullah (may All be pleased with him) that the Messenger of

Islamic Economics: Wage Maximization

It is proposed that the wage maximization is one of the fundamental principles of Islamic economics, and should be counterposed to the profit maximization principle of private capital. Wage maximization needs to be analyzed for both the macroeconomy as well as for the microeconomy, since wage maximization has to be realized at the level of the firms of the microeconomy. A mathematical model for the Islamic macroeconomy is postulated that determines how to maximize macroe conomic wages. A model for a firm is proposed that pays minimum wages based on macroeconomic wage maximization. Wages can be further augmented by wages having a variable component based on profit and loss sharing with the firm, and which entails a degree of risk. Fixing the variable wage component results in the rate of profit of all firms becoming equal to the macroeconomic wage maximizing macroeconomic rate of profit.

Notes from Fiqh & Finance: Empowering Muslims in Navigating a New Economic Paradigm with Emerging Financial Tools

At this point in history, the pace of practical developments in society is fast surpassing their ethical framing and religious jurispudential deliberations. One clear example is how we are far from reaching consensus in determining the permissublility of cryptocurrencies and other emerging financial tools in accordance to Islam. While some scholars and religious organisations have ruled cryptocurrencies as haram (prohibited), others hold an an opposing opinion.

Through a sharing on the diversity of approaches and views from a critical lens and Islamic Juristic perspective, the notes shared aims to foster a nuanced understanding of Islamic Financial ethics within contemporary financial landscape and explore a roadmap for Muslims to navigate and thrive in the complexities of today’s economic world, empowered, and guided by maqasid and Islamic principles.

How to Kickstart Your Personal Finance Journey as a Muslim

Managing finances through an Islamic lens involves a comprehensive approach, encompassing budgeting, investments, protection, and future planning. By adhering to these financial principles, Muslims can build a stable foundation for their families and contribute positively to society while remaining true to their faith.