How to Kickstart Your Personal Finance Journey as a Muslim

Tip 1: Foundations of Financial Stability

In Islamic finance, having the crux of our financial decisions to be ethical is crucial. Debt, though permissible, requires careful management. The Hadith, “Whoever dies and he is free of three: Kibr (Pride), Ghulul, and debt, he will enter paradise” (Jami` at-Tirmidhi 1572) emphasizes a massive responsibility in financial management, urging us to repay debts sincerely. This includes avoiding interest-laden transactions by taking up loans only when necessary and resorting to a conventional loan when no Islamic financing exists aligns with Islamic principles.

Tip 2: Pitfalls of Credit Cards

One significant financial danger is credit card usage. Surprisingly, a significant number of youths (45% of males and 39% of females aged 15 and above) claimed to have a credit card (World Bank). Credit cards are dangerous as they grant the illusion of increased financial capacity, leading many into a debt spiral. Islam, however, encourages restraint and warns against arrogance and wastefulness. Hence, avoiding excessive credit card debt is a cornerstone of financial well-being. Instead, opt for debit cards.

Tip 3: Light at the End of the Debt Tunnel

Recognizing many challenges, initiatives like the Debt Advisory Center by AMP aim to provide guidance and support. They help individuals burdened by debt by offering financial advice and fostering a community where shared experiences alleviate the burden.

Tip 4: Lender’s Rejoice

Islam encourages a virtuous approach to lending and borrowing. Forgiveness and charity play pivotal roles as mentioned in our religious texts where the prophet Muhammad ﷺ was recorded to have said, “He who grants a respite to one who is in straitened circumstances or remits his debt will be taken by God under His protection” (Mishkat al-Masabih 2904). When debtors struggle, offering them time and understanding instead of harbouring resentment leads to spiritual rewards.

Tip 5: The Road to Financial Freedom

Achieving financial freedom is a simple principle—earning more than you spend. The formula is:

Income – Expenditure = Net Asset or Net Liability.

If your income is less than your expenses, you’ll dip into your savings or take up a loan, thus increasing your debts. Conversely, if your income is more than your expenses, you’ll grow your assets as you’ll have the surplus to invest in other investments such as ETFs and stocks. Do note that your expenses also include paying off your debts.

You can thus reach financial freedom when disciplined financial habits become a way of life.

Tip 6: Financial Discipline

Managing money effectively begins with discipline. For many, traditional salary management may involve automated standing orders to allocate funds to various accounts. This approach ensures financial commitments, such as bills and savings, are addressed before delving into discretionary spending.

To put this into practice, open your bank account and set up an automated amount that will be transferred to other accounts that pay the bills, etc. If the amount you transferred exceeds the total bill, you can use the surplus to pay off other debts or invest!

In addition, consider opening multiple Islamic Bank accounts to help you with this! Here’s the list of Islamic Banking accounts (updated on February 1, 2024):

- OCBC Wadiah Savings Account

- Maybank Savings Account-i

- Maybank Foreign Currency Term Deposit-i

- Maybank Ar-Rihla Savings Account-i

- Maybank Singapore Dollar Term Deposit-i

- Maybank PremierOne Account-i

- Maybank Currency Current Account-i

- Maybank iSavvy Savings Account-i

- CIMB FastSaver-i Account

- CIMB StarSaver (Savings)-i Account

- CIMB Hajj Savings-i Account

- CIMB StarSaver-i Account

- CIMB Why Wait Fixed Deposit-i Account

Tip 7: Safeguarding Your Financial Future

Beyond accounting for daily expenses, Islamic teachings encourage protection against unforeseen events. This includes embracing Takaful insurance when available or seeking alternative means to ensure financial stability for oneself and loved ones.

While we don’t have a takaful product in Singapore at the moment, we could at least use term insurance to cover us in case of death or Total Permanent Disability. For more information on insurance for Muslims, read our guide here.

Tip 8: Invest in a Shariah Compliant Manner

Investing aligns with Islamic principles when approached through Sharia-compliant avenues. Today, options include Islamic bank accounts, stocks, ETFs , mutual funds, crowdfunding, land investing, etc.

This is in stark contrast to when the industry was starting in the 2010s, when there were just a few funds that met Shariah requirements. Halal investors had to resort to screening each constituent of a fund for its Shariah Compliance. For more information on how to invest, refer to our guides here:

- Step by step guide to investing in ETFs through IBKR

- Sarwa, an alternative to Wahed Robo Advisory Platform

- 12 Halal investing Options for Muslims in Singapore

- Shariah Compliant Stock Investing Guide

Tip 9: Building a Lasting Legacy through Wakaf

A unique form of investment in Islam is the Waqf or endowment. By creating a perpetual charitable fund, individuals can support causes close to their hearts even beyond their lifetime and earn constant rewards in the hereafter, as has been mentioned by the prophet Muhammad ﷺ “When a man dies, all his good deeds come to an end except three: Ongoing charity (Sadaqah Jariyah), beneficial knowledge and a righteous son who prays for him” (Sunan an-Nasa’i 3651).

You can start doing wakaf in many ways, for instance, by contributing to the improvement of our local mosques, whether through new furniture or equipment.

Tip 10: Ensuring Fair Distribution through Estate Planning

Estate planning holds particular importance in Islam. Muslims are encouraged to draft wills that adhere to Islamic laws. The prophet Muhammad said, “It is not proper for a Muslim who has got something to bequeath to spend even three nights without having his will written down with him regarding it.” (Sahih Muslim 1627d). It is worth noting that you can will away 1/3 of your wealth to your parents who may not be Muslims, adopted children, debt forgiveness and charities of your liking. You can also use the different tools in Islamic Estate planning, such as Hibah, Nuzriah and so on. The remainder will then be treated according to Faraid.

This addresses concerns on fair distribution of assets among immediate family members and ensures the just treatment of non-Muslim parents. While it may be early for youths to think about this, you can utilise this tool by the Syariah court in Singapore to calculate the potential estate planning treatment for your family in case death occurs.

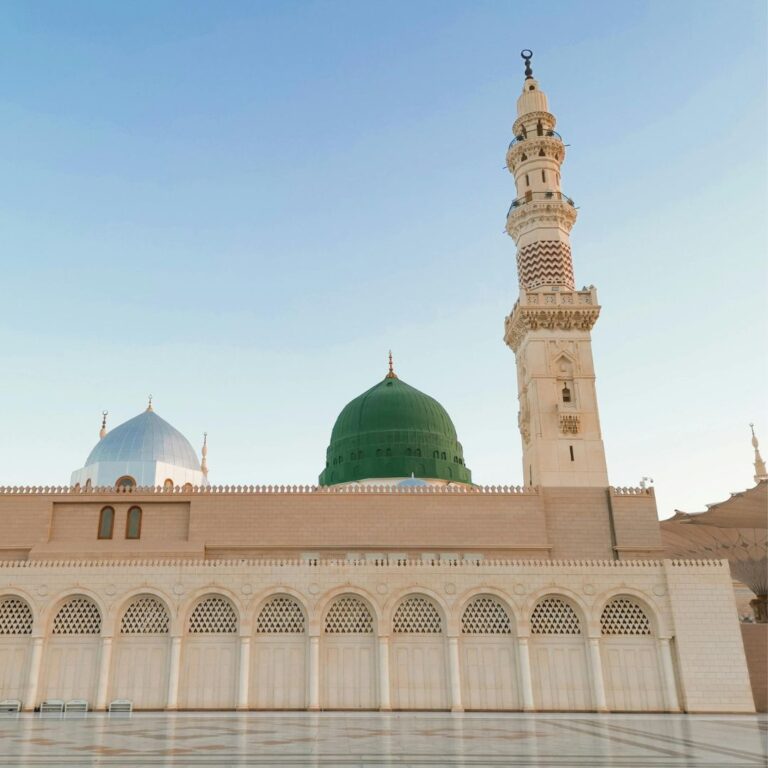

Tip 11: Fulfilling Religious Obligations Through Zakat and Hajj

Zakat, the mandatory charitable giving, and Hajj, the pilgrimage to Mecca, are integral aspects of Islamic finance. Adhering to these pillars fulfils religious duties and fosters a sense of responsibility towards the less fortunate and one’s spiritual growth.

For Zakat, one can visit Zakat.sg to contribute the zakat amount payable on your assets if they meet the haul and nisab.

Hajj, on the other hand, requires some patience as there are currently 35,000 prospective pilgrims awaiting their turn for Hajj (as of 1 Jan 2020), and last year, only 900 spaces were allocated for Singaporeans. An application fee of S$240 is required to register your place here, and while it may be a long queue, you never know if your turn could be earlier than expected.

Conclusion:

Managing finances through an Islamic lens involves a comprehensive approach, encompassing budgeting, investments, protection, and future planning. By adhering to these financial principles, Muslims can build a stable foundation for their families and contribute positively to society while remaining true to their faith.